MSquare 2025 Review: Everything You Need to Know

Executive Summary

MSquare shows major problems in the forex world. This msquare review finds serious red flags that traders need to think about carefully. Many sources, including DNB Forex Price Action and LycanRetrieve, report scam claims and bad user feedback about withdrawal problems and account blocks.

The company started in 2019 in Las Vegas, Nevada. MSquare Group calls itself a top global forex trading platform, but user stories tell a very different tale. People complain about customer service that doesn't respond and withdrawals that get blocked, though some good feedback exists about employee training at MSquare Engineering and company culture at M Square Media.

Most users are retail forex traders. Given the many fraud claims and lack of clear regulatory info, potential clients should be very careful when dealing with this broker. This review gives a complete analysis based on user feedback and company background to help traders make smart choices.

Important Disclaimers

This msquare review uses public user feedback, company info, and third-party reports. Readers should know that specific regulatory details were not found in available sources, which may greatly affect user trust and protection in different regions.

Our review method uses user stories, company background data, and industry reports when available. Since we found limited official documents about regulatory status and specific trading conditions, some parts of this review may lack full detail, so potential users should do their own research and check all information before making financial commitments.

Rating Framework

Based on available information and user feedback, here are our ratings for MSquare across six key dimensions:

Broker Overview

MSquare Group started in 2019. The company calls itself a top global forex trading platform based in Las Vegas, Nevada, United States, and it operates in financial services, focusing on forex trading. However, the company's real structure and business model face questions due to many user complaints and fraud claims.

The broker targets retail forex traders who want online trading opportunities. Even though it's fairly new, MSquare gets attention mainly for negative user experiences rather than good market performance, and WikiBit and other forex review sites have recorded various concerns about the broker's legitimacy and practices.

Available sources don't give specific info about MSquare's regulatory status or licensing with recognized financial authorities. This lack of clear regulatory information is a big concern for potential users since regulatory oversight protects traders and secures funds in the forex industry, and the absence of clear regulatory details in this msquare review shows the limited official documentation available about the broker's compliance status.

Regulatory Regions: Available sources don't specify which regulatory areas MSquare operates under. This raises concerns about oversight and trader protection.

Deposit/Withdrawal Methods: Specific information about supported payment methods for deposits and withdrawals was not detailed in available sources.

Minimum Deposit Requirements: The minimum deposit amount needed to open an account with MSquare was not specified in available documentation.

Bonus Promotions: No information about promotional offers or bonus programs was mentioned in the sources reviewed for this msquare review.

Tradeable Assets: The broker mainly focuses on forex trading. The complete range of available trading instruments was not fully detailed.

Cost Structure: Specific information about spreads, commissions, and other trading costs was not available in the sources reviewed. This makes it hard to judge the broker's competitiveness.

Leverage Ratios: Available sources did not specify the maximum leverage offered by MSquare to its clients.

Platform Options: Detailed information about trading platform choices and their specific features was not mentioned in available sources.

Regional Restrictions: Information about geographical limits or restricted countries was not specified in available documentation.

Customer Service Languages: The languages supported by MSquare's customer service team were not detailed in available sources.

Detailed Rating Analysis

Account Conditions Analysis (Rating: N/A)

Checking MSquare's account conditions is hard because detailed information is missing from available sources. Specific account types, their features, and benefits remain unclear, making it impossible to give a complete assessment of the broker's account offerings.

Minimum deposit requirements are crucial for traders to understand entry barriers, but they were not specified in any reviewed sources. This lack of transparency about basic account details raises concerns about the broker's commitment to clear communication with potential clients.

The account opening process wasn't detailed in available sources, including required documents and verification procedures. Also, information about specialized account types, such as Islamic accounts for traders needing Sharia-compliant trading conditions, was not mentioned.

Without access to full account condition details, this msquare review cannot give a meaningful rating for this area. The absence of such basic information itself serves as a red flag for potential users who need clear understanding of account terms before putting in funds.

