Is Matsui safe?

Pros

Cons

Is Matsui Safe or Scam?

Introduction

Matsui Securities Co., Ltd., a prominent player in the Japanese financial market, has positioned itself as a reliable online brokerage service provider, primarily catering to retail investors. Established in 1918, the firm has evolved significantly, especially in the realm of online trading, and is known for its competitive pricing and innovative trading platforms. However, as the forex market continues to grow, the importance of assessing the credibility of brokers like Matsui cannot be overstated. Traders must be vigilant in evaluating the reliability of their chosen trading platforms to protect their investments and ensure compliance with regulations. In this article, we will investigate the safety of Matsui Securities through a comprehensive analysis of its regulatory status, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial in determining its credibility and trustworthiness. Matsui Securities is regulated by Japan's Financial Services Agency (FSA), which is a significant regulatory body ensuring the integrity of financial markets in the country. Below is a summary of Matsui's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 関東 財務 局長 (金商) 第 164 号 | Japan | Verified |

The FSA is known for its stringent oversight and compliance requirements, which adds a layer of security for traders. Matsui Securities has maintained a solid reputation over its long history, with no significant regulatory infractions reported. However, the lack of detailed information regarding the expiration date of its license raises some concerns about transparency. Overall, the regulation by FSA indicates that Matsui is committed to adhering to industry standards, which is a good sign for potential investors looking to determine if Matsui is safe.

Company Background Investigation

Matsui Securities has a rich history that dates back to its founding in 1918, making it one of Japan's oldest brokerage firms. The company transitioned into online trading in 1998, becoming a pioneer in the Japanese market. This shift allowed Matsui to capture a significant share of the market, focusing on experienced retail investors who demand competitive pricing and innovative services. The management team, led by President Akira Warita, has extensive experience in the financial services industry, contributing to the firm's strategic direction and operational efficiency.

Despite its achievements, transparency remains a concern. While Matsui provides basic information about its services and history, detailed disclosures about its ownership structure and financial performance are limited. This lack of transparency could be a red flag for potential clients who value comprehensive information before making investment decisions. Overall, the company's longstanding presence and regulatory compliance suggest that Matsui is a credible brokerage, but potential investors should remain cautious due to the gaps in transparency.

Trading Conditions Analysis

When assessing whether Matsui is safe, it is essential to analyze its trading conditions, including fees and commissions. Matsui Securities employs a unique fee structure based on the total daily contract price, which can be advantageous for active traders. However, the absence of clear information regarding spreads and commissions can lead to confusion among potential clients. Below is a comparison of Matsui's trading costs with industry averages:

| Fee Type | Matsui Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.4 pips (EUR/USD) | 1.0 pips |

| Commission Model | Box rate fee structure | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

Matsui's spreads appear to be competitive compared to the industry average, which is a positive aspect for traders. However, the lack of clarity regarding overnight interest rates and other potential fees poses a risk for traders who may not be aware of additional costs. This opacity in fee structures can be a significant concern for traders evaluating whether Matsui is safe.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader considering a brokerage. Matsui Securities has implemented several measures to ensure the security of client funds. The company segregates client funds from its operational capital, which is a standard industry practice designed to protect investors in case of company insolvency. Additionally, Matsui adheres to the regulations set forth by the FSA, which includes maintaining a good capital ratio.

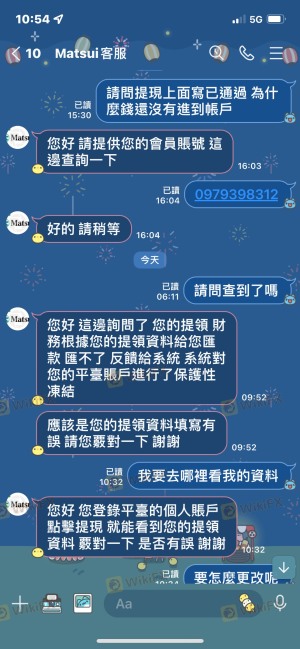

However, it is essential to note that there have been historical concerns regarding the withdrawal processes at Matsui. Some users have reported difficulties in accessing their funds or delays in withdrawal requests, raising questions about the effectiveness of the firm's customer fund safety measures. Overall, while Matsui Securities has established protocols for safeguarding client funds, potential investors should be aware of these withdrawal issues when assessing whether Matsui is safe.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the overall experience of trading with Matsui. Many users appreciate the competitive pricing and user-friendly trading platforms. However, common complaints include difficulties in withdrawing funds and a lack of responsive customer support. Below is a summary of the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited contact options |

| Transparency Concerns | Medium | Inconsistent communication |

One notable case involved a trader who faced significant delays when attempting to withdraw funds, leading to frustration and a negative perception of the brokerage. This pattern of complaints raises concerns about Matsui's operational efficiency and responsiveness to client needs, which are critical factors for traders evaluating whether Matsui is safe.

Platform and Execution

The trading platform's performance is crucial for any forex trader, as it directly impacts the trading experience. Matsui Securities offers several trading platforms, including mobile applications tailored for various asset classes. User feedback generally highlights the platforms' stability and ease of use, but there are concerns regarding order execution quality. Traders have reported instances of slippage and rejections during high volatility periods, which can significantly affect trading outcomes.

The absence of any indications of platform manipulation is a positive sign; however, the execution issues faced by users suggest that traders should exercise caution. A reliable platform is essential for ensuring a seamless trading experience, and any shortcomings in this area could lead to losses. Thus, while Matsui's platforms have their merits, traders must consider these execution challenges when determining if Matsui is safe.

Risk Assessment

Engaging with any brokerage involves inherent risks, and it is essential to evaluate these when considering Matsui Securities. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Regulated by Japan's FSA |

| Withdrawal Difficulties | High | Reported issues with fund withdrawals |

| Transparency Issues | Medium | Lack of detailed information available |

| Platform Execution Quality | Medium | Instances of slippage and rejections |

To mitigate risks, traders should conduct thorough research, understand the fee structures, and ensure they have a clear strategy in place. It is advisable for traders to start with a demo account, if available, to familiarize themselves with the platform and its features before committing significant capital.

Conclusion and Recommendations

In conclusion, while Matsui Securities is regulated by the Financial Services Agency in Japan, which adds a layer of credibility, there are several concerns that potential investors should consider. Issues related to withdrawal difficulties, transparency, and execution quality raise red flags that cannot be ignored. Thus, while Matsui is not outright a scam, it is prudent for traders to exercise caution and conduct thorough due diligence.

For traders looking for reliable alternatives, consider brokers with strong regulatory oversight, transparent fee structures, and proven track records of customer satisfaction. Some reputable options include brokers regulated by the FCA or ASIC, which are known for their robust investor protection measures. Overall, while Matsui has its strengths, potential traders should weigh their options carefully before deciding to invest.

Is Matsui a scam, or is it legit?

The latest exposure and evaluation content of Matsui brokers.

Matsui Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Matsui latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.