AETOS 2025 Review: Everything You Need to Know

Executive Summary

AETOS is a well-established forex and CFD broker. It has been serving traders globally since 2007, building a strong reputation over nearly two decades. This aetos review reveals a broker with a solid regulatory foundation, operating under the oversight of multiple respected financial authorities including the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), and other regional regulators.

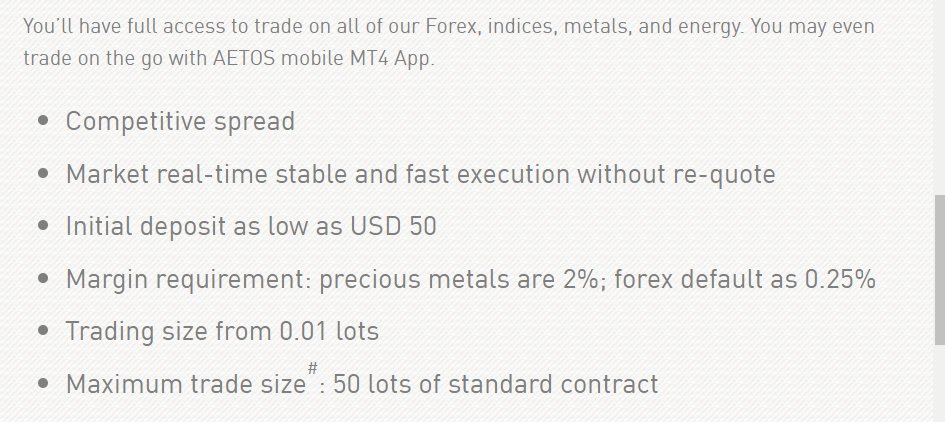

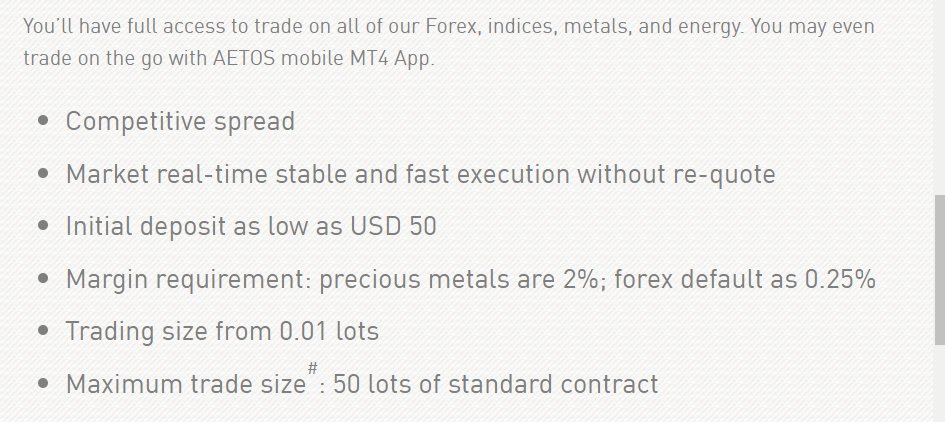

The broker stands out with an accessible entry point for new traders. It features a relatively low minimum deposit requirement of US$50, making it particularly attractive for beginners looking to enter the forex market without significant initial capital. AETOS provides traders with access to industry-standard platforms including MetaTrader 4 and MetaTrader 5. These platforms offer comprehensive trading tools and resources for various trading strategies.

The platform caters to a diverse range of trading preferences. It supports multiple asset classes including major and minor currency pairs, CFDs on indices, commodities, and other financial instruments. With its headquarters in Sydney, Australia, AETOS has expanded its reach to serve clients in over 100 countries worldwide. This expansion has established it as a truly global trading platform.

However, like many brokers in the competitive forex market, AETOS faces challenges in certain areas. These challenges particularly involve customer service quality and user experience consistency, which this review will examine in detail.

Important Disclaimer

This aetos review is based on publicly available information and user feedback compiled from various sources as of December 2024. Trading forex and CFDs involves significant risk of loss and may not be suitable for all investors. AETOS operates under different regulatory frameworks depending on the client's jurisdiction. Services may vary accordingly.

Potential traders should carefully consider their financial situation and risk tolerance before opening an account with any broker. The regulatory status and available services may differ based on your country of residence, and it is essential to verify the specific terms and conditions applicable to your region before making any trading decisions.

