Saafan Markets 2025 Review: Everything You Need to Know

Executive Summary

This saafan markets review shows big concerns about this Saint Lucia-based broker. Potential investors need to pay attention right away. Saafan Markets Ltd works without proper regulatory oversight, which creates major risks for traders who want legitimate forex and financial instrument trading services. Multiple industry reports published in 2024 say the platform has been flagged with many warning signals. These signals suggest potential fraudulent activities.

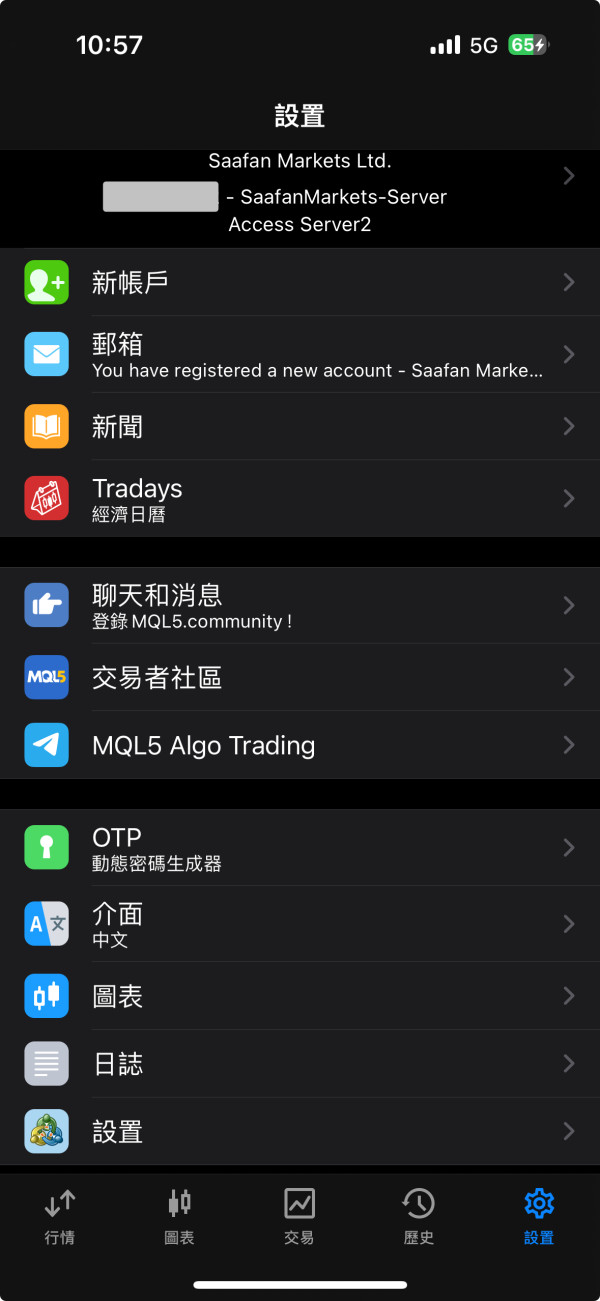

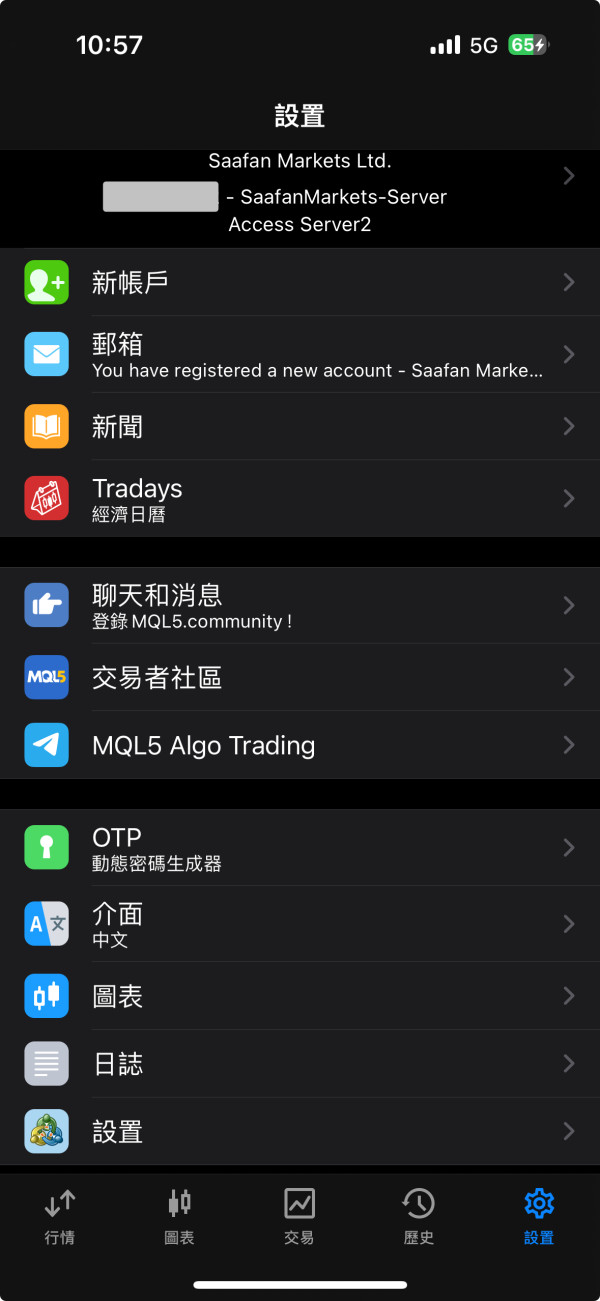

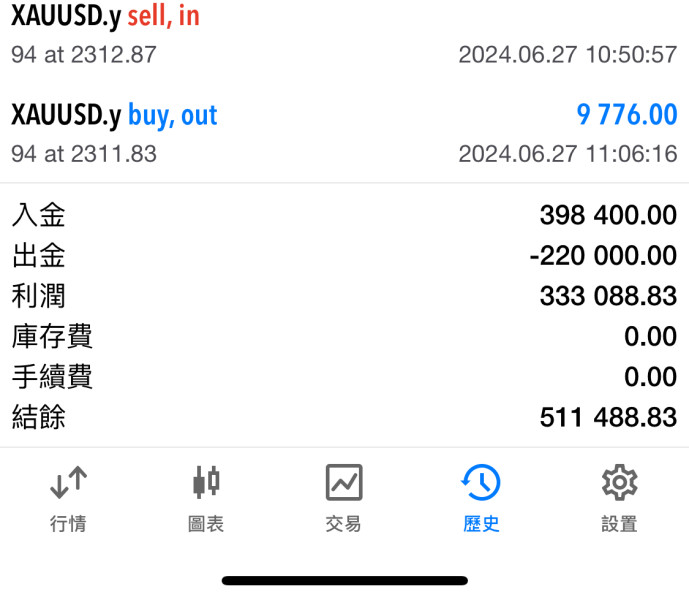

The broker offers MT4 trading platform access and claims to provide multiple asset classes including forex, gold, stocks, metals, bonds, indices, and cryptocurrencies. However, these offerings cannot make up for the basic lack of regulatory protection. The company's registration in Saint Lucia under number 2024-00148 does not mean regulatory authorization. This leaves investors without help in case of disputes or fund recovery issues.

User feedback always points out poor customer service quality, platform stability concerns, and transparency issues. These problems severely hurt the overall trading experience. The broker's marketing claims of "transparency meets success" seem to contradict actual user experiences and industry assessments. Given these major red flags, this review strongly advises extreme caution when considering Saafan Markets for any trading activities.

Important Notice

This evaluation focuses on Saafan Markets Ltd, registered in Saint Lucia. Investors should be extremely careful due to the absence of regulatory oversight. The lack of proper licensing means traders have limited protection and help options compared to properly regulated brokers operating under established financial authorities.

Our assessment method combines publicly available information, user feedback reports, and industry analysis from multiple sources published between August and November 2024. Due to the broker's unregulated status, checking information remains challenging. Potential investors should do additional research before making any financial commitments.

