Is BLUE WHALE MARKETS safe?

Pros

Cons

Is Blue Whale Markets Safe or a Scam?

Introduction

Blue Whale Markets is an online trading platform that positions itself within the forex market, claiming to provide various investment opportunities. As the financial landscape continues to evolve, traders are increasingly faced with a multitude of options, making it crucial to thoroughly assess the legitimacy and safety of any forex broker. This evaluation is particularly important given the rise of fraudulent schemes that can lead to significant financial losses for unsuspecting investors. In this article, we will investigate whether Blue Whale Markets is safe or a scam, using a comprehensive framework that includes regulatory status, company background, trading conditions, customer feedback, and risk assessments.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is subject to oversight from financial authorities, which helps ensure transparency and protect investors' funds. Unfortunately, Blue Whale Markets operates without any valid regulatory oversight, raising immediate red flags regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that there are no legal protections in place for clients. This lack of oversight can lead to situations where brokers engage in unethical practices without the fear of repercussions. Historical compliance records are also absent, as no regulatory authority has verified Blue Whale Markets. Therefore, it is crucial for potential investors to be cautious and consider the inherent risks involved in dealing with unregulated brokers.

Company Background Investigation

Understanding a company's history, ownership structure, and management team is essential when assessing its credibility. Blue Whale Markets has a vague corporate history, with minimal information available regarding its establishment, ownership, or the professional backgrounds of its management team. This opacity raises concerns about the company's transparency and accountability.

The lack of verifiable information about the company's operations and management is alarming. A reputable broker typically provides detailed information about its leadership and organizational structure, which helps build trust with clients. The absence of such disclosures from Blue Whale Markets indicates a potential attempt to obscure its true nature, further fueling suspicions about its legitimacy.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Blue Whale Markets claims to provide competitive trading fees, but a deeper examination reveals inconsistencies and potential issues.

| Fee Type | Blue Whale Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Structure | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While specific figures are not readily available, the lack of transparency in fee structures is concerning. Traders should be wary of any broker that does not clearly outline its fees, as this can lead to unexpected costs and reduced profitability. Furthermore, any unusual or hidden fees could signal that the broker is not operating in good faith.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading environment. Blue Whale Markets does not provide adequate information regarding its fund safety measures. The absence of clear policies on fund segregation, investor protection, and negative balance protection raises concerns about the security of client investments.

Without proper fund segregation, clients' money could be at risk in the event of the broker's financial difficulties. Additionally, the lack of investor protection mechanisms means that clients may have no recourse if the broker engages in fraudulent activities. Historical disputes or fund security issues are also not disclosed, further exacerbating the concerns surrounding this broker.

Customer Experience and Complaints

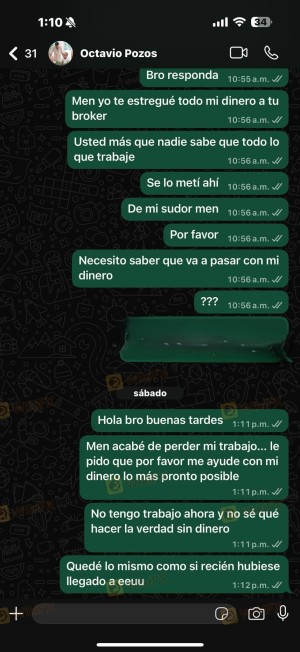

Analyzing customer feedback is vital in determining the reliability of a broker. Reports from users of Blue Whale Markets indicate a pattern of negative experiences. Common complaints include difficulties in withdrawing funds, high-pressure tactics for deposits, and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High-Pressure Sales Tactics | Medium | Poor |

| Unresponsive Support | High | Poor |

These complaints suggest that Blue Whale Markets may not prioritize customer service or ethical business practices. For instance, clients have reported being pressured to make additional deposits after initial investments, only to face challenges when attempting to withdraw their funds. Such practices are often indicative of a scam, leading to the conclusion that potential investors should proceed with caution.

Platform and Trade Execution

The performance of a trading platform is crucial for traders. Blue Whale Markets' platform has received mixed reviews regarding its stability and user experience. Issues such as slippage, order rejections, and overall execution quality have been reported, raising questions about the reliability of the platform.

Inconsistent order execution can lead to significant financial losses, especially in a volatile market. If traders cannot trust that their orders will be executed promptly and accurately, their ability to trade effectively is compromised. Furthermore, any signs of potential manipulation or unfair practices should be taken seriously, as they can indicate deeper issues within the broker's operations.

Risk Assessment

Using Blue Whale Markets entails several risks that potential investors should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation, increasing vulnerability to scams. |

| Fund Security | High | Lack of fund segregation and investor protection. |

| Customer Service | Medium | Poor response to complaints and withdrawal issues. |

Given these risks, it is crucial for traders to exercise caution. Recommendations for mitigating risks include starting with small investments, thoroughly researching the broker's reputation, and avoiding any platforms that lack regulatory oversight.

Conclusion and Recommendations

In conclusion, Blue Whale Markets exhibits numerous characteristics that raise serious concerns about its legitimacy and safety. The lack of regulation, transparency issues, and negative customer feedback all point towards the possibility that this broker may not be trustworthy.

For traders seeking to invest in the forex market, it is advisable to consider regulated alternatives that offer better security and transparency. Some reputable brokers include those regulated by well-known authorities like the FCA, ASIC, or CySEC, which provide a safer trading environment and more robust investor protections. Always prioritize your financial security by conducting thorough research before engaging with any trading platform.

Is BLUE WHALE MARKETS a scam, or is it legit?

The latest exposure and evaluation content of BLUE WHALE MARKETS brokers.

BLUE WHALE MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BLUE WHALE MARKETS latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.