Is Truefxmarkets safe?

Business

License

Is TrueFXMarkets Safe or Scam?

Introduction

TrueFXMarkets positions itself as a player in the forex trading space, claiming to provide a platform for traders seeking opportunities in foreign exchange and other financial instruments. However, the forex market is notoriously rife with scams and unregulated brokers, making it crucial for traders to thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article will investigate TrueFXMarkets, focusing on its regulatory status, company background, trading conditions, customer fund security, and user experiences. Our assessment will be grounded in a comprehensive review of available data, including user reviews, regulatory filings, and industry analyses, to determine whether TrueFXMarkets is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in assessing its safety. A regulated broker typically adheres to strict guidelines designed to protect traders, including ensuring the segregation of client funds, maintaining transparency, and providing recourse in case of disputes. In the case of TrueFXMarkets, it claims to operate under the auspices of regulatory authorities; however, scrutiny reveals a more concerning picture.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

TrueFXMarkets does not hold a license from any reputable regulatory body, which raises significant red flags. The absence of regulation means that the broker is not subject to oversight, potentially exposing traders to various risks, including fraud and mismanagement of funds. Moreover, user reviews indicate that TrueFXMarkets may not have a history of compliance with industry standards, further questioning its legitimacy. Without a regulatory framework, the broker's operations could be deemed illegal, especially in jurisdictions like the UK where strict laws govern forex trading.

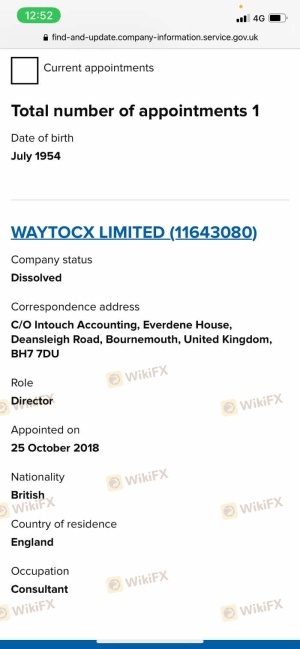

Company Background Investigation

TrueFXMarkets presents itself as a UK-based broker; however, details regarding its ownership and operational history are scant. The lack of transparency surrounding the company‘s origins and management raises concerns about its credibility. A thorough investigation into the company’s background reveals that there is little publicly available information about its founders or management team, which is crucial for assessing the broker's reliability.

The management teams professional experience is a critical factor in determining a broker's trustworthiness. A well-structured team with a proven track record in finance and trading can significantly enhance a broker's reputation. Unfortunately, TrueFXMarkets fails to provide such information, leaving potential clients in the dark about who is managing their investments. Furthermore, the absence of clear contact information and a physical address on their website contributes to a perception of opacity, which is often associated with fraudulent operations.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. TrueFXMarkets claims to offer competitive trading conditions, but a closer examination reveals potential inconsistencies in its fee structure and trading policies.

| Fee Type | TrueFXMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2-5% |

The absence of specific information about spreads, commissions, and overnight fees is troubling. Reputable brokers typically provide clear details about their fee structures, allowing traders to make informed decisions. The lack of such transparency at TrueFXMarkets may indicate hidden fees or unfavorable trading conditions that could erode traders' profits. Additionally, the high minimum deposit requirement of $10,000 is significantly higher than the industry average, suggesting that TrueFXMarkets may prioritize capital over client accessibility.

Customer Fund Security

The safety of customer funds is a primary concern for any trader. TrueFXMarkets' approach to fund security is questionable, as it does not appear to offer robust measures for safeguarding client assets. Key aspects to consider include the segregation of funds, investor protection mechanisms, and negative balance protection policies.

TrueFXMarkets does not provide clear information regarding whether client funds are held in segregated accounts, which is a standard practice among regulated brokers to ensure that traders' money is protected in the event of the broker's insolvency. Furthermore, the absence of negative balance protection leaves traders vulnerable to losing more than their initial investment, a risk that could lead to financial devastation.

Historical issues regarding fund security have also been reported by users, with several complaints about difficulties in withdrawing funds. Such incidents are common red flags that indicate a broker may not prioritize the safety of its clients' investments.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the operational integrity of TrueFXMarkets. User reviews reveal a mixed bag of experiences, with many users expressing dissatisfaction with the broker's responsiveness and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Inconsistent |

| Misleading Information | High | Unresponsive |

One common theme among user complaints is the difficulty in withdrawing funds. Numerous reports indicate that clients have faced significant delays or outright denials when trying to access their money. Such practices are often indicative of a scam, where brokers employ tactics to withhold funds from clients. Additionally, the overall quality of customer support has been criticized, with many users noting that they received vague or unhelpful responses to their inquiries.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for any trader's success. TrueFXMarkets claims to offer a user-friendly platform, but user experiences suggest otherwise. Reports of poor execution quality, including slippage and rejected orders, raise concerns about the platform's reliability.

Traders have noted instances of significant slippage during volatile market conditions, which can adversely affect trading outcomes. Furthermore, any signs of platform manipulation, such as artificially inflating spreads during critical trading periods, would further undermine the broker's credibility.

Risk Assessment

Using TrueFXMarkets presents several risks that potential clients should consider before opening an account.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Fund Security Risk | High | Lack of segregation and protection policies. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

Given the high-risk levels associated with TrueFXMarkets, potential traders should exercise extreme caution. It is advisable to conduct thorough due diligence and consider alternative brokers with established regulatory oversight and a track record of positive user experiences.

Conclusion and Recommendations

In conclusion, the investigation into TrueFXMarkets raises significant concerns regarding its legitimacy and safety. The broker operates without regulation, lacks transparency in its operations, and has received numerous complaints about fund withdrawal issues. These factors collectively suggest that TrueFXMarkets is not safe and may pose a substantial risk to traders.

Potential clients are advised to seek alternative options that offer regulatory protection, transparent fee structures, and a proven track record of customer satisfaction. Brokers regulated by authorities such as the FCA in the UK, ASIC in Australia, or CySEC in Cyprus are recommended as safer alternatives, as they adhere to strict guidelines designed to protect traders' interests. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is Truefxmarkets a scam, or is it legit?

The latest exposure and evaluation content of Truefxmarkets brokers.

Truefxmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Truefxmarkets latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.