Established recently, Trust Broker Group Ltd. operates from Vanuatu and is governed by the Vanuatu Financial Services Commission (VFSC). However, the VFSC is not viewed as a reputable regulatory authority, sparking concerns over the effective safeguarding of client funds. Trust Broker aims to capture the market of savvy retail traders by providing low-cost trading with an appealing range of tools and platforms. However, this positioning must be understood in the context of its regulatory shortcomings.

Trust Broker provides a variety of trading services across forex, CFDs, and commodities, utilizing the widely recognized MetaTrader 4 platform. Despite offering only a few asset classes, including about 60 currency pairs and precious metals, the broker distinguishes itself with favorable trading conditions, including variable spreads and flexible leverage options up to 1:200. However, this product range and leverage offering come with inherent risks given the broker's lack of more recognized regulatory oversight.

To navigate the uncertain waters of online trading, users must arm themselves with knowledge about the regulatory framework surrounding their chosen broker.

Trust Broker is regulated under Vanuatu's VFSC, which is often considered a low-tier regulator due to sparse oversight and less stringent operational compliance. This regulatory landscape raises critical flags about fund safety, as contrasted with various top-tier authorities like the FCA (UK) or ASIC (Australia) which have established standards for protecting trader interests. Consequently, potential traders must weigh the enjoyment of low spreads against regulatory assurance.

- Visit the NFA Website: Use their BASIC database to check broker details.

- Search with Broker‘s Name: Input “Trust Broker” to find relevant licensing information.

- Consult the FCA Website: Similarly, check the FCA’s official website for any overlaps with registration or alerts.

- Crossreference User Feedback: Explore sites like TrustPilot or ForexPeaceArmy for community ratings or red flags on Trust Broker‘s services.

- Log All Research: Document the details you find about Trust Broker’s regulatory status and community feedback.

Industry Reputation and Summary

The reputation of Trust Broker is mixed within trading forums. Many users voice concerns regarding functionality, user support, and withdrawal frustrations. As one user noted:

"Dealing with Trust Broker was frustrating. Getting funds out felt more like a chore than a service."

This feedback signals an alarming trend and establishes the necessity of thorough verification before engagement.

Trading Costs Analysis

Exploring the trading costs at Trust Broker unveils both attractive advantages and possible pitfalls.

Advantages in Commissions

Trust Broker boasts low commission rates enabling traders to minimize transaction costs. With spreads starting at 0.6 pips, it enables competitive trading opportunities, particularly attractive for high-frequency traders and those operating under low operational capital.