This review aims to provide an objective assessment based on available information. It should be considered alongside other research sources when evaluating AETOS as your potential trading partner.

AETOS Rating Framework

Rating Methodology: Our evaluation is based on regulatory compliance, platform features, trading conditions, customer feedback, and industry standards. Each category is weighted according to its importance for typical retail forex traders.

Broker Overview

AETOS Capital Group was established in 2007. It has since grown to become a notable player in the global forex and CFD trading industry. Headquartered in Sydney, Australia, the company has built its reputation on providing accessible trading services to retail and institutional clients across more than 100 countries worldwide. The broker operates as part of AETOS Capital Group, with subsidiaries in various jurisdictions to serve different regional markets effectively.

The company's business model centers on providing forex and Contract for Difference (CFD) trading services through sophisticated online platforms. AETOS positions itself as a bridge between individual traders and the global financial markets. It offers access to a wide range of financial instruments including major and exotic currency pairs, precious metals, energy commodities, and stock indices from around the world.

AETOS has built its trading infrastructure around the popular MetaTrader platform suite. It offers both MT4 and MT5 to accommodate different trader preferences and strategies. This dual-platform approach allows the broker to serve both traditional forex traders who prefer the familiar MT4 environment and those seeking the advanced features and expanded asset classes available through MT5.

The broker's regulatory framework spans multiple jurisdictions, with primary oversight from the Australian Securities and Investments Commission (ASIC), the UK's Financial Conduct Authority (FCA), Vanuatu Financial Services Commission (VFSC), and the Cayman Islands Monetary Authority (CIMA). This multi-jurisdictional approach allows AETOS to serve a global client base while maintaining compliance with various international regulatory standards. It also provides appropriate client protections in different regions.

Regulatory Status and Jurisdictions

AETOS operates under a comprehensive regulatory framework that includes oversight from several respected financial authorities. The Australian Securities and Investments Commission (ASIC) provides primary regulation for the company's Australian operations. The Financial Conduct Authority (FCA) oversees UK-based activities. Additional regulatory oversight comes from the Vanuatu Financial Services Commission (VFSC) and the Cayman Islands Monetary Authority (CIMA). This ensures compliance across multiple jurisdictions and provides client protection measures according to different regional standards.

