Regarding the legitimacy of CLMFX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CLMFX safe?

Pros

Cons

Is CLMFX markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

City of London Markets Limited

Effective Date:

2013-10-01Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2024-04-23Address of Licensed Institution:

Official Receiver 4 Abbey Orchard St London SW1P 2HTPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Clmfx Safe or Scam?

Introduction

Clmfx is a forex broker that has garnered attention in the trading community for its offerings in the foreign exchange market. Positioned as a platform for both novice and experienced traders, Clmfx claims to provide a robust trading environment with various account types and competitive spreads. However, the increasing number of scams in the forex industry has made it crucial for traders to thoroughly evaluate the legitimacy and safety of brokers before committing their funds. This article aims to investigate the safety of Clmfx by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. The analysis will be based on a comprehensive review of multiple reputable sources and user feedback.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a significant indicator of its legitimacy. Clmfx is purportedly registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This lack of stringent oversight raises questions about the broker's reliability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 24750-IBC-2018 | Saint Vincent | Unverified |

The absence of a reputable regulatory body, such as the FCA or ASIC, overseeing Clmfx means that traders have limited recourse in case of disputes or issues. Moreover, there have been numerous reports indicating that Clmfx has not adhered to regulatory standards, which could potentially expose traders to significant risks. The quality of regulation is paramount; brokers regulated by tier-1 authorities are generally considered safer due to their adherence to strict operational guidelines. In contrast, Clmfx's lack of robust regulatory oversight suggests a higher risk profile for traders.

Company Background Investigation

Clmfx's operational history is relatively short, having been established in 2016. The company claims to operate under the ownership of Core Liquidity Markets, which adds a layer of complexity to its credibility. With limited transparency regarding its management team and ownership structure, potential clients may find it challenging to ascertain the broker's reliability.

The management teams background is crucial for evaluating the broker's trustworthiness. Unfortunately, the available information about Clmfx's management is sparse, raising concerns about their expertise and experience in the financial services sector. Transparency regarding company operations is essential; brokers that openly share their management structure and operational history tend to instill more confidence among traders.

Trading Conditions Analysis

When assessing whether Clmfx is safe, one must consider its trading conditions, including fees, spreads, and commissions. Clmfx offers various account types, but the fee structure appears to be somewhat opaque.

| Fee Type | Clmfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 pips |

| Commission Model | $9 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Clmfx are higher than the industry average, which may eat into traders' profits. Additionally, the commission structure is not particularly competitive, making it essential for traders to understand the total cost of trading before opening an account. Such fees can significantly impact trading performance, especially for high-frequency traders.

Client Funds Security

The security of client funds is a crucial aspect of determining whether Clmfx is safe. The broker claims to maintain segregated accounts for client funds, which is a standard industry practice aimed at protecting clients' money from operational risks. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Furthermore, Clmfx does not offer negative balance protection, which means traders could potentially lose more than their initial investment. This absence of protection can be alarming, especially for inexperienced traders who may not fully understand the risks involved in forex trading. Historical disputes or issues related to fund security could further complicate the broker's reputation, making it vital for potential clients to conduct thorough research before depositing funds.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding whether Clmfx is a scam. Reviews from users reveal a mixed bag of experiences, with some praising the platform's ease of use while others report significant issues with withdrawals and customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Management | Medium | Limited Support |

| Platform Stability | High | Frequent Crashes |

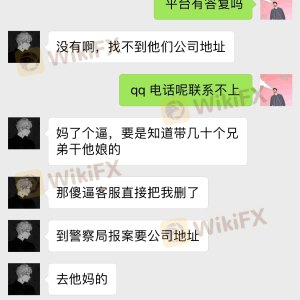

Common complaints include difficulties in withdrawing funds, which is a significant red flag in the forex industry. Many users have reported that their accounts were inexplicably frozen after making profits, leading to suspicions of potential fraud. Such patterns of complaints are concerning and indicate a lack of effective customer support and resolution mechanisms in place.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing whether Clmfx is safe. Users have reported issues with platform stability, including frequent crashes and slow execution times.

The quality of order execution is paramount in forex trading; slippage and rejected orders can adversely affect trading outcomes. If traders experience consistent delays or issues with execution, it could indicate underlying problems with the broker's infrastructure. Moreover, any signs of platform manipulation should be taken seriously, as they can significantly impact traders' confidence and financial outcomes.

Risk Assessment

Engaging with Clmfx presents several risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight from credible authorities |

| Financial Risk | Medium | Potential for loss exceeding deposits |

| Operational Risk | High | Platform instability and withdrawal issues |

To mitigate these risks, traders are advised to start with a small investment, conduct thorough research, and consider using risk management tools such as stop-loss orders. Additionally, exploring alternative brokers with better regulatory oversight and customer reviews might provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about whether Clmfx is safe for trading. The lack of robust regulatory oversight, coupled with numerous customer complaints regarding withdrawals and platform stability, suggests that potential traders should exercise extreme caution.

For those considering forex trading, it may be prudent to seek out brokers with solid regulatory frameworks and positive user experiences. Reliable alternatives include brokers regulated by tier-1 authorities, offering better customer support and transparent fee structures. Ultimately, traders should prioritize safety and reliability to protect their investments in the volatile forex market.

Is CLMFX a scam, or is it legit?

The latest exposure and evaluation content of CLMFX brokers.

CLMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CLMFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.