ABSystem Review 1

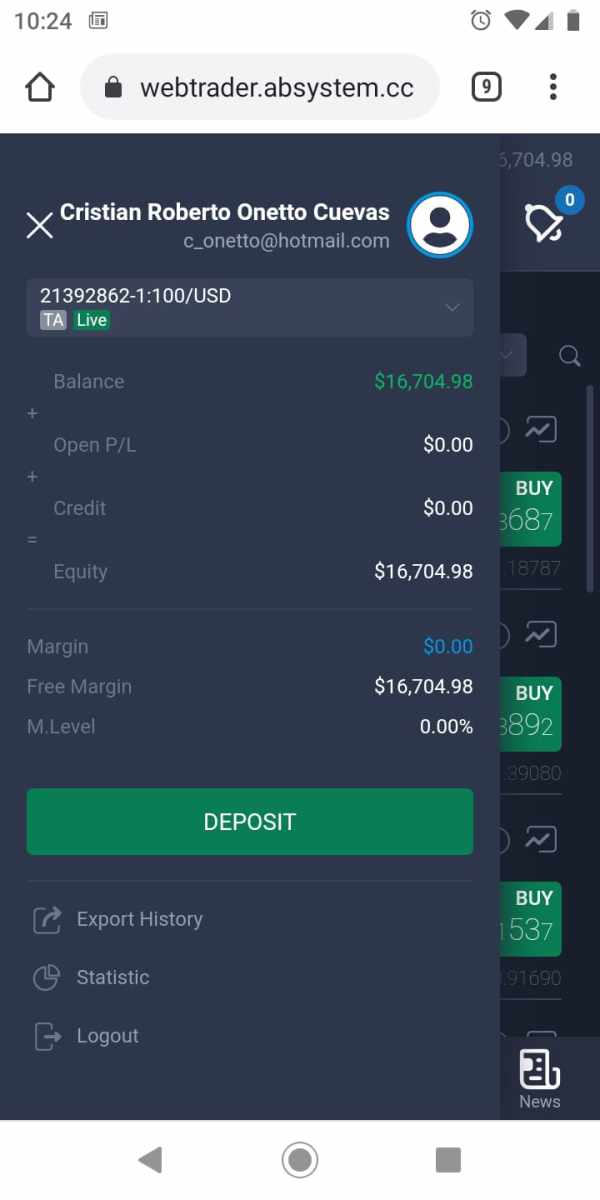

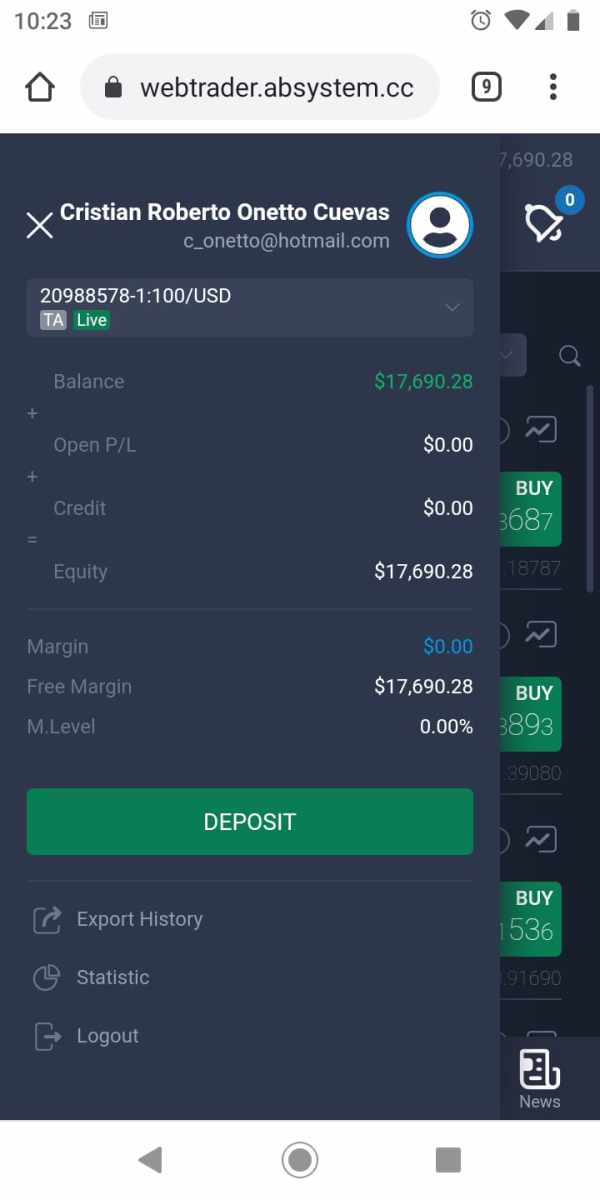

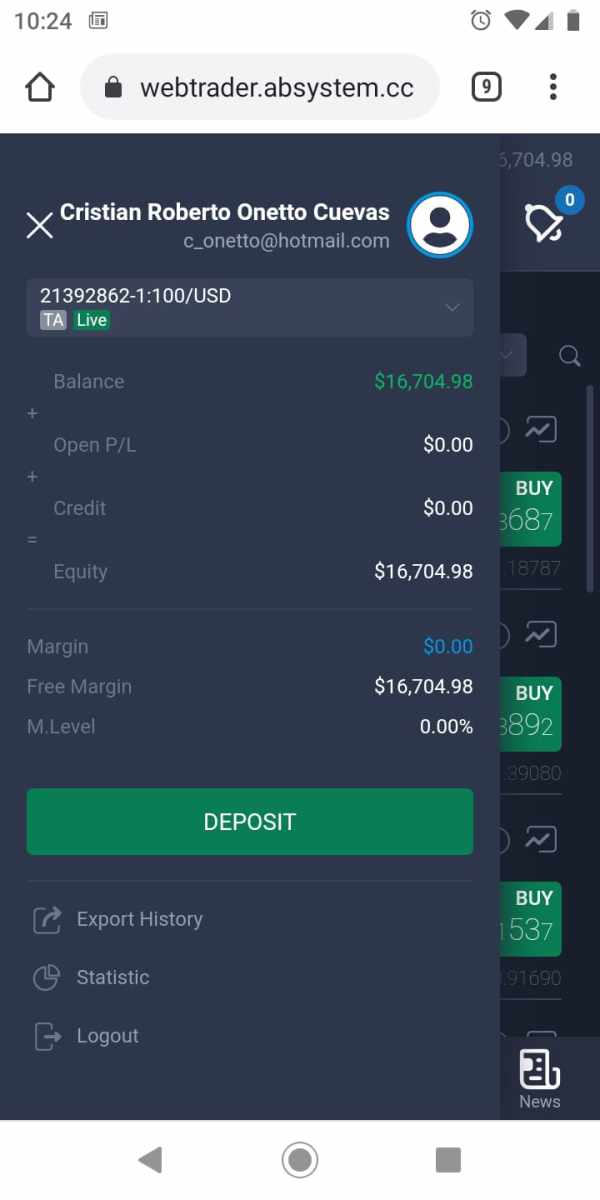

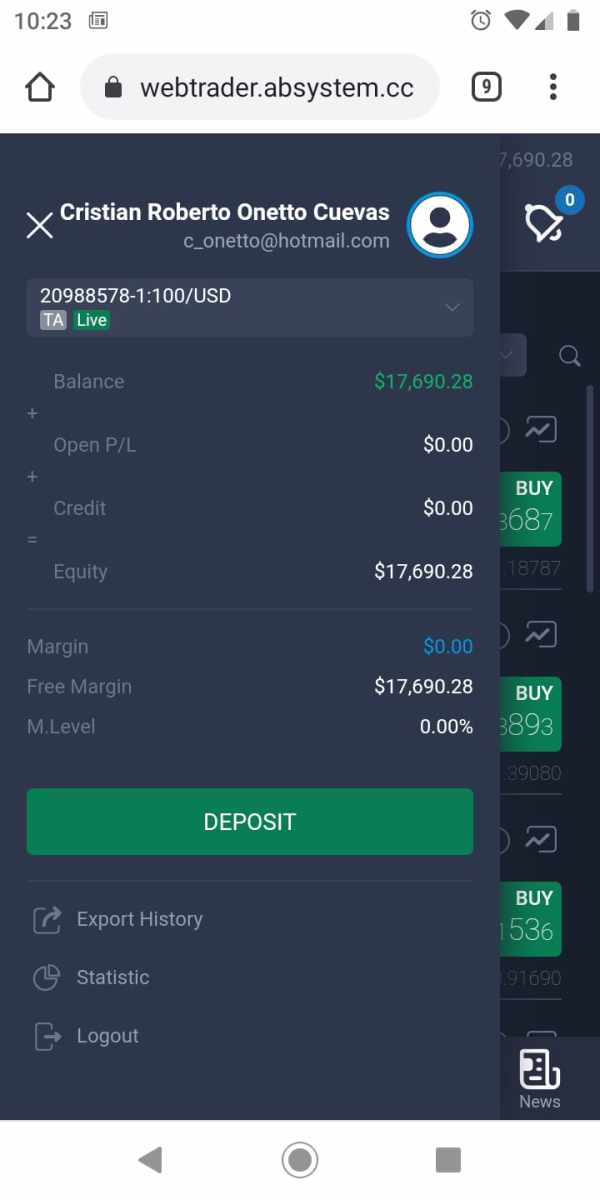

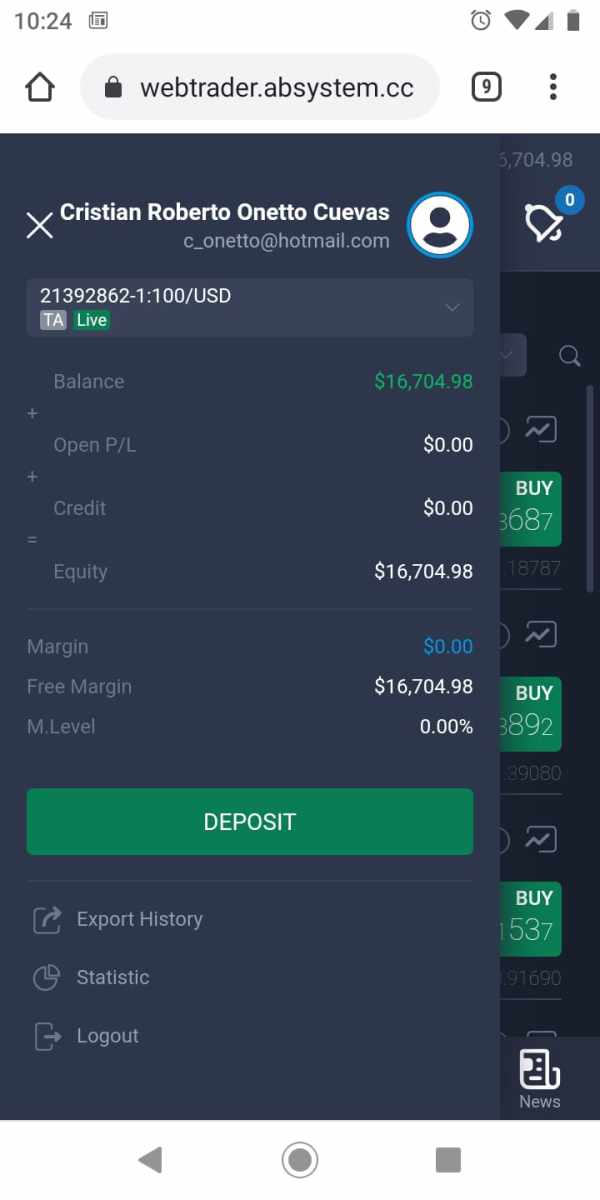

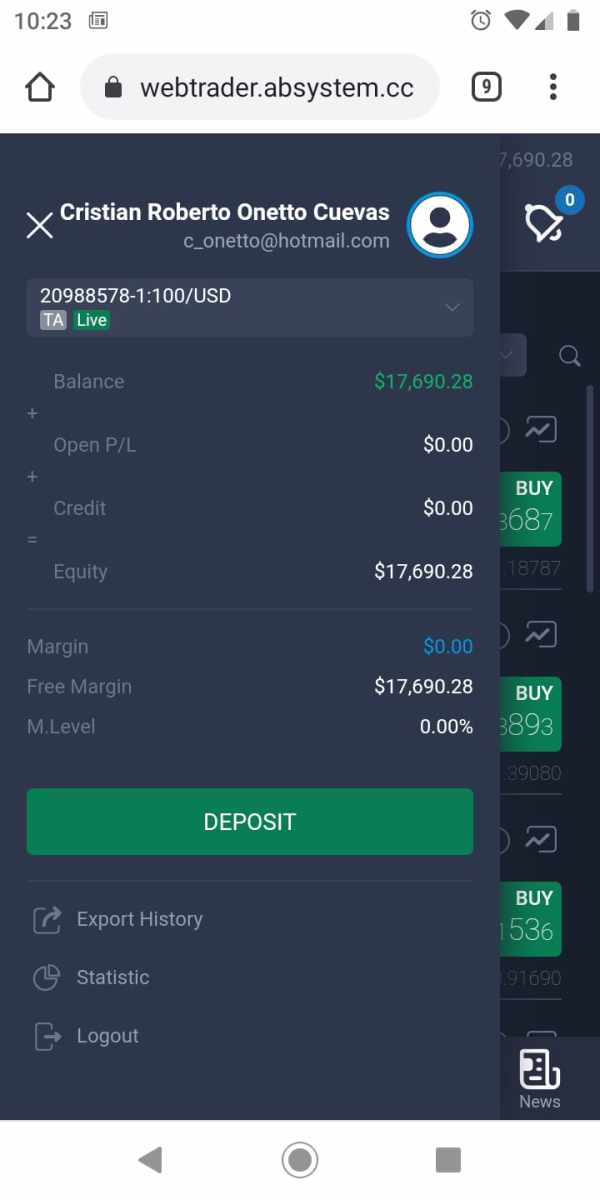

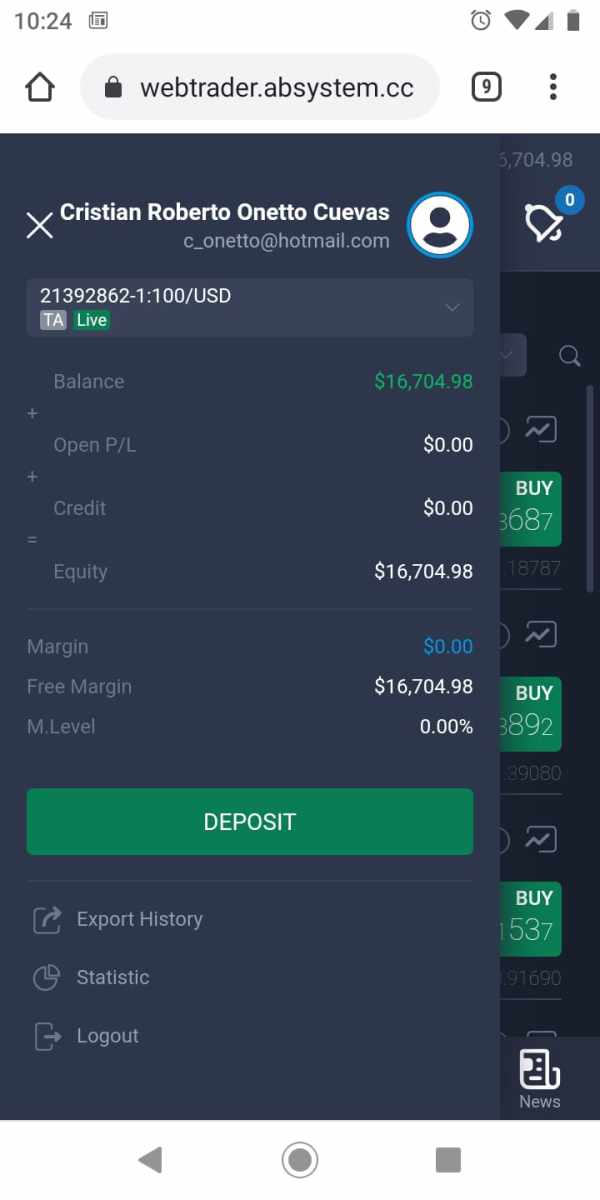

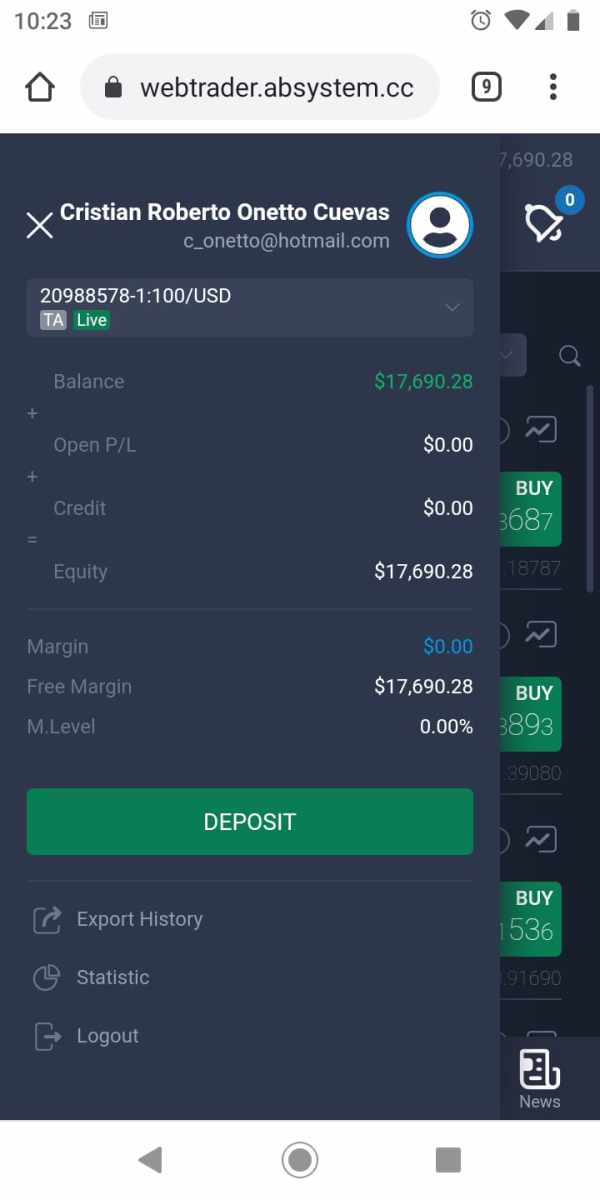

I was scammed by absystem for the amount of 11,540 USD 3 years ago. This money was withdrawn through the Buda virtual exchange house in Chile (where I am from) this happened in July 2021 and as of today, I have no response.

ABSystem Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I was scammed by absystem for the amount of 11,540 USD 3 years ago. This money was withdrawn