Libbit 2025 Review: Everything You Need to Know

Summary: The overall sentiment surrounding Libbit is largely negative, with numerous reports of users experiencing significant difficulties, including withdrawal issues and lack of regulatory oversight. Key findings indicate a troubling pattern of user complaints regarding fund accessibility and transparency.

Note: It is essential to recognize that Libbit operates under different entities across regions, which may complicate the regulatory landscape. This review aims for fairness and accuracy by consolidating information from various reputable sources.

Rating Box

We evaluate brokers based on a combination of user feedback, expert analysis, and factual data.

Broker Overview

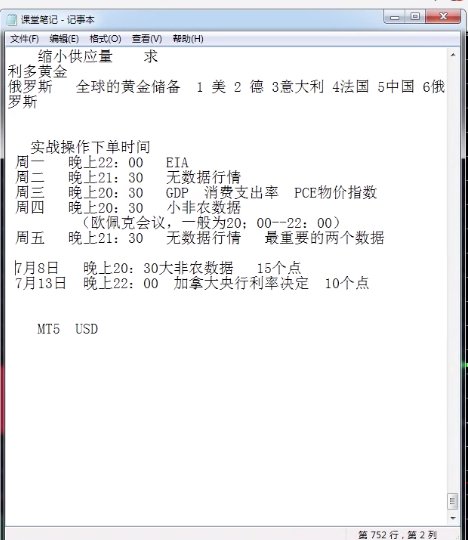

Founded approximately three years ago, Libbit is an online broker registered in Latvia, although specific details regarding its establishment and actual office location remain elusive. The broker claims to offer a diverse range of trading opportunities, including forex, commodities, stocks, indices, and cryptocurrencies. However, it lacks a recognized trading platform like MT4 or MT5, which raises concerns about its reliability and user experience. Furthermore, Libbit does not appear to be regulated by any major financial authority, which significantly impacts its trustworthiness.

