ABinvesting 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ABinvesting is a regulated forex and CFD brokerage, overseen by the Mauritius Financial Services Commission (FSC). It is particularly noted for offering a broad array of trading instruments with an emphasis on education for traders ranging from novice to intermediate levels. The platform is designed to be user-friendly and caters to those interested in trading forex, commodities, cryptocurrencies, and indices. Although ABinvesting boasts low trading fees and several account options, it presents certain drawbacks, such as the absence of advanced platforms like MetaTrader 5 (MT5) and significant restrictions for U.S.-based traders. Consequently, while ABinvesting offers various opportunities for those eligible to trade, potential clients must weigh these benefits against the operational limitations that may not cater to their trading needs.

⚠️ Important Risk Advisory & Verification Steps

When considering trading with ABinvesting, it's crucial to be aware of the following risks:

- Regulatory Conflicts: Always verify the broker's regulatory status through official channels to avoid misinformation.

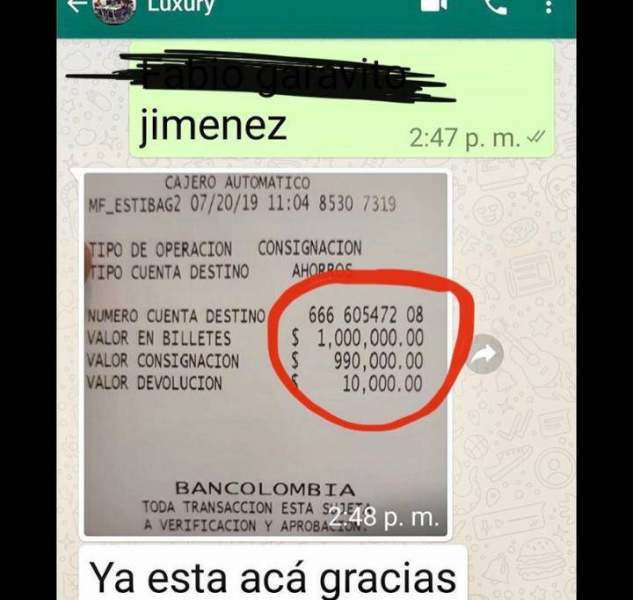

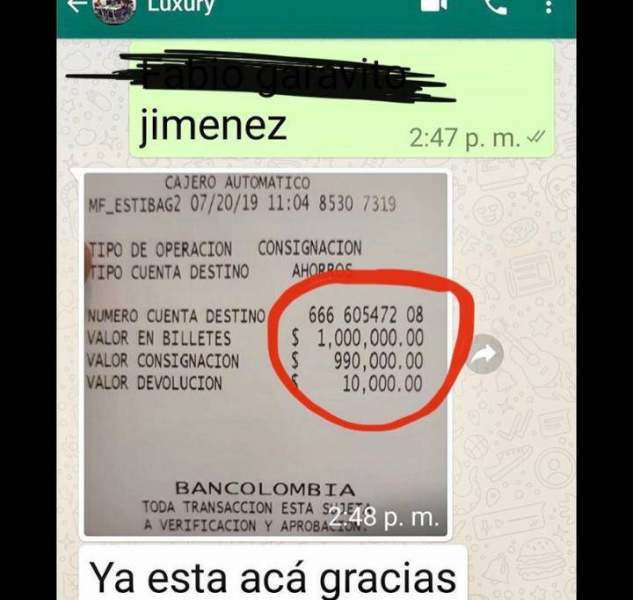

- Fund Safety: User feedback suggests some concerns about the safety of funds and withdrawal processes.

- Platform Availability: ABinvesting does not support MT5, which may limit advanced trading options for experienced traders.

To verify ABinvestings legitimacy:

- Visit the official website of the Mauritius Financial Services Commission (FSC).

- Check for licensing and registration information with license no. GB20025728.

- Review public reports and user testimonials to understand the broker's reputation.

