Is ABSystem safe?

Business

License

Is Absystem Safe or a Scam?

Introduction

Absystem is an online forex and CFD broker that has emerged in the trading landscape, primarily targeting clients who seek to engage in foreign exchange markets through various trading instruments. However, the rapid growth of online trading platforms has also led to an increase in fraudulent schemes, making it essential for traders to exercise caution when selecting a broker. The need for thorough due diligence cannot be overstated, as the repercussions of engaging with an untrustworthy broker can be financially devastating. This article aims to provide an objective analysis of whether Absystem is a safe trading platform or if it exhibits characteristics typical of a scam. The evaluation is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and trustworthiness. Absystem operates without any regulatory oversight, which raises significant concerns regarding the safety of client funds and the overall reliability of the trading services offered. The absence of regulation means that there is no authoritative body to hold the broker accountable for its actions or to protect traders from potential fraud.

Core Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory license is a major red flag for any prospective trader. Absystem is associated with Donnybrook Consulting Ltd., a company that has been linked to multiple fraudulent activities and has faced blacklisting by several European financial authorities, including BaFin (Germany), FMA (Austria), and Consob (Italy). These warnings highlight the risks involved with trading through Absystem, as unregulated brokers often lack the necessary consumer protection measures that regulated firms are required to maintain.

Company Background Investigation

Absystem was established recently in the Commonwealth of Dominica, a known offshore jurisdiction that offers minimal regulatory oversight for financial services. The company claims to provide a variety of trading services, but its ownership structure and operational transparency raise significant concerns. The management team behind Absystem lacks publicly available information, making it difficult to assess their qualifications and expertise in the financial sector.

The opacity surrounding the companys operations is troubling. A reputable broker typically provides detailed information about its management team and corporate structure, allowing potential clients to gauge the firm's credibility. In contrast, Absystem's lack of transparency could indicate an attempt to obscure potential fraudulent activities. The absence of clear information about the company's history and the individuals behind it is a significant factor in determining whether Absystem is safe for traders.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in the overall trading experience. Absystem has set a minimum deposit requirement of $500, which is relatively high compared to industry standards. Additionally, the broker advertises spreads starting from 3 pips for major currency pairs, which is less competitive than many regulated brokers.

Core Trading Cost Comparison

| Fee Type | Absystem | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-1.5 pips |

| Commission Model | N/A | Variable |

| Overnight Interest Range | N/A | Varies |

The high spreads and minimum deposit requirements suggest that Absystem may not offer the best value for traders. Furthermore, the lack of clarity regarding commission structures and overnight interest rates raises concerns about potential hidden fees that could further erode trading profits. These unfavorable trading conditions contribute to the overall assessment of whether Absystem is a safe platform for traders.

Client Fund Security

Ensuring the safety of client funds is paramount when evaluating a broker. Absystem does not provide adequate information about its fund security measures, which is a significant concern. The absence of segregated accounts and investor protection schemes means that clients may be at risk of losing their funds in the event of the broker's insolvency or fraudulent activities.

The lack of transparency regarding fund management practices raises questions about how client deposits are handled. Additionally, the absence of negative balance protection leaves traders vulnerable to significant losses beyond their initial deposit. The historical context of Absystem's operations, especially its association with Donnybrook Consulting Ltd., further exacerbates concerns about fund security.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real-world experiences of traders using Absystem. Numerous complaints have surfaced regarding withdrawal issues, with many users reporting delays and refusals to process withdrawal requests. This pattern of behavior is characteristic of unregulated brokers, which often manipulate withdrawal processes to retain client funds.

Major Complaint Types and Severity Assessment

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Case studies reveal that clients who attempted to withdraw their funds often faced numerous obstacles, including vague excuses and prolonged waiting periods. Such experiences highlight the risks associated with trading through Absystem and raise further questions about whether it is a safe option for potential traders.

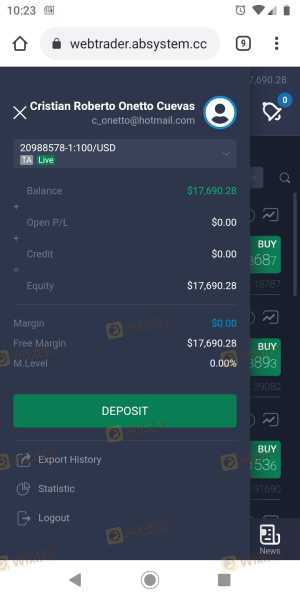

Platform and Trade Execution

The performance of the trading platform is another critical aspect of the trading experience. Absystem offers a web-based platform that lacks the sophistication of industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform stability, order execution quality, and the occurrence of slippage during trades.

The quality of order execution is particularly concerning, as traders expect timely and accurate execution of their trades. Reports of high rejection rates and delays in order processing further diminish confidence in the platform's reliability. The combination of these factors leads to skepticism regarding whether Absystem is safe for traders.

Risk Assessment

Engaging with an unregulated broker like Absystem entails various risks that traders should be aware of. The absence of regulatory oversight, combined with a history of complaints and a lack of transparency, contributes to an overall high-risk profile for this broker.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Condition Risk | High | High spreads and fees |

To mitigate these risks, potential traders are advised to conduct thorough research and consider alternative, regulated brokers that offer better protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence presented strongly suggests that Absystem is not a safe trading platform. The lack of regulation, coupled with numerous complaints from clients regarding withdrawal issues and poor customer service, raises significant red flags. Traders are advised to exercise extreme caution when considering this broker.

For those seeking a reliable trading experience, it is recommended to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Some reputable options could include brokers regulated by the FCA, ASIC, or CySEC, which offer better security measures and transparency.

In summary, is Absystem safe? The overwhelming consensus based on the available evidence indicates that it is not, and potential traders should be wary of engaging with this broker.

Is ABSystem a scam, or is it legit?

The latest exposure and evaluation content of ABSystem brokers.

ABSystem Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ABSystem latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.