Regarding the legitimacy of UGL forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is UGL safe?

Business

License

Is UGL markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

UGL Exchange Limited

Effective Date:

--Email Address of Licensed Institution:

info@uglexchange.comSharing Status:

No SharingWebsite of Licensed Institution:

www.uglexchange.comExpiration Time:

--Address of Licensed Institution:

Agiou Ioanni Prodromou 31, Yioupis Tower, 3rd Floor, Office 301, 4002 LimassolPhone Number of Licensed Institution:

+357 25 389 206Licensed Institution Certified Documents:

Is UGL Safe or Scam?

Introduction

UGL, a forex brokerage based in Cyprus, has garnered attention in the trading community for its range of services aimed at retail traders. Operating since 2016, UGL claims to offer various financial instruments, including forex, CFDs, commodities, and indices. However, the legitimacy and safety of such platforms are critical considerations for traders. The forex market is rife with risks, and with numerous brokers vying for attention, it is essential for traders to conduct thorough assessments before committing their funds. This article investigates whether UGL is safe or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk.

Regulation and Legitimacy

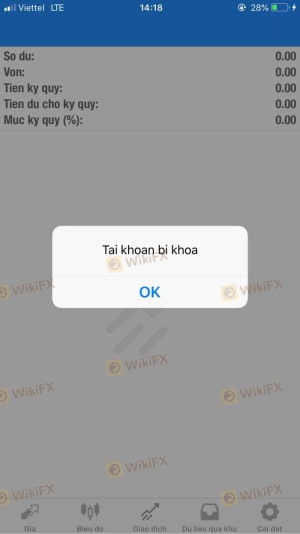

The regulatory environment is a crucial factor when evaluating the safety of a forex broker. UGL operates under the jurisdiction of Cyprus, which is overseen by the Cyprus Securities and Exchange Commission (CySEC). However, reports indicate that UGL is currently unregulated, raising red flags about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | Not applicable | Cyprus | Unregulated |

The lack of a valid license from a recognized regulatory authority is concerning. A regulated broker is typically held to strict standards regarding client fund protection, transparency, and operational integrity. UGL's unregulated status suggests a potential lack of oversight, which could expose traders to higher risks. Additionally, there have been claims that UGL's license was suspended due to compliance issues, further questioning the broker's reliability. Therefore, when considering whether UGL is safe, one must take into account its questionable regulatory standing.

Company Background Investigation

UGL was established in 2016 and has positioned itself as a global online broker. However, the company's history and ownership structure remain somewhat opaque. Information about the management team is scarce, which raises concerns about accountability and transparency. A reliable broker typically provides detailed information about its executives and their qualifications.

The absence of clear ownership information is another red flag. Traders should be cautious when dealing with a broker that does not disclose its leadership or operational history. Transparency is a key indicator of a broker's reliability, and UGL's lack of information could imply that it is not fully committed to ethical trading practices.

Trading Conditions Analysis

When evaluating whether UGL is safe, it is essential to consider the trading conditions offered by the broker. UGL's fee structure includes spreads, which vary depending on the account type, but there is limited information about other potential costs.

| Fee Type | UGL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.4 pips | 1.5 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not specified | Varies |

The spreads offered by UGL are relatively high compared to industry averages, which could significantly impact trading profitability. Additionally, the lack of transparency regarding overnight interest rates and commission structures is concerning. Traders should be wary of hidden fees that could erode their capital. Overall, the trading conditions at UGL do not inspire confidence, raising further questions about whether UGL is safe.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. UGL's approach to fund security appears to lack essential measures such as segregated accounts and investor protection schemes. Without these protections, clients may face significant risks in the event of broker insolvency or mismanagement.

Furthermore, UGL does not provide adequate information regarding its policies on negative balance protection, which is crucial for safeguarding traders from incurring debts beyond their initial deposits. Historical disputes involving fund security issues could also suggest that UGL has not prioritized client safety in its operations. Therefore, when assessing whether UGL is safe, it is crucial to highlight these shortcomings in fund protection measures.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of UGL indicate a mixed bag of experiences, with some users reporting satisfactory service, while others express concerns about withdrawal issues and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | Unresponsive |

Common complaints include difficulties in withdrawing funds and a perceived lack of transparency regarding trading conditions. In some cases, customers have reported that their withdrawal requests take an inordinate amount of time to process, leading to frustration and distrust. A few users have also noted that the company's customer support is often unresponsive, making it challenging to resolve issues effectively. Such complaints raise serious concerns about whether UGL is safe for traders.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. UGL offers the popular MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, reports suggest that users have experienced issues with order execution, including slippage and rejected orders.

Inconsistent order execution quality can significantly impact trading success, particularly in a fast-moving market. If traders are unable to execute their trades at desired prices, it could lead to unexpected losses. Additionally, any signs of platform manipulation or irregularities in pricing should be thoroughly investigated to determine if UGL is safe.

Risk Assessment

Using UGL for forex trading entails several risks, primarily stemming from its unregulated status and questionable operational practices.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with a suspended license. |

| Fund Security Risk | High | Lack of investor protection measures. |

| Customer Service Risk | Medium | Inconsistent support and high complaint volume. |

Traders should approach UGL with caution, given the high regulatory and fund security risks. To mitigate these risks, it is advisable to limit the amount of capital allocated to trading with UGL and to consider diversifying trading activities across multiple regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence suggests that UGL raises several red flags that traders should consider seriously. Its unregulated status, lack of transparency, high trading costs, and negative customer feedback all contribute to a conclusion that UGL may not be a safe trading option.

For traders seeking reliability and security, it is recommended to consider alternative brokers with established regulatory frameworks and positive customer reviews. Some reputable options include brokers regulated by top-tier authorities such as the FCA or ASIC. In summary, while UGL may offer attractive trading conditions on the surface, the underlying risks indicate that traders should exercise caution and thoroughly evaluate whether UGL is safe for their trading needs.

Is UGL a scam, or is it legit?

The latest exposure and evaluation content of UGL brokers.

UGL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UGL latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.