Regarding the legitimacy of AETOS forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is AETOS safe?

Pros

Cons

Is AETOS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

AETOS CAPITAL GROUP PTY LTD

Effective Date: Change Record

2007-10-12Email Address of Licensed Institution:

compliance@aetoscg.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 15 122 ARTHUR ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

0299292100Licensed Institution Certified Documents:

Is Aetos a Scam?

Introduction

Aetos, established in 2007, positions itself as a global online trading service provider specializing in Forex and Contracts for Difference (CFDs). With its headquarters in Sydney, Australia, Aetos has expanded its operations to cater to traders across more than 100 countries. As the Forex market continues to attract both novice and seasoned traders, it becomes increasingly crucial for individuals to evaluate the trustworthiness of their chosen brokerage. The prevalence of scams in the Forex industry necessitates a thorough investigation into the legitimacy of brokers like Aetos. This article aims to provide a comprehensive assessment of Aetos, focusing on its regulatory status, company background, trading conditions, customer fund security, and user experiences. The evaluation will be based on a combination of qualitative analysis and quantitative data sourced from various reputable financial websites and regulatory bodies.

Regulation and Legitimacy

When it comes to Forex trading, regulation plays a pivotal role in ensuring the safety and integrity of the trading environment. Aetos is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK, which are considered top-tier regulatory bodies. Below is a summary of Aetos' regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 313016 | Australia | Verified |

| FCA | 592778 | United Kingdom | Verified |

| VFSC | 700450 | Vanuatu | Verified |

The presence of multiple regulatory licenses enhances Aetos's credibility, as it must adhere to stringent compliance standards set forth by these authorities. ASIC, in particular, requires brokers to maintain a minimum capital requirement and ensure that client funds are kept in segregated accounts, which adds a layer of protection for traders. However, it's important to note that while regulation provides some assurance, it does not eliminate all risks associated with trading. Historical compliance records indicate that Aetos has maintained a good standing with these regulatory bodies, although there have been some complaints about withdrawal issues, which we will explore further in the article.

Company Background Investigation

Aetos Capital Group Pty. Ltd. was founded in 2007, and its operational history reflects a commitment to providing diverse trading options and robust customer service. The company has evolved over the years, expanding its reach and adapting to the changing landscape of online trading. Its ownership structure is characterized by a focus on transparency, with regulatory disclosures readily available to the public.

The management team at Aetos comprises professionals with extensive experience in finance and trading. This expertise is crucial in navigating the complexities of the Forex market and ensuring that the brokerage operates effectively. The company's commitment to transparency is evident in its regular communication with clients and the availability of detailed information regarding its services and trading conditions.

Aetos has established a reputation in the industry, having received various awards for its customer service and trading conditions. However, prospective traders should consider the overall transparency of the brokerage, including how well it discloses potential risks and trading conditions. While Aetos has made strides in maintaining a clear communication channel, some users have expressed concerns about the responsiveness of customer support, particularly during high-demand periods.

Trading Conditions Analysis

Aetos offers a range of trading conditions that are competitive within the Forex market. The overall fee structure is primarily based on spreads, with no commission charged on trades. Below is a comparison of Aetos' core trading costs with industry averages:

| Fee Type | Aetos | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spread of 1.8 pips for major currency pairs is slightly higher than the industry average, which could impact profitability for frequent traders. However, the absence of commission fees can offset this disadvantage, especially for traders who engage in high-volume trading. It's essential for traders to be aware of any unusual fees or hidden costs that may arise, particularly regarding withdrawal fees or inactivity fees.

Aetos also provides various account types, including a general account with a minimum deposit requirement of $250. This relatively low barrier to entry makes Aetos accessible to a wide range of traders, including those who are just starting. Nevertheless, traders should review the specific conditions associated with each account type to ensure that they align with their trading strategies and goals.

Customer Fund Security

The safety of client funds is a paramount concern for any trader. Aetos implements several measures to safeguard customer deposits, including segregated accounts that ensure client funds are kept separate from the company's operational funds. This practice is crucial in protecting traders in the event of financial difficulties faced by the brokerage.

Additionally, Aetos adheres to the regulations set forth by ASIC, which mandates that licensed brokers maintain a minimum capital requirement and comply with strict operational standards. However, it's important to note that while ASIC provides a robust regulatory framework, Australian brokers are not covered by a compensation scheme like the Financial Services Compensation Scheme (FSCS) in the UK. This means that in the unlikely event of Aetos facing insolvency, traders may not have access to compensation for their losses.

