AXA 2025 Review: Everything You Need to Know

In the ever-evolving landscape of forex and financial services, AXA has emerged as a notable player, particularly in the Hong Kong market. This review synthesizes user experiences, expert opinions, and key features to provide a comprehensive overview of AXA's offerings. While some users appreciate the range of investment products, many express frustrations regarding customer service and withdrawal processes.

Note: It's essential to recognize that AXA operates under various entities across regions, leading to differing user experiences. This review aims to be fair and accurate by considering multiple perspectives.

Ratings Overview

How We Rated the Broker: Ratings are based on a synthesis of user reviews and expert analyses from various sources.

Broker Overview

Founded in 2005, AXA is a Hong Kong-based broker regulated by the Securities and Futures Commission (SFC). It offers a range of investment products, including forex, commodities, and indices, but lacks popular trading platforms like MT4 or MT5. While it provides a solid foundation for trading, user experiences have been mixed, particularly concerning its customer service and withdrawal processes.

Detailed Breakdown

Regulatory Regions

AXA is regulated primarily in Hong Kong, which adds a layer of security for investors. However, there are reports of withdrawal issues that raise concerns about the effectiveness of this regulation.

Deposit/Withdrawal Currencies

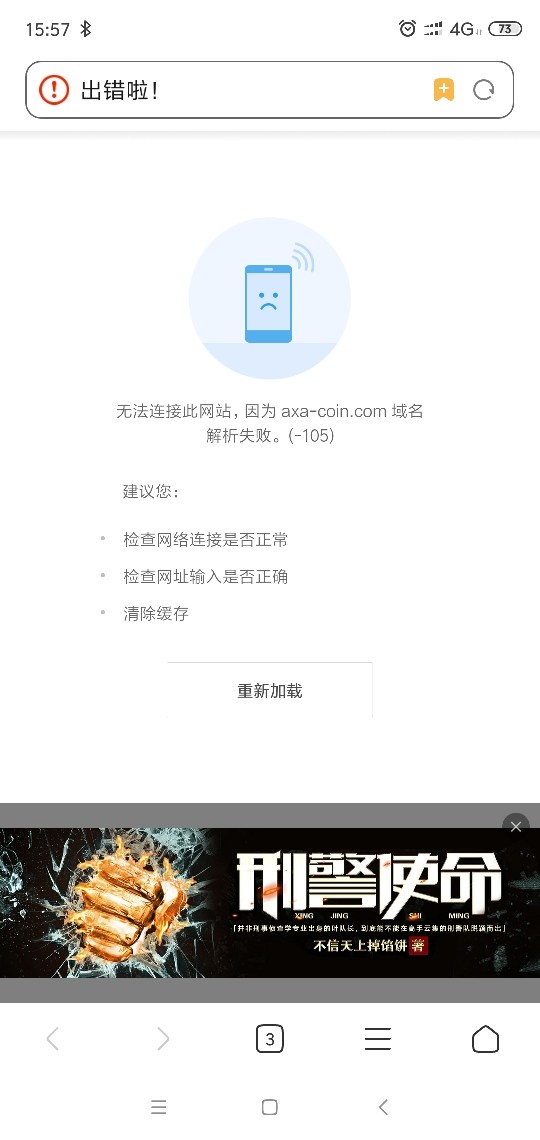

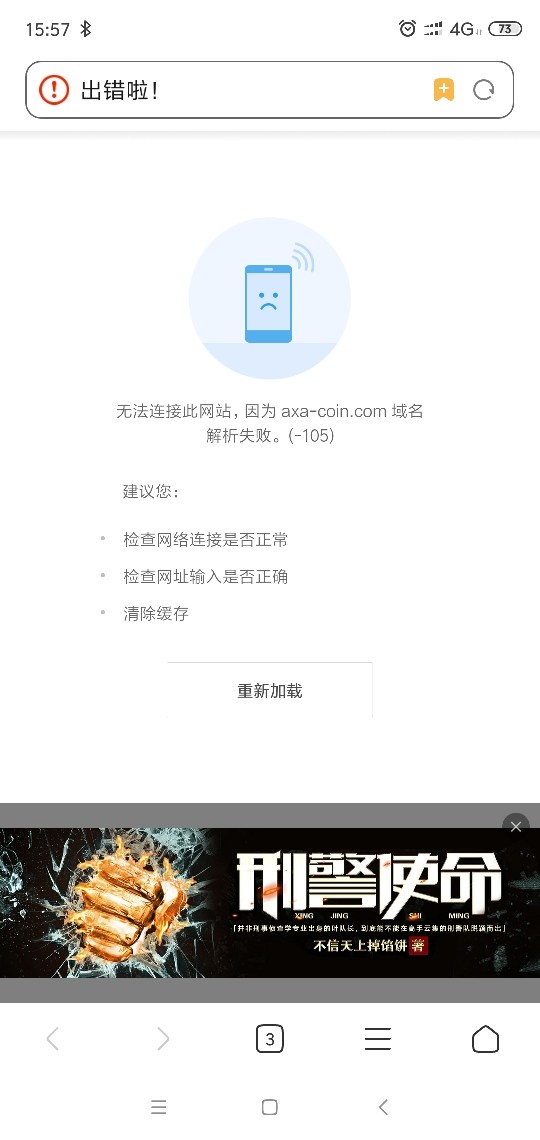

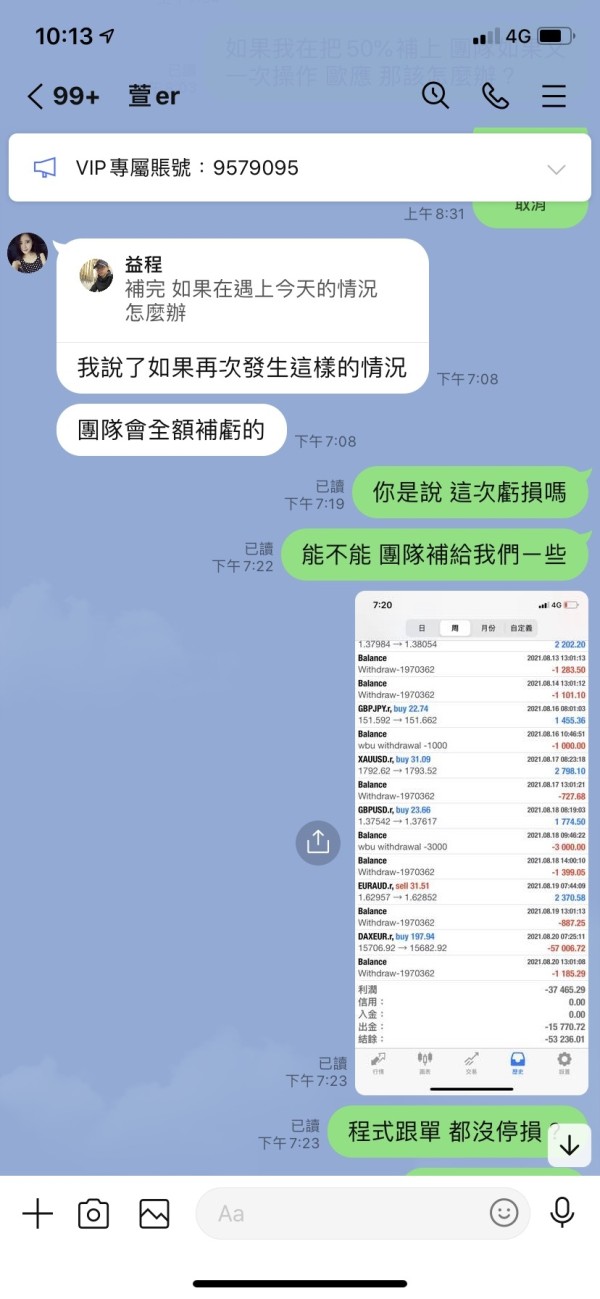

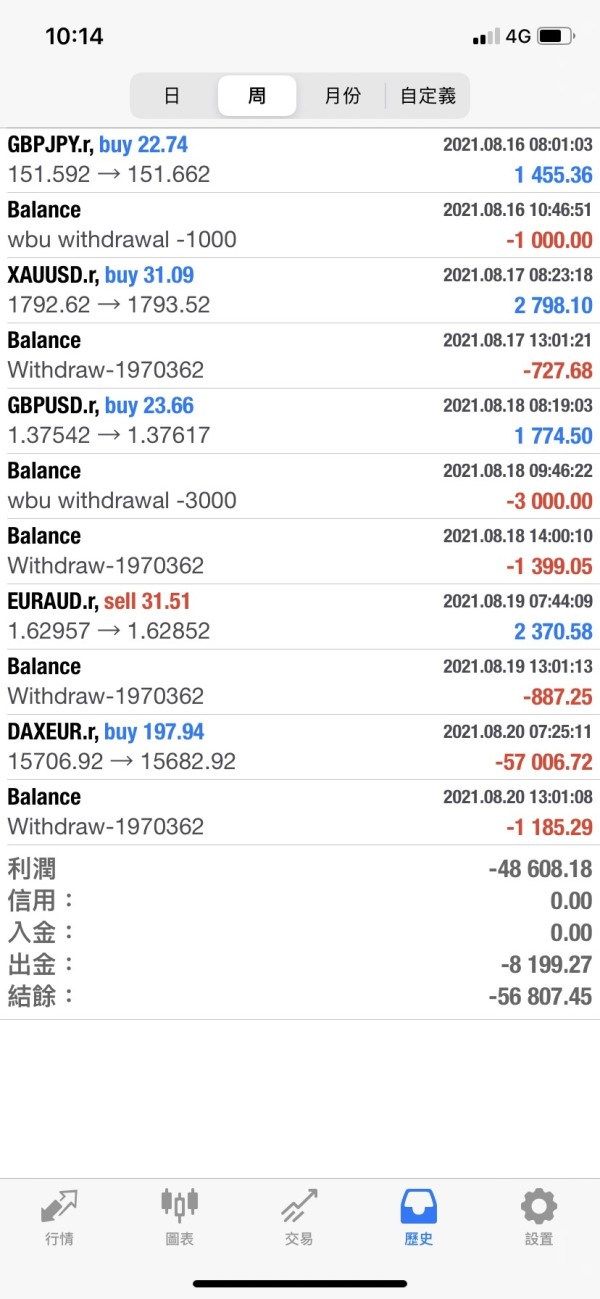

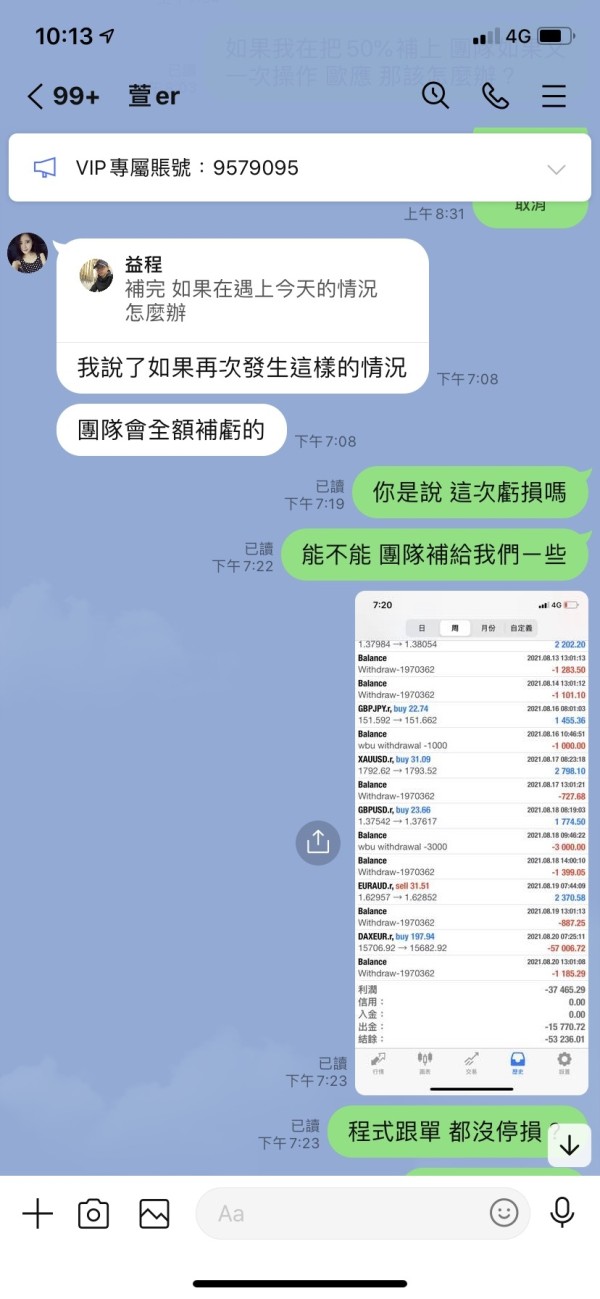

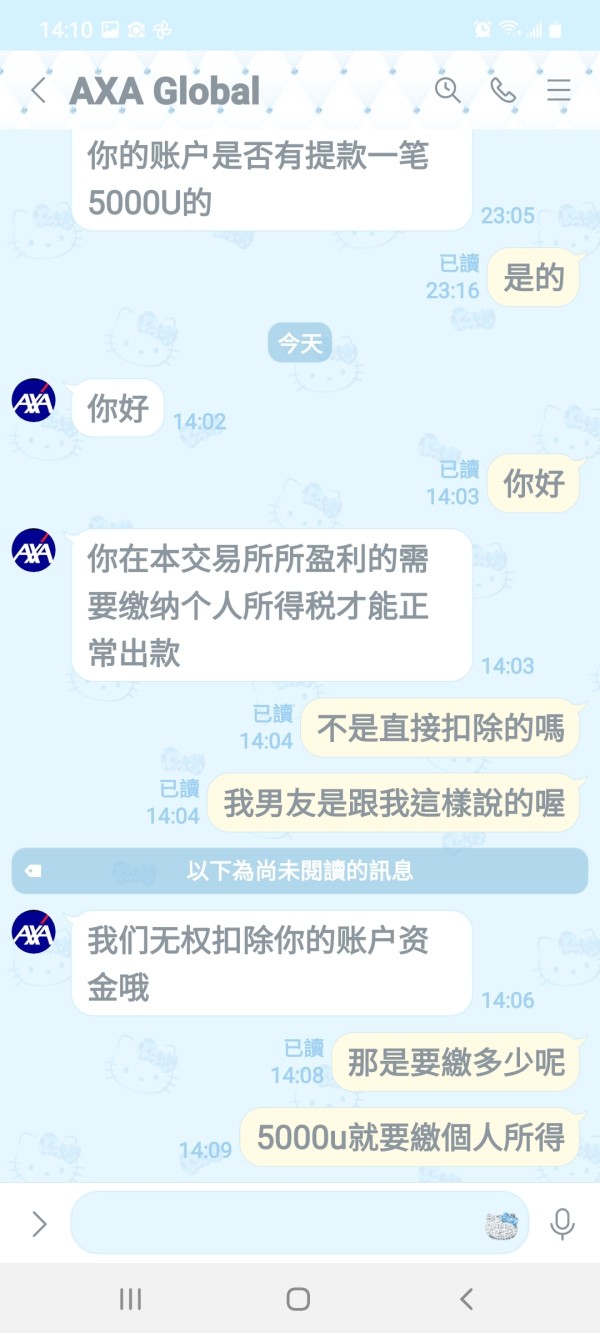

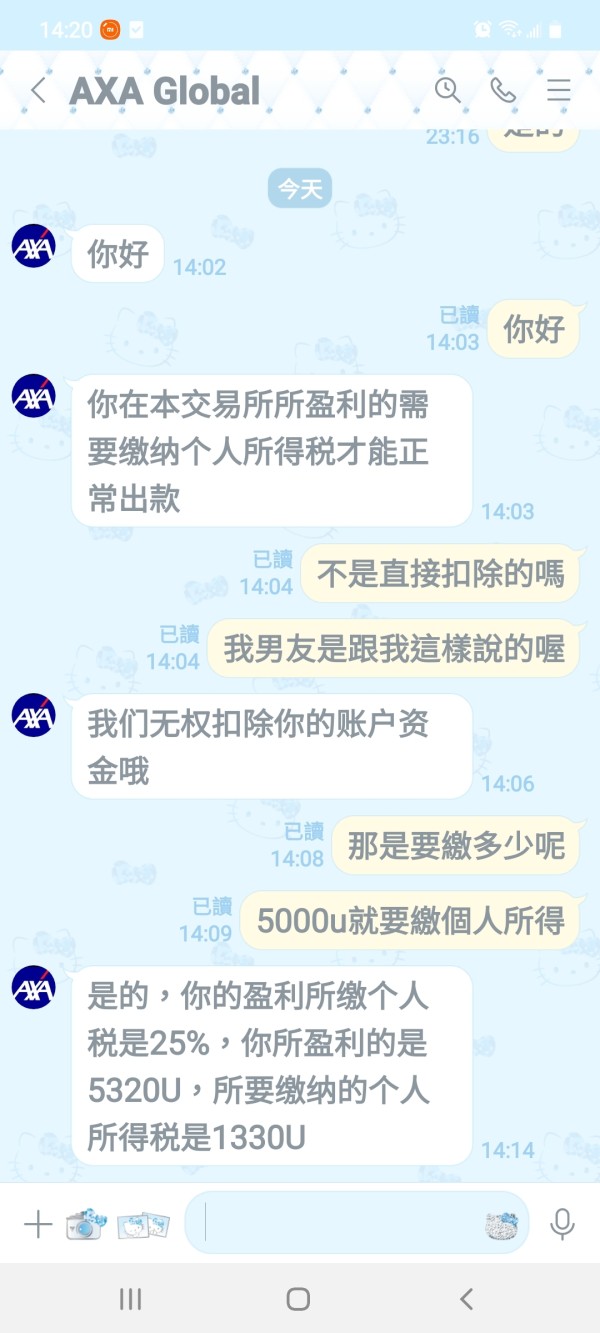

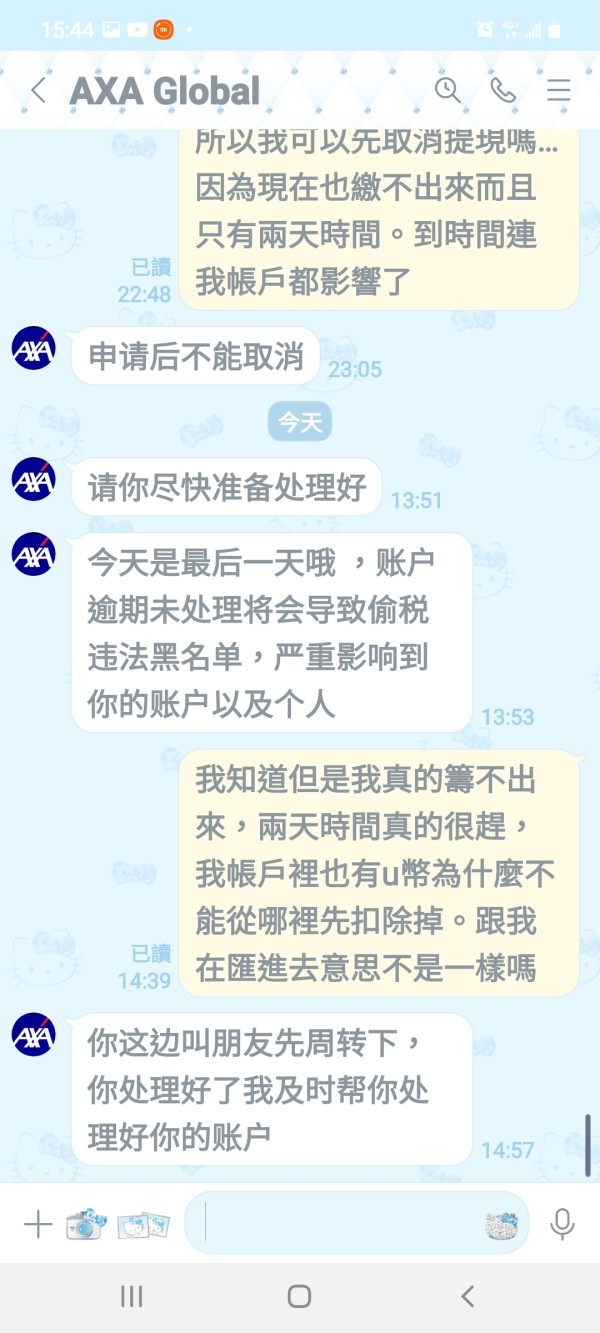

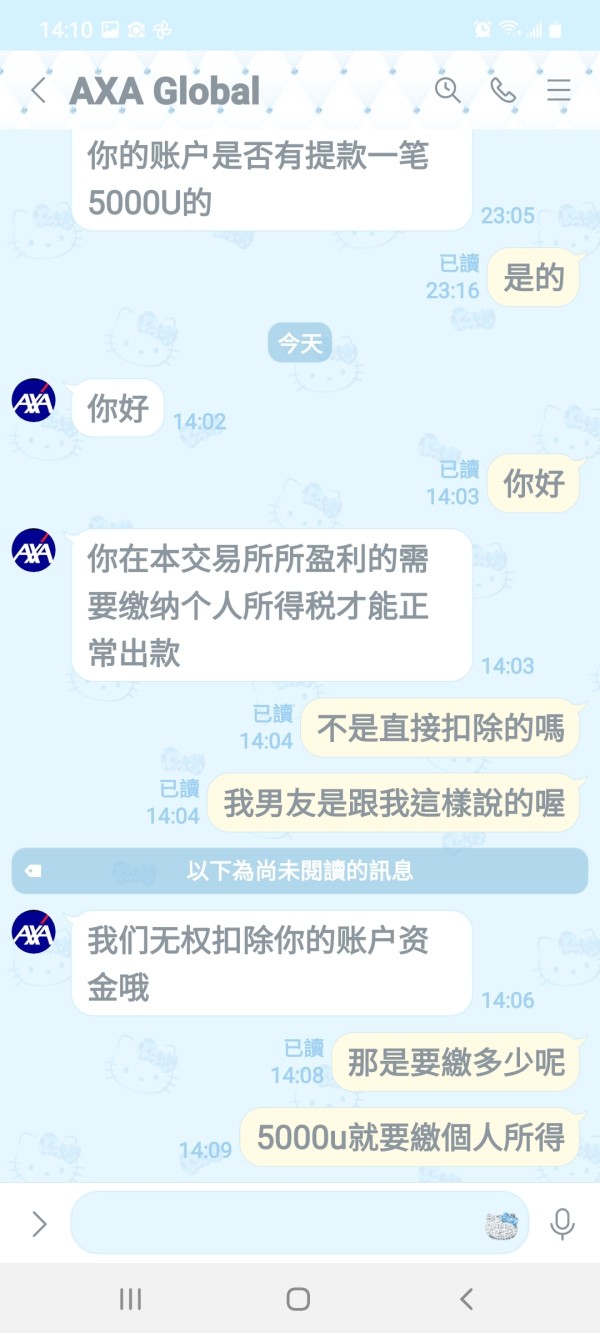

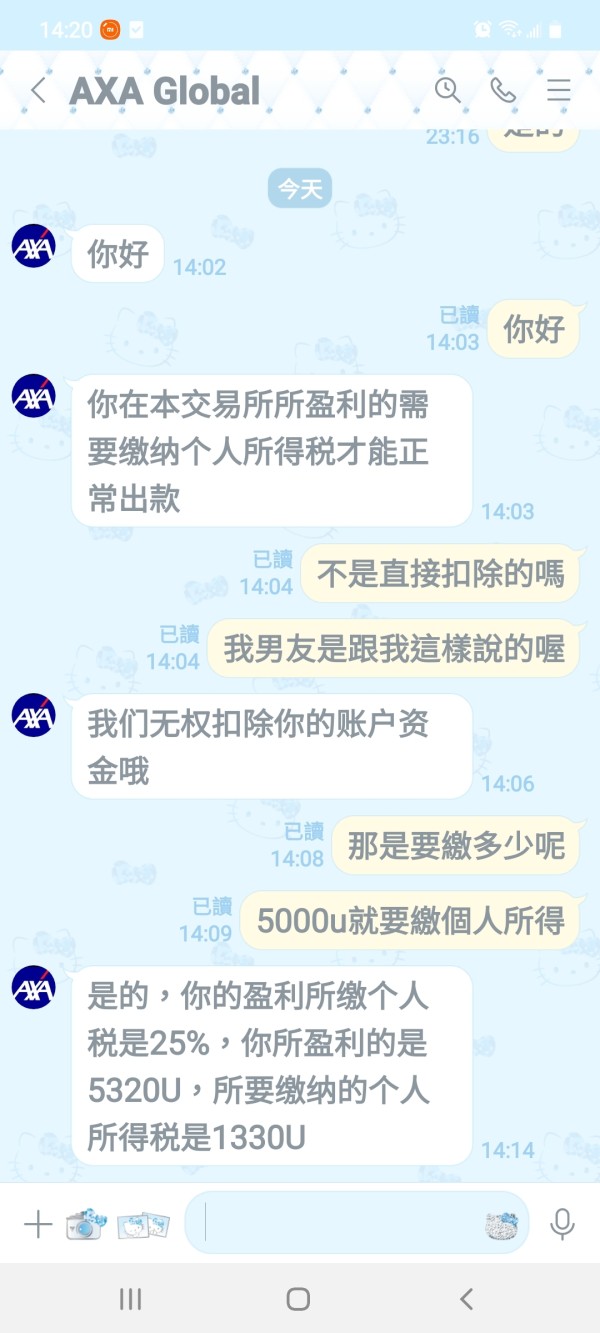

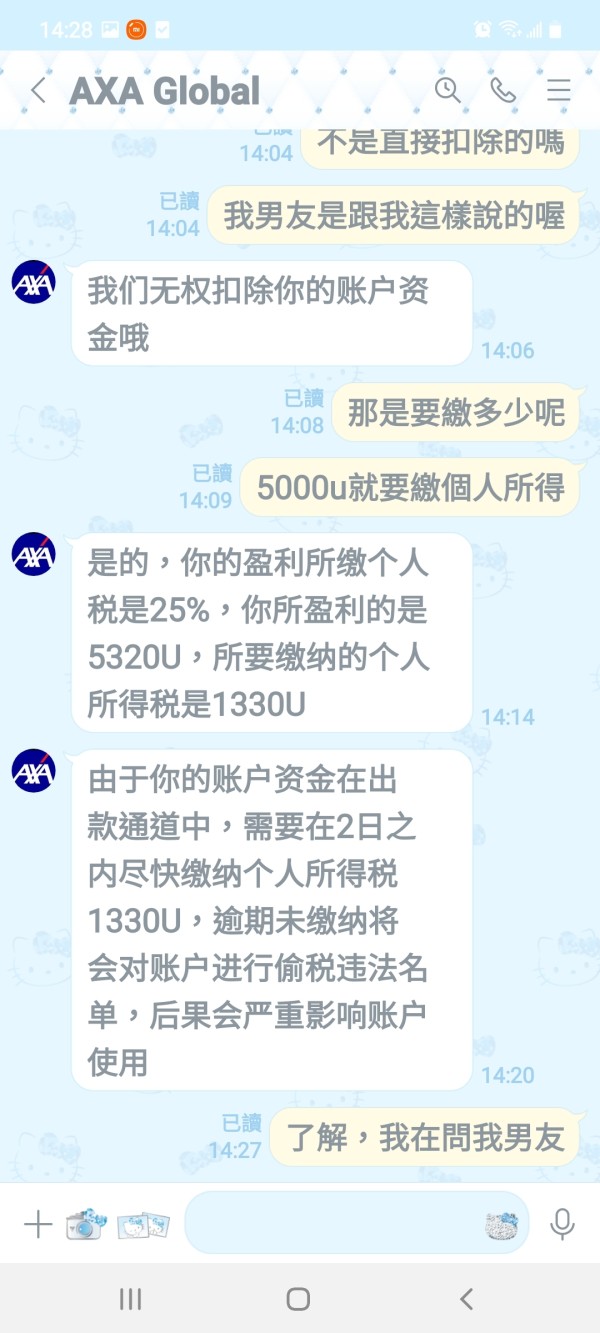

AXA supports multiple currencies for deposits and withdrawals, but users have reported difficulties in accessing their funds, which can be a significant drawback.

Minimum Deposit

The minimum deposit requirement is not explicitly stated in many reviews, suggesting variability based on account types or promotions.

AXA does not appear to offer significant bonuses or promotions, which is common among brokers focused on regulatory compliance.

Tradable Asset Classes

AXA provides access to various asset classes, including forex, commodities, and indices. However, the lack of cryptocurrencies is noted, which may limit appeal for some traders.

Costs (Spreads, Fees, Commissions)

Users have reported that AXA's fees can be high, particularly regarding withdrawal processes. The spread is considered competitive, but the overall cost structure lacks transparency.

Leverage

The leverage offered by AXA is competitive, allowing traders to amplify their positions. However, users should exercise caution, as higher leverage also increases risk.

AXA does not support popular trading platforms like MT4 or MT5, which may deter experienced traders accustomed to these environments.

Restricted Regions

There are no specific mentions of restricted regions, but users should verify local regulations before opening an account.

