ibf 2025 Review: Everything You Need to Know

1. Abstract

This article gives you a complete ibf review of IBF Advisors as of 2025. IBF gets an "average" rating from market watchers and users who have tried their services. Users give mixed feedback about the company. Some people call the organization a "SCAM," but others stay neutral when they talk about it. IBF works under BAPPEBTI rules and offers many different trading products like Forex, precious metals, oil, and indices. The company focuses on small and medium investors who want to try different types of trading with various assets. Even though BAPPEBTI watches over IBF, the feedback shows some worries about trust and being open with customers. This ibf review uses information that anyone can find and what customers have said about their experiences. The review explains what the broker does well, what problems might come up, and how it compares to other companies in the market. We look at many different areas like trading tools and how users feel about the service to help new traders make smart choices.

2. Precautions

IBF might work differently depending on where you live. The company's performance and service quality can change based on local rules and market conditions in different areas. This review looks at public data and user feedback, especially focusing on BAPPEBTI oversight. IBF follows the rules in Indonesia, but you should carefully check how things might be different in your region if you want to use their services. Our review method uses experiences that users have shared publicly and things we can observe and document, so we suggest you do more research and look at other sources too. Important details like how you can put money in and take money out, the smallest amount you need to start, and bonus offers are not fully explained in the materials we could find, so we mark them as missing in our analysis.

3. Scoring Framework

Note: "To Be Updated" indicates that the summary did not provide enough details to assign a precise rating.

4. Broker Overview

Company Background and Business Model

IBF Advisors is a team of experienced brokers who work on business deals and franchise investments. The team has years of market experience and gives personal guidance and custom support to clients who need help buying and selling businesses. We don't know exactly when the firm started, but you can see their deep knowledge through their work in many financial areas. IBF offers many different trading products that include Forex, precious metals, oil, and indices. This wide range lets traders work with multiple types of assets using just one provider, which works well for investors who want variety in their portfolios. The company's business plan shows they want to give complete financial services while balancing regular broker work with a focus on business and franchise areas.

Trading Environment and Regulatory Oversight

IBF Advisors also uses its rule-following under BAPPEBTI, which is really important for making investors feel confident in the Indonesian market. The broker helps with trading in major asset types like Forex and commodities, making sure clients can access many different financial tools. But specific details about the trading platform technology and extra account features are not shared with the public. This ibf review considers that while IBF has a strong rule-following foundation, not having clear information on some operational parts could create problems for certain investors. The firm's current approach targets small and medium investors who like the ease of a one-stop solution for different types of trading. Following BAPPEBTI standards is meant to make users feel better about following rules and security, even as individual service parts need more explanation.

Regulatory Region

IBF works under BAPPEBTI oversight, making sure it follows strict rules within Indonesia. This rule framework keeps market integrity and protects investor interests by enforcing strong compliance measures. Traders in the Indonesian market can trust that IBF follows local financial regulations, even if additional regional details are limited.

