Is W-Wealth safe?

Business

License

Is W Wealth Safe or Scam?

Introduction

W Wealth, a forex broker, has garnered attention in the trading community for its offerings in the foreign exchange market. As traders increasingly seek opportunities for profit, the importance of choosing a trustworthy broker cannot be overstated. With the rise of scams and unregulated entities in the financial sector, it is crucial for traders to conduct thorough evaluations of potential brokers. This article aims to provide an objective analysis of W Wealth, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether W Wealth is safe or a potential scam.

To conduct this investigation, we reviewed multiple sources, including regulatory databases, customer reviews, and expert analyses. Our assessment framework includes an examination of W Wealth's regulatory compliance, company history, trading conditions, customer fund security, client feedback, platform performance, and risk factors.

Regulation and Legitimacy

The regulatory environment plays a vital role in ensuring the safety and legitimacy of a forex broker. W Wealth's regulatory status is a significant concern, as it has been reported that the broker operates without proper oversight from recognized financial authorities. The absence of regulation raises red flags for potential investors, as unregulated brokers often lack accountability and can engage in unethical practices.

Here is a summary of W Wealth's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

As indicated in the table, W Wealth does not have any regulatory oversight, which is a critical factor for traders to consider. The lack of regulation means that there are no legal protections in place for clients, making it difficult for them to seek recourse in the event of disputes or issues with fund withdrawals. Furthermore, the history of compliance for unregulated brokers often reveals a pattern of customer complaints and financial irregularities. Therefore, the question remains: Is W Wealth safe? The evidence suggests that potential clients should proceed with caution.

Company Background Investigation

W Wealth's company background is another essential aspect to consider when evaluating its legitimacy. The broker is reportedly registered in China, but detailed information regarding its ownership structure and history is sparse. This lack of transparency can be concerning for potential investors, as it raises questions about the broker's accountability and operational integrity.

The management team behind W Wealth also plays a crucial role in its credibility. However, information about the key individuals managing the broker is limited. A well-established management team with relevant experience can significantly enhance a broker's reliability. In W Wealth's case, the absence of detailed profiles for its leadership raises further doubts about its operational practices.

Moreover, the overall transparency and information disclosure from W Wealth appear to be inadequate. A reputable broker typically provides comprehensive information about its services, fees, and operational structure. The lack of such disclosures may indicate a reluctance to provide clients with necessary information, further fueling concerns about whether W Wealth is safe for trading.

Trading Conditions Analysis

When assessing a forex broker, understanding the trading conditions they offer is vital. W Wealth's fee structure and trading policies are essential components of its overall attractiveness to traders. Reports suggest that W Wealth has a complex fee structure that may include hidden charges, which could significantly impact a trader's profitability.

The following table provides a comparison of W Wealth's core trading costs:

| Fee Type | W Wealth | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Varies |

As illustrated, W Wealth's spreads can be variable, potentially leading to higher trading costs compared to industry averages. Additionally, the absence of a clear commission model raises concerns about hidden fees that could affect traders' bottom lines. Such practices are often indicative of brokers that prioritize profit over client welfare, leading to the question of whether W Wealth is safe for traders who are looking for transparent and fair trading conditions.

Customer Fund Security

The security of customer funds is paramount in evaluating any forex broker. W Wealth's approach to fund security has raised concerns among potential clients. Reports indicate that the broker does not have adequate measures in place to ensure the safety of client deposits. This includes the lack of segregated accounts, which are essential for protecting client funds from being misused in the broker's operations.

Furthermore, the absence of investor protection schemes is alarming. In regulated environments, brokers are often required to participate in compensation schemes that safeguard clients' funds in the event of insolvency. However, W Wealth's unregulated status means that clients have no such protections. Historical issues related to fund withdrawals and customer complaints about difficulties in accessing their money further emphasize the risk associated with trading with W Wealth. Therefore, it is crucial to ask: Is W Wealth safe? The evidence suggests significant risks regarding fund security.

Customer Experience and Complaints

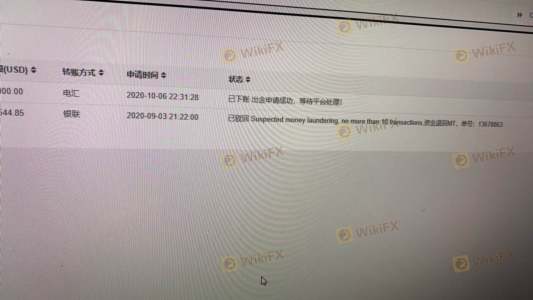

Examining customer feedback provides valuable insights into the reality of trading with W Wealth. Numerous reviews from traders indicate a pattern of complaints related to fund withdrawals and customer service responsiveness. Many users have reported difficulties in retrieving their funds, with some claiming that their requests were ignored for extended periods.

The following table summarizes the main types of complaints associated with W Wealth:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inadequate |

| Transparency Concerns | High | Lacking |

As seen, the most severe complaints revolve around withdrawal issues, which are a significant red flag for any broker. The company's inadequate response to these complaints further exacerbates the situation, leading to a lack of trust among clients. A typical case involved a trader who reported being unable to withdraw funds for over a month, with customer service failing to provide satisfactory answers. Such experiences raise serious questions about whether W Wealth is safe for potential clients.

Platform and Execution

The performance of a broker's trading platform is critical to the overall trading experience. W Wealth claims to offer a user-friendly platform, but reviews suggest that the platform's stability and execution quality may be lacking. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

In addition, any signs of potential platform manipulation should be taken seriously. If traders suspect that a broker is engaging in practices that disadvantage them, it raises significant concerns about the broker's integrity. Therefore, assessing the execution quality and reliability of W Wealth's platform is essential for determining its safety for traders.

Risk Assessment

The overall risk associated with trading through W Wealth is a crucial consideration for potential clients. The following risk assessment table summarizes key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation, high risk of fraud |

| Fund Security | High | No investor protection or segregation |

| Customer Service | Medium | Poor response to complaints |

| Trading Conditions | Medium | Hidden fees and variable spreads |

Given the high-risk levels associated with W Wealth, it is imperative for prospective traders to exercise caution. To mitigate these risks, it is advisable to conduct thorough research, consider regulated alternatives, and avoid investing significant funds until the broker's legitimacy can be established.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns about W Wealth's legitimacy and safety. The lack of regulation, poor customer feedback, and inadequate fund security measures suggest that W Wealth is not safe for traders. Potential clients should be wary of engaging with this broker due to the numerous red flags identified throughout this analysis.

For traders seeking reliable options, it is recommended to consider well-regulated brokers with transparent practices and positive customer feedback. Trustworthy alternatives can provide the necessary protections and support for a secure trading experience. Always prioritize safety and due diligence when selecting a forex broker.

Is W-Wealth a scam, or is it legit?

The latest exposure and evaluation content of W-Wealth brokers.

W-Wealth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

W-Wealth latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.