Available Customer Service Languages

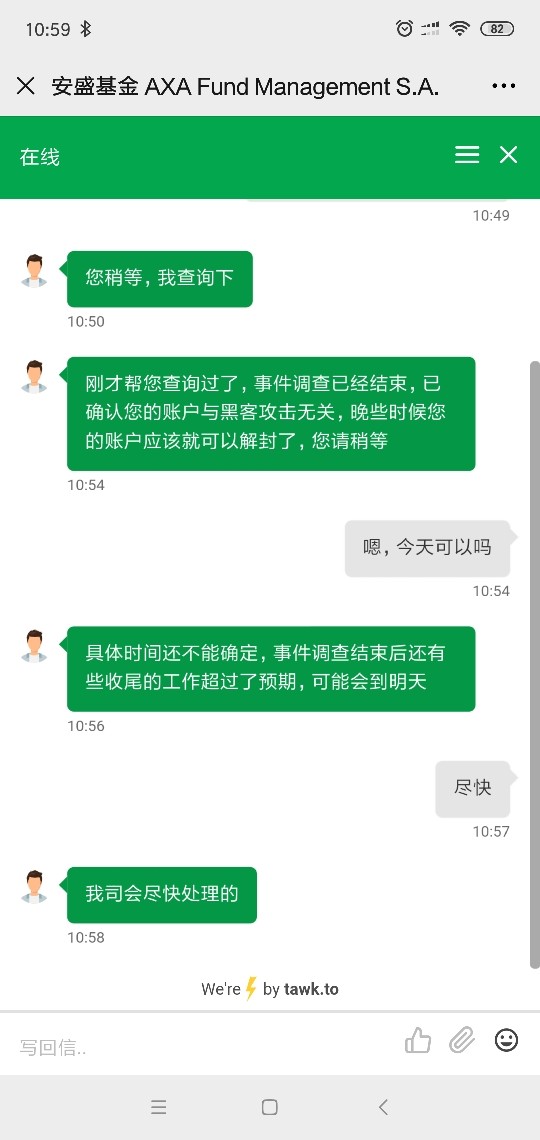

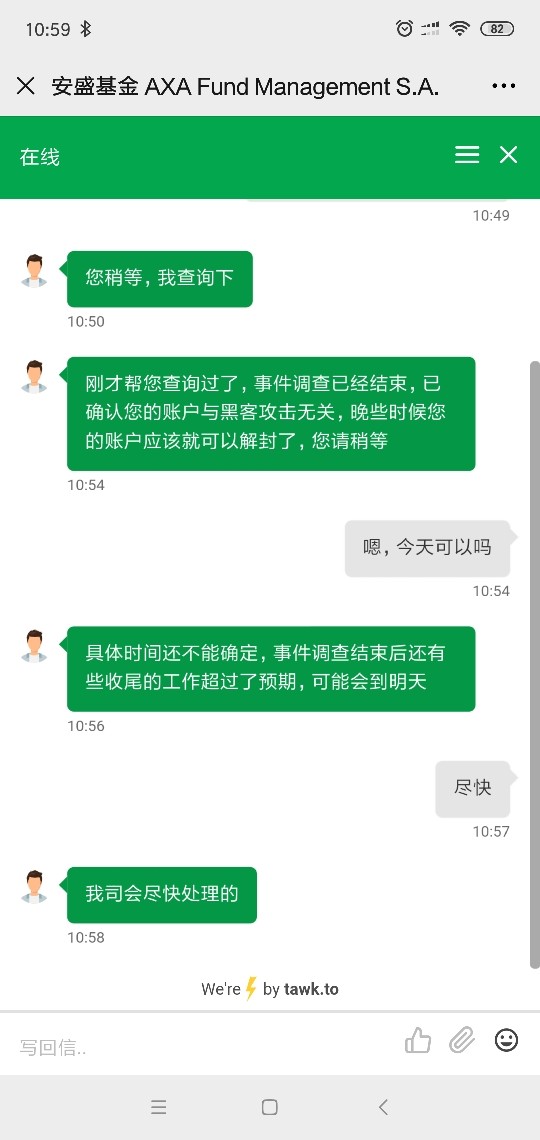

AXA offers customer service in multiple languages, including English, which is beneficial for its diverse client base. However, many reviews highlight a significant delay in response times.

Repeated Ratings Overview

Detailed Analysis of Ratings

-

Account Conditions (6.5): Users appreciate the variety of accounts offered, but many express dissatisfaction with the lack of clarity regarding fees and conditions.

Tools and Resources (7.0): AXA provides a decent range of research tools and resources, though some users find them lacking compared to other brokers.