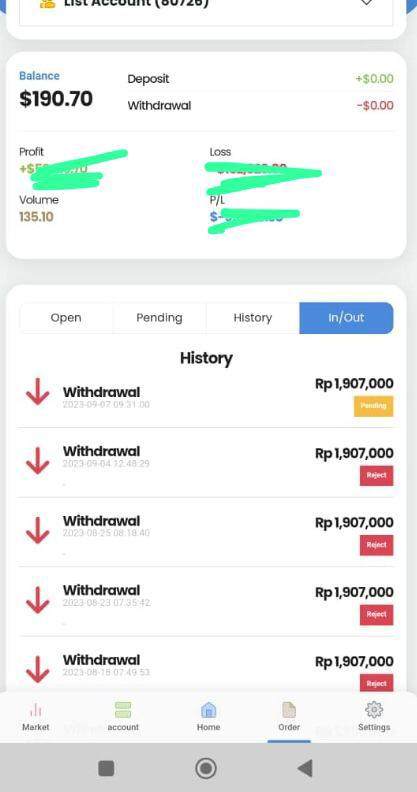

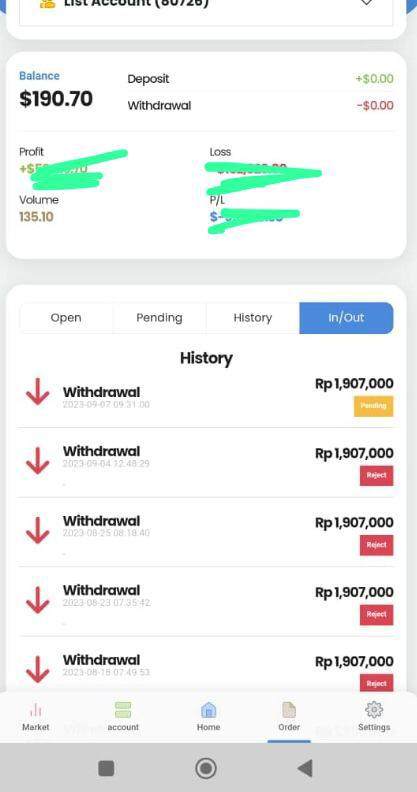

Deposit & Withdrawal Methods

The specific ways to put money in and take money out of IBF were not explained in the available information. Potential users must look at other materials to learn about payment options, how long processing takes, and what security measures are in place.

Minimum Deposit Requirements

There is no clear information on the smallest deposit that IBF requires. Without this important detail, future traders should ask the broker directly to understand how much money they need to start.

Information about bonus promotions or special offers was not given in the current summary. Traders who want potential rewards should ask for more details to see if such benefits match what they need for trading.

Tradable Assets

IBF offers many different assets you can trade. Clients can trade across major asset types like Forex, precious metals, oil, and indices. This multi-asset setup gives investors the flexibility to spread out their portfolios and take advantage of different market movements—a key strength despite not having additional operational details.

Cost Structure

The detailed cost structure, including spreads and commission rates, is not shared in the available summary. This lack of clear information on trading costs means that future traders will need to ask for more information to fully understand potential trading expenses. Without clear cost details, figuring out how competitive IBF's pricing is becomes hard.

Leverage Ratio

There is no mention of the maximum available leverage ratio or its specific conditions in the information provided. This missing detail is important for understanding the risk-return profile that IBF offers, and interested people should ask IBF directly about their leverage policies.

Specific details about the trading platforms that IBF offers remain unknown. The summary does not include information on available software, mobile apps, or any special trading technology, showing a potential information gap that traders must check on their own.

Regional Restrictions

Information on regional restrictions is not available in the provided documentation. It is unclear whether IBF stops people from certain areas from participating. Investors outside Indonesia may need to do more research before working with the broker.

Customer Service Languages

The IBF website supports multiple languages including English, Arabic, and French, among others. This approach with many languages makes sure that a broader international audience can access customer support and services well.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

Looking at IBF's account conditions is hard because there is not enough detailed public information. No specifics were given about the types of accounts available, such as standard, micro, or potentially Islamic-compliant accounts. Also, insights into account opening procedures, minimum deposit requirements, or any unique account-related features remain unknown. Across the industry, clear account conditions are a key driver of user confidence; therefore, IBF's gap in this area represents a significant information problem. User feedback on this aspect was not common in the available reviews, leaving potential clients without a clear way to compare against competitors. This lack of detail makes it hard to judge the overall suitability and flexibility of IBF's account structures. Given these unclear points, further questions with the broker are advised for future traders. This gap in information has a notable impact on the overall rating and user satisfaction, showing the need for better transparency about account conditions.

IBF gives access to many trading products, including Forex, precious metals, oil, and indices, which shows its commitment to offering different market exposure. But beyond the range of tradable assets, detailed information on the specific trading tools, research resources, and analytical tools available to clients is missing. There is no mention of advanced charting software, market news updates, or economic calendars that are commonly provided by industry leaders. Also, educational resources such as webinars, tutorials, or e-books were not mentioned in the available summary. This gap means that while the basic product offering is strong, the supporting tools that can help traders make informed decisions may be less complete. The absence of clear details on automation, such as algorithmic trading support, further adds to the uncertainty. Overall, while the range of assets is definitely a plus, a deeper look into the usability and quality of the available tools and resources would make the overall user experience better. Future users should consider this an area for potential improvement as IBF continues to develop its service platform.