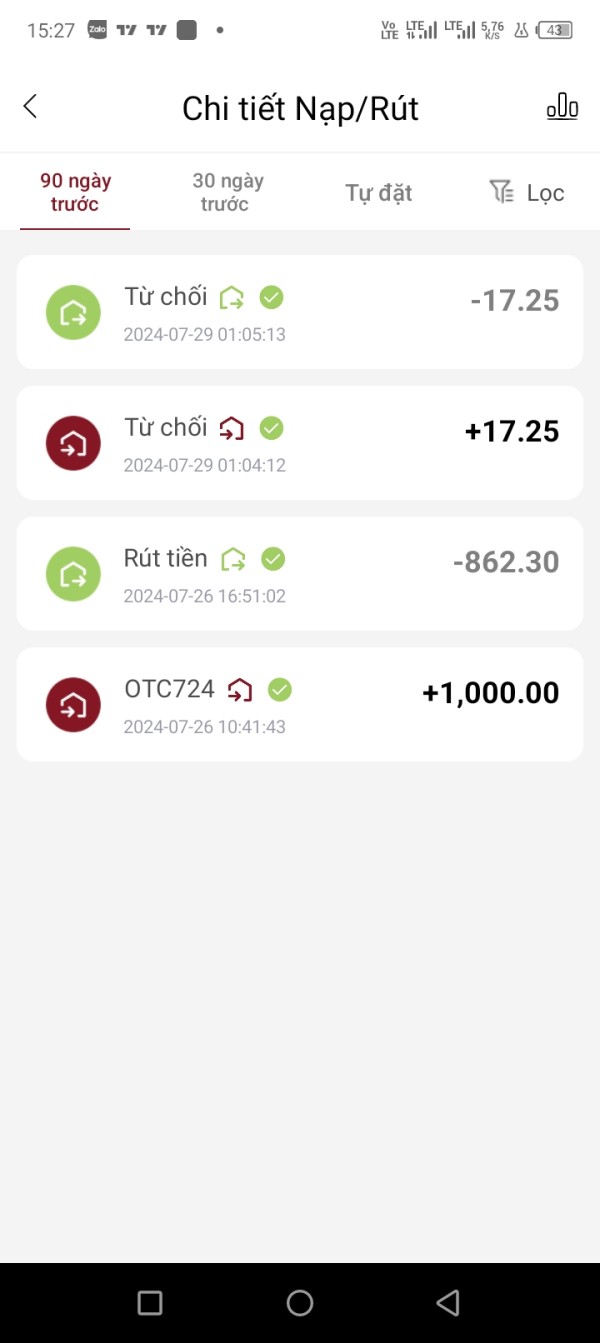

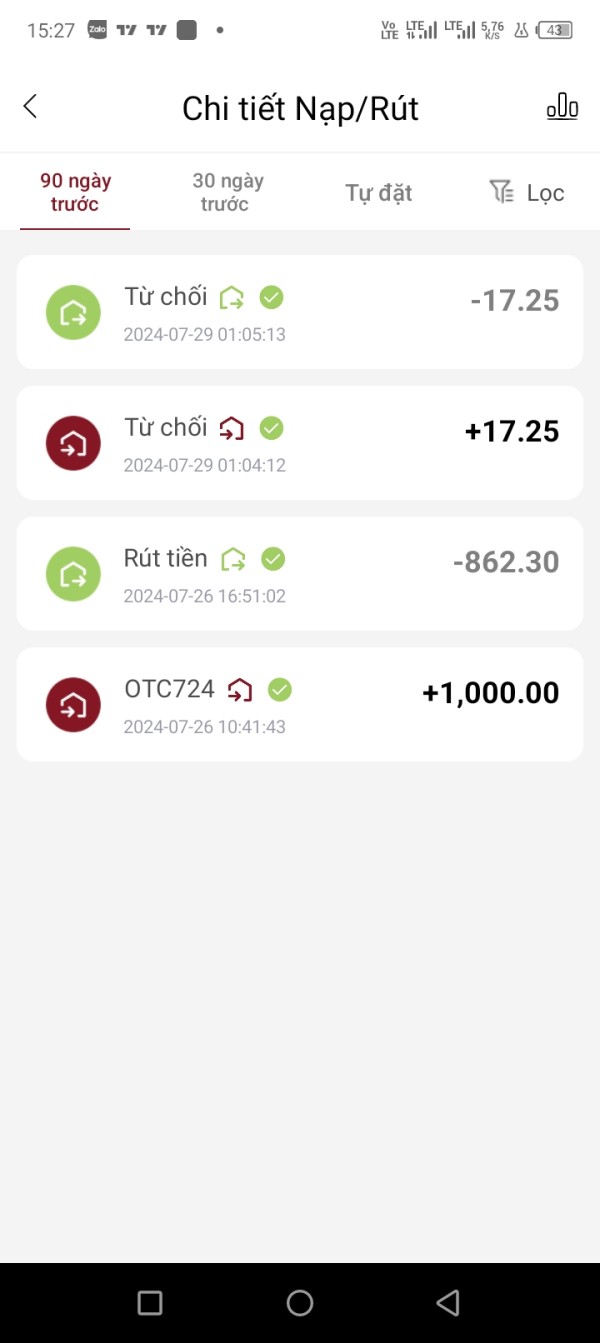

Deposit and Withdrawal Methods

While specific details about deposit and withdrawal methods were not comprehensively detailed in available sources, AETOS typically supports standard funding options common among international forex brokers. Traders should verify available payment methods directly with the broker as these may vary by region and regulatory requirements.

Minimum Deposit Requirements

AETOS sets its minimum deposit requirement at US$50. This makes it one of the more accessible brokers for new traders. This low entry threshold allows beginners to start trading with minimal initial capital while learning the markets. However, traders should be aware that starting with small amounts may limit trading flexibility and position sizing options.

Information regarding specific bonus programs or promotional offers was not detailed in the available source materials. Potential clients should inquire directly with AETOS about any current promotions. They should keep in mind that bonus terms and conditions can significantly impact trading flexibility and withdrawal procedures.

Tradeable Assets and Instruments

AETOS provides access to a diverse range of financial instruments including major, minor, and exotic currency pairs covering the global forex market. The broker also offers CFDs on various asset classes including international stock indices, precious metals like gold and silver, energy commodities, and other popular trading instruments. This variety allows traders to diversify their portfolios and implement different trading strategies across multiple markets.

Cost Structure and Fees

Specific information about spreads, commissions, and other trading costs was not comprehensively detailed in the available sources. According to some reports, AETOS may have relatively higher spreads compared to some competitors. However, traders should verify current pricing directly with the broker as these can vary based on account type and market conditions.

