Is Quotex safe?

Business

License

Is Quotex A Scam? A Comprehensive Evaluation

Introduction

Quotex is a relatively new player in the online trading space, having launched in 2019. It positions itself as a binary options trading platform, allowing users to trade a variety of financial instruments, including currencies, commodities, and cryptocurrencies. As the popularity of online trading continues to grow, the need for traders to carefully assess their chosen brokers becomes increasingly critical. Traders often face risks associated with unregulated platforms, including potential scams and loss of funds. This article aims to provide a thorough investigation into Quotex's legitimacy, focusing on its regulatory status, company background, trading conditions, customer feedback, security measures, and overall risk assessment. The evaluation is based on a review of various sources, including expert analyses, user testimonials, and regulatory databases.

Regulation and Legitimacy

When assessing the safety of any trading platform, regulatory compliance is a vital factor. Quotex operates under the ownership of Awesomo Ltd, which is registered in Seychelles. However, it is important to note that this jurisdiction is known for its lenient regulatory environment, which raises concerns about the broker's oversight and accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| International Financial Market Relations Regulation Centre (IFMRRC) | N/A | Seychelles | Not widely recognized |

The IFMRRC is not considered a top-tier regulator like the FCA (Financial Conduct Authority) in the UK or the ASIC (Australian Securities and Investments Commission), which enforce stringent rules and provide robust investor protections. The lack of regulation from a reputable authority means that Quotex may not be subject to the same level of scrutiny and operational standards. Historical compliance issues have also been noted, with various warnings issued by European regulators regarding its unregulated status, leading to questions about its reliability.

In summary, IS Quotex safe for trading? The absence of stringent regulatory oversight is a significant red flag, indicating that potential traders should exercise caution.

Company Background Investigation

Quotex is owned by Awesomo Ltd, which operates out of Seychelles. The company presents itself as a modern trading platform, but its ownership structure and management team remain somewhat opaque. There is limited publicly available information regarding the backgrounds of the individuals managing Quotex, which raises concerns about transparency and accountability.

The company claims to prioritize user experience and offers a user-friendly interface, but the lack of detailed disclosures about its operations and management team could be indicative of a less-than-ideal level of transparency. In the financial industry, especially in the realm of online trading, a clear understanding of the company's leadership and their qualifications is crucial for establishing trust.

Given the unregulated nature of Quotex and the ambiguous information surrounding its management, potential traders may find it challenging to assess the broker's reliability. Thus, the question remains: IS Quotex safe? Without clear information about its leadership and operational practices, traders should approach with caution.

Trading Conditions Analysis

Quotex offers a variety of trading conditions that may appeal to both new and experienced traders. The platform boasts a low minimum deposit requirement of just $10, which allows users to start trading without a significant financial commitment. However, the overall fee structure and potential hidden costs warrant closer examination.

| Fee Type | Quotex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | Varies (1-3 pips) |

| Commission Model | No commissions | Varies (0-0.5%) |

| Overnight Interest Range | Not applicable | Varies (0.5-2%) |

While Quotex claims to have no hidden fees, the lack of transparency regarding spreads and commissions is concerning. Many traders have reported issues with withdrawal processes and unexpected charges, which suggests that the broker may not be entirely upfront about its costs. Additionally, the absence of a clear fee structure can lead to confusion and potential financial losses for traders.

In conclusion, while the low entry barrier may be attractive, the lack of clarity around trading costs raises questions about the overall integrity of Quotex. Therefore, IS Quotex safe? The potential for undisclosed fees and poor trading conditions suggests that traders should proceed with caution.

Customer Funds Safety

The safety of customer funds is paramount in the online trading environment. Quotex claims to implement security measures to protect client information and funds, including SSL encryption and segregated accounts. However, the absence of regulation raises concerns about the effectiveness of these measures.

Traders should consider the following aspects regarding Quotex's fund security:

- Segregated Accounts: Quotex claims to keep client funds separate from operational funds, which is a standard practice among reputable brokers. However, the lack of regulatory oversight means that there is no guarantee of compliance with this practice.

- Investor Protection: Unlike brokers regulated by top-tier authorities, Quotex does not offer investor protection schemes or compensation funds, leaving clients vulnerable in the event of insolvency or mismanagement.

- Negative Balance Protection: Quotex does not provide negative balance protection, which means that traders could potentially lose more than their initial investment.

Past incidents involving unregulated brokers have resulted in traders losing significant amounts of money due to inadequate safety measures. Therefore, when asking, IS Quotex safe? The lack of robust investor protection and regulatory oversight suggests that traders should be wary of entrusting their funds to this platform.