through the Buda virtual exchange house in Chile (where I am from) this happened in July 2021 and as of today, I have no response.

This absystem review examines a broker that has created major controversy in the trading community. Absystem started in 2021 and calls itself an online forex and CFD trading provider that offers services through what looks like an offshore structure. The broker says it provides access to foreign exchange markets, contracts for difference, commodities, indices, and stocks, plus an automated trading solution called the Absystem bot.

Our analysis shows concerning elements that potential traders should carefully consider. Many sources have raised serious questions about the broker's legitimacy, with some platforms calling Absystem a potential scam operation. User feedback has been mostly negative, with a modest 3.3 rating based on available reviews.

The broker's offshore registration through Donnybrook Consulting, combined with limited transparency about operational details, adds to the uncertainty around its credibility. The primary target audience appears to be retail traders seeking forex and CFD trading opportunities, particularly those interested in automated trading solutions. However, given the significant red flags identified in our investigation, this broker may pose substantial risks to traders' capital and should be approached with extreme caution.

This absystem review is based on publicly available information and user feedback collected as of 2025. Due to Absystem's offshore company structure, regulatory oversight and legal protections may vary significantly across different jurisdictions.

Traders should be aware that offshore brokers often operate with limited regulatory supervision compared to well-established, domestically regulated entities. Our evaluation methodology incorporates multiple sources including regulatory databases, user testimonials, and industry reports. However, this analysis should not be construed as investment advice or a recommendation to engage with this broker.

Potential clients are strongly advised to conduct their own due diligence and consider consulting with financial professionals before making any trading decisions.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 3/10 | Poor |

| Tools and Resources | 5/10 | Below Average |

| Customer Service and Support | 4/10 | Poor |

| Trading Experience | 4/10 | Poor |

| Trust and Reliability | 2/10 | Very Poor |

| User Experience | 3/10 | Poor |

Absystem emerged in the online trading landscape in 2021. The company established itself under the corporate structure of Donnybrook Consulting and presents itself as a comprehensive trading solutions provider, focusing primarily on forex and CFD markets. According to available information, the broker operates through an offshore framework, which immediately raises questions about regulatory oversight and client fund protection.