The "Traps" of Non-Trading Fees

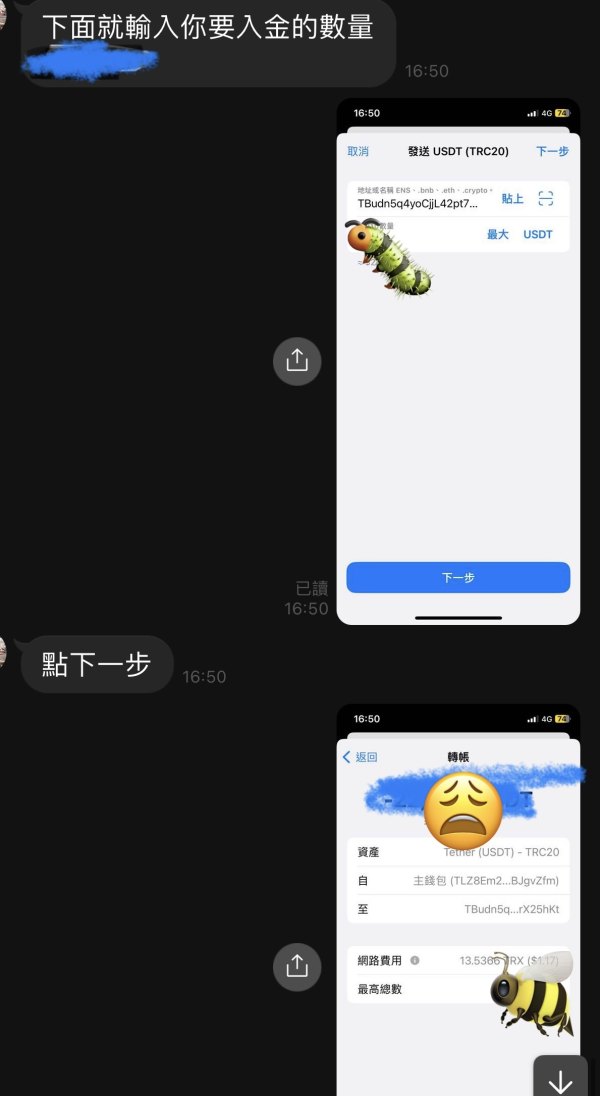

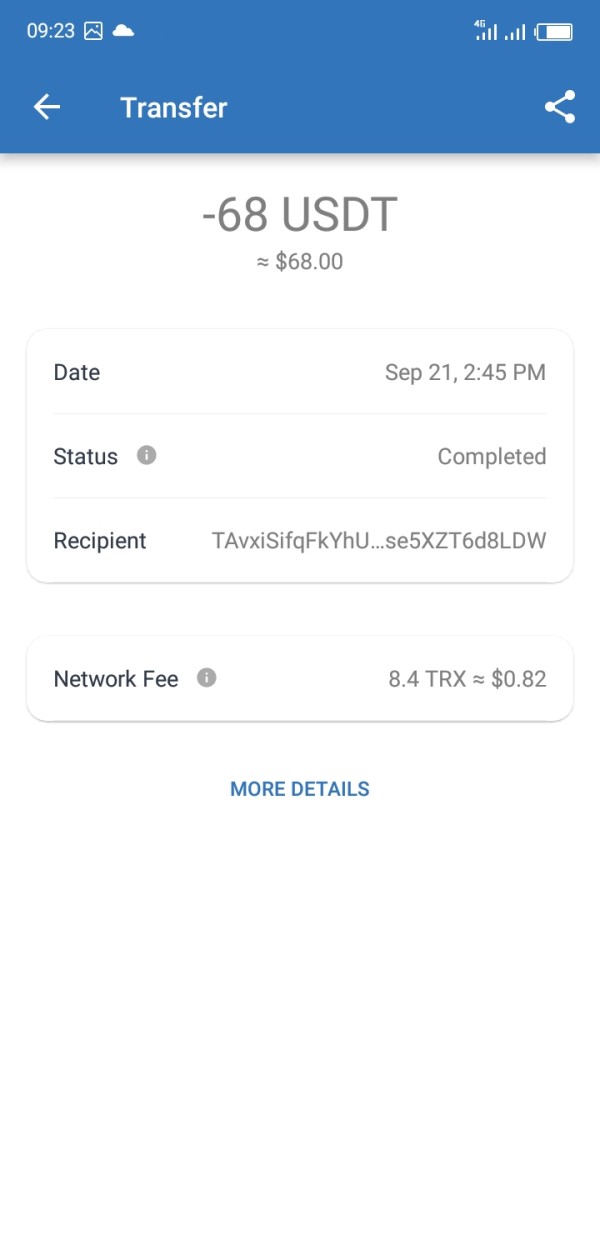

Despite attractive spreads, users have cited hidden costs that effectively erode initial cost advantages. For example, one user reported withdrawal fees that could reach $30, presenting unexpected obstacles when users attempt to access their own funds.

"I was shocked to learn about the $30 withdrawal fee after I thought I could freely access my earnings," a recent user commented.

This insight underscores the importance of understanding all potential costs involved beyond initial pricing, especially when dealing with low-cost brokers.

Cost Structure Summary

While Trust Broker promotes competitive trading costs, the real cost of trading may be skewed by non-transparent fees impacting overall profitability. This makes it crucial for different trader types to tread carefully in understanding the complete cost structure to avoid underestimating their financial outlays.

Trust Broker markets itself as a user-friendly platform, appealing to new entrants while providing enough tools for the more experienced trader.

