Is Amitell Capital safe?

Pros

Cons

Is Amitell Capital Safe or Scam?

Introduction

Amitell Capital PTE LTD positions itself as a forex and CFD broker, claiming to provide traders with access to global markets through a modern trading platform. As the forex market continues to attract a wide range of investors, from retail traders to institutional players, the importance of thoroughly evaluating the legitimacy of brokers cannot be overstated. Many traders have fallen victim to scams, leading to significant financial losses. Therefore, it is crucial to assess the reliability and safety of platforms like Amitell Capital before committing any funds. This article will investigate Amitell Capital's regulatory status, company background, trading conditions, customer experience, and overall safety to determine whether it is a trustworthy broker or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its legitimacy. Regulatory bodies ensure that brokers adhere to strict guidelines designed to protect investors. For Amitell Capital, the claims of operating under the oversight of the Monetary Authority of Singapore (MAS) raise questions of authenticity. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Monetary Authority of Singapore (MAS) | Not Applicable | Singapore | Not Verified |

While Amitell Capital claims to be regulated by MAS, there is no verifiable evidence supporting this assertion. In fact, numerous reviews indicate that the broker operates without proper licensing, raising red flags regarding its legitimacy. The lack of an official license for providing brokerage services is a significant concern, as it suggests that Amitell Capital may not comply with the necessary legal frameworks to protect traders.

Company Background Investigation

A detailed examination of Amitell Capital's history reveals a lack of transparency and credible information. The broker was purportedly established in 2024, but its domain was registered only a few months ago, indicating a very short operational history. This raises significant questions about its experience and reliability. Furthermore, the ownership structure of the company remains obscure, with little information available about the management team or their professional backgrounds.

The absence of transparency is a common characteristic among fraudulent brokers. Legitimate companies typically provide information about their founders and management team, showcasing their expertise and experience in the financial industry. However, Amitell Capital's website lacks such details, which can be a strong indicator of a potential scam.

Trading Conditions Analysis

The trading conditions offered by Amitell Capital warrant careful consideration. While the broker advertises competitive trading conditions, a thorough analysis reveals several discrepancies. The overall fee structure appears to be standard, but there are indications of hidden fees that could affect traders negatively.

Heres a comparison of key trading costs:

| Cost Type | Amitell Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.8 pips | 0.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The spreads offered by Amitell Capital are higher than the industry average, which could lead to increased trading costs for clients. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about potential hidden fees. This lack of transparency in trading conditions is a common tactic used by dubious brokers to exploit unsuspecting traders.

Client Funds Security

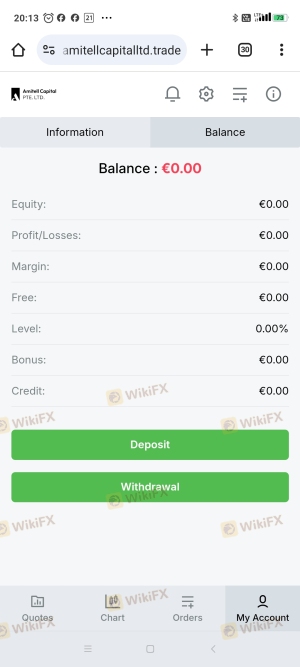

The safety of client funds is paramount when evaluating a broker's reliability. Amitell Capital claims to implement various measures to safeguard client funds, including segregated accounts and adherence to anti-money laundering (AML) regulations. However, the lack of verifiable information regarding these practices raises concerns about their effectiveness.

A detailed analysis of Amitell Capital's fund security measures reveals the following:

- Segregated Accounts: The broker claims to use segregated accounts for client funds, a standard practice among regulated brokers. However, without proper verification, it is impossible to ascertain the legitimacy of this claim.

- Investor Protection: There is no evidence of any investor protection schemes in place, which further heightens the risk for potential clients.

- Negative Balance Protection: The absence of information regarding negative balance protection policies is alarming. This protection is crucial for preventing traders from losing more than their initial investment.

Historical complaints regarding fund security and withdrawal issues have surfaced in numerous reviews, indicating that clients have faced difficulties accessing their funds. Such incidents are significant warning signs that potential investors should consider seriously.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews for Amitell Capital reveal a mix of experiences, with many users expressing dissatisfaction with the broker's services. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Fair |

| Misleading Information | High | Poor |

A frequent complaint revolves around withdrawal issues, where clients report delays and outright refusals to process their requests. This is a critical red flag, as reputable brokers typically facilitate quick and hassle-free withdrawals.

One notable case involved a trader who attempted to withdraw funds after several months of trading. Despite repeated requests, the broker failed to process the withdrawal, citing vague reasons. This kind of behavior is often indicative of a scam operation, where brokers aim to retain client funds for as long as possible.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Amitell Capital claims to offer a modern trading platform with advanced features, but user reviews suggest otherwise. Many clients report issues related to platform stability, order execution quality, and slippage.

The following points summarize the platform's performance:

- Execution Quality: Users have reported high slippage rates and instances of order rejections, which can significantly impact trading outcomes.

- Platform Manipulation: There are allegations of potential platform manipulation, where prices displayed do not match

Is Amitell Capital a scam, or is it legit?

The latest exposure and evaluation content of Amitell Capital brokers.

Amitell Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Amitell Capital latest industry rating score is 1.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.