Leverage Options

AETOS offers maximum leverage of 1:30. This aligns with regulatory requirements in many jurisdictions, particularly those governed by European and Australian regulations. This conservative leverage approach prioritizes client protection over high-risk trading opportunities. It makes the platform suitable for traders who prefer more controlled risk exposure.

The broker provides access to both MetaTrader 4 and MetaTrader 5 platforms. These cover the preferences of most forex traders. These industry-standard platforms offer comprehensive charting tools, technical analysis capabilities, automated trading support through Expert Advisors, and mobile trading applications for on-the-go market access.

Geographic Restrictions

While AETOS serves clients in over 100 countries, specific geographic restrictions were not detailed in available sources. Potential clients should verify service availability in their jurisdiction as regulatory requirements may limit access in certain regions.

Customer Support Languages

The available sources indicate that AETOS provides multilingual customer support. However, specific languages supported were not comprehensively listed. This multilingual approach aligns with the broker's global service model and diverse client base.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

AETOS demonstrates strong accessibility through its low minimum deposit requirement of US$50. This makes it particularly attractive for new traders who want to enter the forex market without substantial initial capital commitment. This low barrier to entry represents a significant advantage over many competitors who require higher minimum deposits, sometimes ranging from $100 to $500 or more.

However, this aetos review must note that specific information about different account types and their respective features was not comprehensively detailed in available sources. Many competitive brokers offer tiered account structures with varying spreads, commission structures, and additional services based on deposit levels or trading volumes. The absence of detailed account type information makes it difficult to assess how AETOS serves different trader segments, from beginners to high-volume institutional clients.

The 1:30 maximum leverage ratio aligns with current regulatory standards in major jurisdictions. This particularly follows European Securities and Markets Authority (ESMA) guidelines and similar regulations in Australia. While this conservative approach prioritizes client protection, some experienced traders might find it limiting compared to brokers offering higher leverage in less regulated jurisdictions.

Account opening procedures and verification processes were not specifically detailed in available sources. However, as a regulated broker, AETOS must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. The efficiency and user-friendliness of these processes can significantly impact the overall client experience, particularly for traders eager to begin trading quickly.

AETOS earns strong marks in this category by providing access to both MetaTrader 4 and MetaTrader 5 platforms. This covers the vast majority of trader preferences and requirements. MT4 remains the gold standard for forex trading, offering robust charting capabilities, extensive technical analysis tools, and comprehensive Expert Advisor support for automated trading strategies. The addition of MT5 provides access to additional asset classes and enhanced features for traders who require more advanced functionality.

The dual-platform approach demonstrates AETOS's commitment to meeting diverse trader needs. MT4 appeals to traditional forex traders while MT5 attracts those interested in stocks, futures, and other financial instruments beyond forex and CFDs. Both platforms support mobile trading through well-developed smartphone and tablet applications. This enables traders to monitor positions and execute trades from anywhere.

However, this analysis must note that specific information about proprietary trading tools, research resources, educational materials, and market analysis was not comprehensively detailed in available sources. Many competitive brokers differentiate themselves through exclusive research reports, trading signals, economic calendars, and educational webinars. The absence of detailed information about these value-added services makes it difficult to fully assess AETOS's competitive position in providing comprehensive trading support beyond basic platform access.

The platforms' technical analysis capabilities include standard indicators, drawing tools, and charting options that satisfy most trading strategies. Expert Advisor support allows for automated trading, which can be particularly valuable for traders employing systematic approaches or those unable to monitor markets continuously.

