Is DEMARKET safe?

Pros

Cons

Is Demarket Safe or Scam?

Introduction

Demarket is an emerging platform in the forex and digital trading market, focusing on providing a decentralized trading experience using Web 3.0 technology. As with any trading platform, it is crucial for traders to evaluate the safety and legitimacy of Demarket before engaging in trading activities. The forex market is known for its volatility and the presence of scams, making it essential for traders to conduct thorough due diligence on any broker or trading platform. This article aims to investigate whether Demarket is safe or a potential scam by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile.

Regulation and Legitimacy

Understanding the regulatory status of Demarket is vital for assessing its credibility. Regulatory bodies enforce rules and standards that protect traders from fraud and ensure fair trading practices. A lack of regulation can be a significant red flag. Demarket claims to operate under certain regulatory frameworks, yet the details are often vague.

Here is a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not disclosed | N/A | N/A | Unverified |

The absence of a clear regulatory framework raises concerns about the platform's legitimacy. Historically, platforms that lack robust regulatory oversight have been linked to fraudulent activities. Hence, the quality of regulation and compliance history is critical when evaluating if Demarket is safe.

Company Background Investigation

Demarket was established as a platform to facilitate the trading of digital items, including cryptocurrencies and in-game assets. The company's history appears to be relatively short, having emerged in recent years, which may raise questions regarding its stability and experience in the market.

The ownership structure of Demarket is not entirely transparent, which can be a cause for concern. A lack of clear information about the management team and their professional backgrounds often leads to skepticism. Transparency and information disclosure are essential for building trust in the trading environment. If the company does not provide adequate information about its leadership and operational practices, it may indicate potential risks for traders.

Trading Conditions Analysis

The trading conditions offered by Demarket are another critical factor in determining its safety. A transparent fee structure is vital for traders to understand the costs involved in trading. Demarket's fee structure, however, has been reported to be somewhat convoluted.

Here is a comparison of core trading costs:

| Fee Type | Demarket | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads and commission structures should be competitive to ensure that traders are not overpaying. Unusual or excessive fees can be red flags indicating that a broker may not have the trader's best interests in mind.

Customer Funds Safety

The safety of customer funds is paramount when assessing whether Demarket is safe. Traders must know how their funds are protected. Demarket claims to implement various safety measures, including fund segregation and investor protection policies.

However, the specifics of these measures are often not well-documented. The platform's approach to negative balance protection is another area of concern. If traders can lose more than their initial deposit, it could lead to significant financial losses.

Historical incidents involving fund security issues could further illuminate the risks associated with trading on Demarket. Any past controversies or disputes regarding fund safety should be thoroughly examined to gauge the platform's reliability.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real user experience on Demarket. Reviews and testimonials can provide insights into common issues faced by users.

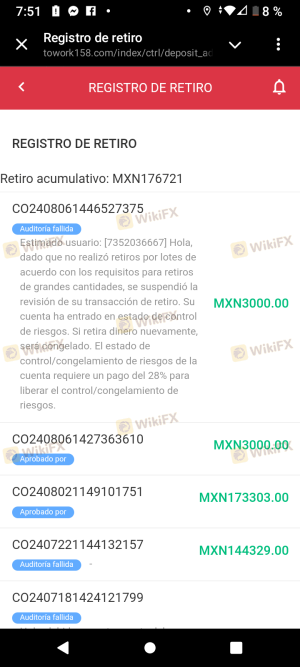

Common complaint patterns observed include withdrawal difficulties, lack of responsive customer service, and issues with account bans. Here is a summary of major complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed |

| Customer Support Delays | Medium | Inconsistent |

| Account Bans | High | Unexplained |

Typical case studies reveal that users often report being banned without clear justification, leading to frustration and distrust. Such experiences highlight the importance of having a responsive and transparent support system.

Platform and Execution

The performance of the trading platform itself is critical for user satisfaction. Demarket's platform has received mixed reviews regarding its stability and user experience.

Concerns about order execution quality, slippage, and rejection rates have been raised by users. If traders experience frequent issues with executing trades at desired prices, it can significantly impact their trading outcomes.

Signs of potential platform manipulation, such as unusual price movements or irregularities during high volatility, should also be monitored closely.

Risk Assessment

Using Demarket comes with a set of risks that traders must consider. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation |

| Financial Risk | Medium | Uncertainty in fees |

| Operational Risk | High | Platform stability issues |

| Security Risk | High | Past fund safety concerns |

To mitigate these risks, traders should consider using smaller amounts for initial trades, ensure they fully understand the platform's fee structure, and maintain regular communication with customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that potential risks associated with Demarket cannot be overlooked. The lack of clear regulatory oversight, transparency issues regarding company management, and frequent customer complaints raise significant concerns about its safety.

Traders should exercise caution when considering Demarket as their trading platform. It is advisable to explore alternative platforms with robust regulatory frameworks and proven track records.

For traders seeking reliable options, platforms like [Alternative Broker 1] and [Alternative Broker 2] offer safer trading environments backed by reputable regulatory bodies. Ultimately, thorough research and careful consideration are essential in ensuring a secure trading experience.

In summary, while Demarket may offer certain advantages, the overall landscape suggests that it is prudent to remain vigilant and cautious, prompting the question: Is Demarket safe? The answer remains uncertain, and traders should prioritize platforms that prioritize their safety and transparency.

Is DEMARKET a scam, or is it legit?

The latest exposure and evaluation content of DEMARKET brokers.

DEMARKET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DEMARKET latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.