Customer Experience and Complaints

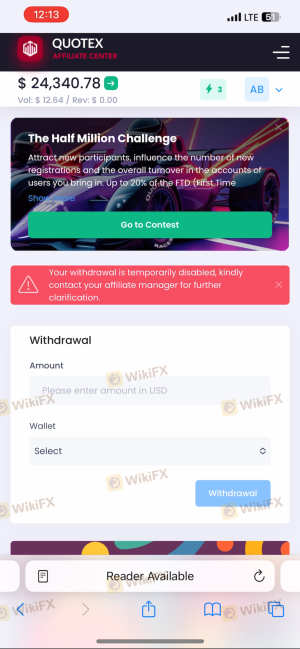

Customer feedback is a critical component of evaluating any trading platform. Quotex has received mixed reviews from users, with some praising its user-friendly interface and quick withdrawal processes, while others have reported significant issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Account Suspension | High | No clear resolution |

| Misleading Promotions | Medium | Partial acknowledgment |

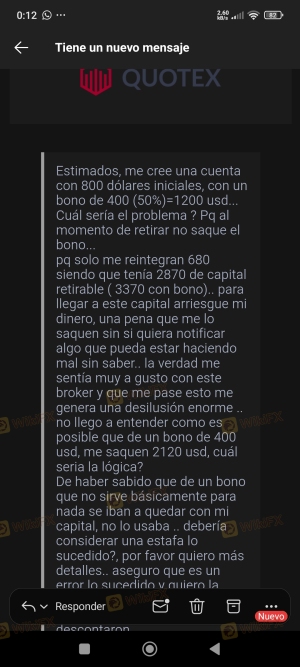

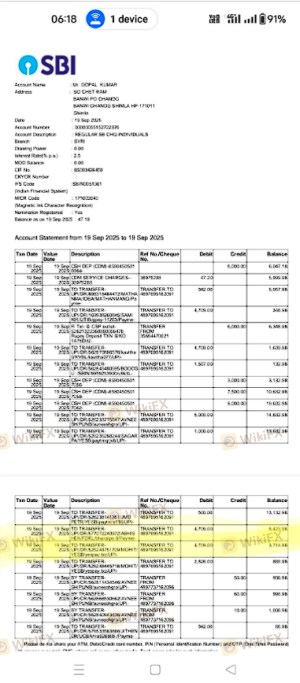

Common complaints include difficulties with withdrawals, account suspensions without clear explanations, and concerns about the legitimacy of promotional offers. Some users have reported that their accounts were frozen after they attempted to withdraw funds, leading to frustration and distrust.

For instance, one trader reported being unable to access their account after depositing funds, claiming that Quotex did not provide adequate support during the issue. This has led to speculation about the broker's reliability and whether it is operating in good faith.

Given the patterns of complaints and the quality of responses from Quotex, it raises further questions about the broker's commitment to customer satisfaction. Therefore, when considering whether IS Quotex safe, the evidence suggests that potential traders should remain cautious.

Platform and Trade Execution

The trading platform provided by Quotex is designed to be user-friendly, featuring a modern interface and various trading tools. However, the quality of order execution, including slippage and rejection rates, is a crucial factor for traders.

Users have reported that the platform is generally stable and responsive, but there are concerns about the execution quality. Instances of slippage during high volatility periods have been noted, which can significantly affect trading outcomes. Additionally, some traders have expressed concerns about potential market manipulation, although substantial evidence is lacking.

In summary, while Quotex offers a visually appealing platform, the execution quality and potential issues with slippage and order rejection may pose risks for traders. Thus, it remains to be seen if IS Quotex safe for serious trading activities.

Risk Assessment

Engaging with Quotex presents several risks that potential traders should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Lack of oversight from reputable authorities. |

| Fund Security | High | Limited investor protection and fund segregation. |

| Trading Conditions | Medium | Unclear fee structure and potential hidden costs. |

| Customer Support | Medium | Mixed reviews on responsiveness and effectiveness. |

To mitigate risks, traders should conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and only invest funds they can afford to lose. Additionally, diversifying investments and avoiding over-leveraging can help manage potential losses.

In conclusion, while Quotex may offer some appealing features, the associated risks raise significant concerns regarding its safety and reliability. Thus, IS Quotex safe? The evidence suggests that traders should approach with caution and consider alternative platforms.

Conclusion and Recommendations

In conclusion, after a comprehensive evaluation of Quotex, it is evident that the broker has several concerning aspects that may indicate potential risks. The lack of regulation, mixed customer feedback, and unclear trading conditions suggest that traders should exercise caution when considering this platform.

For those seeking reliable trading options, it is advisable to explore alternative brokers that are regulated by reputable authorities and offer robust investor protections. Some recommended alternatives include:

- eToro: A regulated broker with a strong reputation and a user-friendly platform.

- IG Markets: Offers a wide range of assets and is regulated by top-tier authorities.

- OANDA: Known for its transparency and competitive trading conditions.

In summary, while Quotex may appeal to some traders, the associated risks and lack of regulatory oversight warrant careful consideration. Always prioritize safety and due diligence when selecting a trading platform.

Is Quotex a scam, or is it legit?

The latest exposure and evaluation content of Quotex brokers.

Quotex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Quotex latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.