Rating Framework

Broker Overview

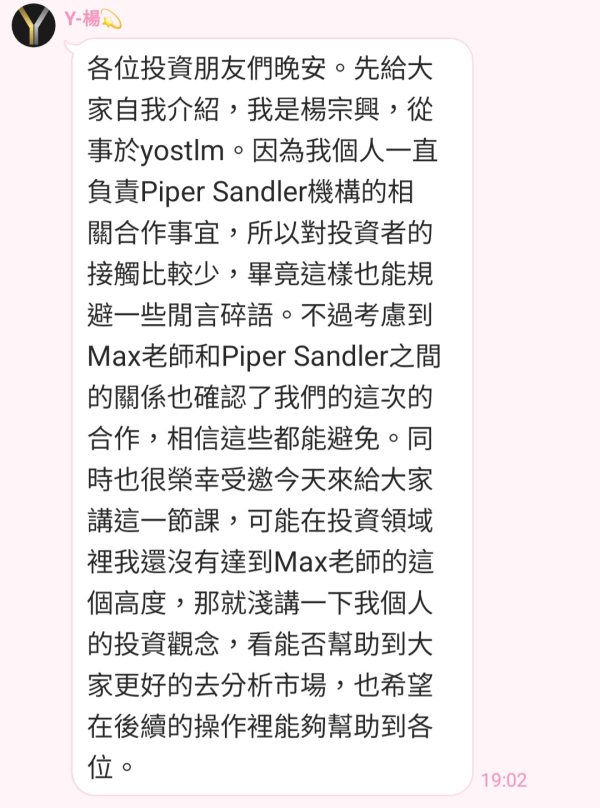

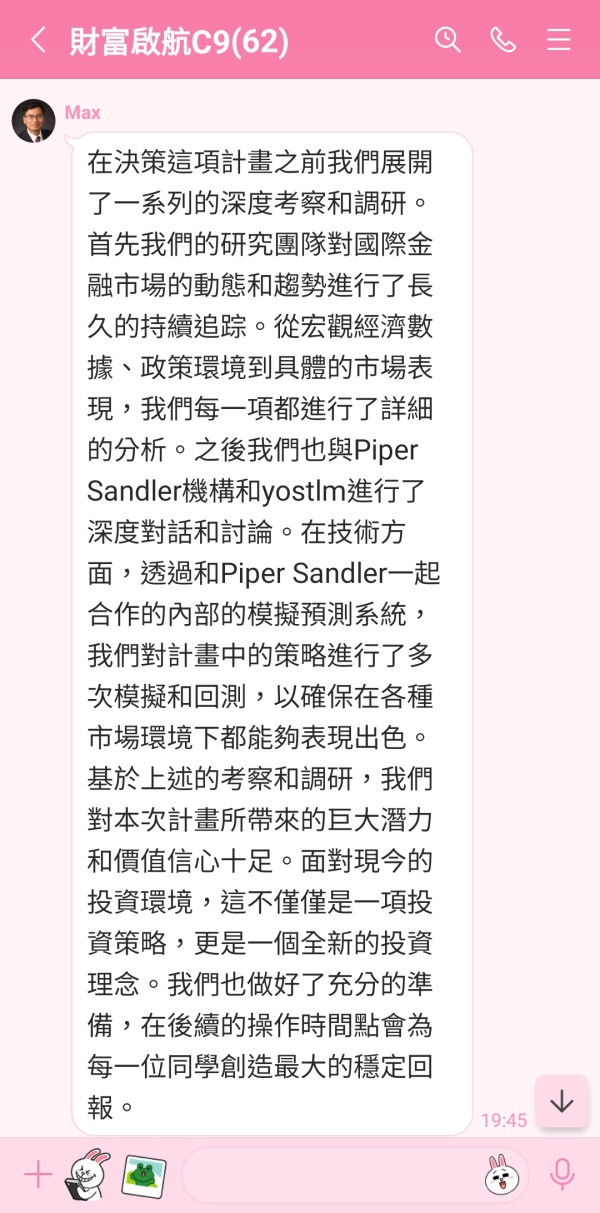

Saafan Markets Ltd presents itself as a financial services provider offering forex and multi-asset trading solutions through their platform infrastructure. The company maintains registration in Saint Lucia, a place known for more relaxed financial oversight compared to major regulatory centers. According to available information from the broker's official communications, they emphasize "empowering trades" and claim to offer "optimal solutions tailored to client needs." These marketing statements require careful examination given the regulatory concerns.

The broker's business model appears to focus on providing access to global financial markets through the popular MetaTrader 4 platform. This platform remains a standard choice among retail forex brokers worldwide. However, the absence of detailed operational information raises immediate transparency concerns. This includes company founding dates, management structure, and specific business practices. This saafan markets review finds that such information gaps are particularly problematic for an unregulated entity where due diligence becomes even more critical for potential clients.

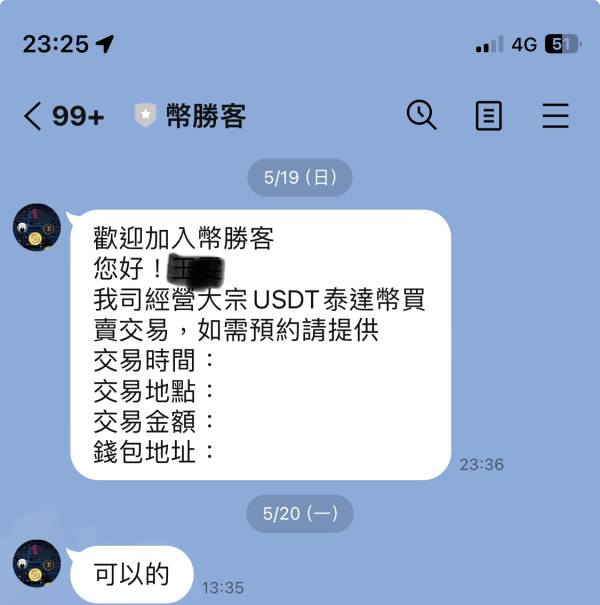

According to industry reports from AlertTrade and ScamsReport published in late 2024, the broker's operational practices have attracted negative attention from fraud monitoring services. The company's website promotes various asset classes and trading opportunities. Independent verification of these claims remains challenging due to limited third-party oversight and the absence of regulatory reporting requirements.

Regulatory Status: Saafan Markets Ltd operates under Saint Lucia registration number 2024-00148. This registration does not constitute regulatory authorization or supervision by any recognized financial authority. The absence of proper licensing creates significant investor protection gaps.

Deposit and Withdrawal Methods: Specific information regarding payment processing, supported banking methods, and transaction procedures remains undisclosed in available public materials. This creates uncertainty about fund management processes.

Minimum Deposit Requirements: The broker has not published transparent minimum deposit amounts or account tier structures. This makes it difficult for potential clients to understand entry-level investment requirements and account accessibility.

Promotional Offers: Available sources do not detail any specific bonus programs, promotional campaigns, or incentive structures. Unregulated brokers often use aggressive marketing tactics that may not be sustainable or legitimate.

Available Assets: The platform claims to offer forex pairs, precious metals including gold, energy commodities, individual stocks, metals trading, government and corporate bonds, major indices, and cryptocurrency instruments. The actual availability and trading conditions for these assets remain unverified.

Cost Structure: Critical pricing information including spreads, commission rates, overnight financing charges, and other trading costs are not transparently published. This prevents effective cost comparison with regulated alternatives. This saafan markets review identifies this lack of pricing transparency as a significant concern.

Leverage Ratios: Specific leverage offerings and margin requirements have not been clearly communicated in available materials. This is problematic given the importance of understanding risk exposure levels.

Platform Options: The broker appears to exclusively offer MetaTrader 4 platform access. There is no mention of additional trading interfaces, web platforms, or proprietary software solutions.

Geographic Restrictions: Specific information about service availability, restricted jurisdictions, or compliance with local regulations in various countries remains unclear from available sources.

Customer Support Languages: The range of supported languages for customer service and the availability of multilingual support has not been specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account structure and conditions offered by Saafan Markets present significant transparency issues that severely impact this evaluation. Available information fails to specify distinct account types, their respective features, or the criteria for accessing different service levels. This saafan markets review finds that legitimate brokers typically provide clear account tier structures with specific benefits, trading conditions, and eligibility requirements. None of these are readily available from Saafan Markets.

Minimum deposit requirements remain undisclosed. This prevents potential clients from understanding the financial commitment necessary to begin trading. Industry standards typically range from $10 to $500 for retail accounts, but without specific information, clients cannot properly budget or compare options. The account opening process, required documentation, and verification procedures are similarly unclear. This creates uncertainty about onboarding timelines and requirements.

User feedback suggests dissatisfaction with account terms and conditions, particularly regarding transparency and unexpected fees or requirements that emerge after account creation. The absence of information about special account features such as Islamic accounts, professional trading accounts, or institutional services further demonstrates the lack of comprehensive service offerings expected from established brokers.