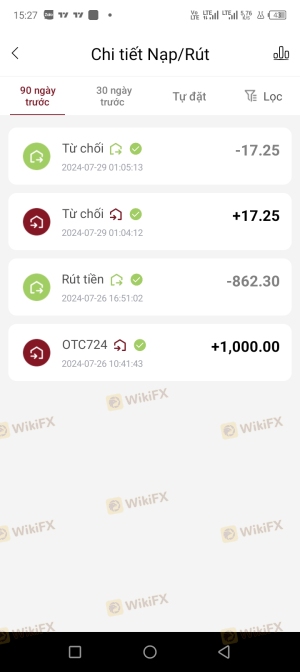

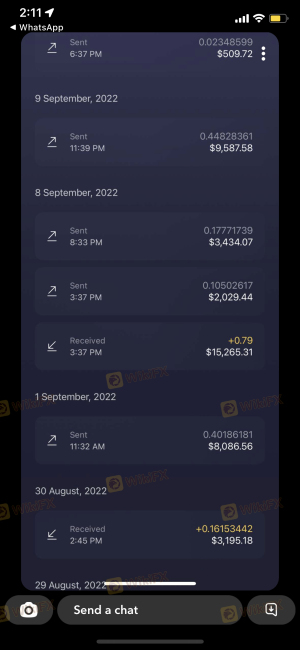

Historically, Aetos has faced some scrutiny regarding fund security, with reports of withdrawal delays and complaints from users about accessing their funds. While these issues may not be indicative of a systemic problem, they highlight the importance of conducting thorough research before engaging with any brokerage.

Customer Experience and Complaints

User feedback is a vital component of assessing a brokerage's reliability. Aetos has received mixed reviews from its clients, with some praising its trading conditions and customer service, while others have raised concerns about withdrawal processes. Below is a summary of common complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Verification Issues | Medium | Average response |

| Customer Support Availability | Medium | Average response |

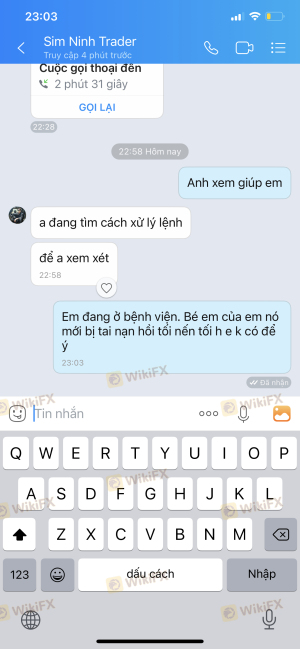

Common complaints include difficulties in withdrawing funds, with some users reporting delays and lack of communication from customer support. For instance, one user noted that their withdrawal request was initially rejected, and subsequent attempts to withdraw were met with further delays. This type of experience can be frustrating and may deter potential traders from engaging with Aetos.

However, it's worth noting that Aetos has made efforts to address these issues by improving its customer support channels and providing additional resources for traders. While some complaints are valid, they should be weighed against the overall performance of the brokerage and the experiences of other clients.

Platform and Trade Execution

Aetos provides its clients with access to the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. The platform supports various order types, including market orders, pending orders, and stop-loss orders, which are essential for effective trading strategies.

In terms of order execution, Aetos claims to offer fast and reliable execution, although some users have reported experiencing slippage during volatile market conditions. While slippage is a common occurrence in Forex trading, excessive slippage can indicate potential issues with the brokerage's execution quality. Traders should remain vigilant and monitor their experiences to ensure that they are receiving the expected level of service.

Additionally, there have been no significant reports of platform manipulation or other unethical practices associated with Aetos. However, as with any brokerage, traders should remain cautious and conduct their due diligence before committing significant funds.

Risk Assessment

Utilizing Aetos as a trading platform comes with inherent risks, as is the case with any brokerage. Below is a summary of the key risk areas associated with trading with Aetos:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | While regulated, past complaints raise concerns. |

| Fund Security | Medium | Segregated accounts are a positive, but no compensation scheme is a drawback. |

| Customer Support Availability | High | Reports of slow responses to withdrawal issues. |

| Trading Conditions | Medium | Slightly higher spreads than average can affect profitability. |

To mitigate these risks, traders should consider starting with a smaller investment to gauge the brokerage's performance and reliability. Additionally, maintaining an open line of communication with customer support can help address any issues that may arise during the trading process.

Conclusion and Recommendations

In conclusion, Aetos presents itself as a legitimate brokerage with a solid regulatory framework and a range of trading options. However, potential traders should remain cautious, especially given the mixed reviews regarding customer experiences and withdrawal processes. While there are no clear signs of Aetos being a scam, the presence of complaints and concerns about fund accessibility warrant careful consideration.

For traders seeking a reliable platform, it may be beneficial to explore alternative brokers with strong reputations and positive user feedback. Some recommended options include brokers regulated by both ASIC and FCA, which often provide enhanced security and customer support. Ultimately, conducting thorough research and remaining vigilant will help traders make informed decisions in the dynamic world of Forex trading.

Is AETOS a scam, or is it legit?

The latest exposure and evaluation content of AETOS brokers.

AETOS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AETOS latest industry rating score is 7.28, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.28 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.