Detailed Section

Regulatory Regions

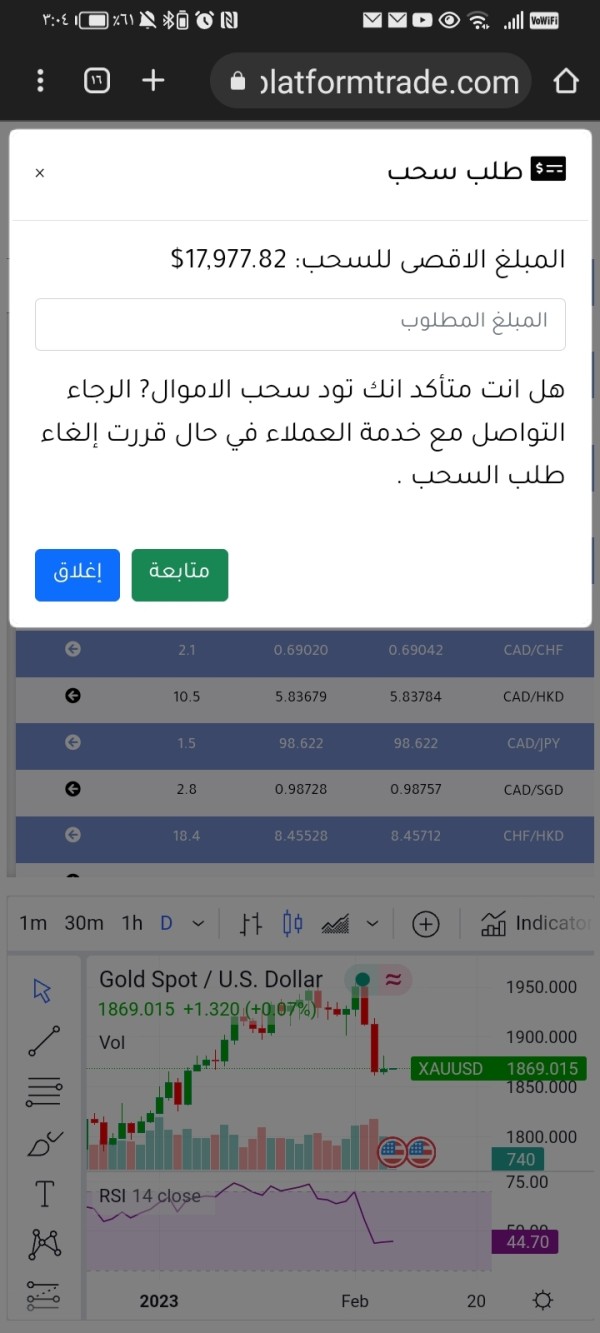

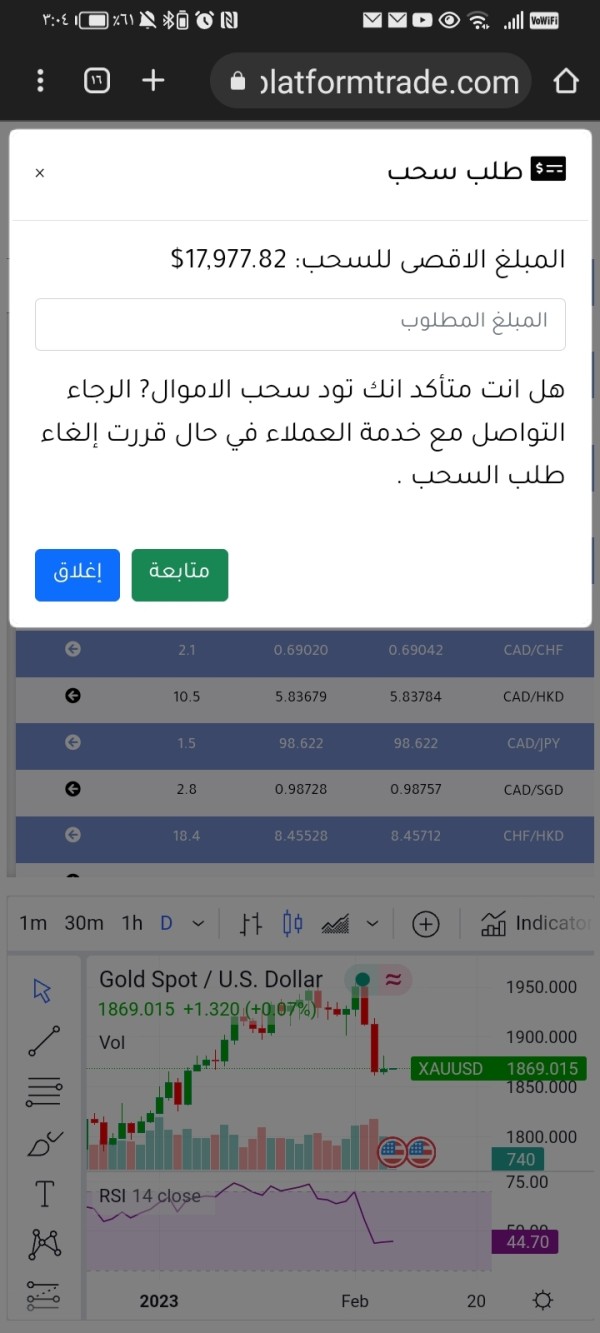

Libbit operates without valid regulatory oversight, a fact that raises red flags for potential investors. Reports indicate that it operates as an unregulated offshore broker, which is a common characteristic of many scams. Without a reliable regulatory body, users may find it challenging to seek recourse in the event of disputes or issues with fund withdrawals.