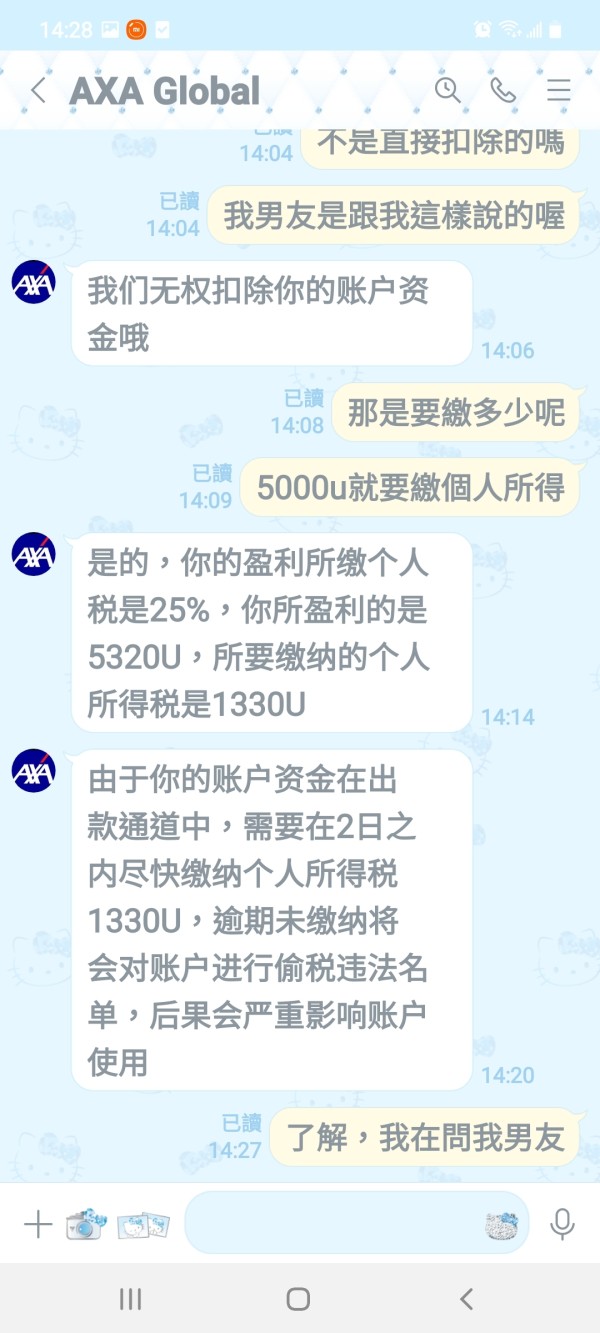

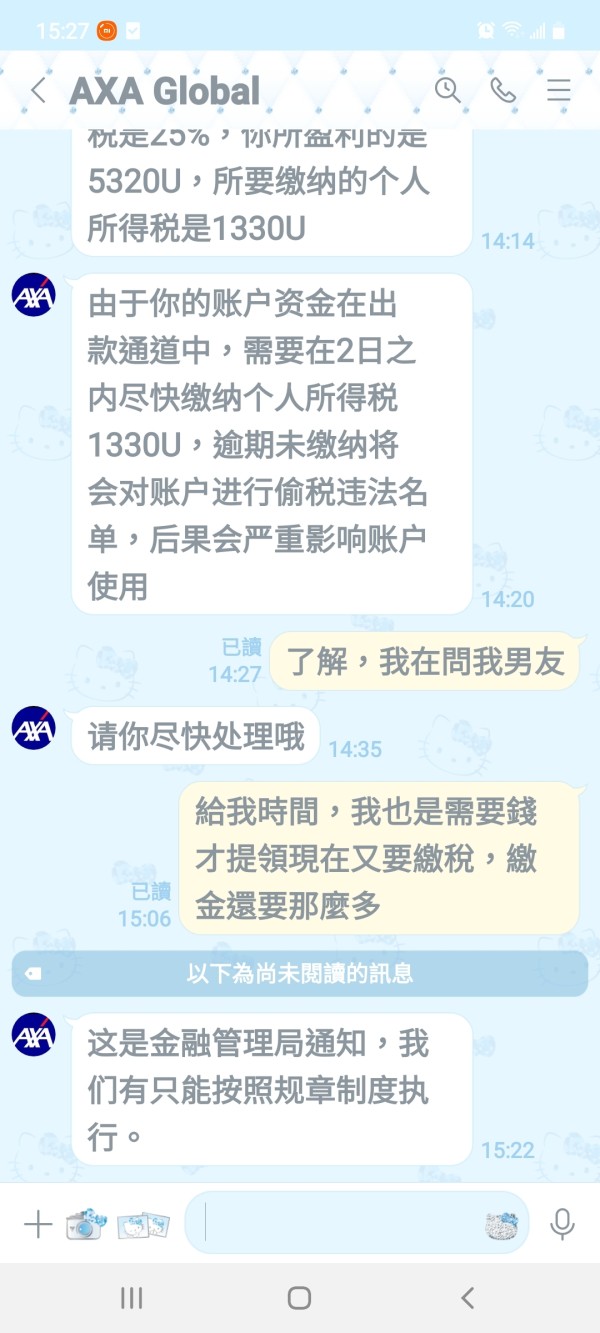

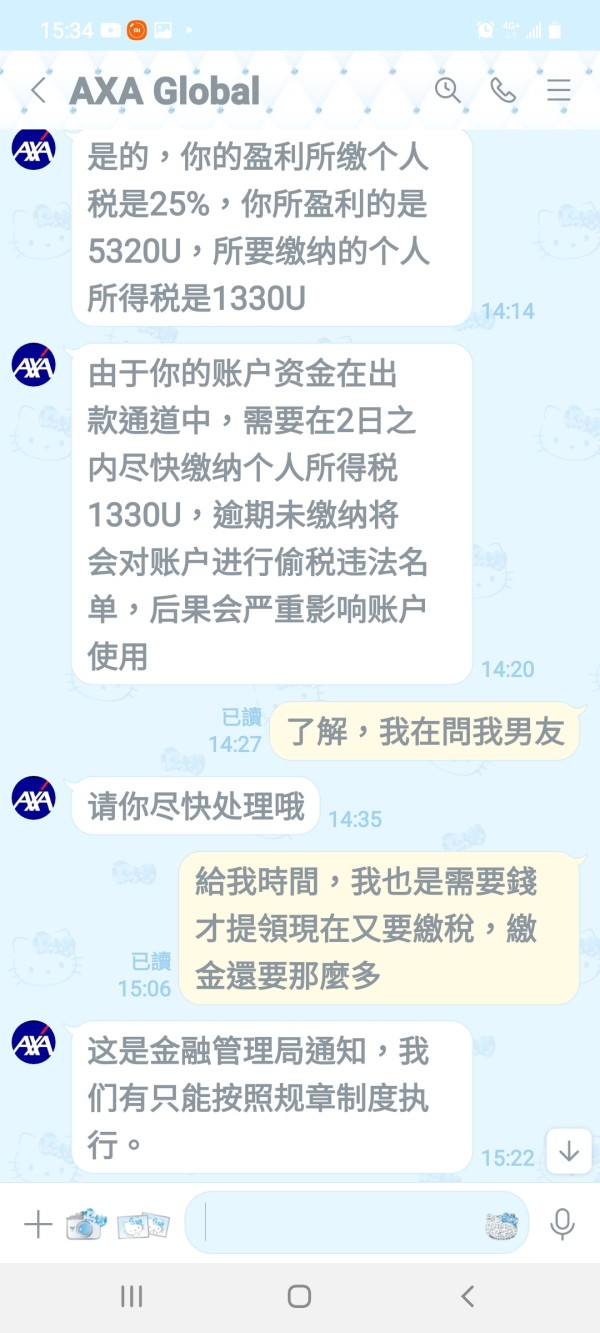

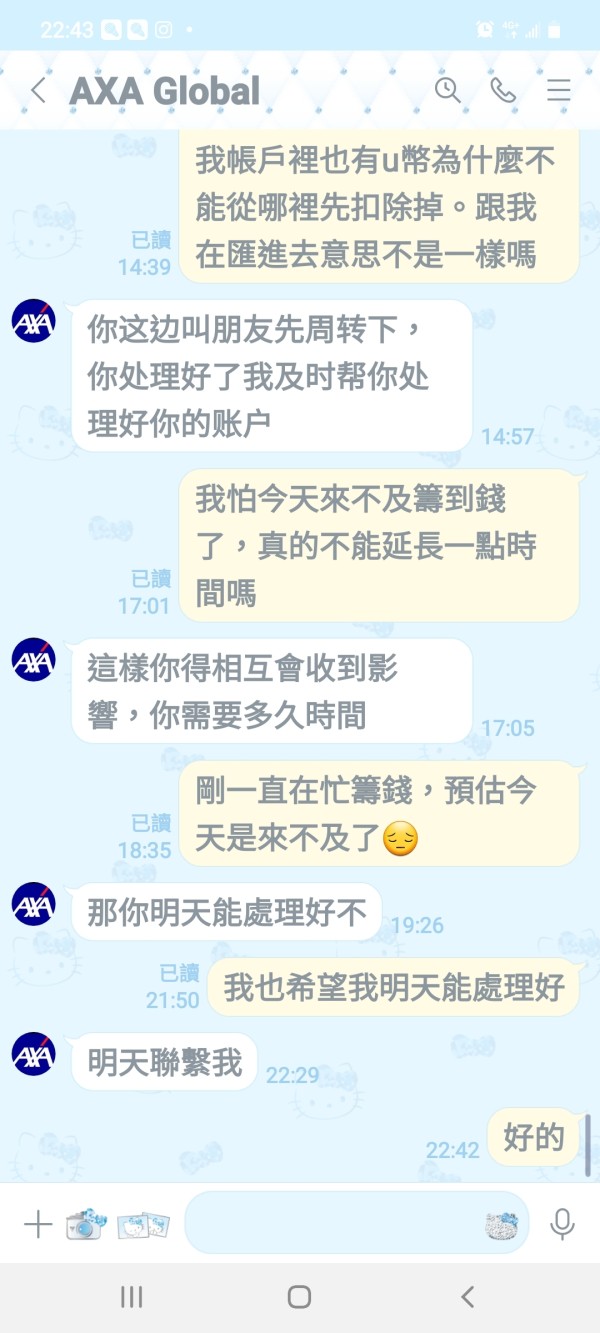

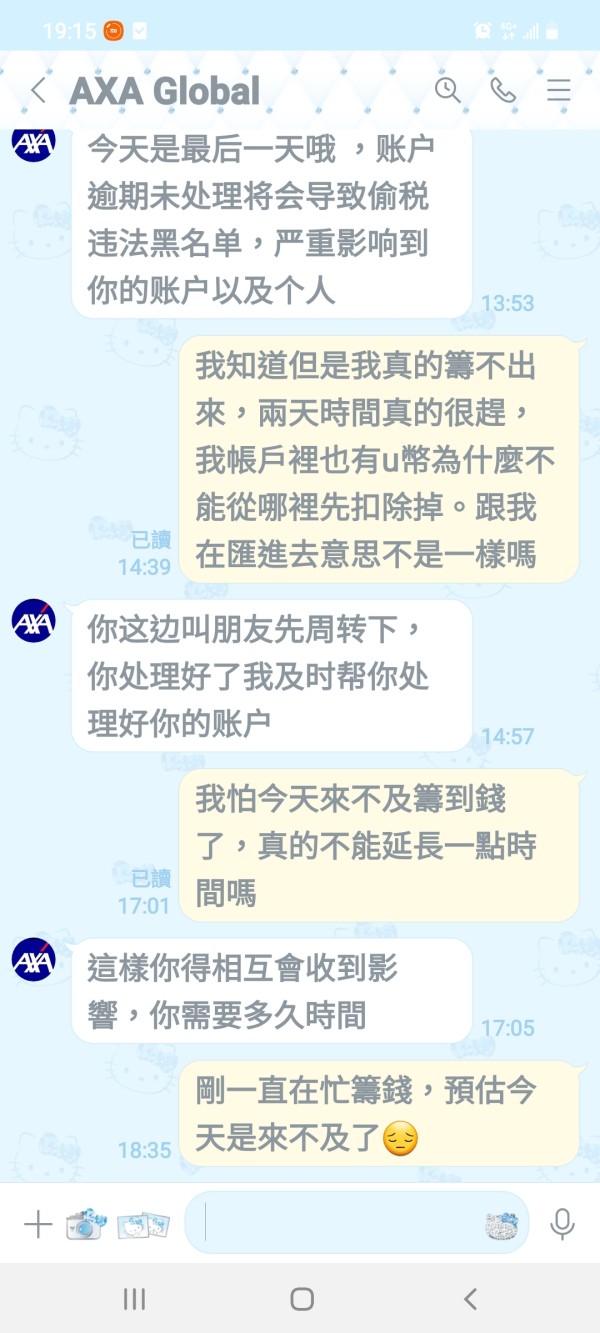

Customer Service and Support (4.0): This is a significant pain point, with numerous complaints about slow response times and unhelpful customer service representatives. Many users have reported feeling ignored, particularly when trying to withdraw funds.

Trading Setup (5.5): The trading experience is generally acceptable, but the absence of popular trading platforms like MT4 and MT5 is a notable drawback for many traders.

Trustworthiness (6.0): While AXA is regulated by the SFC, concerns about withdrawal issues and customer service have led some users to question its reliability.

User Experience (5.0): Overall, the user experience is mixed, with some users reporting positive interactions while others express frustration over service delays and withdrawal difficulties.

Regulatory Compliance (7.5): AXA's regulation by the SFC offers a level of security for investors, although the effectiveness of this regulation is called into question by user experiences.

Conclusion

In summary, AXA presents a mixed bag for potential traders. While it offers a regulated environment and a variety of investment products, significant concerns about customer service and withdrawal processes must be addressed. As always, potential investors should conduct thorough research and consider their options before committing funds. The AXA review indicates that while there are strengths, the weaknesses, particularly in user support, may deter some traders from choosing this broker.