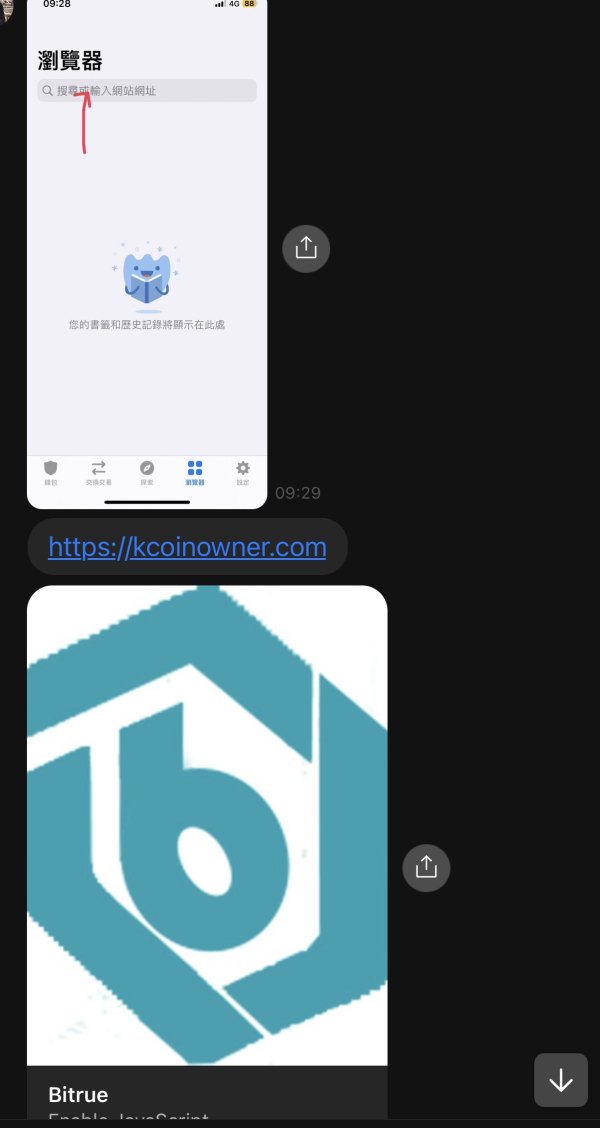

Offering MetaTrader 4 and a web-based platform, Trust Broker provides essential tools for traders. MT4 is extensively favored for its comprehensive suite of trading tools, indicators, and the ability to customize trading strategies through expert advisors (EAs). Nevertheless, the absence of newer platforms like MT5 may deter traders looking for more advanced features.

The broker provides useful educational resources and analytical tools to assist users in making informed trading decisions. This includes access to tutorials, market analysis, and trading signals, which together enhance the trading experience.

User feedback largely emphasizes ease of use on Trust Brokers platforms. However, some discontent arises when dealing with technical glitches that interrupt trading.

"At times, I found the platform freezing unexpectedly, which can be detrimental in a volatile market." A user expressed.

This feedback suggests that while the platform is generally user-friendly, technical reliability issues remain a key concern.

User Experience Analysis

The overall user experience at Trust Broker tightropes between effective service delivery and shortcomings in responsiveness.

Analysis of General User Sentiment

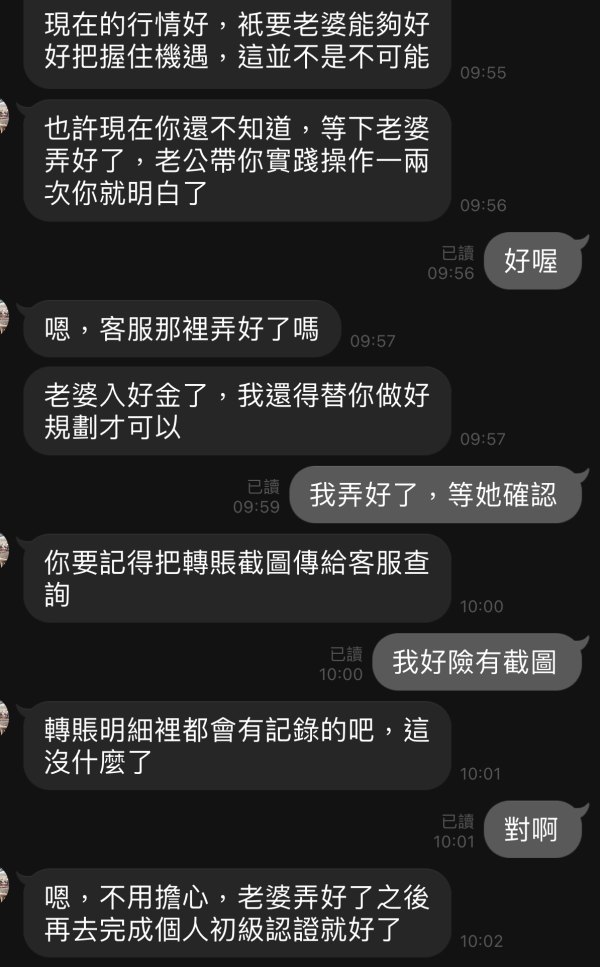

Although many users appreciate the access to a wide range of trading tools, frustrations often stem from the quality of customer service. Reports indicate delays in response times for support requests, impacting overall satisfaction.