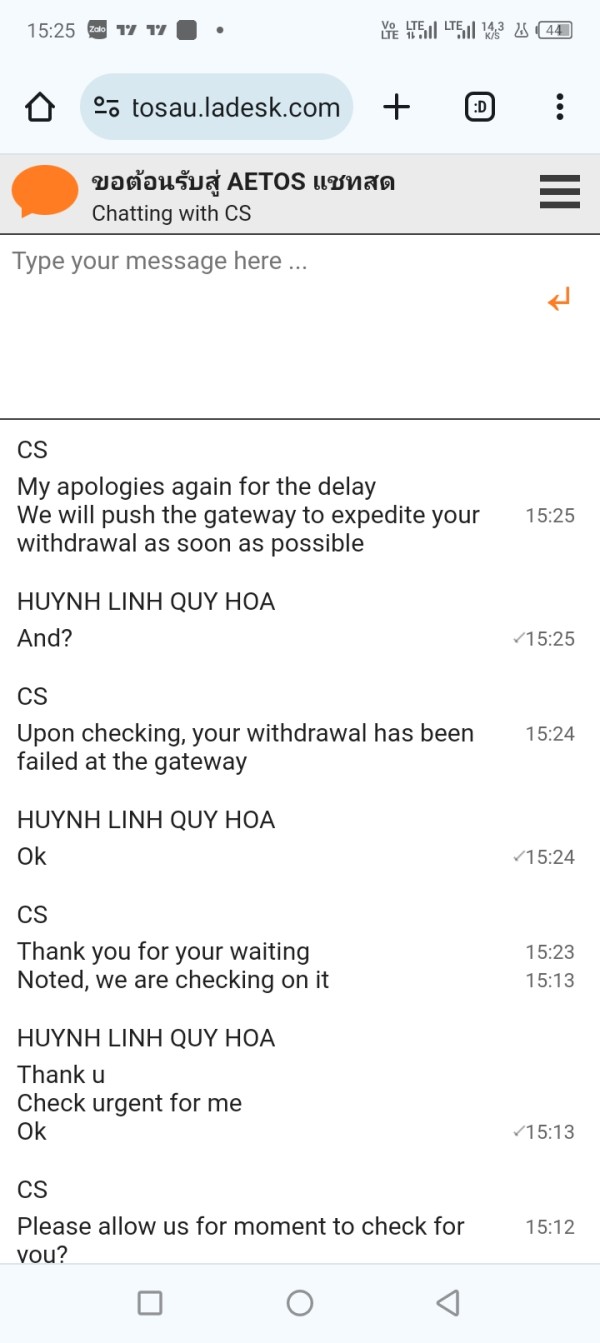

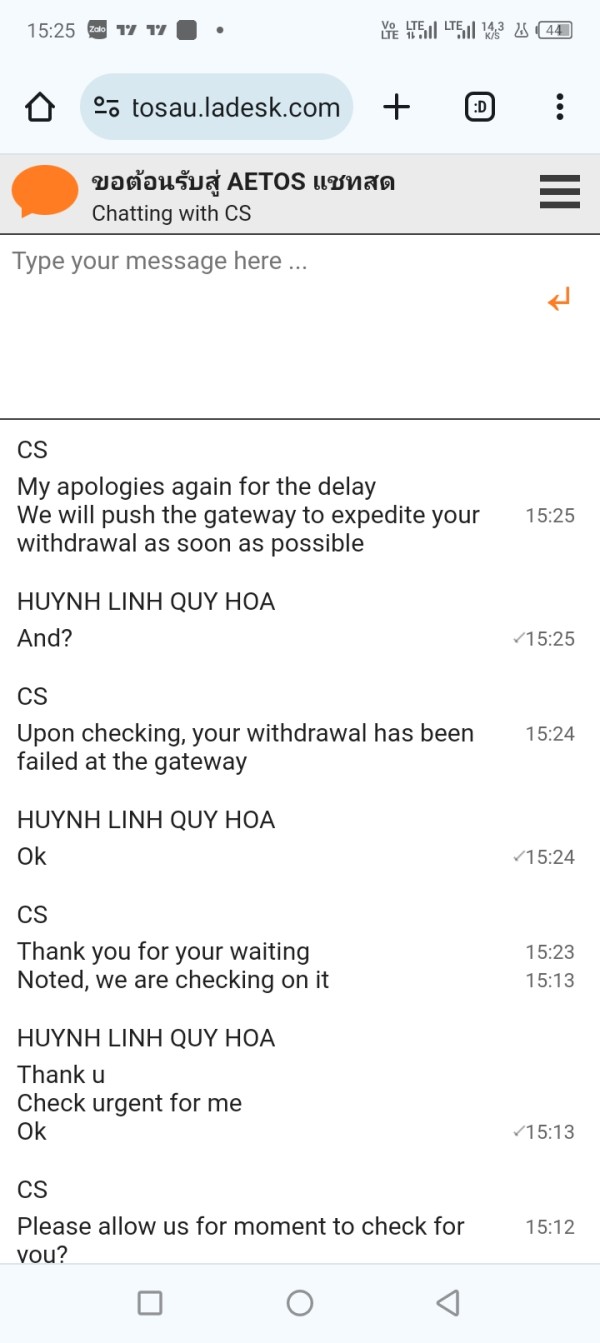

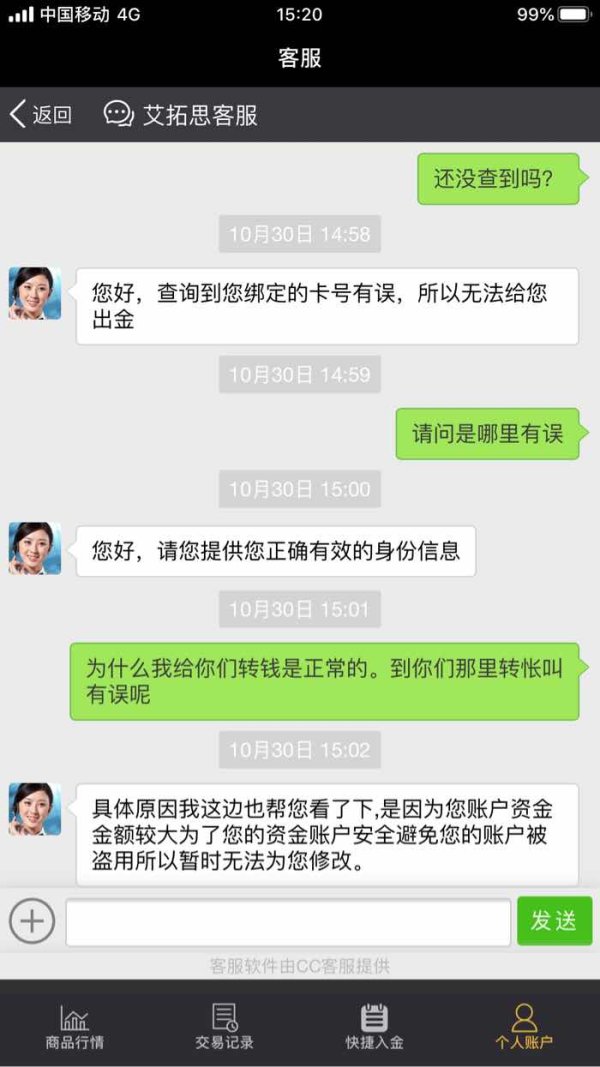

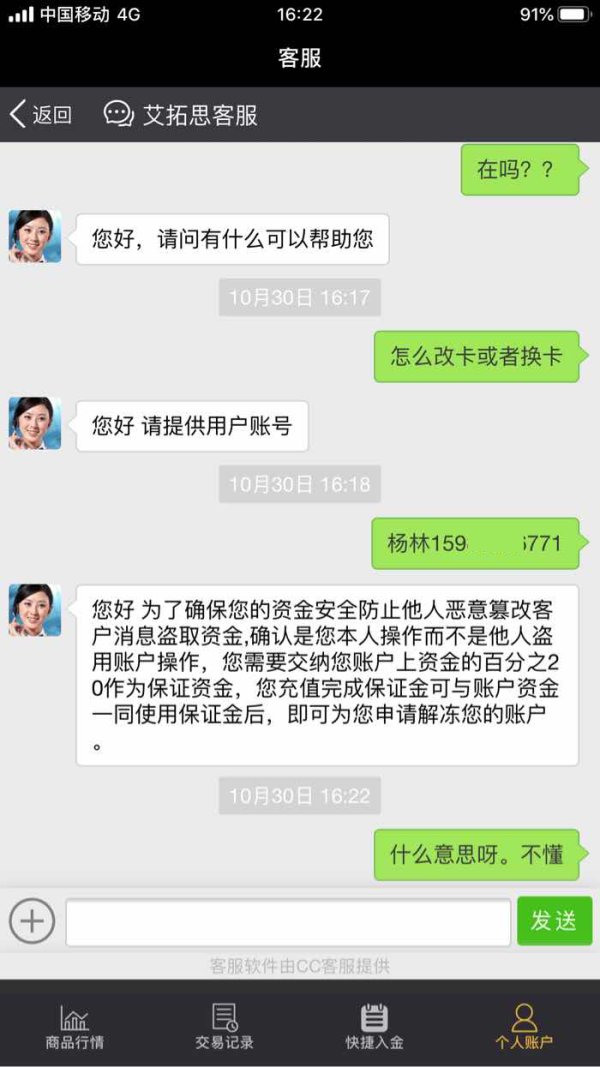

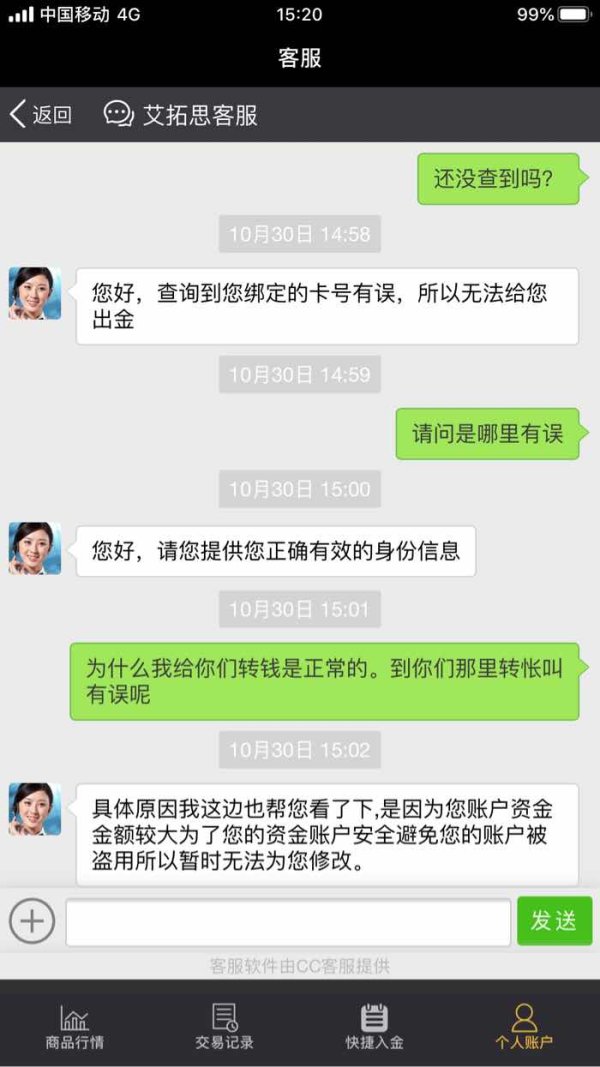

Customer Service and Support Analysis (6/10)

Customer service represents a challenging area for AETOS based on available feedback and industry reports. While specific response times and support channel details were not comprehensively provided in source materials, some indicators suggest that service quality may be inconsistent. This potentially falls below industry standards for a broker of AETOS's size and regulatory standing.

The broker's global presence across over 100 countries necessitates multilingual support capabilities. Sources indicate that AETOS does provide support in multiple languages. However, the effectiveness and availability of this support across different time zones and languages can vary significantly. This potentially creates frustration for clients in certain regions or those requiring assistance outside standard business hours.