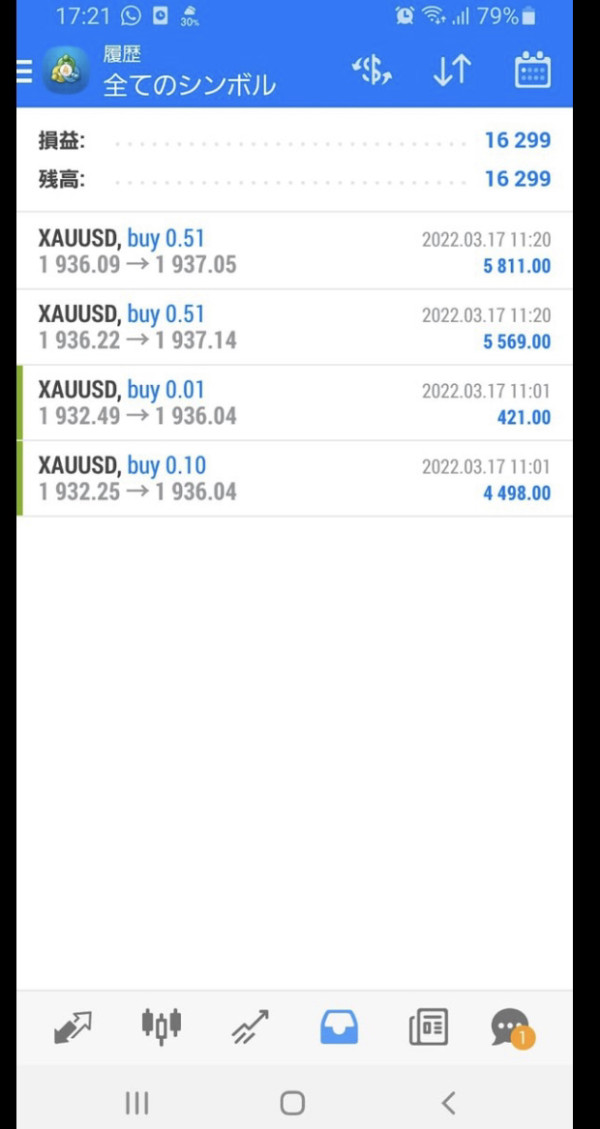

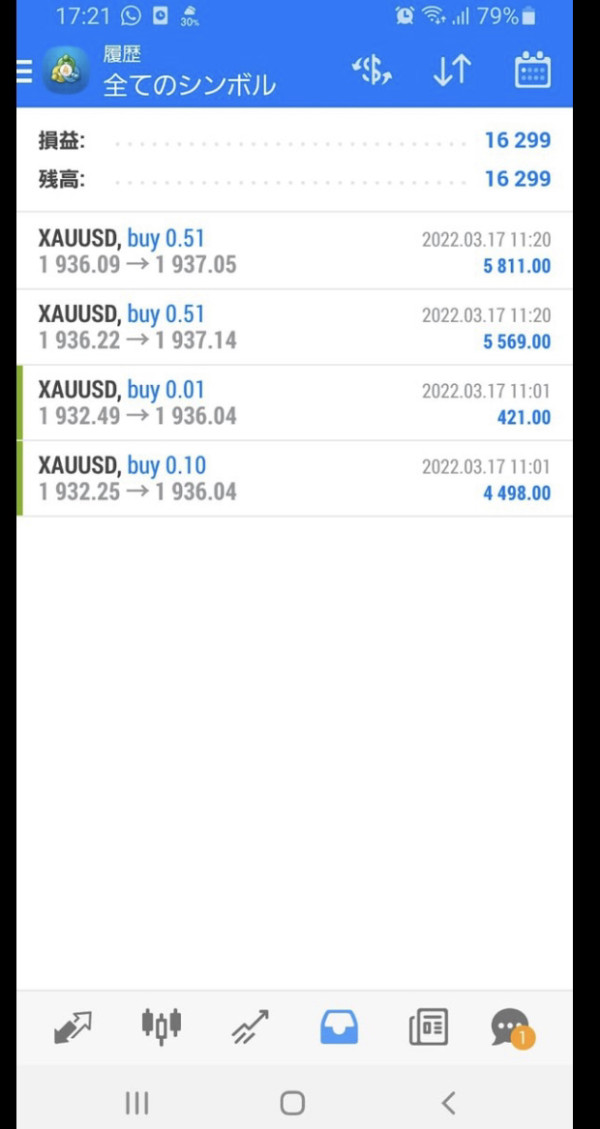

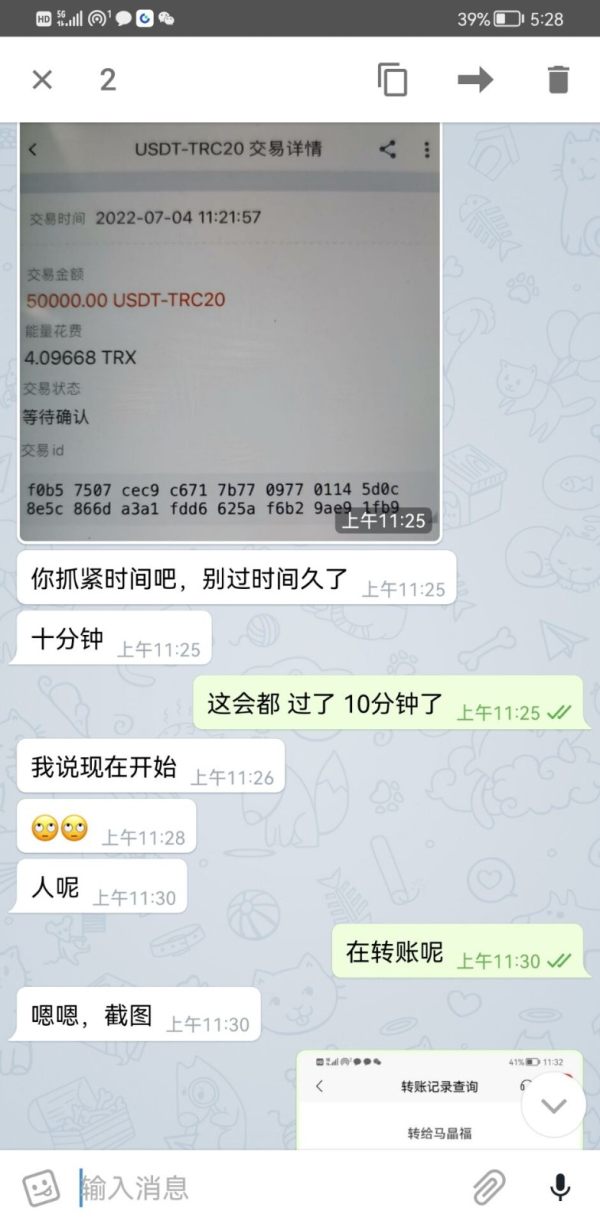

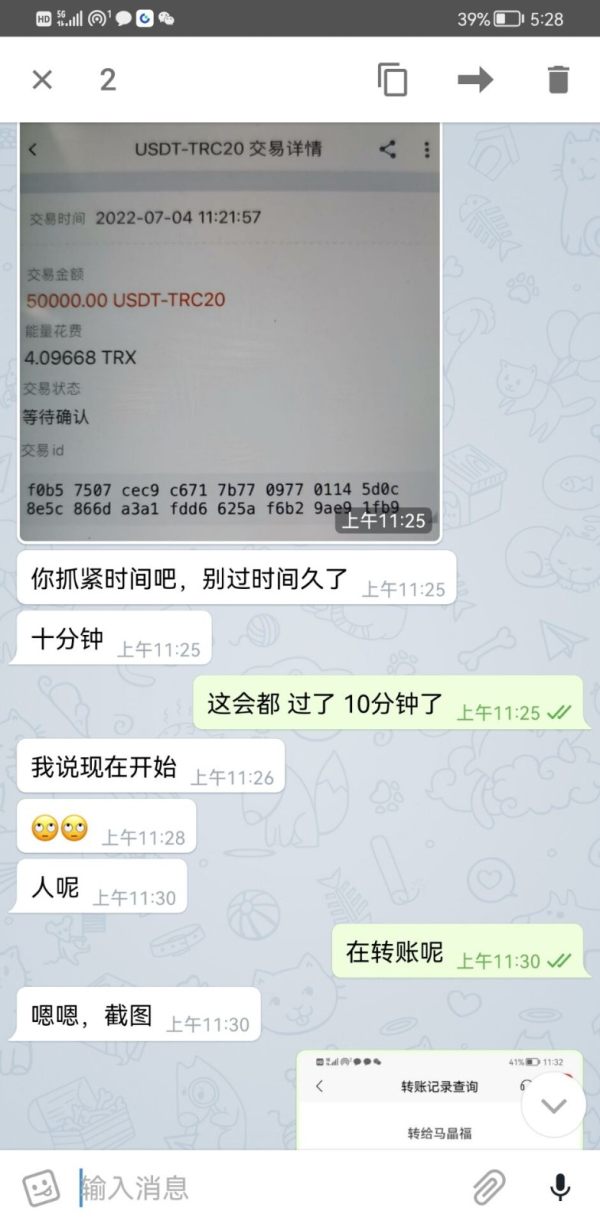

Deposit/Withdrawal Currencies/Cryptocurrencies

The broker does not provide clear information regarding the currencies supported for deposits and withdrawals. Many users have reported difficulties in accessing their funds, leading to a growing number of complaints about withdrawal issues. This lack of transparency regarding payment methods is a significant concern for potential traders.

Minimum Deposit

Libbit offers multiple account types, with minimum deposits ranging from $100 for the base trade account to $1,000 for the opti trade account. However, the absence of clarity regarding what each account type entails raises questions about the value provided for these minimum deposits.

