Is TNG safe?

Pros

Cons

Is TNG Safe or Scam?

Introduction

TNG, operating under the name TNG Global Limited, positions itself as a forex and CFD broker in the competitive landscape of online trading. As the forex market continues to attract a diverse range of traders, from seasoned professionals to novices, it becomes increasingly crucial for participants to conduct thorough evaluations of their chosen brokers. The integrity and reliability of these platforms can significantly impact trading outcomes, making it essential to discern whether TNG is a trustworthy option or a potential scam.

This article employs a comprehensive investigative approach, utilizing a combination of regulatory analysis, company background checks, customer feedback, and risk assessments to evaluate TNG's legitimacy and safety. By synthesizing information from various credible sources, we aim to provide readers with a balanced view of whether TNG is safe for trading or if it poses risks to investors.

Regulation and Legitimacy

One of the foremost indicators of a broker's reliability is its regulatory status. TNG claims to be registered in the United Kingdom; however, a deeper investigation reveals that it operates without any valid regulatory oversight. This lack of regulation raises immediate red flags about the safety of funds and the overall trustworthiness of the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | United Kingdom | Unregulated |

The absence of regulation means that TNG is not subject to the stringent compliance measures imposed by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or other top-tier regulators. This lack of oversight can result in heightened risks for traders, as unregulated brokers often operate with less transparency and accountability. Furthermore, according to various reviews, TNG has received low scores on regulatory indices, indicating a high potential risk for investors. This brings us to the critical question: Is TNG safe? The evidence suggests otherwise, as the absence of a regulatory framework significantly undermines the broker's legitimacy.

Company Background Investigation

TNG Global Limited has been in operation for approximately 2 to 5 years, but its history is marred by a lack of transparency. The company's ownership structure is not clearly outlined, raising concerns about accountability and operational integrity. The management team behind TNG has not been extensively documented, which further complicates efforts to assess their qualifications and experience in the financial services sector.

The company's address is listed as Unit G25, Waterfront Studios, 1 Dock Road, London, United Kingdom, but the legitimacy of this location is questionable, given the absence of regulatory oversight. A significant aspect of evaluating any broker is understanding its transparency and information disclosure levels. In TNG's case, potential clients may find it difficult to obtain crucial information about the company's operations, which is a significant drawback when considering whether TNG is safe for trading.

Trading Conditions Analysis

When evaluating a broker like TNG, understanding the trading conditions they offer is paramount. TNG advertises competitive trading conditions, including leverage of up to 100:1. However, the lack of transparency regarding fees and commissions raises concerns. Traders should be cautious of any unusual or hidden fees that could significantly impact their trading profitability.

| Fee Type | TNG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not specified | $0 - $10 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest can lead to unexpected costs for traders. This lack of clarity is a significant factor in assessing whether TNG is safe for trading. Traders should always seek brokers that provide transparent and competitive fee structures to avoid potential pitfalls.

Customer Fund Security

The safety of customer funds is a critical concern for any trader. TNG does not provide adequate information regarding its fund security measures. Without proper segregation of client funds, investors face the risk of losing their capital in the event of the broker's insolvency. Furthermore, there is no mention of investor protection schemes or negative balance protection policies, which are essential for safeguarding traders' investments.

Historically, unregulated brokers have been associated with various security issues, including fund misappropriation and fraud. The lack of documented security measures at TNG raises concerns about the safety of client funds. Thus, the question remains: Is TNG safe? Based on the available information, potential investors should approach with caution.

Customer Experience and Complaints

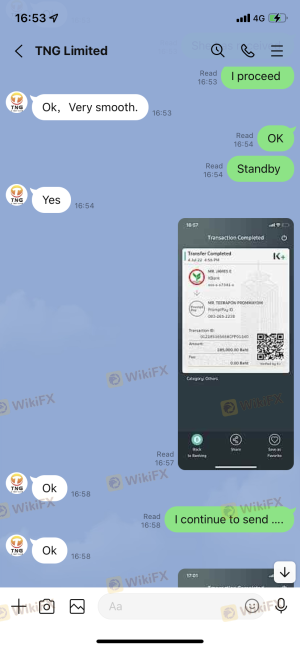

Customer feedback is an invaluable resource for gauging a broker's reliability. Reviews of TNG indicate a mix of experiences, with several users highlighting issues related to withdrawal difficulties and lack of responsive customer support. Common complaints include delayed processing of withdrawal requests and insufficient communication from the company's support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Average |

A few notable cases involve traders who reported being unable to access their funds after multiple attempts to withdraw. These experiences raise significant concerns about the broker's operational integrity and responsiveness to client issues. As such, when considering whether TNG is safe for trading, these complaints should be taken seriously.

Platform and Trade Execution

A broker's trading platform is a pivotal aspect of the trading experience. TNG offers the widely-used MetaTrader 4 platform, which is known for its stability and range of features. However, there are reports of execution delays and slippage, which can adversely affect trading outcomes.

Additionally, the absence of transparency regarding order execution quality and potential manipulation raises further doubts about the broker's integrity. Traders should be aware of the risks associated with platforms that do not provide clear information about execution practices.

Risk Assessment

Using TNG as a trading platform involves several risks that potential traders should consider. The lack of regulation, transparency issues, and customer complaints all contribute to a risk-laden environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Unclear fund segregation and protection policies |

| Customer Support | Medium | Issues with responsiveness and withdrawal delays |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with smaller investments, and explore alternative brokers that offer better regulatory protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that TNG is not a safe option for traders. The lack of regulation, transparency issues, and numerous customer complaints point to significant risks associated with using this broker. While some may find the trading conditions appealing, the potential for financial loss due to unregulated practices and inadequate fund security measures is a serious concern.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, offer transparent fee structures, and have a proven track record of customer satisfaction. Ultimately, the question "Is TNG safe?" leans towards a negative answer, and traders should exercise caution when considering this broker for their trading activities.

Is TNG a scam, or is it legit?

The latest exposure and evaluation content of TNG brokers.

TNG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TNG latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.