Professional forex brokers typically offer multiple contact channels including live chat, telephone support, email assistance, and sometimes callback services. The responsiveness and knowledge level of support staff can significantly impact trader satisfaction, particularly during volatile market conditions when quick resolution of technical or account issues becomes critical.

Some industry feedback suggests that AETOS may face challenges in maintaining consistent service quality across all support channels and regions. This inconsistency can be particularly problematic for active traders who rely on prompt technical support or account assistance. The broker's distributed regulatory structure across multiple jurisdictions may contribute to varying service levels depending on which subsidiary handles specific client relationships.

Training and expertise of customer service representatives in handling complex trading-related inquiries, platform technical issues, and account management requests appears to be an area where AETOS could potentially improve. This improvement would help match the standards set by leading industry competitors.

Trading Experience Analysis (7/10)

The trading experience with AETOS centers around the proven MetaTrader platform ecosystem. This provides a solid foundation for most trading activities. Both MT4 and MT5 offer stable, reliable trading environments with minimal technical disruptions when properly maintained. The platforms' order execution capabilities generally meet industry standards, though specific performance metrics regarding slippage, requotes, and execution speeds were not detailed in available sources.

Platform stability and uptime are crucial factors for active traders, particularly during high-impact news events or volatile market conditions. The MetaTrader platforms have established track records for reliability. AETOS's implementation appears to maintain these standards based on the absence of widespread technical complaints in available sources.

However, this aetos review must acknowledge that specific user feedback regarding order execution quality, platform responsiveness during peak trading hours, and overall trading environment quality was limited in available sources. These factors can significantly impact profitability, particularly for scalpers and high-frequency traders who depend on precise execution and minimal latency.