When compared to regulated alternatives, Saafan Markets fails to meet basic industry standards for account information disclosure. This makes informed decision-making virtually impossible for potential clients. This fundamental lack of transparency regarding account conditions represents a significant red flag for any trading platform.

Saafan Markets' trading infrastructure centers around the MetaTrader 4 platform, which provides a solid foundation for forex and CFD trading activities. MT4 remains widely respected in the industry for its stability, comprehensive charting capabilities, and extensive technical analysis tools. The platform supports automated trading through Expert Advisors, provides real-time market data, and offers customizable interface options that many traders find familiar and effective.

However, the broker appears to lack additional analytical resources, market research, and educational materials that enhance the trading experience. Professional traders often require economic calendars, market sentiment indicators, trading signals, and fundamental analysis reports that supplement technical analysis capabilities. The absence of proprietary research or third-party analytical partnerships limits the platform's value proposition compared to more comprehensive service providers.

Educational resources appear minimal or non-existent. This is particularly concerning given that many forex traders benefit from ongoing education about market dynamics, risk management, and trading strategies. Legitimate brokers typically invest in client education through webinars, tutorials, market analysis, and trading guides that help improve client success rates and retention.

User feedback suggests limited satisfaction with the range of available tools beyond basic MT4 functionality. While the platform itself receives recognition for standard features, clients express desire for additional resources, better market analysis, and more comprehensive trading support tools. These could enhance their trading effectiveness and decision-making processes.

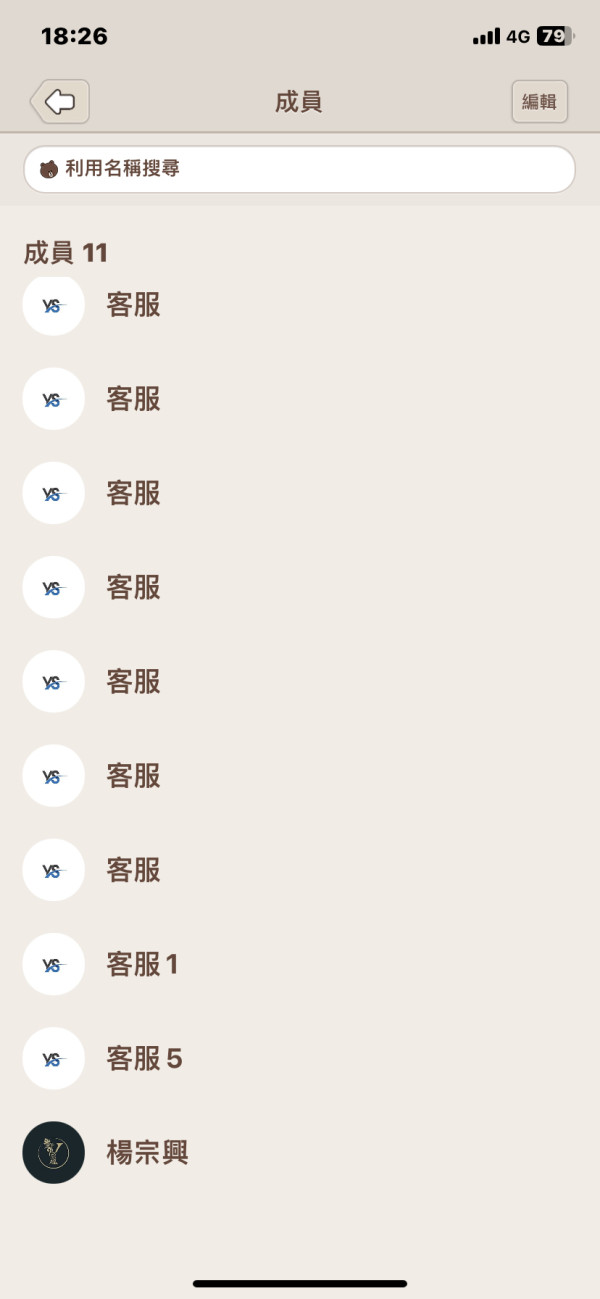

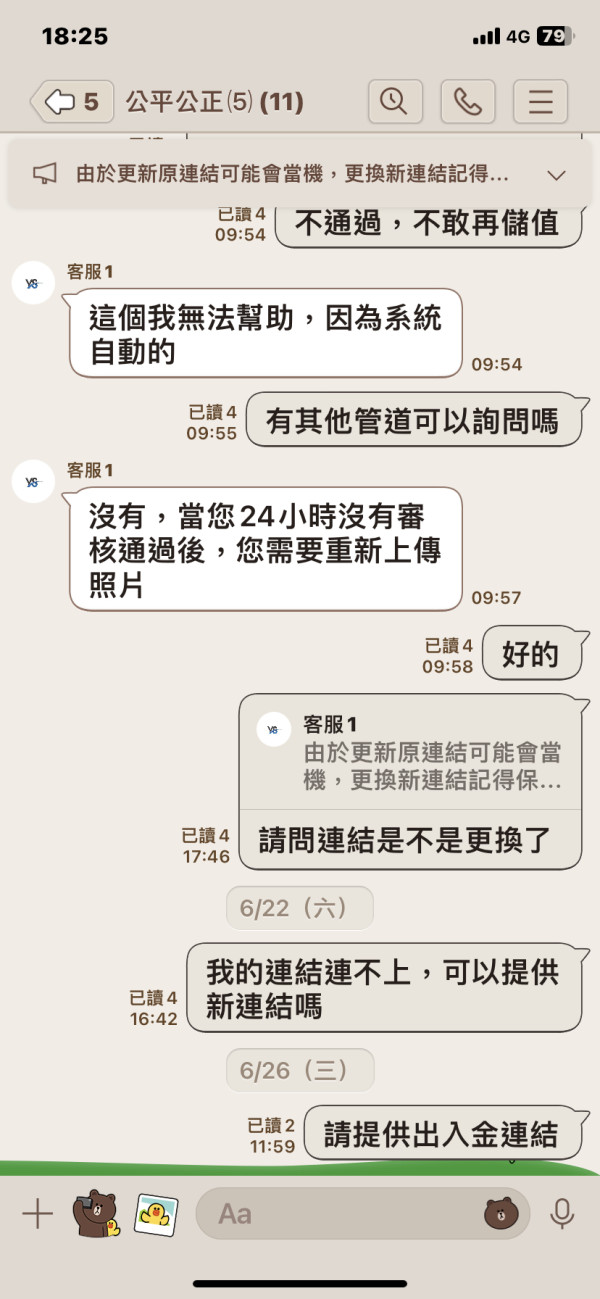

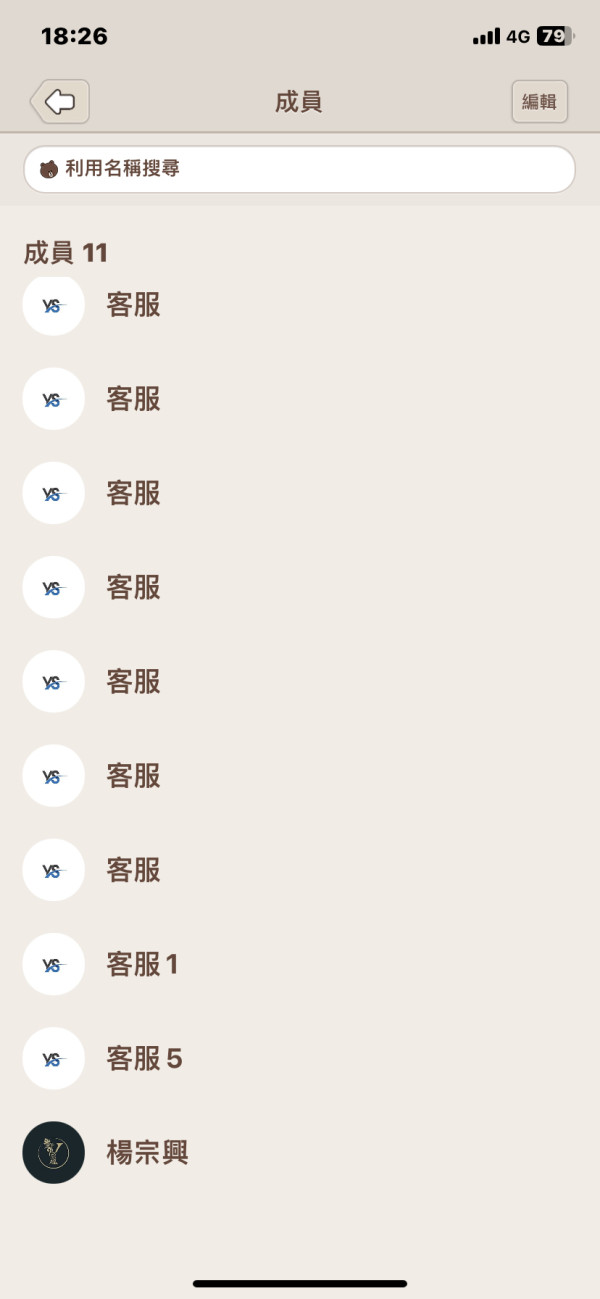

Customer Service and Support Analysis (Score: 3/10)