6.3 Customer Service and Support Analysis

Customer service and support remain an important factor in a broker's overall evaluation. For IBF, however, the available information does not give concrete details about the range of customer support channels, such as direct phone support, live chat, or email help. While it is noted that the website supports multiple languages—including English, Arabic, and French—there is little else to explain about how responsive or knowledgeable support representatives are. There is no mention of the average response times or the quality of support based on user experiences. In many broker evaluations, quick and effective customer service is critical to solving trading issues, especially during volatile market conditions. The absence of such details in the available summary leaves a significant gap in understanding the true operational effectiveness of IBF's support structure. Without documented feedback or metrics, potential clients may find it hard to judge whether their questions will be addressed quickly and professionally. The focus on multilingual support is a positive note, yet overall, additional transparency in this area is needed.

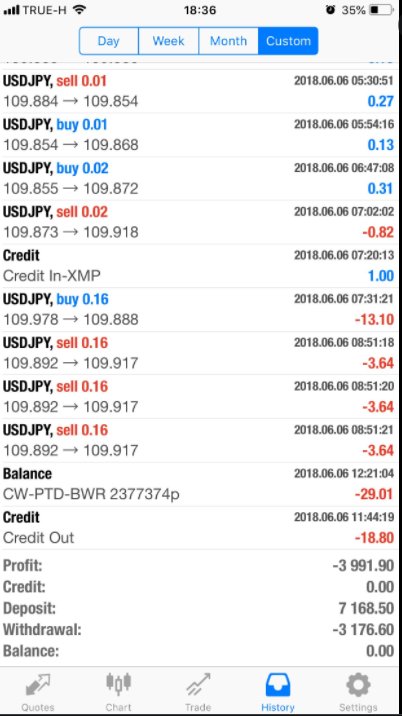

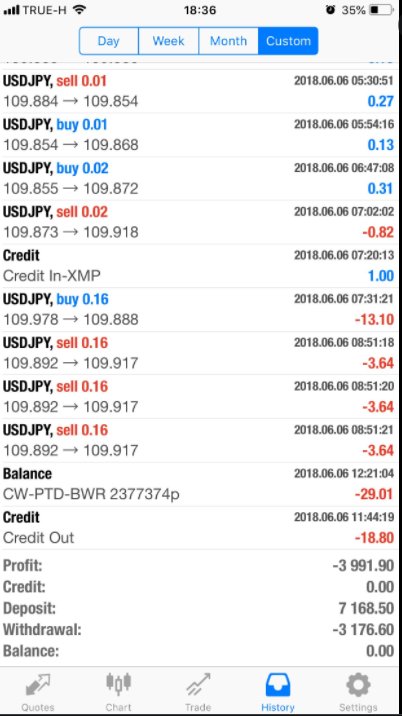

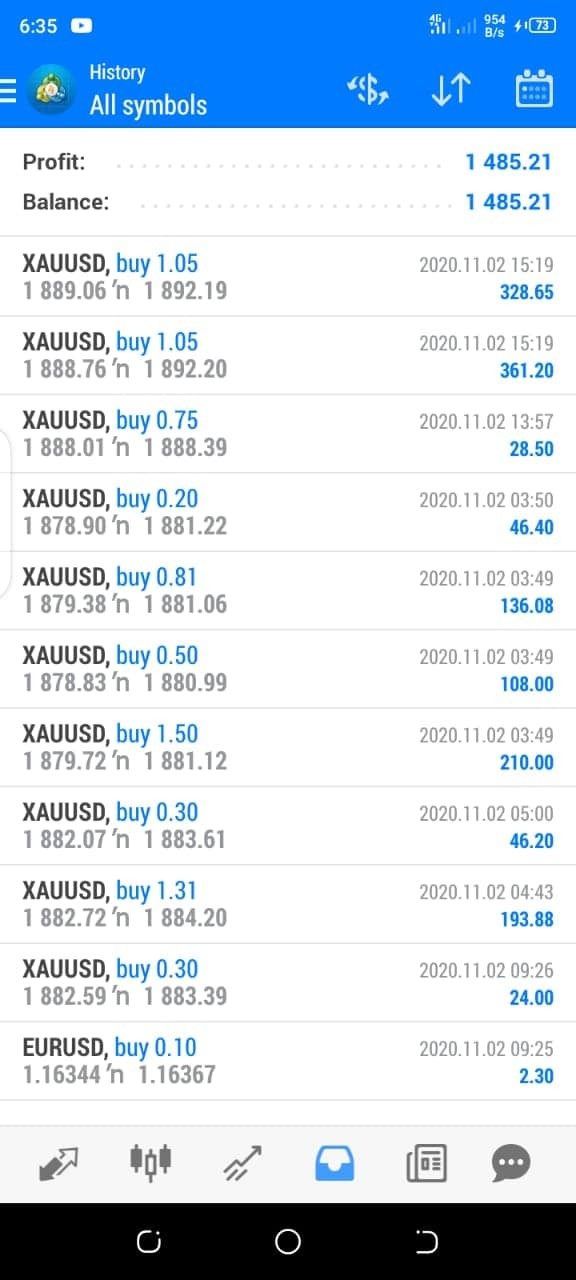