The variety of available trading instruments across forex pairs, CFDs on indices, commodities, and other assets provides reasonable diversification opportunities for most trading strategies. The ability to trade multiple asset classes through a single platform can be advantageous for traders implementing cross-market strategies or seeking portfolio diversification.

Mobile trading capabilities through MT4 and MT5 mobile applications enable traders to maintain market connectivity and manage positions while away from their primary trading setups. The quality and functionality of these mobile platforms can significantly impact the overall trading experience for modern traders who require flexibility and mobility.

Trust and Security Analysis (8/10)

AETOS demonstrates strong credentials in the trust and security category through its comprehensive regulatory framework spanning multiple respected jurisdictions. Regulation by the Australian Securities and Investments Commission (ASIC) provides robust client protection measures including segregated client funds, negative balance protection, and membership in the Australian Financial Complaints Authority (AFCA) for dispute resolution.

Additional oversight from the Financial Conduct Authority (FCA) in the United Kingdom adds another layer of regulatory protection. The FCA maintains some of the world's strictest financial services regulations. The FCA requires authorized firms to maintain adequate capital reserves, implement appropriate risk management systems, and provide compensation scheme coverage for eligible clients.

Regulatory coverage through the Vanuatu Financial Services Commission (VFSC) and Cayman Islands Monetary Authority (CIMA) extends AETOS's ability to serve international clients while maintaining appropriate oversight. While these jurisdictions may have different regulatory standards compared to ASIC or FCA, they still provide legitimate regulatory frameworks for international financial services.

The multi-jurisdictional regulatory approach allows AETOS to offer appropriate services to clients in different regions while complying with local requirements. This structure can provide flexibility in service offerings while maintaining regulatory compliance. However, clients should understand which entity provides their services and the corresponding protections available.

However, specific details about client fund segregation procedures, insurance coverage, and other security measures were not comprehensively detailed in available sources. These operational security measures can be crucial for client confidence, particularly for traders maintaining larger account balances or those concerned about broker financial stability.

User Experience Analysis (6/10)

The overall user experience with AETOS presents a mixed picture based on available information and industry feedback. While the broker provides solid foundational elements through regulated operations and established trading platforms, several factors may impact overall user satisfaction and experience quality.

The low minimum deposit requirement creates an accessible entry point for new traders. This positively impacts the initial user experience. However, the overall account opening process, verification procedures, and onboarding experience were not detailed in available sources. This makes it difficult to assess how smoothly new clients can transition from registration to active trading.

Platform usability benefits from the familiar MetaTrader environment, which many traders already understand and prefer. This familiarity can reduce the learning curve for new AETOS clients who have previous MetaTrader experience with other brokers. However, traders new to MetaTrader may require additional support and educational resources to fully utilize the platform's capabilities.

Some industry indicators suggest that user satisfaction with AETOS may be inconsistent. This is potentially related to service quality variations and support responsiveness issues mentioned in the customer service analysis. Inconsistent experiences can significantly impact overall user satisfaction, particularly for traders who encounter problems or require assistance.

The funding and withdrawal experience, while not detailed specifically in available sources, can significantly impact user satisfaction. Efficient, transparent, and cost-effective deposit and withdrawal procedures are essential for positive user experiences. This is particularly true for active traders who frequently move funds in and out of their trading accounts.

Geographic service variations may also impact user experience, as regulatory requirements and operational capabilities can differ significantly between regions. Traders in some jurisdictions may receive superior service levels compared to others. This creates inconsistent brand experiences across AETOS's global client base.

Conclusion

This comprehensive aetos review reveals a broker with solid regulatory foundations and accessible trading conditions. It is particularly suitable for new traders seeking entry into the forex market with minimal initial capital requirements. AETOS's multi-jurisdictional regulatory framework provides appropriate client protections, while the low US$50 minimum deposit and proven MetaTrader platform access create a reasonable foundation for beginning traders.

However, the broker faces notable challenges in customer service consistency and overall user experience delivery that may impact trader satisfaction. This is particularly true for those requiring frequent support or assistance. While the regulatory oversight and platform stability provide confidence in the broker's operational integrity, potential clients should carefully consider their service expectations and trading requirements when evaluating AETOS against competitive alternatives.

The broker appears most suitable for beginning to intermediate traders who prioritize regulated operations and familiar trading platforms over premium service levels or advanced trading features. More experienced traders or those requiring exceptional customer service standards may find better alternatives elsewhere in the competitive forex broker landscape.