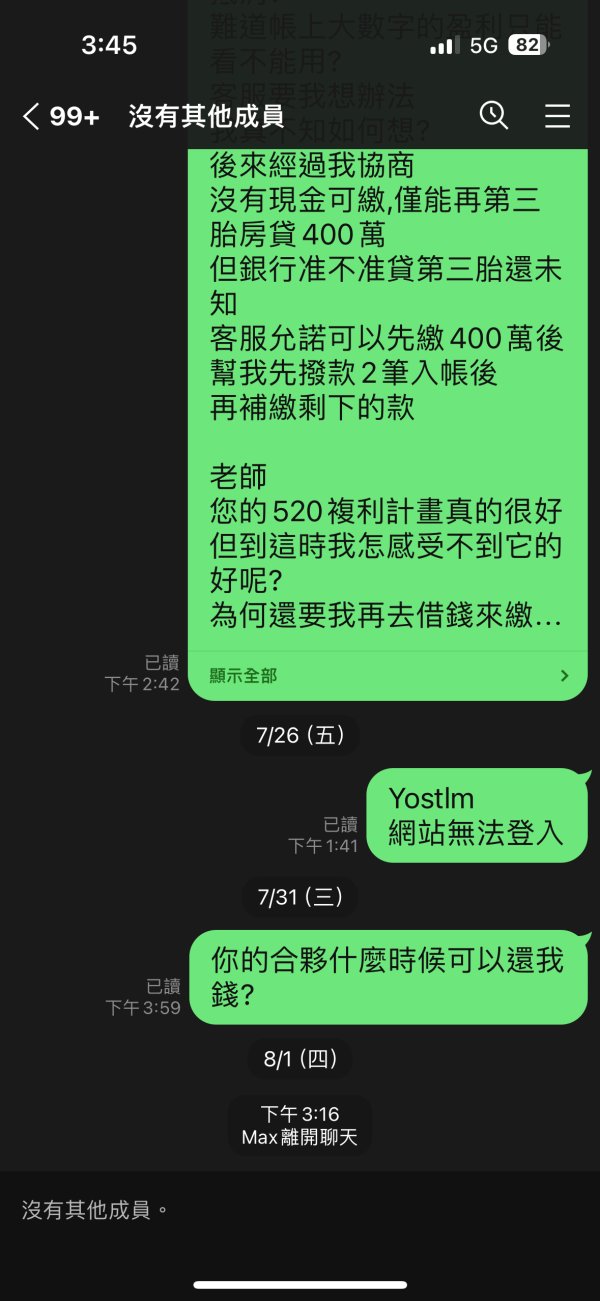

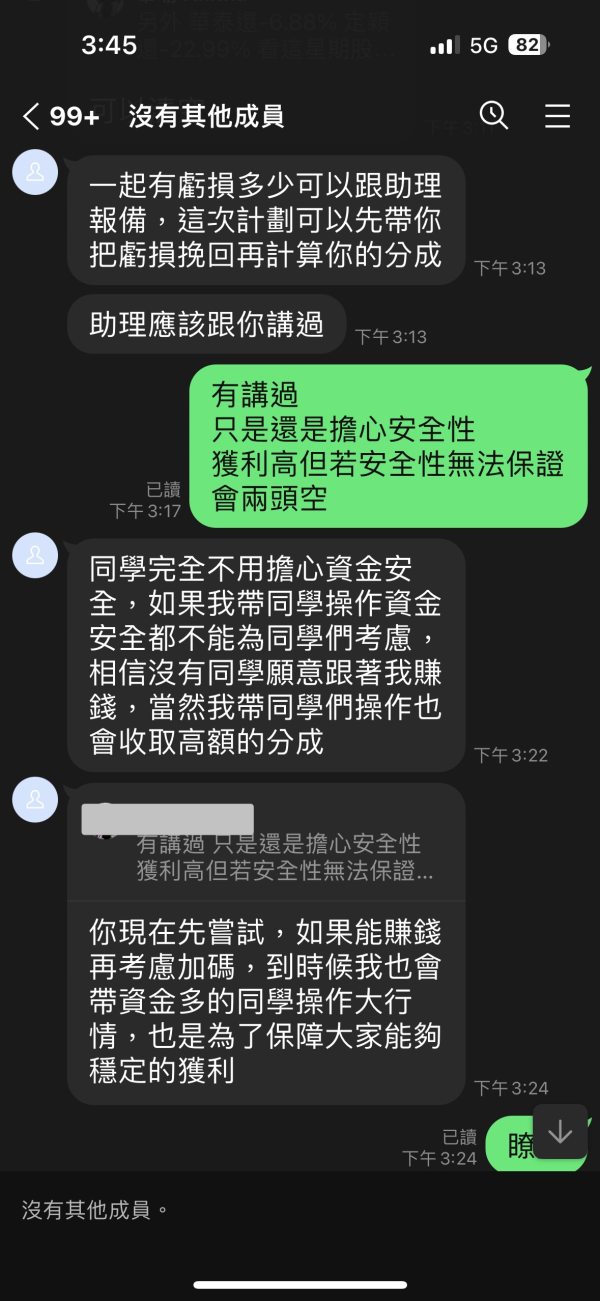

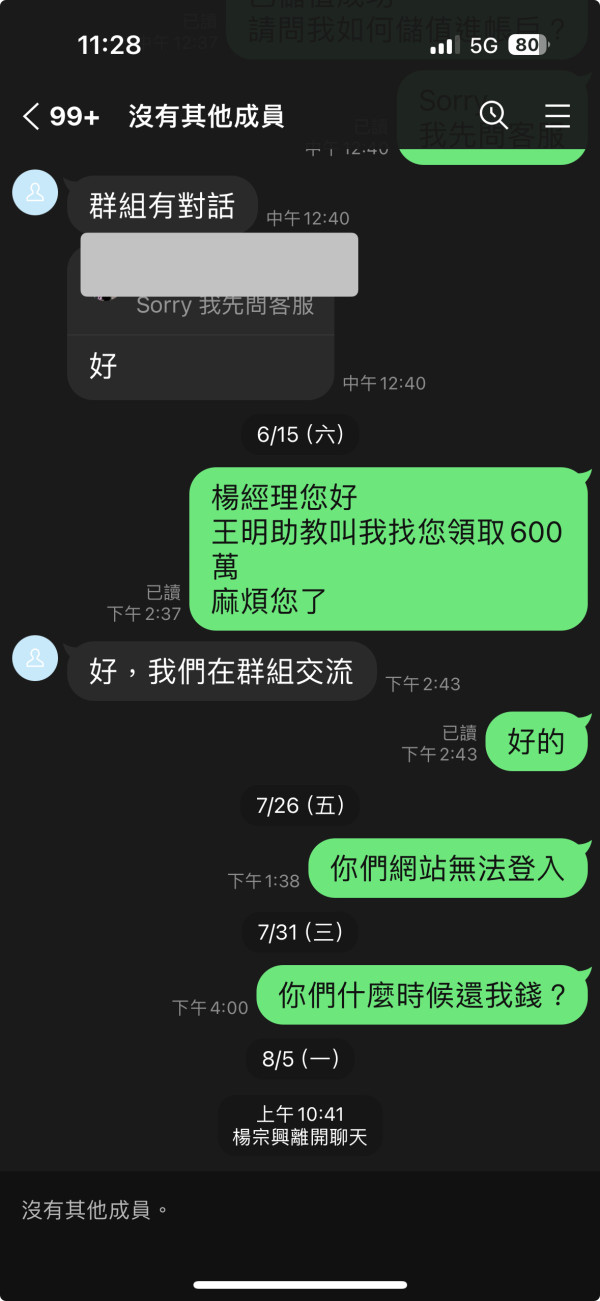

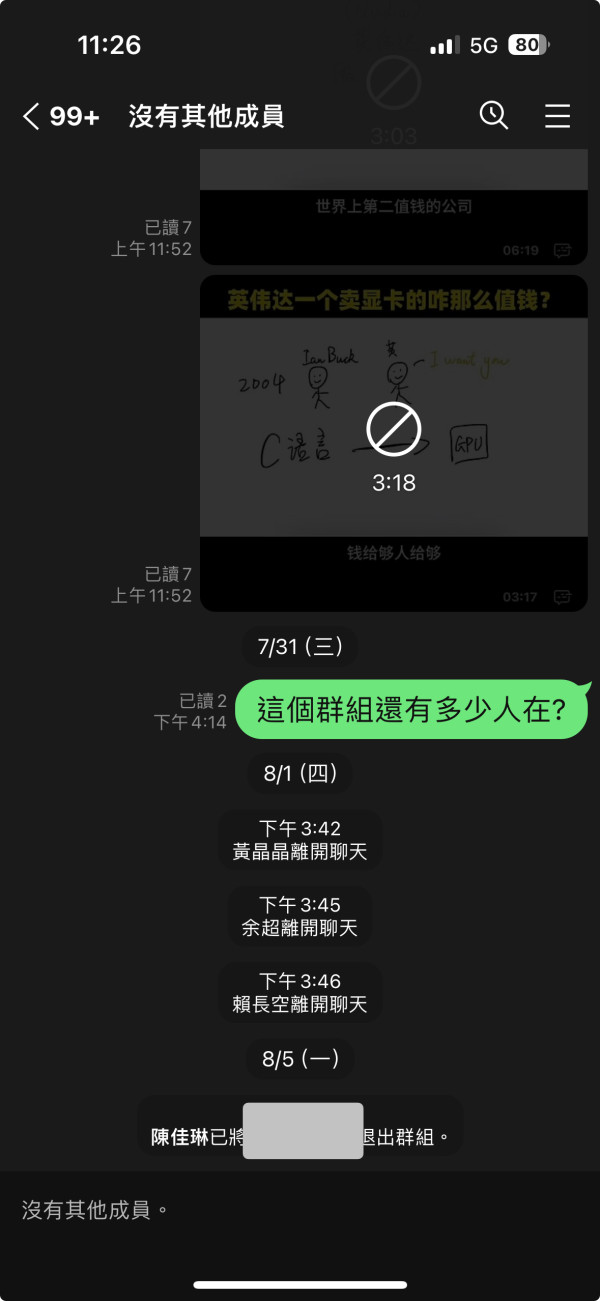

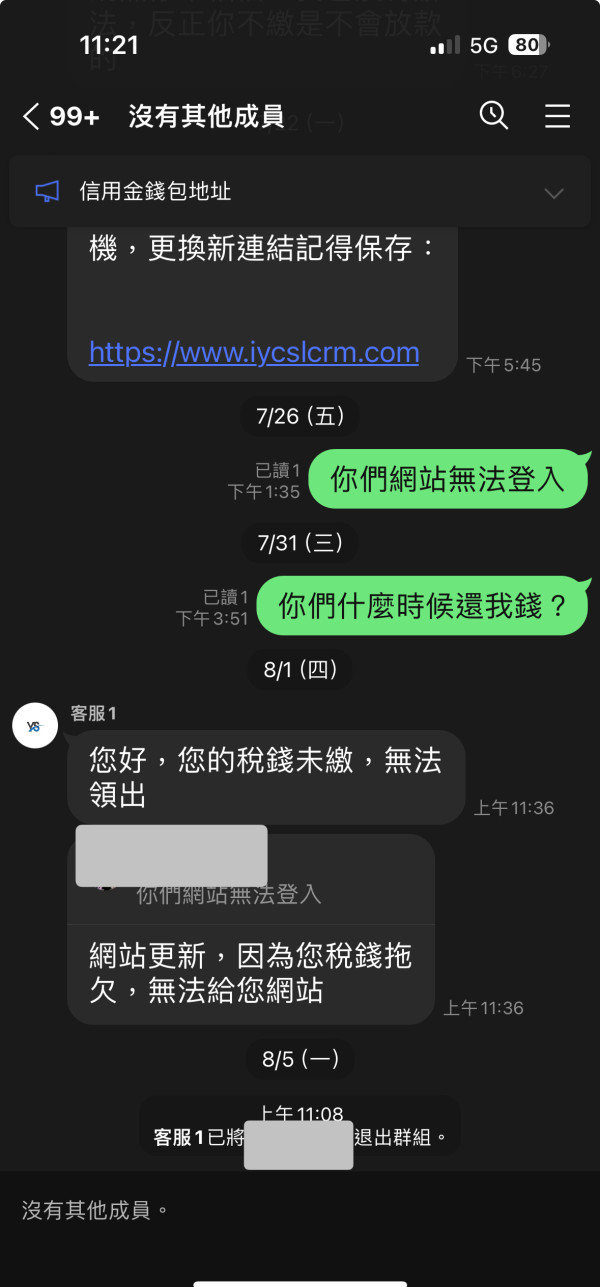

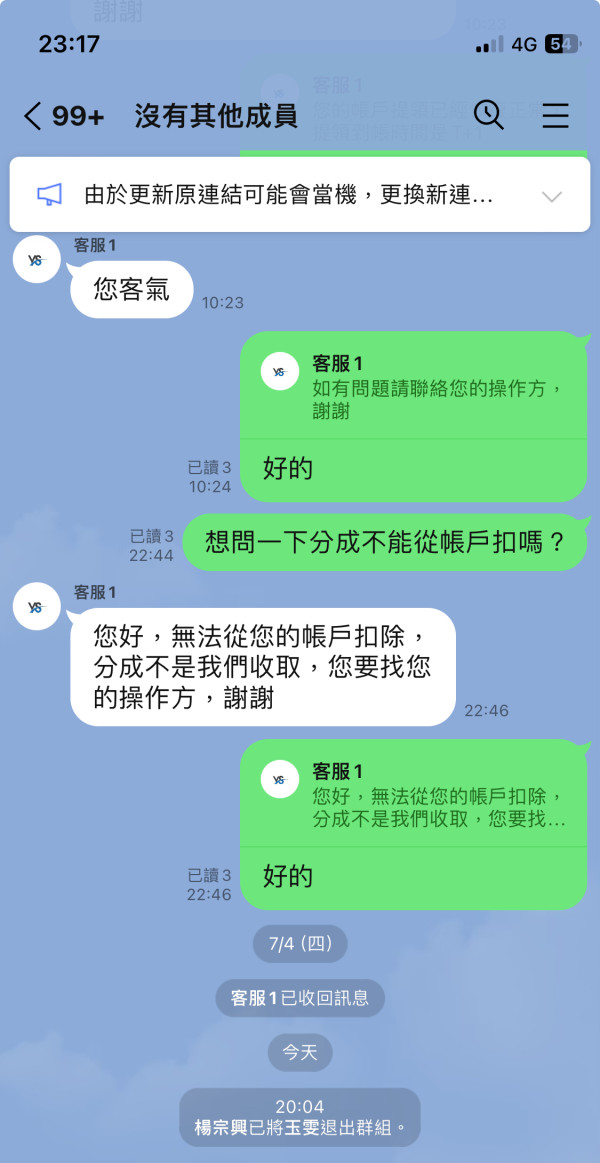

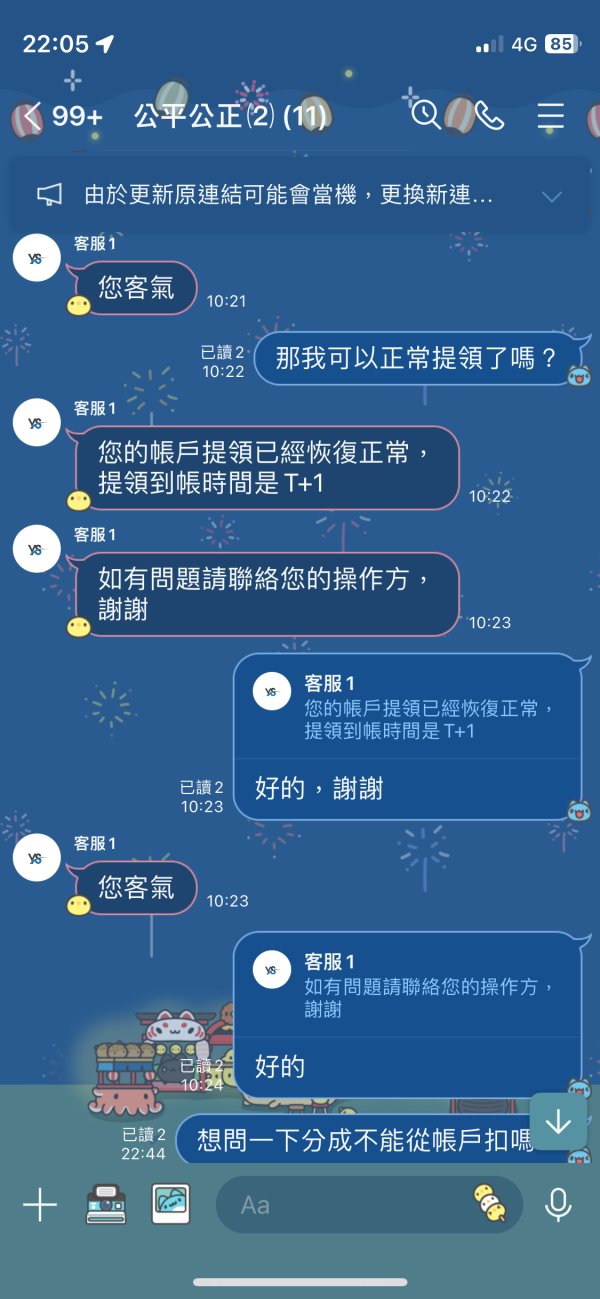

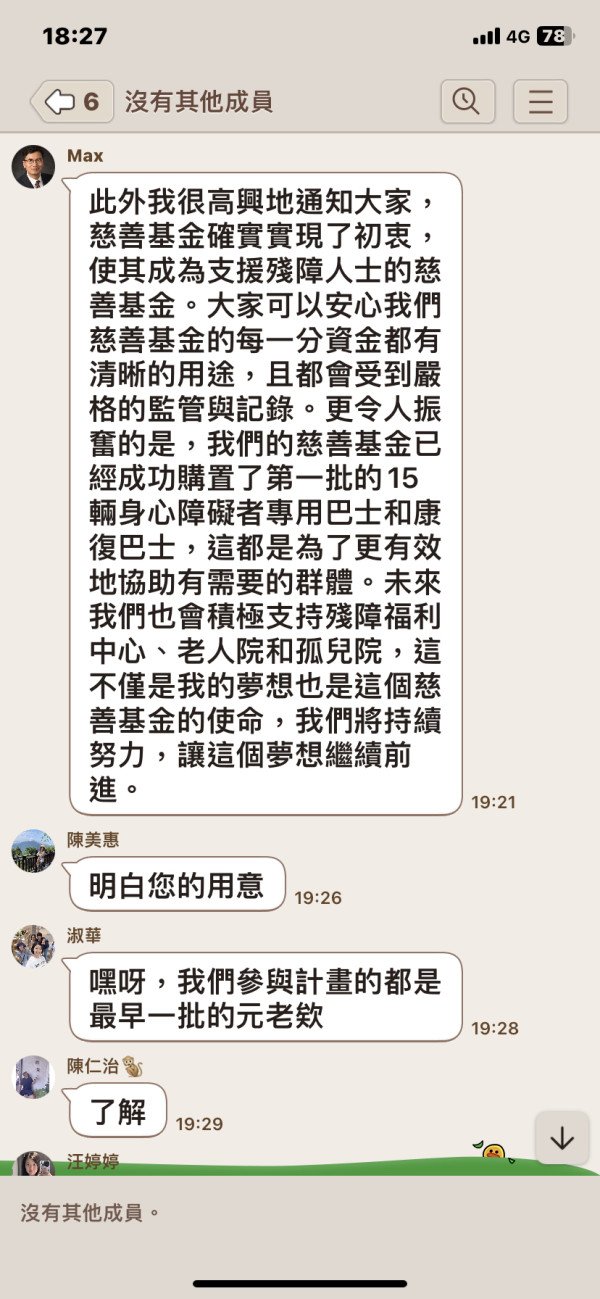

Customer service quality represents one of the most significant weaknesses identified in available user feedback about Saafan Markets. Multiple reports indicate extended response times, limited problem-solving capabilities, and unsatisfactory resolution of client concerns. These service quality issues become particularly problematic when combined with the broker's unregulated status. Clients have fewer external help options for dispute resolution.

The specific customer support channels available remain unclear from available information. This includes phone support, email assistance, live chat functionality, and help desk hours. Professional brokers typically provide multiple contact methods with clearly defined response time commitments and escalation procedures for complex issues. The absence of transparent support structure information suggests limited investment in customer service infrastructure.