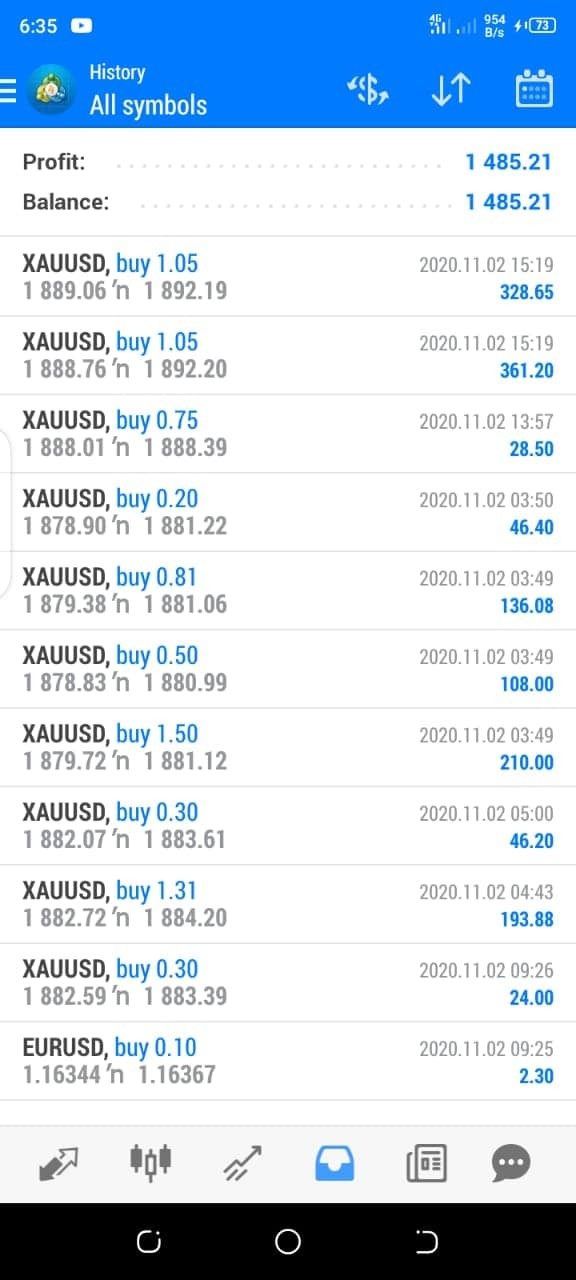

6.4 Trading Experience Analysis

The trading experience at IBF is an important sign of its operational excellence, yet detailed insights into the actual user experience remain limited. While IBF provides many different assets for trading, specific information about the stability and speed of the trading platform is not available. Things like order execution quality, platform functionality, and mobile trading experiences were also not explained in the published summary. User reviews have been mixed, with some neutral opinions and others calling the broker "SCAM," which may show inconsistency in trading performance or user interface issues. The lack of detailed technical performance data or direct user testimonials on platform reliability means that traders are left to guess on how competitive IBF's trading environment actually is. In many cases, a strong trading experience is supported by advanced analytical tools, clear order management processes, and a smooth user interface—none of which are defined in the present literature. As a result, while the asset range is promising, the overall trading experience remains an area of uncertainty for potential users. This shows the need for further checking and testing by interested parties before putting money in.

