Is Sunlaideal safe?

Business

License

Is Sunlaideal a Scam?

Introduction

Sunlaideal, officially known as Sun La Ideal FE Markets Limited, positions itself as a forex broker offering various trading services in the foreign exchange market. It claims to provide access to a range of financial instruments, including forex pairs, commodities, and indices. However, the forex market is notorious for its lack of regulation and the prevalence of scams, making it crucial for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to investigate the safety and legitimacy of Sunlaideal by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The findings are based on a comprehensive analysis of online reviews and regulatory data to provide a well-rounded perspective.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its safety. Brokers that operate without proper regulation are often viewed as high-risk entities, and Sunlaideal appears to fall into this category. According to various sources, Sunlaideal is not regulated by any recognized financial authority. This lack of oversight raises significant concerns about the safety of traders' funds and the broker's operational integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license indicates that Sunlaideal does not adhere to the stringent compliance requirements set by reputable financial authorities. This lack of regulation can lead to potential fraud, as unregulated brokers are not held accountable for their actions. Furthermore, historical compliance issues and the company's failure to provide transparent information about its operations further exacerbate concerns regarding its legitimacy.

Company Background Investigation

Sunlaideal was established in 2018, but details about its ownership structure and management team are scarce. The company's website lacks comprehensive information about its founders and key personnel, which is a red flag for potential investors. Transparency is vital in the financial sector, and the inability to ascertain the qualifications and backgrounds of the management team raises questions about the company's credibility.

Moreover, online reviews suggest that Sunlaideal has undergone name changes and has been associated with various complaints, indicating a potentially dubious history. The lack of a physical office and verifiable contact information further complicates efforts to assess the company's legitimacy. Potential clients should be wary of engaging with a broker that does not provide clear and accessible information about its operations and team.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Sunlaideal claims to offer competitive trading fees and leverage options. However, the overall fee structure remains ambiguous, with many users reporting unexpected charges and difficulties in withdrawing funds.

| Fee Type | Sunlaideal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-1.5% |

Reports indicate that while deposits are processed quickly, withdrawals often face significant delays, with users citing various excuses from the broker. Such practices can be indicative of a broker attempting to retain client funds, which is a common tactic employed by fraudulent platforms. Traders are advised to approach Sunlaideal's trading conditions with caution, as they may not align with standard industry practices.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Sunlaideal does not provide clear information regarding its fund protection measures. The absence of segregated accounts, which separate client funds from the broker's operational funds, raises concerns about the safety of deposits. Additionally, there is no mention of negative balance protection, a critical feature that protects traders from losing more than their initial investment.

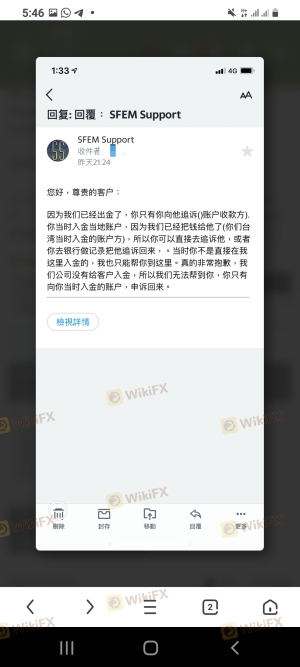

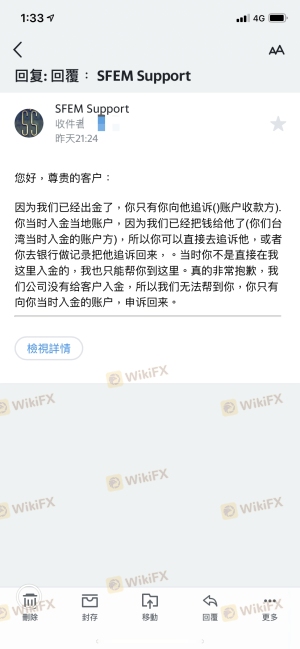

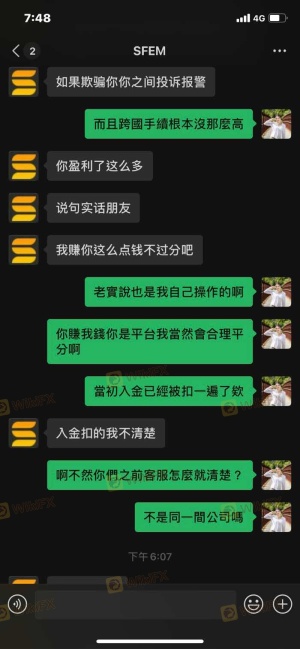

Historically, there have been numerous complaints regarding fund withdrawals, with users reporting being unable to access their money after making deposits. Such incidents highlight the potential risks involved in trading with Sunlaideal and serve as a warning to potential clients about the safety of their investments.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Many reviews of Sunlaideal paint a troubling picture, with numerous users reporting issues related to fund withdrawals and poor customer service. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | High | Poor |

| Misleading Information | High | Poor |

For instance, several traders have shared experiences of being unable to withdraw their funds, with some claiming that customer service becomes unresponsive once withdrawal requests are made. This pattern of complaints suggests a systemic issue within the company, raising further doubts about its integrity and operational practices.

Platform and Trade Execution

The trading platform offered by Sunlaideal is reportedly based on the popular MetaTrader 4 (MT4). While MT4 is known for its robust features and user-friendly interface, user experiences indicate potential issues with execution quality. Reports of slippage and order rejections have surfaced, which can significantly impact trading performance and profitability. Additionally, there are concerns about possible market manipulation, with traders alleging that the broker can close positions at unfavorable rates.

Risk Assessment

Engaging with Sunlaideal carries inherent risks, primarily due to its unregulated status and negative user feedback. The following risk assessment summarizes the primary concerns associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Safety | High | Lack of segregation and protection |

| Withdrawal Issues | High | Numerous complaints from users |

| Transparency | High | Limited information about the company |

To mitigate these risks, potential traders should conduct thorough research and consider alternative brokers that are regulated and have a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Sunlaideal exhibits several characteristics commonly associated with scam brokers. The lack of regulation, poor customer feedback, and issues related to fund withdrawals raise significant concerns about the safety and legitimacy of this broker. Traders should exercise extreme caution when considering Sunlaideal for their trading activities.

For those seeking reliable alternatives, it is advisable to choose brokers that are regulated by reputable authorities, have transparent operations, and demonstrate a commitment to client safety. Always prioritize brokers with positive reviews and a solid track record in the industry. In light of the findings, it is clear that Sunlaideal is not safe, and traders should be wary of engaging with this broker.

Is Sunlaideal a scam, or is it legit?

The latest exposure and evaluation content of Sunlaideal brokers.

Sunlaideal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sunlaideal latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.