Is VI Markets safe?

Pros

Cons

Is VI Markets A Scam?

Introduction

VI Markets, operating under the domain vimarkets.me, positions itself as an online trading platform offering a variety of financial instruments, including forex, CFDs, and cryptocurrencies. As a player in the forex market, it aims to attract both novice and experienced traders with its promises of competitive trading conditions and user-friendly platforms. However, the online trading landscape is rife with potential pitfalls, and traders must exercise caution when evaluating brokers. The importance of assessing a brokers legitimacy cannot be overstated, as many traders have fallen victim to scams that result in significant financial losses. This article aims to provide a comprehensive analysis of VI Markets, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a review of various credible sources, including user reviews, regulatory filings, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A well-regulated broker is expected to adhere to strict guidelines that protect customer funds and ensure fair trading practices. Unfortunately, VI Markets operates without any significant regulatory oversight. The company claims to be affiliated with Axi Financial Services in the UK, but a search of the UK Financial Conduct Authority (FCA) register reveals that it is not authorized to offer investment services. This lack of regulation raises serious concerns about the safety of client funds and the integrity of the trading environment.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

The absence of a valid regulatory framework means that traders using VI Markets are exposed to higher risks, including potential fraud and mismanagement of funds. Moreover, the companys claims of regulatory compliance appear to be misleading, as it lacks a solid track record of compliance with industry standards. This lack of oversight is a significant red flag for any potential investor.

Company Background Investigation

VI Markets is owned by Version International General Trading and Contracting Ltd, a company based in Kuwait. While the company has been operational since 2015, it has not established a credible reputation within the trading community. The management team behind VI Markets lacks transparency, with little information available about their professional backgrounds and expertise in the financial sector. This lack of disclosure raises concerns about the company's commitment to providing a trustworthy trading environment.

Furthermore, the company's website does not provide sufficient information about its ownership structure or operational history, which is essential for assessing its credibility. The absence of detailed information about the company's operations and management team is concerning and suggests a lack of accountability. The overall transparency level of VI Markets is low, making it difficult for potential traders to fully understand who they are dealing with.

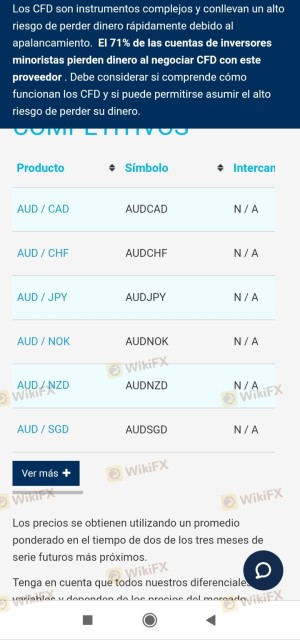

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is crucial. VI Markets claims to provide competitive spreads, but specific details about its pricing structure are vague. The minimum deposit required to open an account is $250, which is relatively standard in the industry. However, the lack of clarity regarding spreads and fees is a concern.

| Fee Type | VI Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information on spreads and commissions makes it difficult for traders to accurately assess the overall cost of trading with VI Markets. Moreover, the lack of transparency regarding overnight interest rates raises further questions about the broker's operational practices. Traders should be wary of any broker that does not provide clear and accessible information about its fee structure, as this can often lead to unexpected costs.

Client Fund Safety

The safety of client funds is paramount in the trading industry. VI Markets claims to implement various safety measures, but the lack of regulatory oversight raises concerns about the effectiveness of these protections. The broker does not clearly state whether it offers segregated accounts for client funds, which is a standard practice among regulated brokers to ensure that client money is kept separate from the broker's operational funds.

Additionally, there is no mention of investor protection schemes, such as those offered by regulatory bodies like the FCA. Such schemes provide a safety net for traders in the event of broker insolvency. The absence of these protections is alarming and indicates that traders using VI Markets may be at significant risk of losing their funds without any recourse.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. A review of user experiences with VI Markets reveals a pattern of complaints, particularly regarding withdrawal issues and customer support. Many users report difficulties in withdrawing their funds, which is a common red flag for potential scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Inconsistent |

One particularly concerning case involved a trader who reported being unable to withdraw their funds after multiple attempts, leading to frustration and distrust in the platform. Such experiences are indicative of a larger issue within the company and suggest that potential clients should exercise caution when considering trading with VI Markets.

Platform and Trade Execution

The trading platform offered by VI Markets is marketed as user-friendly, with claims of high stability and execution quality. However, user reviews indicate that there may be issues with order execution, including slippage and delayed order processing. These factors can significantly impact a trader's ability to execute trades effectively, particularly in volatile market conditions.

Moreover, the platform's performance raises questions about potential market manipulation. Traders have reported instances where price discrepancies occurred, leading to unfavorable trading conditions. These issues undermine the overall reliability of the trading platform and suggest that traders may face challenges when executing their trading strategies.

Risk Assessment

Using VI Markets presents several risks that potential traders should consider. The absence of regulation, combined with reported withdrawal issues and customer complaints, indicates a high-risk environment for trading.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation in place. |

| Fund Safety Risk | High | Lack of investor protection and fund segregation. |

| Execution Risk | Medium | Reports of slippage and delayed orders. |

To mitigate these risks, traders should conduct thorough research before investing with VI Markets. It may be prudent to seek alternative brokers that offer better regulatory oversight and proven reliability.

Conclusion and Recommendations

In conclusion, the investigation into VI Markets raises significant concerns regarding its legitimacy and trustworthiness. The lack of regulatory oversight, coupled with numerous customer complaints and issues related to fund safety, suggests that VI Markets may not be a safe option for traders.

Is VI Markets safe? Based on the available evidence, it appears that potential investors should approach this broker with caution. It is advisable for traders, particularly those new to the forex market, to consider alternative, well-regulated brokers that provide a safer trading environment. Some recommended alternatives include brokers with established reputations and robust regulatory frameworks, such as those regulated by the FCA or ASIC. Ultimately, the safety of your investments should always be the top priority.

Is VI Markets a scam, or is it legit?

The latest exposure and evaluation content of VI Markets brokers.

VI Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VI Markets latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.