The broker's business model centers around providing retail traders with access to various financial instruments. These include foreign exchange pairs, contracts for difference on multiple asset classes, commodities, market indices, and individual stocks. Additionally, Absystem promotes an automated trading system, marketed as the "Absystem bot," which allegedly assists traders in executing automated forex strategies.

However, the broker's operational transparency remains questionable. Multiple industry sources have flagged Absystem as a potentially fraudulent operation, with serious allegations regarding the safety of client funds. The company's offshore registration structure, combined with limited disclosure about its operational headquarters, management team, and detailed business practices, contributes to growing concerns about its legitimacy in the trading community.

According to regulatory information, Absystem claims oversight from both BaFin and FMA. However, the specific license numbers and verification of these regulatory relationships remain unclear in available documentation. This lack of transparency regarding regulatory status represents a significant red flag for potential clients considering this broker for their trading activities.

Regulatory Jurisdiction: Absystem claims regulation under BaFin and FMA, though specific license verification details are not clearly provided in available materials.

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees is not detailed in current available documentation.

Minimum Deposit Requirements: The broker has not clearly disclosed minimum deposit amounts in publicly available sources. This represents a transparency concern.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not specified in available broker information.

Tradeable Assets: The platform offers access to foreign exchange pairs, contracts for difference, commodities, market indices, and individual stocks across multiple markets.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in current documentation. This limits traders' ability to assess total trading expenses.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not clearly outlined in available materials.

Platform Options: The specific trading platforms supported by Absystem are not detailed in current available information. The broker mentions proprietary automated trading solutions.

Geographic Restrictions: Information about restricted jurisdictions and regional limitations is not clearly specified in available documentation.

Customer Service Languages: Supported languages for customer service communications are not detailed in current available materials.

This absystem review highlights the concerning lack of transparency regarding essential trading conditions and operational details.

The account conditions offered by Absystem present several concerning gaps that significantly impact this absystem review assessment. The broker fails to provide clear information about account types, tier structures, or specific features that differentiate various account offerings.

This lack of transparency makes it extremely difficult for potential traders to understand what they can expect when opening an account. Minimum deposit requirements remain unspecified in available documentation, which is highly unusual for legitimate brokers who typically provide clear pricing structures. User feedback suggests dissatisfaction with account conditions, though specific details about deposit amounts, account features, or upgrade requirements are not readily available.

The absence of information about Islamic accounts, professional trading accounts, or other specialized account types further limits the broker's appeal to diverse trading communities. The account opening process appears to lack the transparency and detailed documentation typically expected from regulated brokers. Without clear information about verification requirements, document submission procedures, or account activation timelines, potential clients face uncertainty about the onboarding experience.

This opacity, combined with negative user feedback regarding account management, contributes to the poor rating in this category and raises additional concerns about the broker's operational standards.

Absystem's tools and resources offering centers primarily around their automated trading solution, known as the Absystem bot. This forex trading robot represents the broker's main technological offering, though detailed information about its functionality, performance metrics, or backtesting results is not comprehensively available.

The focus on automated trading may appeal to traders seeking algorithmic solutions, but the lack of detailed performance data limits the ability to assess its effectiveness. The broker appears to lack comprehensive research and analysis resources that traders typically expect from full-service providers. Market analysis, economic calendars, trading signals, and educational webinars are not prominently featured in available documentation.

This limitation significantly impacts traders who rely on broker-provided research to inform their trading decisions and develop market understanding. Educational resources appear minimal or non-existent based on available information. The absence of trading tutorials, market education materials, strategy guides, or beginner-friendly content suggests that Absystem may not be suitable for novice traders seeking to develop their skills.

Advanced traders might also find the limited analytical tools and market insights insufficient for sophisticated trading strategies, contributing to the below-average rating in this category.

Customer service quality emerges as a significant concern in this evaluation, with user feedback indicating substantial issues with support responsiveness and effectiveness. Available reviews suggest that traders have experienced difficulties reaching customer service representatives and obtaining satisfactory resolutions to their inquiries.

