Fastwin 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Fastwin review examines a forex broker that has generated significant discussion within the trading community in 2025. Based on available market data and user feedback, Fastwin presents a mixed picture for potential traders. While some sources indicate positive user engagement, questions surrounding the broker's legitimacy and regulatory status have emerged across multiple review platforms. The broker appears to target forex traders seeking accessible trading platforms. However, specific details about account conditions and trading tools remain limited in publicly available information.

Our analysis reveals that Fastwin operates in a competitive landscape where transparency and regulatory compliance are paramount concerns for traders. Key areas of focus in this Fastwin review include the broker's safety protocols, trading conditions, and overall market reputation. The platform's legitimacy has been questioned by various financial review sites, making due diligence essential for prospective clients. Understanding these factors is crucial for traders considering Fastwin as their broker of choice.

Important Notice

This review is based on publicly available information and industry analysis standards as of 2025. Due to limited regulatory information available about Fastwin, potential differences in compliance and service offerings may exist across different jurisdictions. Traders should verify current regulatory status and terms of service directly with the broker before opening accounts.

Our evaluation methodology incorporates user feedback from multiple sources, industry benchmarks, and standard forex broker assessment criteria. Given the evolving nature of online forex brokers, information presented here should be supplemented with current verification from official sources.

Rating Framework

Broker Overview

Fastwin operates as a forex broker in the competitive online trading market. However, specific details about its establishment date and corporate background remain unclear in available documentation. The broker appears to focus on providing forex trading services to retail clients, positioning itself within the accessible trading platform segment.

According to available information, Fastwin offers forex trading services through what appears to be a web-based platform. However, comprehensive details about the company's operational history, founding team, or corporate structure are not readily available in public sources. This raises important considerations for potential clients regarding transparency.

The broker's business model appears centered on forex trading. However, specific information about asset classes, trading instruments, and platform technology is limited in current documentation. This Fastwin review notes that the lack of detailed public information about core business operations represents a significant consideration for traders evaluating the platform.

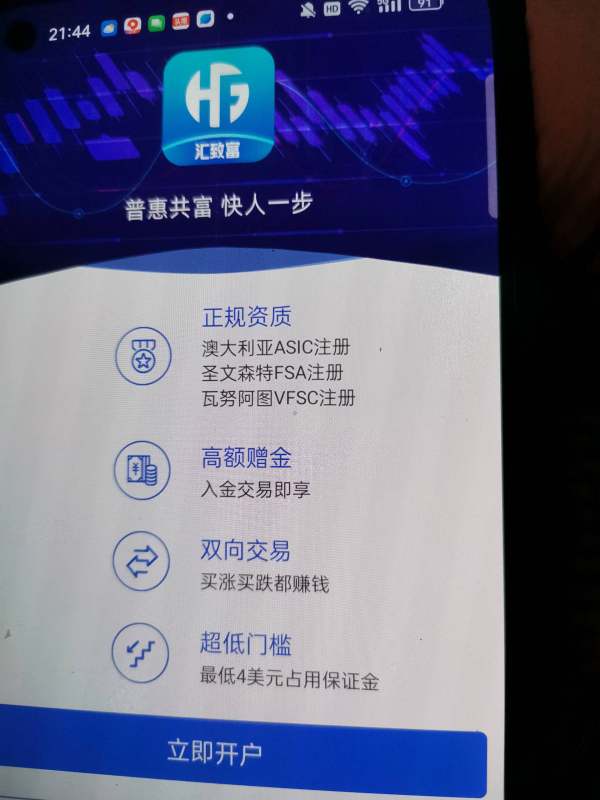

Regulatory information for Fastwin is notably absent from easily accessible sources. This is a critical factor in broker evaluation. The absence of clear regulatory oversight details has contributed to questions about the broker's legitimacy and compliance status across different jurisdictions where it may operate.

Regulatory Status: Specific regulatory information for Fastwin is not clearly documented in available sources. This raises important compliance questions for potential traders.

Deposit and Withdrawal Methods: Information about supported payment methods and processing procedures is not comprehensively detailed in current documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly stated in available broker information.

Bonuses and Promotions: Details about promotional offers or bonus structures are not documented in accessible sources.

Available Assets: While forex trading appears to be the primary focus, comprehensive asset lists are not available in current documentation.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in available sources. This makes cost comparison challenging.

Leverage Options: Leverage ratios offered by Fastwin are not specifically documented in current information sources.

Platform Options: Technical details about trading platforms and software options are limited in available documentation.

Geographic Restrictions: Information about regional availability and restrictions is not clearly documented.

Customer Support Languages: Specific language support details are not comprehensively available.

This Fastwin review emphasizes that the limited availability of detailed operational information represents a significant consideration for traders evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Account conditions represent a fundamental aspect of any forex broker evaluation. However, Fastwin's specific offerings in this area are not comprehensively documented in available sources. The lack of detailed information about account types, minimum deposit requirements, and account features makes it challenging for traders to make informed decisions about suitability.

While some forex brokers provide extensive documentation about different account tiers, Islamic accounts, and special features, Fastwin's account structure is not clearly outlined in publicly available materials. This absence of detailed account information impacts the overall assessment in this Fastwin review.