Available sources don't give specific information about the trading tools and resources offered by MSquare. This makes it impossible to evaluate this crucial part of the broker's service offering, and modern forex trading requires sophisticated analytical tools.

Research and analysis resources weren't mentioned in the reviewed sources, including market commentary, economic calendars, and technical analysis tools. These resources are essential for informed trading decisions, and their absence from available documentation raises questions about the broker's commitment to supporting trader success.

Educational resources weren't detailed in any of the sources reviewed, which are particularly important for novice traders. The lack of information about webinars, tutorials, or educational materials suggests either their absence or poor marketing of these potentially valuable services.

Automated trading support wasn't mentioned in available sources, including expert advisors and algorithmic trading capabilities. Given the growing importance of automated trading in modern forex markets, this information gap represents a significant limitation in assessing MSquare's platform capabilities.

Customer Service and Support Analysis (Rating: 3/10)

Customer service emerges as one of the most problematic aspects of MSquare's operations based on user feedback documented in various sources. Multiple user complaints specifically mention unresponsive customer service, which represents a fundamental failure in broker-client relationships.

The available customer service channels and their operational hours were not specified in reviewed sources. User feedback consistently indicates difficulties in reaching support staff, and response times appear to be poor, with users reporting prolonged periods without resolution to their inquiries or concerns.

Service quality, as reflected in user testimonials, suggests significant deficiencies in problem resolution and client support. The complaints about unresponsive service directly impact trader confidence and operational efficiency, particularly when urgent issues require immediate attention.

Multi-language support capabilities were not detailed in available sources. Specific customer service hours were not mentioned, and the overall picture painted by user feedback suggests a customer service framework that fails to meet basic industry standards for responsiveness and effectiveness.

Trading Experience Analysis (Rating: N/A)

The assessment of MSquare's trading experience faces limitations due to insufficient specific information about platform performance and functionality. Platform stability and execution speed are crucial for successful forex trading, but they were not detailed in available sources.

Order execution quality wasn't specifically addressed in the reviewed materials, including factors such as slippage, requotes, and execution timing. These technical aspects are fundamental to trading success, and their absence from available documentation prevents comprehensive evaluation.

Platform functionality completeness wasn't described in sufficient detail, including charting capabilities, order types, and analytical tools. The mobile trading experience, increasingly important for modern traders, was also not specifically mentioned in available sources.

Trading environment details weren't specified in this msquare review, such as the dealing desk model, market maker versus ECN execution, and other structural elements that affect trading conditions. This information gap significantly limits the ability to assess the broker's suitability for different trading strategies and styles.

Trustworthiness Analysis (Rating: 2/10)

Trustworthiness represents MSquare's most concerning aspect. Multiple sources indicate potential scam allegations and fraudulent practices, and the lack of specific regulatory information in available sources immediately raises red flags about the broker's legitimacy and operational compliance.

Fund safety measures weren't detailed in any of the reviewed sources, including segregated accounts, insurance coverage, and regulatory protections. This absence of transparency regarding client fund protection represents a significant trust concern for potential users.

Company transparency appears limited. Basic operational information and regulatory status are not clearly communicated through available channels, and the opacity surrounding fundamental business details contradicts industry best practices for broker transparency.

Industry reputation suffers significantly due to documented scam allegations from multiple sources, including specialized forex review platforms. The consistent pattern of negative feedback and fraud warnings from various independent sources suggests systemic issues with the broker's operations.

User Experience Analysis (Rating: 3/10)

Overall user satisfaction with MSquare appears significantly below industry standards based on documented feedback from multiple sources. The pattern of negative reviews and complaints suggests widespread user dissatisfaction with the broker's services.