- Contact customer support to gauge their responsiveness and reliability.

Rating Framework

Broker Overview

Company Background and Positioning

ABinvesting operates under the brand name of Hub Investments Ltd, a regulatory-compliant entity registered in Mauritius. Established to cater to traders' needs, ABinvesting has built a reputation for providing comprehensive trading solutions. With a particular focus on customer service and educational resources, the firm has positioned itself as a reliable broker among its peers.

Core Business Overview

ABinvesting offers a range of trading instruments exceeding 350 assets, including forex, commodities, cryptocurrencies, and indices. The broker operates under the license of the Mauritius Financial Services Commission (FSC), ensuring compliance with relevant regulations. The platform utilizes popular trading tools such as MetaTrader 4 and their proprietary web-based trading options.

Quick-Look Details Table

In-depth Analysis of Each Dimension

1. Trustworthiness Analysis

The reliability of a broker is paramount, and with ABinvesting, regulatory compliance plays a significant role in establishing trust. The FSC has stringent requirements that the broker follows, reflecting its commitment to maintaining a trustworthy trading environment.

- Regulatory Information Conflicts: Examine reports that highlight any regulatory conflicts or inconsistencies in user experiences. Always refer to the latest information from the FSC.

- User Self-Verification Guide: Users can verify ABinvesting's legitimacy by:

- Visiting the official FSC website.

- Searching for the license number, GB20025728.

- Validating company registration under 176512 GBC.

- Industry Reputation and Summary: General consensus indicates that ABinvesting is perceived as a legitimate broker, although caution with user-generated reviews is advised.

2. Trading Costs Analysis

In terms of trading costs, ABinvesting stands out for its competitive pricing and low fees, appealing to both novice and more experienced traders.

- Advantages in Commissions: Traders benefit from the commission-free structure, making it easier to maximize profits.

- The "Traps" of Non-Trading Fees:

- Withdrawals below a certain threshold might incur a fee, as highlighted by users: **€160** for inactivity beyond 61 days.

- Cost Structure Summary: While the variable spread for assets may deter high-frequency traders, the overall structure is advantageous for those primarily engaged in longer-term trades.

ABinvesting offers an engaging trading experience through various platforms, although some advanced tools API integrations are lacking.

- Platform Diversity: The primary platforms include:

- MetaTrader 4: Widely recognized for its performance among retail traders.

- Webtrader: Offers accessibility without the need for software installation.

- Quality of Tools and Resources: The platform includes an array of tools for analysis, although advanced traders may miss the features of MT5.

- Platform Experience Summary: Users generally rate the platforms positively for their ease of use and access to necessary market instruments.

4. User Experience Analysis

The trading experience at ABinvesting is frequently highlighted as user-friendly, particularly for less experienced traders.

- Accessibility of Educational Resources: The broker provides various educational tools such as articles and webinars.

- Overall User Experience: The user interface is intuitive, which caters well to beginners and contributes to positive client feedback.

5. Customer Support Analysis

Customer service is critical in the trading environment, and ABinvesting excels in this area.

- Multilingual Support Availability: Support is provided in 11 languages, ensuring assistance for a diverse clientele.

- Feedback on Responsiveness: Customer reviews suggest that support is prompt and effective, with various contact methods available.

6. Account Conditions Analysis

ABinvesting offers multiple account types, catering to diverse trading needs and providing flexibility.

- Flexibility in Account Types: Three main account categories—Silver, Gold, and Platinum—address varying levels of trader experience and preferences.

- Performance of Islamic Accounts: The Islamic account option allows adherence to Sharia law, catering to Muslim clients without swaps or interest charges.

Conclusion

ABinvesting presents an appealing option for novice to intermediate traders, with strong regulatory backing, diverse asset offerings, and educational resources. However, its limitations—such as the absence of MT5 and restrictions on U.S. clients—may not fulfill the needs of all traders. Therefore, while many will find ABinvesting a rich opportunity, those with advanced trading needs should proceed with caution.