Response time complaints from users indicate that urgent trading-related issues may not receive timely attention. This could potentially impact trading opportunities and risk management. In financial markets where timing is critical, delayed customer support can result in significant financial consequences for traders. This happens when they encounter platform issues, account problems, or technical difficulties during active trading sessions.

The quality of problem resolution appears inconsistent based on user reports. Many clients express frustration about incomplete solutions or recurring issues that require multiple support interactions. This pattern suggests insufficient technical expertise or inadequate support staff training. Both are concerning for a financial services provider handling client funds and trading activities.

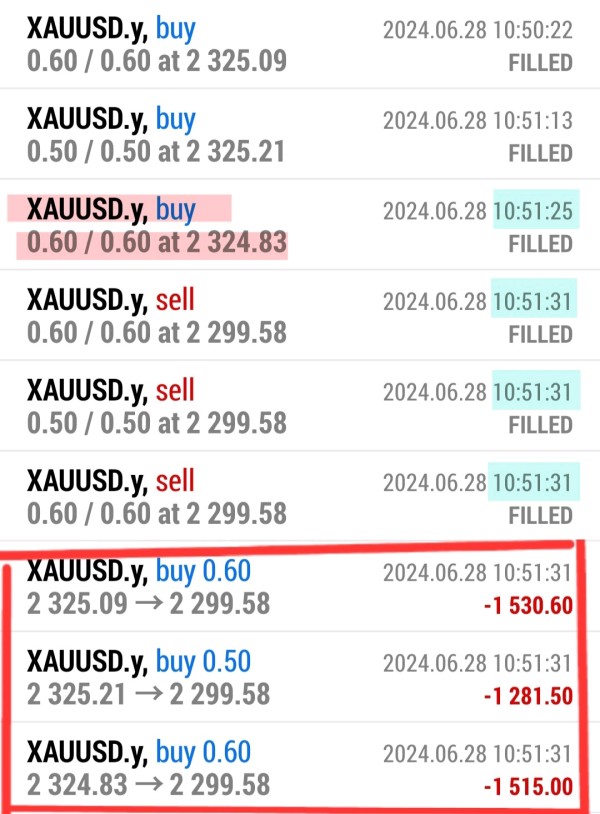

Trading Experience Analysis (Score: 4/10)

The trading experience at Saafan Markets centers around MetaTrader 4 platform functionality, which provides familiar tools for experienced forex traders. However, it may lack the enhanced features offered by more modern trading platforms. User feedback indicates occasional platform stability concerns, including connection issues and system slowdowns that can impact trading effectiveness during volatile market conditions.

Order execution quality appears inconsistent according to available user reports. Some clients experience slippage issues that affect trade profitability. In forex trading, execution speed and price accuracy are critical for successful trading strategies, particularly for scalping and short-term trading approaches. Any execution delays or price deviations can significantly impact trading results and client satisfaction levels.

The platform's feature completeness receives mixed reviews. Users appreciate standard MT4 capabilities while noting the absence of advanced features available through newer platform versions or proprietary trading interfaces. Mobile trading experience, while supported through standard MT4 mobile applications, lacks the enhanced functionality and user interface improvements that many modern brokers provide through custom mobile solutions.

Trading environment factors such as spread consistency, market depth, and liquidity provision remain unclear due to limited transparency about the broker's execution model and liquidity partnerships. This saafan markets review notes that without clear information about market making versus STP execution, clients cannot properly evaluate the trading conditions and potential conflicts of interest. These may affect their trading results.