Information regarding bonuses or promotional offers is scarce, and it appears that Libbit may not provide any significant incentives for new users. The lack of promotional activity could be indicative of a broader issue with the broker's marketing strategies and user engagement efforts.

Tradable Asset Classes

Libbit claims to offer over 200 types of assets, including forex pairs, commodities, stocks, indices, and cryptocurrencies. However, the absence of a reputable trading platform and the unclear nature of these assets may deter potential traders who are looking for transparency and reliability.

Costs (Spreads, Fees, Commissions)

According to the broker's website, spreads for the EUR/USD pair start at 0.1 pips, but there is no clear information regarding commissions or additional fees. This lack of clarity can lead to unexpected costs for traders and contributes to the negative user experience reported by many.

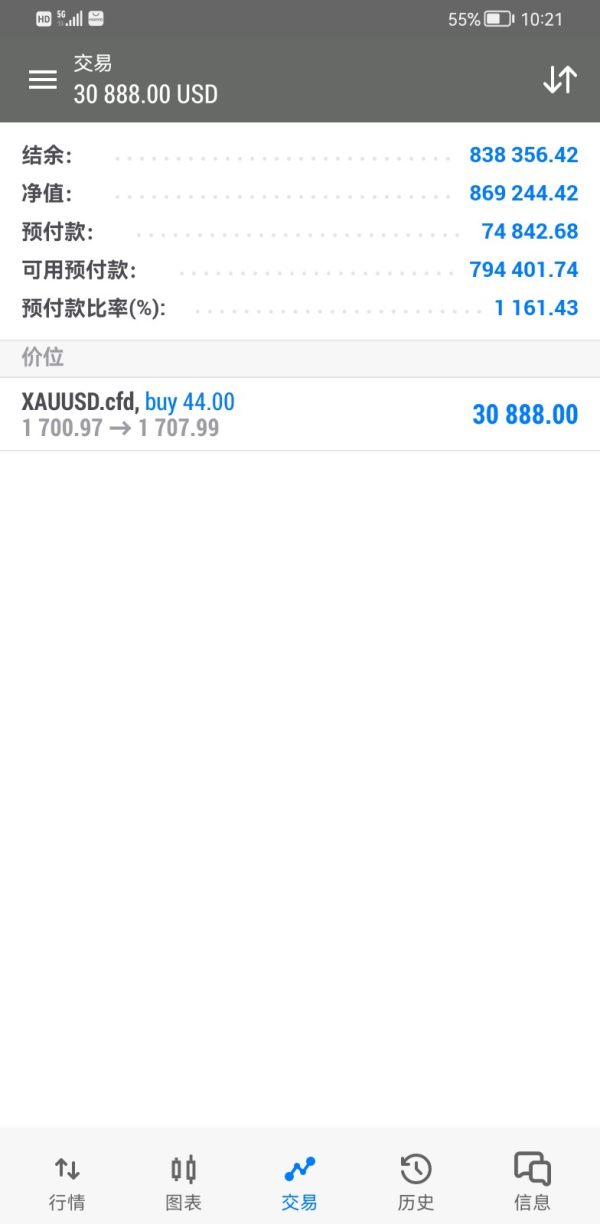

Leverage

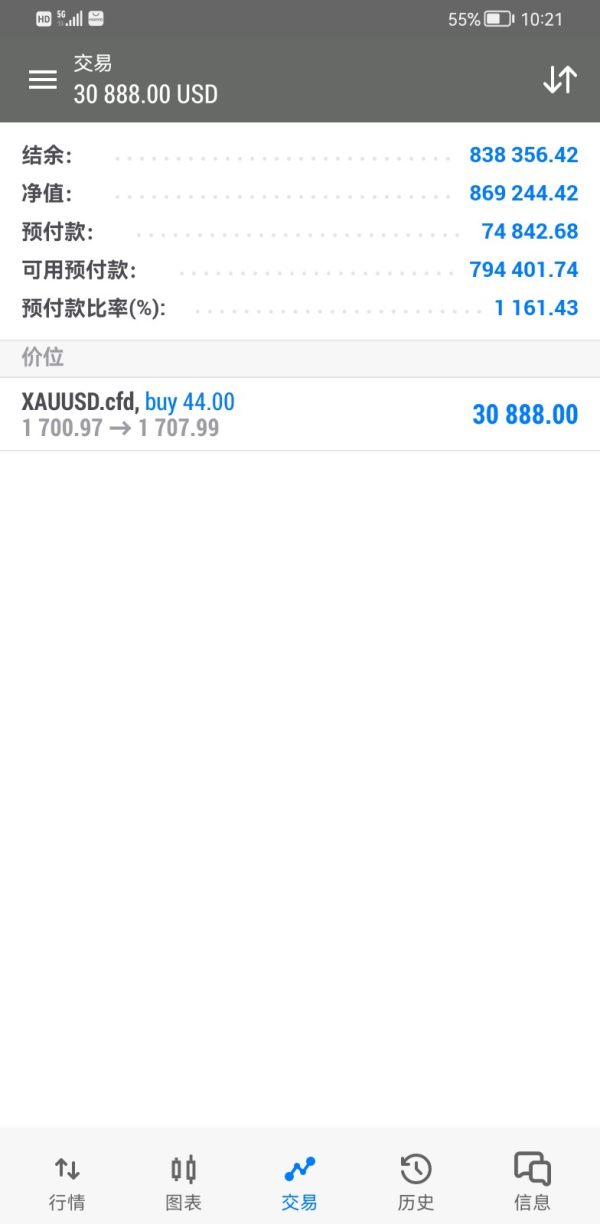

Leverage options vary depending on the account type, with a maximum of 1:100 for the base account and up to 1:500 for the opti trade account. While high leverage can amplify profits, it also increases risk, making it crucial for traders to understand the implications fully.

Libbit does not offer well-known trading platforms like MT4 or MT5, which are preferred by many traders for their advanced features and reliability. This absence may limit the trading experience and tools available to users, further contributing to the negative sentiment surrounding the broker.

Restricted Regions

While specific information about restricted regions is not provided, the lack of regulatory oversight suggests that traders from certain jurisdictions may face additional risks when trading with Libbit.