The account opening process and verification requirements are similarly undocumented in accessible sources. Standard industry practices typically include identity verification, address confirmation, and financial suitability assessments. However, specific procedures for Fastwin are not clearly detailed.

Without comprehensive account condition information, traders cannot adequately assess whether Fastwin's offerings align with their trading needs, capital requirements, or specific account preferences. This information gap represents a significant limitation for potential clients.

Trading tools and educational resources are essential components of a comprehensive forex broker offering. However, specific details about Fastwin's capabilities in this area are limited in available documentation. Modern forex traders typically expect access to technical analysis tools, economic calendars, and market research resources.

Educational resources, including webinars, tutorials, and market analysis, are standard offerings among established forex brokers. However, information about Fastwin's educational support and trader development resources is not clearly documented in current sources.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, represents another important consideration for many forex traders. Specific information about Fastwin's support for automated trading strategies is not available in current documentation.

The absence of detailed information about trading tools and resources makes it difficult for traders to assess whether Fastwin provides the analytical and educational support necessary for effective forex trading. This limitation impacts the overall evaluation in this comprehensive Fastwin review.

Customer Service and Support Analysis (Score: 6/10)

Customer service quality and availability are crucial factors in forex broker selection. This is particularly true for traders who may require assistance during volatile market conditions. However, specific information about Fastwin's customer support infrastructure is not comprehensively documented in available sources.

Standard customer service considerations include multiple contact channels, response times, service hours, and multilingual support capabilities. The availability of live chat, phone support, and email assistance typically varies among forex brokers. However, Fastwin's specific support offerings are not clearly detailed.

Response time expectations and service quality metrics are important benchmarks for evaluating customer support effectiveness. Without documented information about Fastwin's customer service performance standards, traders cannot adequately assess support quality expectations.

The absence of detailed customer service information represents a significant limitation for traders who prioritize responsive and accessible broker support. This factor contributes to the moderate scoring in this area of the Fastwin review.

Trading Experience Analysis (Score: 6/10)

Platform stability, execution speed, and overall trading environment quality are fundamental considerations for forex traders. However, specific information about Fastwin's trading platform performance and user experience is limited in available documentation.

Order execution quality, including fill rates, slippage characteristics, and execution speed, represents critical performance metrics for forex brokers. Without documented performance data or user feedback about trading execution quality, it's challenging to assess Fastwin's trading environment effectiveness.

Mobile trading capabilities have become essential for modern forex traders who require platform access across different devices. Information about Fastwin's mobile trading solutions and cross-platform compatibility is not clearly documented in current sources.

Platform functionality, including charting capabilities, order types, and trading tools integration, varies significantly among forex brokers. The absence of detailed platform information limits the ability to evaluate Fastwin's trading experience comprehensively in this review.

Trust and Safety Analysis (Score: 4/10)

Trust and safety considerations represent perhaps the most critical aspects of forex broker evaluation. This area presents significant concerns in the Fastwin review. Multiple sources have raised questions about the broker's legitimacy and regulatory compliance status.

Regulatory oversight provides essential protection for forex traders, including segregated fund protection, dispute resolution mechanisms, and operational transparency requirements. The absence of clear regulatory information about Fastwin raises important safety considerations for potential clients.

Fund security measures, including client money segregation and insurance protection, are standard practices among regulated forex brokers. Without documented information about Fastwin's fund protection protocols, traders cannot adequately assess capital safety measures.

Industry reputation and track record provide important context for broker evaluation. The emergence of legitimacy questions and scam concerns in various review sources significantly impacts the trust assessment for Fastwin. This contributes to the lower scoring in this critical evaluation area.

User Experience Analysis (Score: 5/10)

User experience encompasses the overall interaction quality between traders and the broker's services. This includes platform usability, account management, and operational efficiency. However, comprehensive user feedback about Fastwin is limited in available sources.

Interface design and platform usability significantly impact trading effectiveness and user satisfaction. Without detailed information about Fastwin's platform design and user interface quality, it's challenging to assess the overall user experience comprehensively.

Account registration and verification processes can significantly impact initial user experience with forex brokers. Standard procedures typically include document submission, identity verification, and account approval timelines. However, specific details about Fastwin's onboarding process are not documented.

User feedback analysis reveals mixed signals about Fastwin, with some positive indicators balanced against legitimacy concerns raised in various review sources. This mixed feedback pattern contributes to the moderate scoring in user experience evaluation.

Conclusion

This comprehensive Fastwin review reveals a broker with limited publicly available information and significant transparency concerns. While some positive user indicators exist, the absence of clear regulatory information and questions about legitimacy raised across multiple sources present important considerations for potential traders.

Fastwin may appeal to traders seeking accessible forex trading platforms. However, the lack of detailed operational information and regulatory clarity suggests that more established, transparent brokers might better serve most trading needs. The limited documentation about account conditions, trading tools, and safety measures represents significant evaluation challenges.

The primary concerns identified include regulatory uncertainty, limited operational transparency, and questions about legitimacy that have emerged in various review sources. These factors suggest that traders should exercise considerable caution and conduct thorough due diligence before considering Fastwin as their forex broker choice.