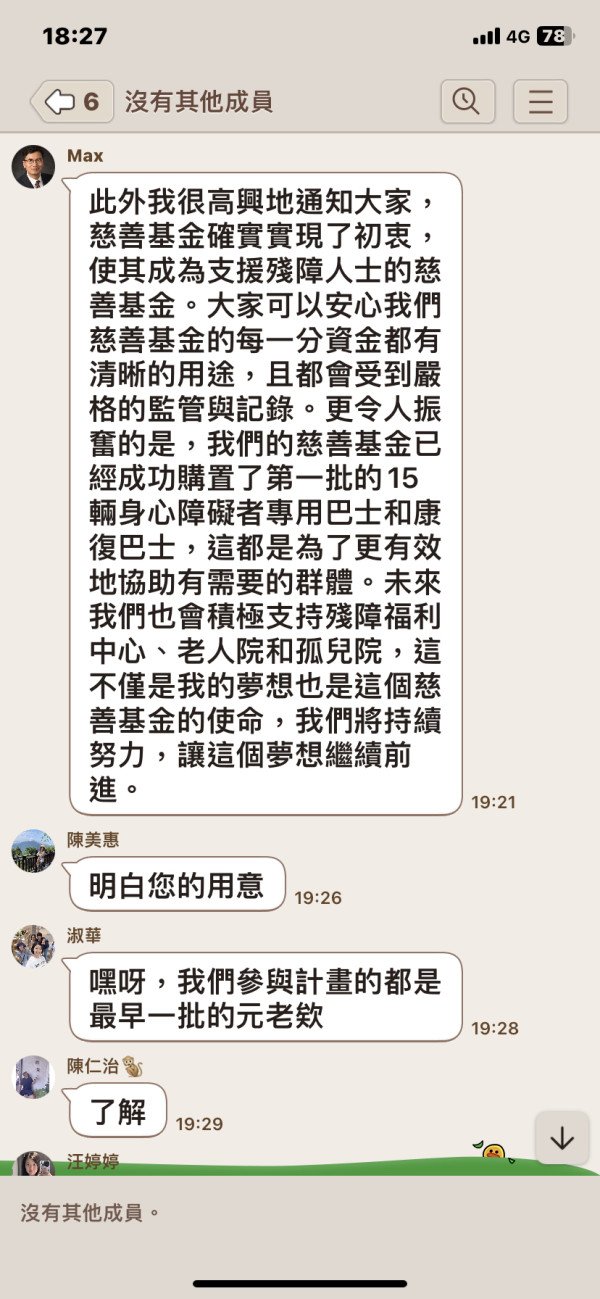

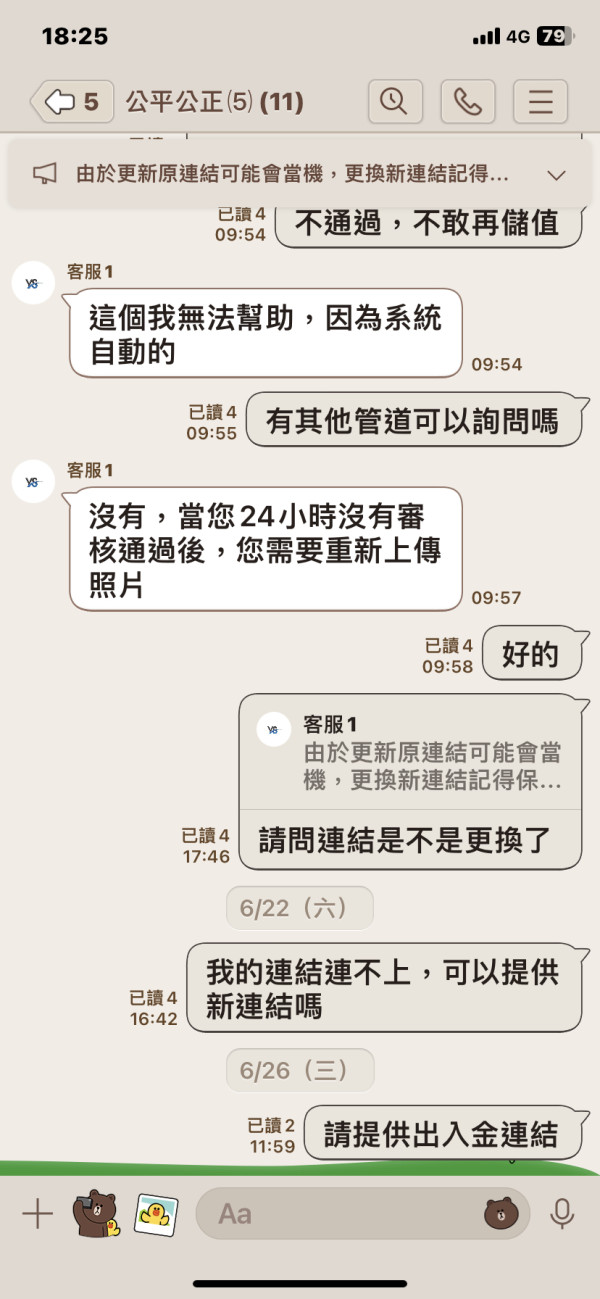

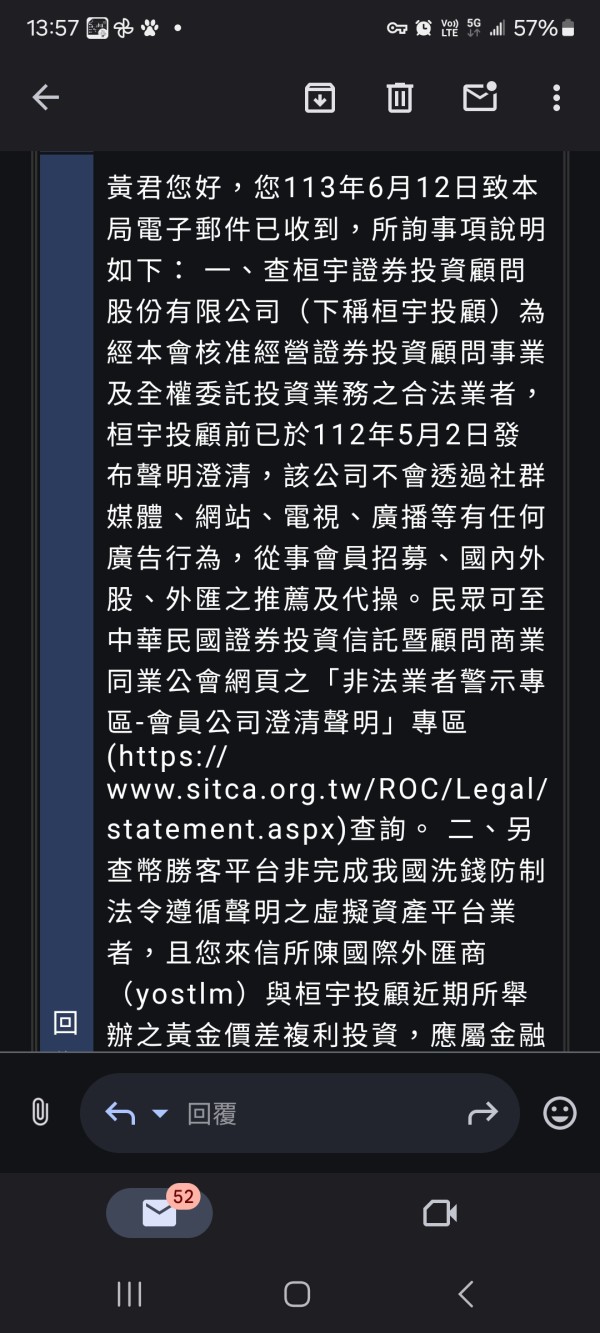

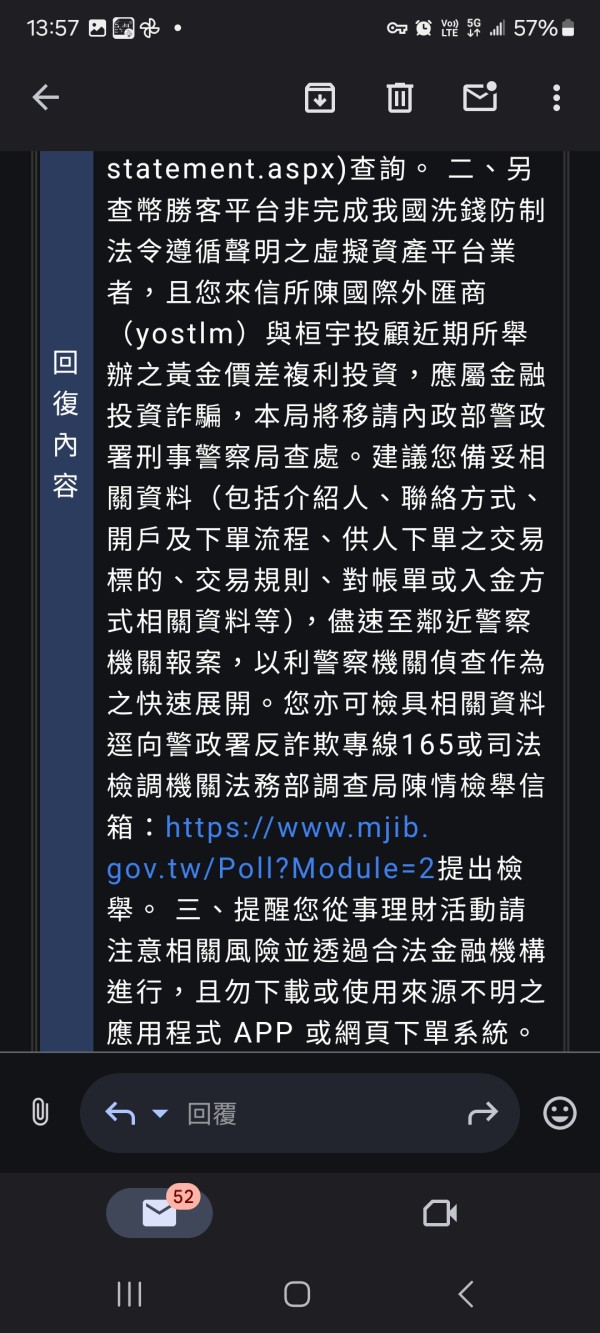

Trust and Safety Analysis (Score: 1/10)