"When I needed assistance, I waited days for a reply. Not ideal for anyone in a fast-paced trading environment," remarked a customer.

Recommendations for Improvement

Trust Broker must bolster customer service channels and response times to mitigate user complaints and enhance satisfaction in this competitive space. Enhanced communication mechanisms could transpire into a more seamless trading experience.

Customer Support Analysis

Customer support is a vital component in the trading experience, especially for troubleshooting unexpected issues.

Assessment of Support Channels

Trust Broker offers 24/7 customer support through multiple channels, including chat and email. However, as indicated by user feedback, response efficacy remains inconsistent, leading to widespread frustrations.

Summary of Customer Feedback

While some users reported satisfactory support experiences, many others expressed disappointment over delays or unhelpful responses. The inconsistency of support emerges as a recurrent theme in reviews.

"I wouldn't count on their support team. Most times, I was left without answers and felt abandoned," a user highlighted.

Immediate improvements in customer responsiveness should be a focal point for Trust Broker.

Account Conditions Analysis

Account conditions encapsulate the tone of the trading experience offered by Trust Broker, influencing trader confidence.

Overview of Account Features

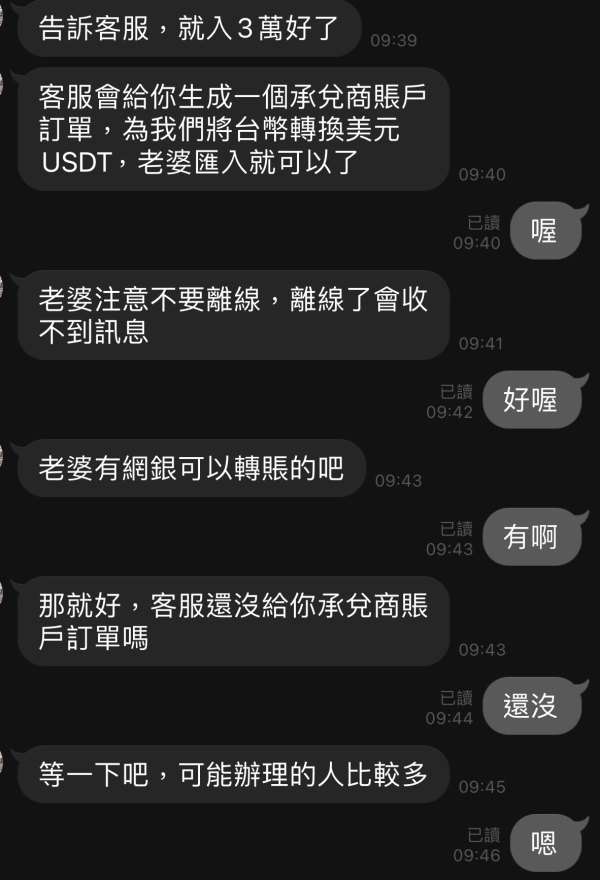

The minimum deposit for opening an account with Trust Broker is a competitive $100, a characteristic which appeals to beginner traders. Generally, the broker provides a range of account types catering to diverse trading preferences, though comprehensive educational guidance about account transitions is lacking.

User Insights on Account Management

User reports about account conditions reveal a spectrum of experiences, with several relating issues regarding the process to upgrade and access better features or tools.

"Upgrading my account felt complicated, and I wished there were clearer instructions available to follow," one user recounted.

Transparency improvements in account conditions, such as defining the steps to upgrade accounts and detailing the benefits therein, could enhance trader engagement and satisfaction.

Conclusion

Trust Broker presents itself as an appealing option for cost-conscious traders seeking low spreads and user-friendly platforms. Nevertheless, prospective customers must carefully evaluate the inherent risks tied to its minimal regulatory framework, potential challenges with withdrawals, and reports of inconsistent customer support. While opportunities exist for savvy investors to take advantage of competitive trading costs, the risks involved cannot be overlooked, warranting prudent consideration and self-verification steps before embarking on their trading journey with Trust Broker. This thorough review serves to equip traders with the necessary insights to make an informed decision, ultimately enhancing their trading experience in this dynamic market landscape.