Available Customer Service Languages

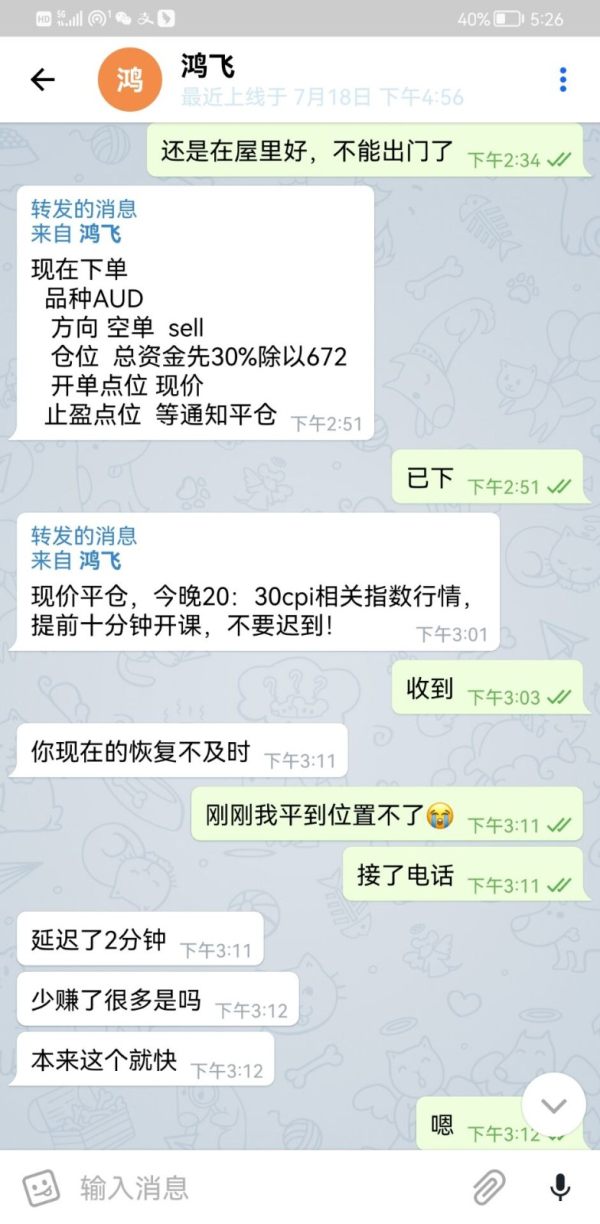

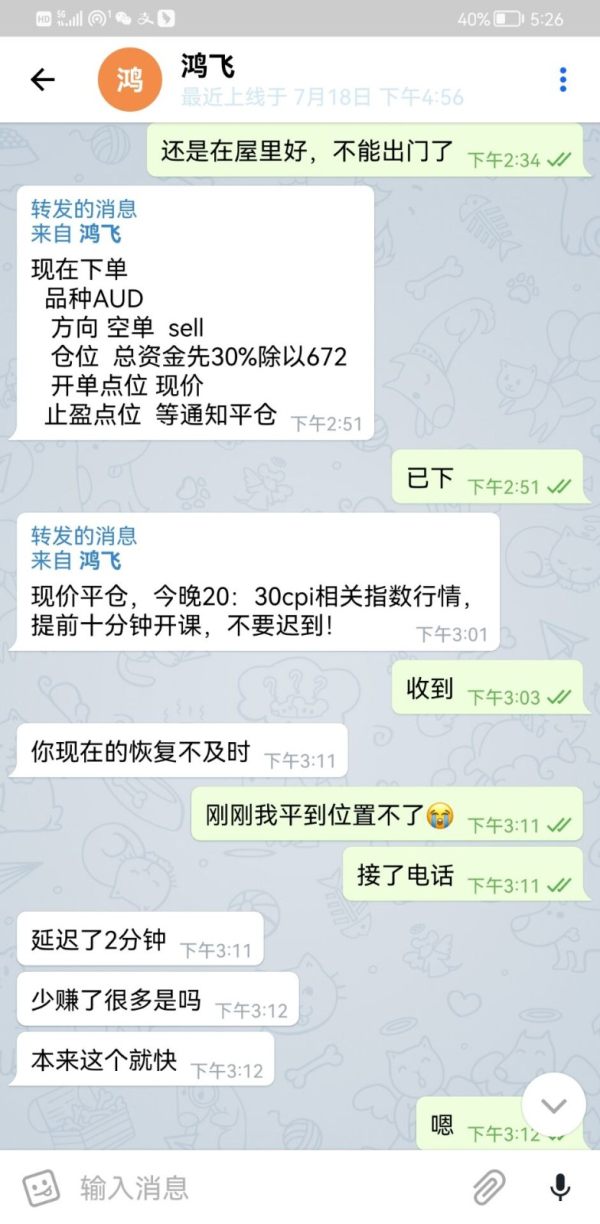

Customer service options appear limited, with reports indicating a lack of live chat support and minimal responsiveness from the customer service team. This deficiency in support can significantly impact user experience, particularly for traders who may require assistance with their accounts.

Repeat Rating Box

Detailed Breakdown

-

Account Conditions: Libbit's account types offer minimal flexibility and transparency, contributing to a low score in this category. Users have expressed dissatisfaction with the lack of clear benefits associated with different account levels.

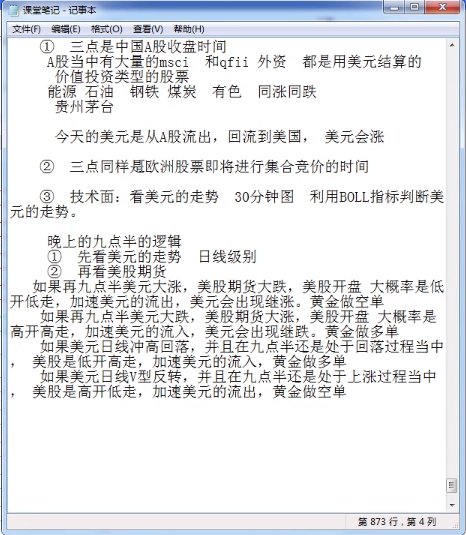

Tools and Resources: The absence of a recognized trading platform limits user access to essential trading tools and resources, which is critical for effective trading strategies.

Customer Service and Support: User feedback highlights significant issues with customer support, including delayed responses and a lack of communication regarding account issues.

Trading Setup: The trading experience is hampered by the lack of a reliable platform and the numerous complaints regarding fund accessibility, leading to a low score.

Trustworthiness: The absence of regulatory oversight and numerous user complaints regarding withdrawal issues contribute to a very low trust score for Libbit.

User Experience: Overall, user experiences reported indicate significant dissatisfaction, particularly concerning fund withdrawals and customer support, leading to a low score in this area.

In conclusion, the Libbit review paints a concerning picture of a broker that lacks regulatory oversight and transparency, with numerous user complaints regarding fund accessibility and customer support. Potential investors are strongly advised to conduct thorough research and consider the risks before engaging with Libbit.