Trust and safety concerns represent the most critical issues identified in this evaluation of Saafan Markets. The broker's registration in Saint Lucia under number 2024-00148 provides minimal investor protection compared to regulation by established financial authorities such as the FCA, CySEC, or ASIC. This regulatory gap means clients lack access to compensation schemes, regulatory oversight, and standardized dispute resolution procedures.

Fund safety measures remain unclear. There is no information available about segregated client accounts, deposit insurance, or third-party fund custody arrangements that protect client capital from operational risks. Legitimate brokers typically maintain client funds in segregated accounts with tier-one banks and provide clear documentation about fund protection measures. None of these are evident in available Saafan Markets materials.

Company transparency issues extend beyond regulatory status to include limited information about management structure, operational history, and business practices. The absence of detailed company background, executive profiles, and operational transparency creates significant due diligence challenges for potential clients. These clients need to assess counterparty risk before depositing funds.

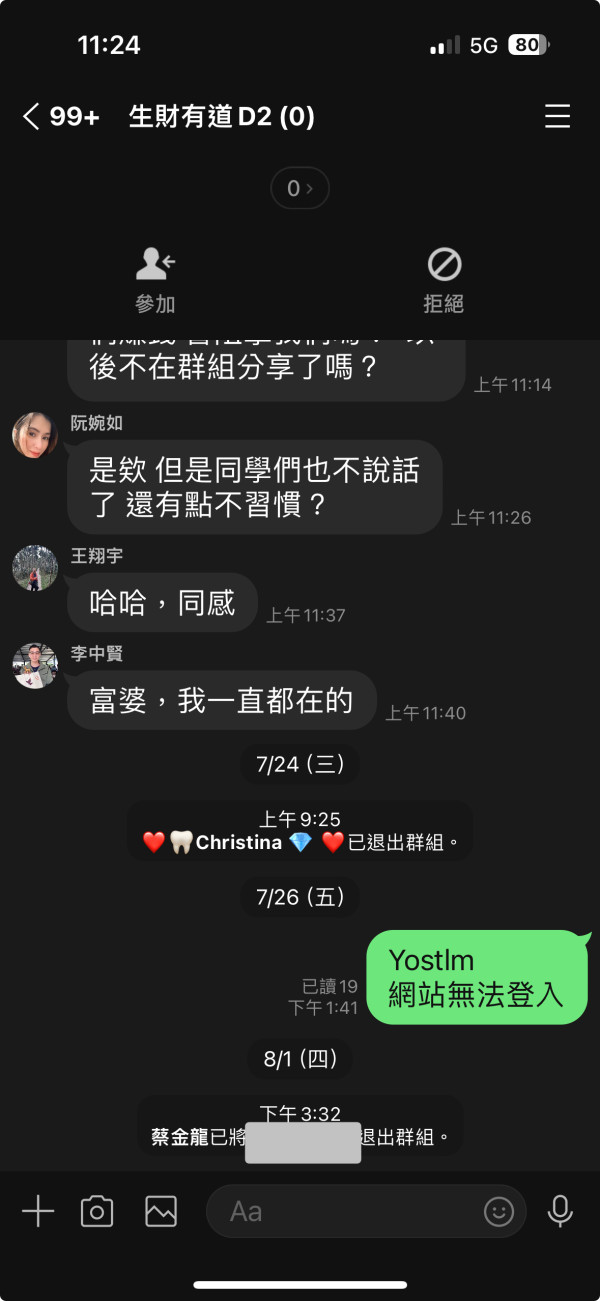

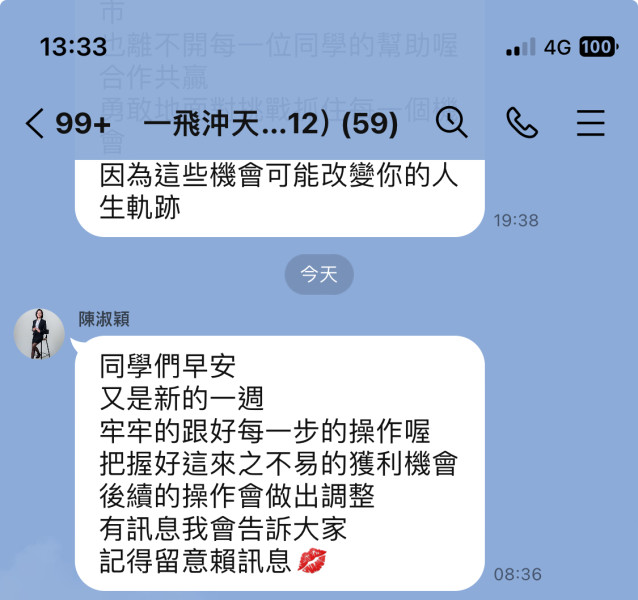

Industry reputation assessment reveals multiple warning signals from fraud monitoring services and review platforms that have flagged Saafan Markets as a potentially problematic broker. These warnings, combined with negative user experiences and the unregulated status, create a pattern of risk factors. This pattern suggests extreme caution is warranted when considering this broker for any trading activities.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Saafan Markets appears consistently low based on available feedback and review sources. Clients report disappointment with multiple aspects of the service, including customer support quality, platform reliability, and transparency issues that impact their overall trading experience. The combination of these factors creates a negative user experience that falls well below industry standards.

Interface design and usability center around the standard MetaTrader 4 platform, which provides familiar functionality for experienced traders. However, it lacks the enhanced user interface improvements and customization options available through more modern trading platforms. While MT4 remains functional, users increasingly expect more intuitive and feature-rich trading interfaces that enhance productivity and trading effectiveness.

Registration and verification processes remain unclear from available information. User feedback suggests potential complications or delays in account setup procedures. Efficient onboarding processes are essential for positive first impressions and client satisfaction. Any difficulties in this area can negatively impact the overall user experience from the beginning of the client relationship.

Common user complaints focus on customer service responsiveness, platform stability concerns, and transparency issues regarding trading conditions and fees. These recurring themes suggest systematic problems rather than isolated incidents. This indicates fundamental service quality issues that affect the majority of clients who choose to trade with this broker.

The user profile best suited for Saafan Markets remains unclear given the significant risk factors and service quality concerns identified in this analysis. While the platform might theoretically appeal to short-term traders familiar with MT4, the regulatory and safety concerns make it unsuitable for any investor prioritizing capital protection and regulatory oversight.

Conclusion

This comprehensive saafan markets review reveals substantial concerns that make Saafan Markets unsuitable for most forex and financial instrument traders. The broker's unregulated status, combined with multiple warning signals from industry monitoring services and consistently negative user feedback, creates an unacceptable risk profile for serious investors. While the platform offers MetaTrader 4 access and claims to provide multiple asset classes, these limited benefits cannot compensate for fundamental safety and transparency deficiencies.

The broker is particularly inappropriate for novice traders who require regulatory protection, comprehensive educational resources, and reliable customer support to develop their trading skills safely. Experienced traders seeking professional trading conditions would also find better alternatives among properly regulated brokers that offer transparent pricing, robust execution, and institutional-grade services.

The primary advantages of multi-asset trading access and MT4 platform availability are significantly outweighed by critical disadvantages. These include lack of regulatory oversight, poor customer service quality, transparency issues, and industry warnings about potential fraudulent activities. Investors are strongly advised to consider well-regulated alternatives that provide proper investor protection and professional service standards.