Is Spring safe?

Business

License

Is Spring Safe or Scam?

Introduction

Spring, a forex broker operating in the global financial markets, positions itself as a platform offering various trading opportunities for retail and institutional traders. However, with the proliferation of online trading platforms, it has become increasingly crucial for traders to meticulously evaluate the legitimacy and safety of forex brokers. The rise of scams in the forex industry has led to significant financial losses for many unsuspecting investors. Therefore, assessing the regulatory status, company background, trading conditions, and customer feedback of brokers like Spring is essential for making informed trading decisions. This article employs a comprehensive evaluation framework, utilizing data from regulatory bodies, user reviews, and financial analyses to determine whether Spring is a safe trading option or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. In the case of Spring, the broker's regulatory standing raises several red flags. According to various sources, Spring is not regulated by any top-tier financial authority, which is a significant concern for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation from recognized authorities such as the FCA (UK), ASIC (Australia), or SEC (USA) indicates that Spring does not meet the necessary compliance standards expected in the forex industry. This lack of oversight could expose traders to higher risks, including unfair trading practices and lack of recourse in case of disputes. Furthermore, historical compliance issues have been reported, with some users claiming difficulties in withdrawing funds and receiving inadequate responses from customer service. Given these factors, it is prudent for traders to exercise caution and question is Spring safe for their investments.

Company Background Investigation

Understanding the background of a broker is vital in assessing its legitimacy. Spring, often referred to as Spring Information, has a somewhat opaque history. Registered in Hong Kong, the company has claimed to offer forex and CFD trading services through various platforms. However, the specifics of its ownership structure and management team remain unclear. The lack of transparency regarding the company's history and its operational framework can be concerning for potential investors.

The management team‘s professional experience is also a critical factor. Many reputable brokers have seasoned professionals at the helm, ensuring that the company operates with integrity and knowledge of market dynamics. Unfortunately, Spring does not provide sufficient information about its management team, which raises questions about its operational credibility. Furthermore, the company’s website has faced accessibility issues, which can deter potential clients from engaging with the platform. All these elements contribute to a perception of mistrust, leading to the question: is Spring safe for traders looking for a reliable forex broker?

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is paramount. Spring presents a range of trading instruments, but the associated costs can significantly impact a trader's profitability. According to user feedback, the overall fee structure at Spring appears to be less competitive compared to industry standards.

| Fee Type | Spring | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

Reports indicate that traders have encountered unusually high spreads, particularly on major currency pairs, which can erode profit margins. Additionally, the commission structure lacks clarity, making it difficult for traders to understand the true cost of trading. Such opaque practices often lead to mistrust and skepticism about the broker's intentions. Therefore, potential clients should critically assess whether is Spring safe for their trading needs, considering these potentially unfavorable trading conditions.

Client Funds Security

The security of client funds is a critical aspect of any forex broker's credibility. Traders must ensure that their investments are protected through robust security measures. In the case of Spring, concerns have been raised regarding the broker's fund safety protocols. Reports suggest that Spring does not maintain segregated accounts for client funds, which is a standard practice among reputable brokers. This lack of segregation increases the risk of funds being mismanaged or lost in the event of financial difficulties faced by the broker.

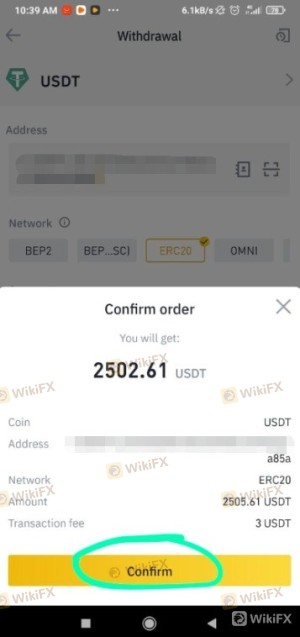

Moreover, there is no evidence to suggest that Spring offers any investor protection schemes or negative balance protection policies. Such protections are crucial for traders, especially in the volatile forex market, where substantial losses can occur. Historical accounts of traders experiencing difficulties in withdrawing their funds from Spring further compound these concerns. This situation leads to the pressing question: is Spring safe for those looking to invest their hard-earned money in the forex market?

Customer Experience and Complaints

Customer feedback plays a pivotal role in assessing a broker's reliability. Reviews of Spring indicate a mix of experiences, with numerous complaints surfacing regarding withdrawal issues and customer service responsiveness. Many users have reported being unable to access their funds after requesting withdrawals, which is a significant red flag for any broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Inadequate |

| Transparency Concerns | High | Non-responsive |

The common complaint themes include difficulties in withdrawing funds, lack of timely responses from customer support, and overall dissatisfaction with the transparency of the broker's operations. Furthermore, case studies reveal instances where traders felt misled about the broker's services and fees. Such patterns of complaints can significantly undermine trust in the broker. Therefore, it is essential for potential clients to consider these experiences and ask themselves: is Spring safe for their trading activities?

Platform and Trade Execution

The performance of a trading platform is crucial for ensuring a smooth trading experience. Spring claims to offer a user-friendly platform, but user reviews suggest otherwise. Many traders have reported issues with platform stability, order execution quality, and slippage during high volatility periods.

Traders have expressed frustration over frequent disconnections and slow order execution times, which can severely impact trading outcomes. Additionally, there are concerns about the potential for platform manipulation, where brokers may interfere with trades to their advantage. Such practices are detrimental to traders and raise serious questions about the integrity of the broker. Given these issues, potential clients should carefully consider whether is Spring safe for their trading needs, particularly in terms of platform reliability.

Risk Assessment

Engaging with any forex broker comes with inherent risks. In the case of Spring, the lack of regulation, transparency issues, and negative customer feedback contribute to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for fraud. |

| Financial Risk | High | Lack of fund segregation and investor protection. |

| Operational Risk | Medium | Platform instability and execution issues. |

To mitigate these risks, potential traders should conduct thorough research, consider using regulated alternatives, and avoid investing more than they can afford to lose. The overarching question remains: is Spring safe for traders seeking a reliable forex broker?

Conclusion and Recommendations

In conclusion, the evidence suggests that Spring raises multiple red flags concerning its safety and reliability as a forex broker. The lack of regulation, customer complaints regarding fund withdrawals, and transparency issues paint a concerning picture. Therefore, potential traders should approach Spring with caution and consider the inherent risks involved.

For those seeking a safer trading environment, it is advisable to explore regulated alternatives that offer robust investor protection, clear fee structures, and transparent operations. Brokers regulated by top-tier authorities such as the FCA or ASIC are generally more trustworthy and provide a safer trading experience. Ultimately, it is crucial for traders to prioritize their financial security and carefully consider whether is Spring safe for their trading activities.

Is Spring a scam, or is it legit?

The latest exposure and evaluation content of Spring brokers.

Spring Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Spring latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.