Is Elon safe?

Pros

Cons

Is Elon Safe or Scam?

Introduction

Elon, often referred to in the context of trading platforms, has emerged as a notable player in the foreign exchange (forex) market. However, with the rapid growth of online trading, the need for traders to critically evaluate the credibility of these platforms has never been more crucial. The forex market is rife with opportunities, but it also harbors risks, particularly from unregulated or poorly regulated brokers. This article aims to provide a comprehensive assessment of whether Elon is a safe trading platform or a potential scam. Our investigation is based on a thorough analysis of regulatory status, company background, trading conditions, customer experiences, and risk factors, allowing traders to make informed decisions.

Regulation and Legitimacy

The regulatory status of a trading platform is a cornerstone of its legitimacy. A well-regulated broker is typically subject to oversight by financial authorities that enforce strict standards to protect investors. In the case of Elon, it is critical to assess whether it holds licenses from reputable regulatory bodies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Unverified |

Elon does not appear to be regulated by any top-tier financial authority, which raises significant concerns about its operational legitimacy. The absence of regulation can expose traders to various risks, including the potential for fraud and the lack of recourse in the event of disputes. Regulatory bodies such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia are known for their rigorous standards. Without oversight from such authorities, the safety of traders' funds and the integrity of trading practices are called into question. Historical compliance issues or warnings from regulators can further highlight the risks associated with unregulated platforms like Elon.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its credibility. Elons history, ownership structure, and management team play a pivotal role in determining its reliability. However, information about Elon is sparse, which is a red flag in itself. A transparent broker should provide clear details about its founding, ownership, and operational history.

Elon lacks significant information regarding its establishment and ownership. This opacity can lead to concerns over accountability and operational integrity. Furthermore, the absence of a recognized management team with proven expertise in the financial sector can exacerbate these concerns. Transparency in operations, including clear communication about company policies and practices, is vital for building trust with clients. Without such transparency, it becomes challenging for traders to assess whether Elon is indeed a safe platform or if it poses risks of being a scam.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact its attractiveness to traders. This includes the fee structure, spreads, and overall trading environment. For Elon, understanding its costs is fundamental to evaluating its competitiveness and fairness.

| Fee Type | Elon | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.5 pips |

| Commission Structure | N/A | $5 per lot |

| Overnight Interest Range | N/A | 0.5% to 2% |

The lack of clear information regarding Elon's fee structure is concerning. Transparent brokers typically provide detailed breakdowns of their costs, which allow traders to understand the potential impact on their profitability. Any unusual or hidden fees can lead to unexpected losses and may indicate a lack of integrity in the brokers operations. Moreover, if Elon's trading costs are significantly higher than industry averages, it could suggest that the platform is not competitive, potentially driving traders away.

Client Funds Security

The safety of client funds is paramount when evaluating any trading platform. Traders need to understand the measures in place to protect their investments. Elons approach to fund security, including whether it utilizes segregated accounts and offers negative balance protection, is crucial in determining its safety.

While specific details about Elon's security measures are limited, a lack of information raises alarms. Reputable brokers usually highlight their commitment to fund safety, including the use of segregated accounts to ensure that client funds are protected from operational risks. The absence of such assurances can indicate a higher risk of loss in the event of financial difficulties faced by the broker. Furthermore, any historical incidents involving fund security breaches or issues would significantly affect the trustworthiness of Elon as a trading platform.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. For Elon, understanding the nature of customer complaints and the company's response can help gauge its commitment to client satisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

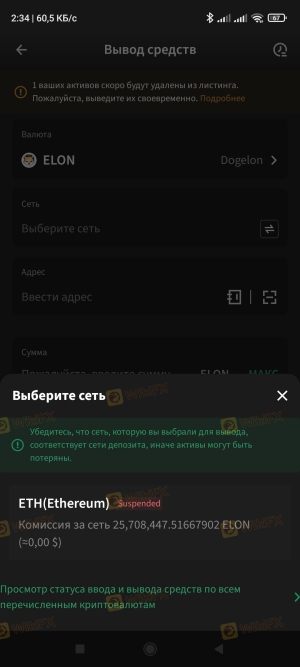

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Information | High | Denial/No Action |

Common complaints regarding Elon's services revolve around withdrawal difficulties and inadequate customer support. Many users have reported challenges in accessing their funds, which is a significant concern for any trader. Additionally, a lack of timely and effective communication from the company can exacerbate frustrations, leading to a negative trading experience. Such patterns of complaints suggest that Elon may not prioritize customer service, which is critical for building trust and fostering long-term relationships with traders.

Platform and Execution

The performance of a trading platform is vital for successful trading experiences. Factors such as stability, order execution quality, and potential signs of manipulation should be thoroughly evaluated.

User reviews indicate mixed experiences with Elon's trading platform. Some traders have reported issues with execution speed and slippage, which can significantly impact trading outcomes. A reliable platform should provide consistent execution without undue delays or refusals of orders. Any indications of manipulative practices, such as artificially widening spreads during high volatility, can further solidify concerns about Elon's legitimacy.

Risk Assessment

Understanding the risks associated with using Elon is essential for traders considering this platform. A comprehensive risk assessment can help identify potential pitfalls.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | Medium | Lack of transparency in fees |

| Operational Risk | High | Reports of withdrawal issues |

The overall risk associated with trading on Elon is significant, primarily due to its unregulated status and lack of transparency. Traders should approach this platform with caution, understanding that the absence of regulatory oversight can lead to potential losses without recourse.

Conclusion and Recommendations

In summary, the evidence suggests that Elon raises multiple red flags that warrant caution. The lack of regulation, transparency, and a history of customer complaints indicate that Elon may not be a safe trading platform. Traders should be wary of engaging with brokers that do not adhere to industry standards and regulations.

For those seeking reliable trading options, it is advisable to consider brokers that are regulated by reputable authorities, offer transparent fee structures, and prioritize customer service. Some recommended alternatives include brokers regulated by the FCA or ASIC, which provide a safer trading environment and better protections for client funds. Ultimately, ensuring that you trade with a reputable broker is essential for a secure trading experience.

In conclusion, the question "Is Elon safe?" leans towards a negative response based on the available evidence. Traders should exercise caution and consider safer alternatives to protect their investments.

Is Elon a scam, or is it legit?

The latest exposure and evaluation content of Elon brokers.

Elon Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Elon latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.