The lack of clearly published customer service channels, operating hours, or response time commitments adds to these concerns. Communication options appear limited, with insufficient information about available contact methods such as live chat, telephone support, email ticketing systems, or callback services. The absence of comprehensive customer service information suggests that trader support may not be a priority for this broker, which is particularly concerning given the complexity of financial markets and the need for reliable assistance when issues arise.

Multilingual support capabilities are not clearly documented, which could create additional barriers for international traders seeking assistance in their native languages. User complaints about service quality, combined with the lack of transparent support structures, indicate that traders may face significant challenges when attempting to resolve account issues, technical problems, or trading disputes. These factors contribute to the poor rating and suggest that customer support represents a major weakness for this broker.

The trading experience offered by Absystem faces significant challenges based on available user feedback and limited platform information. Traders have reported concerns about platform stability, though specific technical performance metrics are not available in current documentation.

The absence of detailed platform specifications makes it difficult to assess execution speeds, server reliability, or system uptime statistics. Order execution quality remains questionable based on user feedback, though specific data about slippage rates, requotes, or execution delays is not comprehensively available. The lack of transparency regarding execution policies, order types supported, or market depth information further complicates the assessment of trading conditions.

These uncertainties create additional risks for traders who require reliable execution for their strategies. Mobile trading capabilities and platform accessibility across different devices are not clearly documented, which may limit trading flexibility for active traders. The absence of detailed platform features, charting capabilities, or technical analysis tools suggests that the trading environment may not meet the expectations of serious traders.

Combined with user concerns about overall trading experience, these factors contribute to the poor rating in this absystem review category and suggest significant limitations in the broker's trading infrastructure.

Trust and reliability represent the most concerning aspects of Absystem's operations, with multiple sources raising serious questions about the broker's legitimacy. Industry platforms have labeled Absystem as a potential scam operation, creating significant red flags for prospective clients.

These allegations, combined with limited operational transparency, severely undermine confidence in the broker's credibility. The regulatory claims regarding BaFin and FMA oversight lack clear verification, with specific license numbers and regulatory status remaining unclear in available documentation. Legitimate brokers typically provide easily verifiable regulatory information, including license numbers, regulatory warnings, and compliance reports.

The absence of this transparency raises serious questions about actual regulatory oversight and client fund protection. Fund safety measures are not clearly documented, with no information about segregated client accounts, deposit insurance, or third-party fund management. User feedback includes concerns about fund security and withdrawal difficulties, which further exacerbate trust issues.

The combination of scam allegations, unclear regulatory status, and user concerns about fund safety results in the lowest possible rating in this critical category, suggesting that potential clients should exercise extreme caution.

Overall user satisfaction with Absystem remains poor, reflected in the 3.3 rating based on available user reviews. Feedback indicates widespread dissatisfaction with multiple aspects of the broker's services, from account management to customer support and trading conditions.

The limited number of positive reviews suggests that few traders have had satisfactory experiences with this broker. Interface design and platform usability information is not comprehensively available, making it difficult to assess the quality of the user experience from a technical perspective. However, user feedback suggests that the overall experience falls short of expectations, with complaints about various operational aspects including fund management and customer service interactions.

Registration and verification processes appear to lack the smooth, professional experience that traders expect from established brokers. User complaints about withdrawal difficulties and fund access issues represent serious concerns that significantly impact the overall user experience. The combination of poor user ratings, negative feedback about core services, and operational difficulties results in a poor rating that suggests most traders would likely be dissatisfied with Absystem's services.

This comprehensive absystem review reveals a broker that presents significant risks and concerns for potential traders. The overall assessment is strongly negative, with serious questions about legitimacy, regulatory compliance, and operational transparency.

The combination of scam allegations, poor user feedback, and limited operational disclosure creates a highly unfavorable risk profile. Absystem is not recommended for traders of any experience level, particularly those with lower risk tolerance or limited experience in identifying potentially fraudulent operations. The broker's few potential advantages, such as the availability of automated trading tools, are heavily outweighed by fundamental concerns about safety, reliability, and legitimacy.

The primary weaknesses include questionable regulatory status, poor customer service, limited transparency, and serious allegations about fraudulent activity. Traders seeking reliable forex and CFD trading services would be better served by choosing established, well-regulated brokers with clear operational transparency and positive user feedback.

FX Broker Capital Trading Markets Review