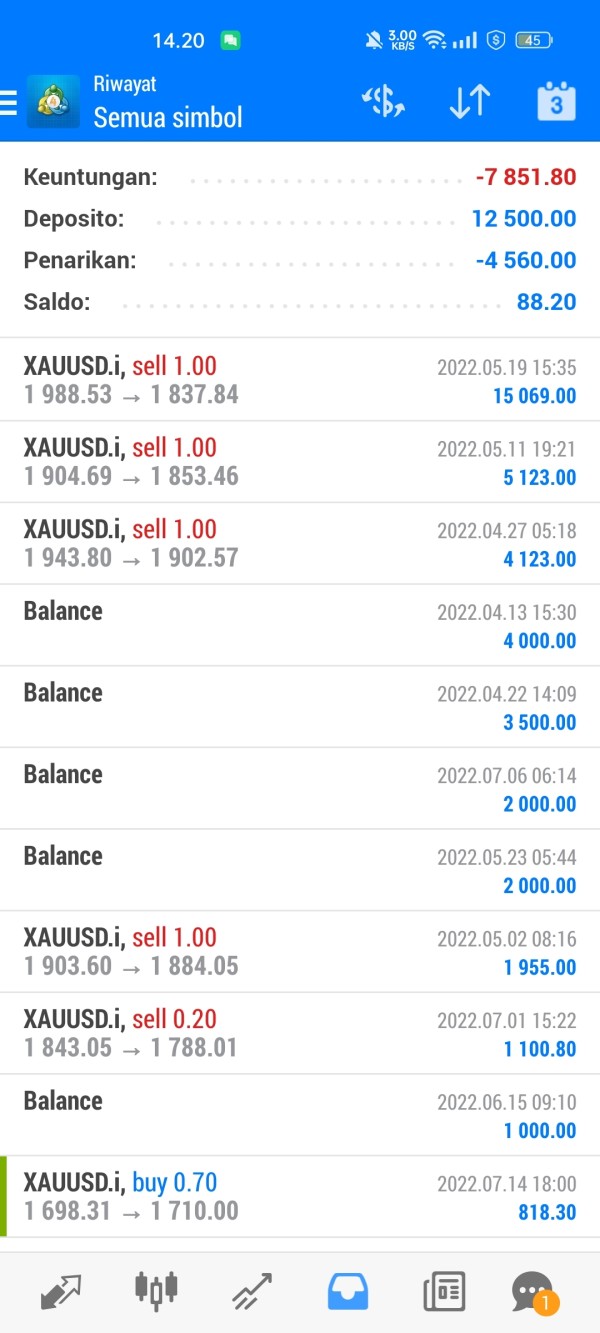

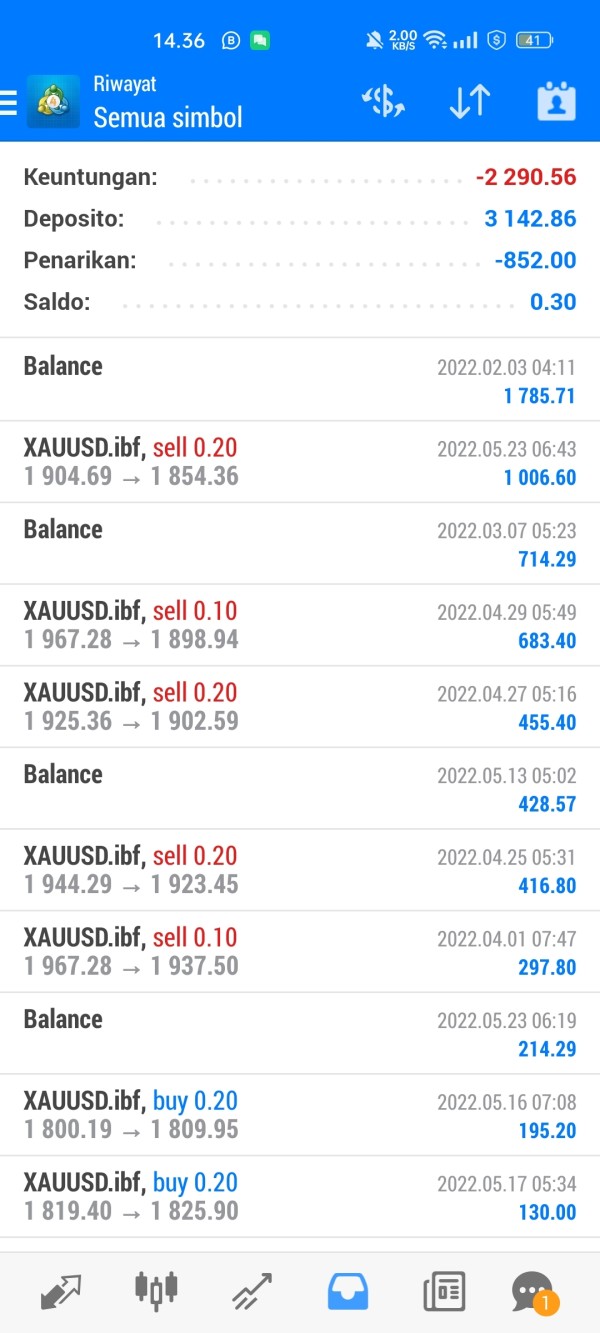

6.5 Trust Analysis

Trust is an important part of a broker's reputation, and for IBF, this area presents a mixed picture. On one hand, the firm is regulated by BAPPEBTI, which gives a baseline assurance of following local regulatory standards in Indonesia. Regulatory oversight is a positive factor that can make investor confidence stronger. But the presence of negative reviews—including claims labeling the broker as "SCAM"—severely hurts trust, especially for new or risk-averse investors. These negative feelings suggest that issues may have come up in areas such as fund security, transparency, or the handling of client complaints. The lack of additional documentation on how IBF manages and reduces such challenges further complicates the trust story. Also, there is no detailed disclosure about protection measures for client funds or corporate transparency initiatives. Compared with industry standards where detailed trust-building practices are common, IBF's current profile shows room for improvement. Future clients are therefore encouraged to do their own research and verify regulatory filings and independent reviews before making a commitment.

6.6 User Experience Analysis

The overall user experience at IBF is a mix of several unverified factors. While the broker targets small and medium investors by offering multiple asset classes, the limited transparency on platform usability, registration processes, and fund management leaves users with an incomplete picture. Feedback from available users remains largely neutral, though some have voiced concerns—mainly focusing on the negative impressions going around online. These concerns include potential difficulties in navigating the website or trading platform, along with uncertainties in the account setup and fund transfer processes. Also, while multilingual customer support is a significant advantage, the practical application of these services and the overall interface design have not been detailed. Compared to brokers with well-documented user interfaces and smooth account management processes, IBF's user experience appears to be an area needing further improvement. For users seeking a complete and hassle-free experience, the current level of detail does not fully inspire confidence. As such, potential clients should seek clarifications directly from the broker and test available demo platforms—if offered—to make sure that their expectations are met.

7. Conclusion

In conclusion, this ibf review presents IBF as an average broker that serves mainly small and medium investors looking for different trading options. While the regulation by BAPPEBTI and the broad asset offering are notable positives, significant information gaps exist—especially about account conditions, trading platforms, and detailed customer service protocols. Mixed user reviews, including some severe negative comments, further complicate the trust factor. IBF may serve as a viable option for investors with a diversified strategy, but potential clients should do additional research and verify missing data before engaging.

All information presented in this review is based on publicly available data and user feedback as of 2025. Prospective investors are advised to seek further clarification from IBF directly to ensure an informed decision.