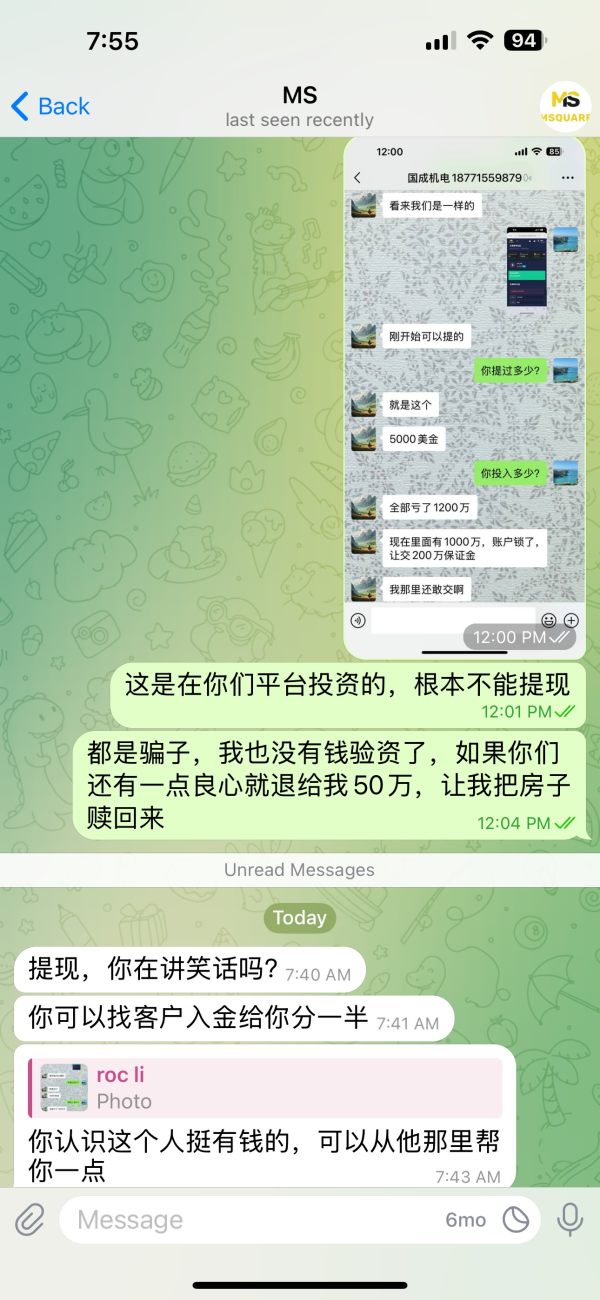

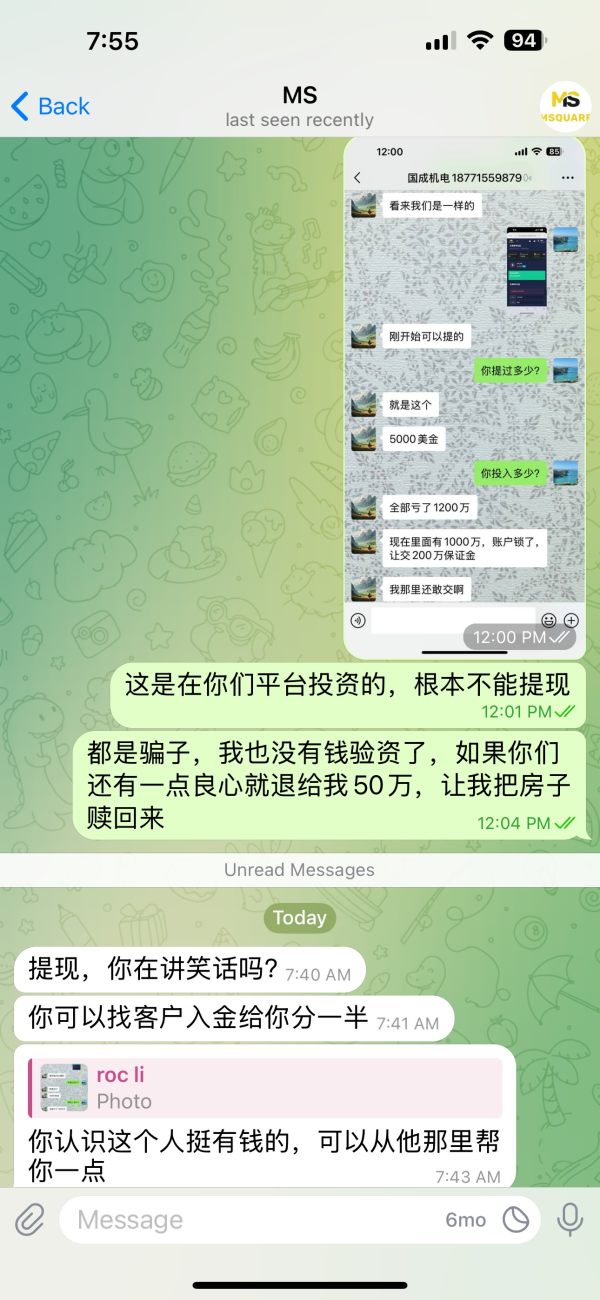

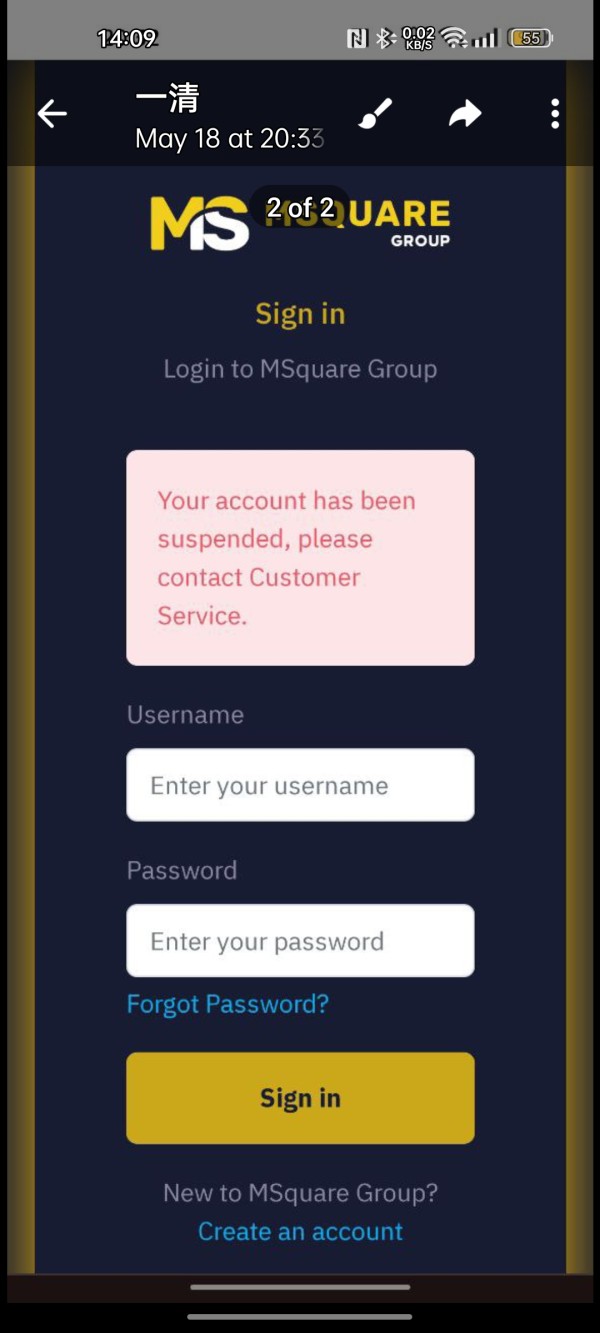

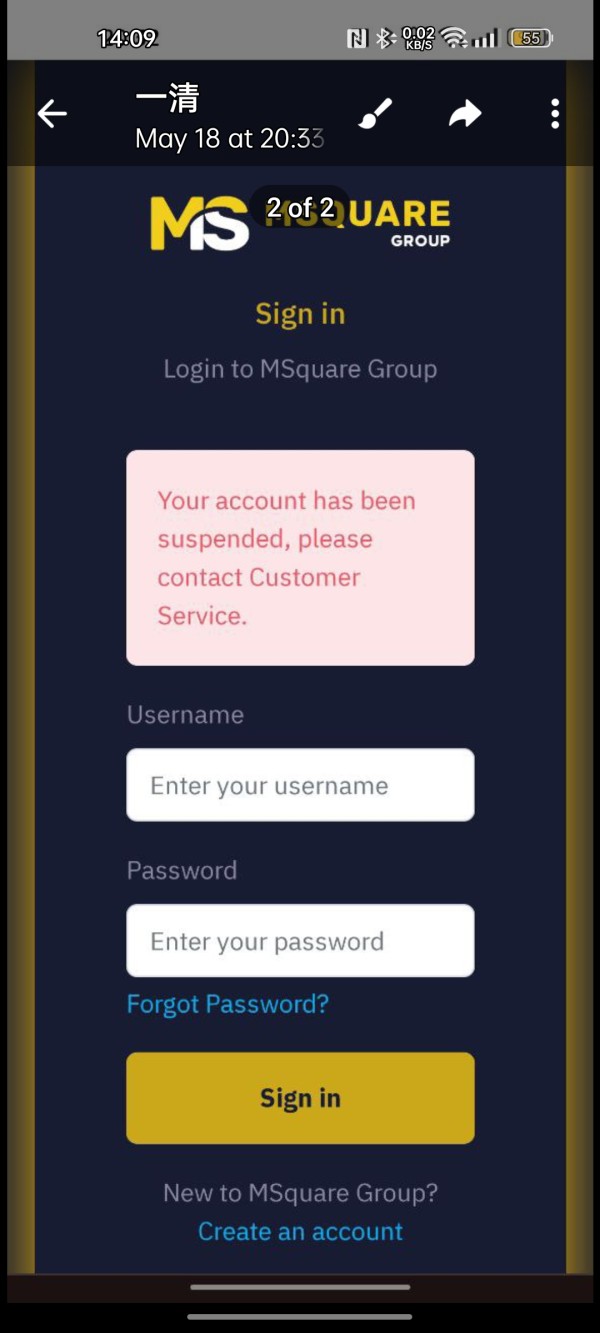

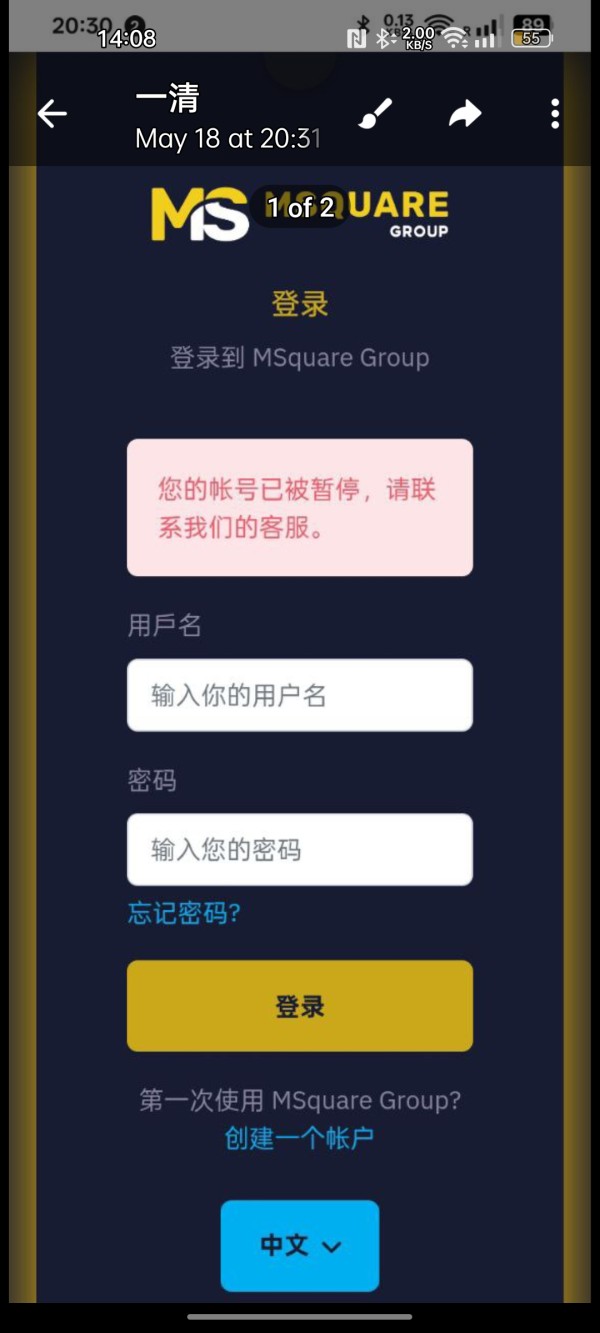

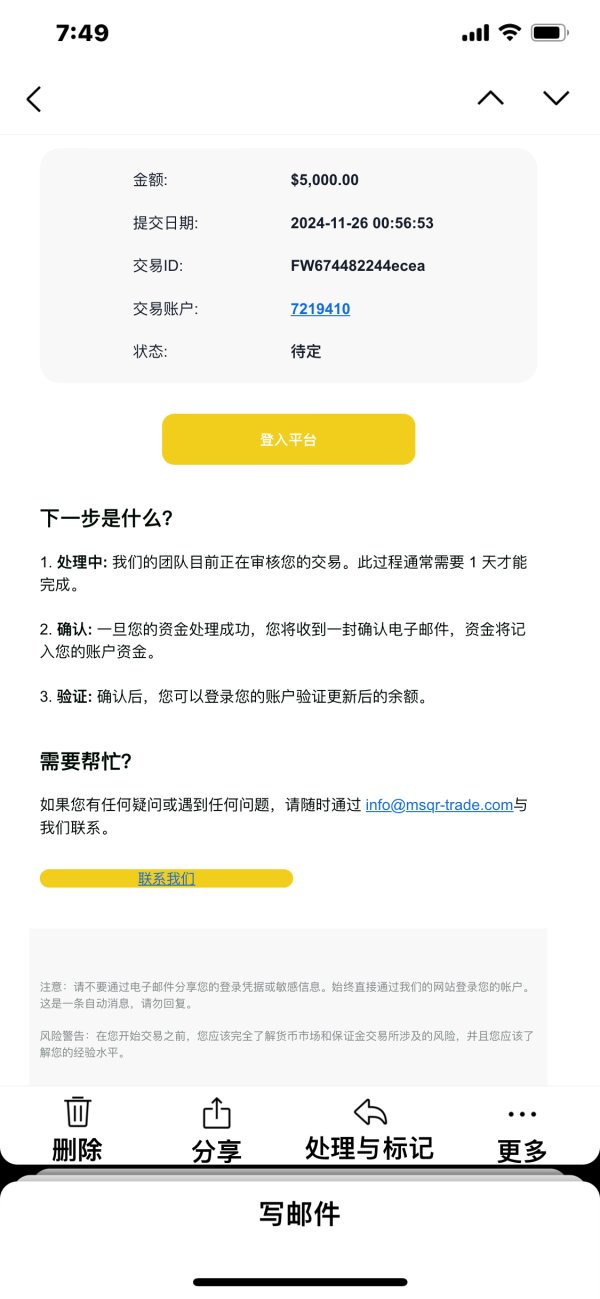

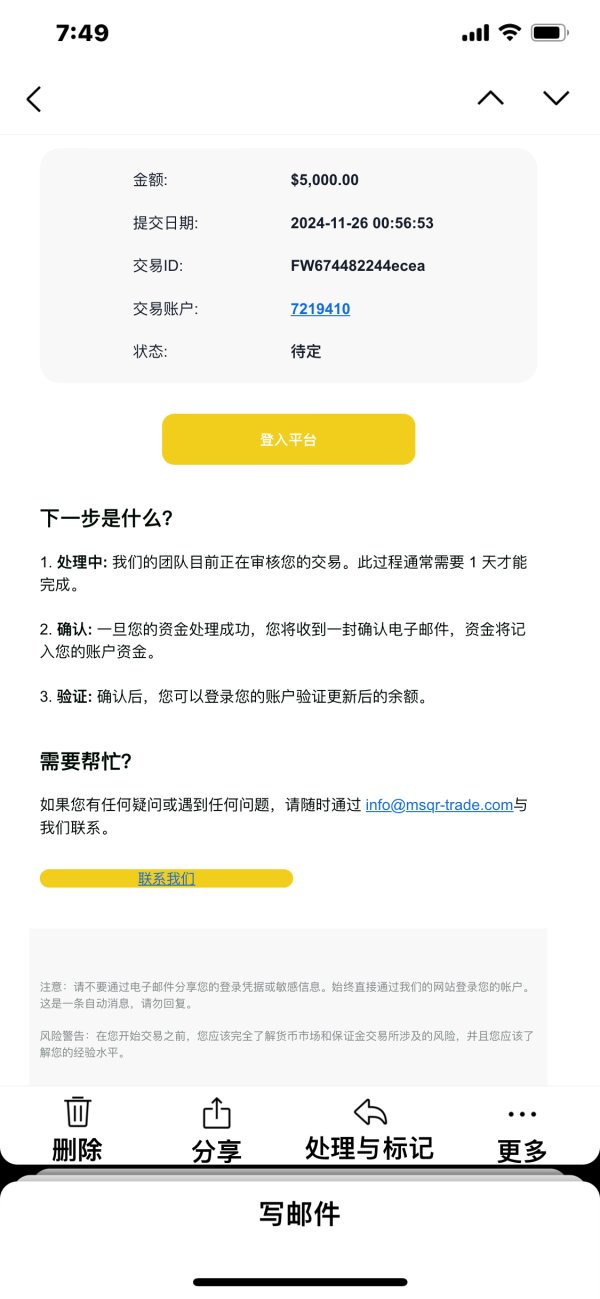

User feedback consistently highlights issues with withdrawal processing and account management. Reports include blocked withdrawals and unexpected account suspensions, and these operational problems directly impact user trust and satisfaction with the broker's services.

Common user complaints center around financial transaction difficulties and communication problems with the broker. The frequency and consistency of these complaints across multiple review platforms suggest systemic issues rather than isolated incidents.

The negative feedback pattern indicates that MSquare may not be suitable for traders seeking reliable, professional forex trading services. The documented user experiences suggest significant operational and ethical concerns that potential clients should carefully consider.

Conclusion

This comprehensive msquare review reveals significant concerns about the broker's operations and user satisfaction levels. Based on documented user feedback and scam allegations from multiple sources, MSquare presents substantial risks that outweigh any potential benefits for forex traders.

The broker is not recommended for traders with low risk tolerance or those seeking reliable, regulated forex trading services. The combination of unresponsive customer service, withdrawal issues, and lack of regulatory transparency creates an environment unsuitable for serious trading activities.

While some positive feedback exists regarding employee development within related MSquare entities, these aspects do not address the fundamental concerns about the broker's trading services. The predominant negative user feedback and fraud allegations suggest that potential clients should exercise extreme caution and consider alternative, well-regulated brokers for their forex trading needs.