Is Elite Strategies safe?

Pros

Cons

Is Elite Strategies A Scam?

Introduction

Elite Strategies is a forex broker that has made its mark in the online trading arena, offering various financial instruments to traders worldwide. Operating under the domain elifx.com, the broker claims to provide competitive trading conditions, including high leverage and low spreads. However, with the proliferation of unregulated brokers in the forex market, traders must exercise caution when evaluating the legitimacy and safety of their trading partners. This article aims to explore whether Elite Strategies is a safe broker or a potential scam. We will conduct a thorough investigation based on available data, user reviews, and regulatory information.

Regulation and Legitimacy

One of the most crucial aspects of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to certain operational standards and provides a level of protection for client funds. Elite Strategies claims to be registered in multiple jurisdictions, including the United States and Australia. However, upon closer inspection, it becomes apparent that the broker operates without proper regulation in major trading regions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unregulated |

| FCA | N/A | UK | Unregulated |

| SEC | N/A | US | Unregulated |

The absence of a valid regulatory license raises significant concerns about the safety of funds deposited with Elite Strategies. The Australian Securities and Investments Commission (ASIC) has revoked the broker's license, and there are no records of it being regulated by any reputable financial authority. This lack of oversight is a red flag for potential investors, as it indicates that Elite Strategies may not be held accountable for its actions, making it difficult for traders to seek recourse in case of disputes or issues.

Company Background Investigation

Elite Strategies presents a convoluted corporate structure that raises questions about its legitimacy. The broker claims to be owned by Elite Strategies Corporation Pty Ltd, purportedly based in Adelaide, Australia. However, conflicting information suggests that it also operates from Colorado, USA, and has links to a company named RS Finance (Aust) Pty Ltd, which shares the same address. Such inconsistencies in corporate information can be indicative of a clone firm—a common tactic used by scammers to mislead potential clients.

The management team behind Elite Strategies remains largely anonymous, with little information available regarding their professional backgrounds or expertise in the financial sector. This lack of transparency further compounds concerns about the broker's credibility. A reputable broker typically provides detailed information about its ownership and management to instill confidence in its clients. The absence of such information regarding Elite Strategies is a cause for alarm.

Trading Conditions Analysis

When analyzing whether Elite Strategies is safe, it is essential to consider the trading conditions it offers. The broker provides a low minimum deposit requirement of $100, which may initially attract new traders. However, the overall fee structure raises several questions. Elite Strategies claims to offer competitive spreads and leverage of up to 1:500, which is significantly higher than what many regulated brokers provide. While high leverage can be appealing, it also increases the risk of substantial losses.

| Fee Type | Elite Strategies | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.5 pips |

| Commission Model | $10 per lot | $7 per lot |

| Overnight Interest Range | Varies | Varies |

Despite the attractive trading conditions, the presence of trading bonuses is particularly concerning. Such bonuses are often used as bait to entice traders into depositing funds, only to impose impossible trading volume requirements before allowing withdrawals. This practice is a common tactic employed by unregulated brokers, further suggesting that Elite Strategies may not be a safe choice for traders.

Client Fund Security

The safety of client funds is paramount when assessing a broker's reliability. Elite Strategies claims to implement various security measures; however, the lack of regulation raises serious concerns about the effectiveness of these measures. There is no evidence that the broker segregates client funds from its operating capital, which is a critical requirement for safeguarding investor assets. Additionally, there is no information provided about investor protection schemes, which are typically offered by regulated brokers to compensate clients in the event of insolvency or fraud.

The absence of negative balance protection is another significant risk factor. Without this feature, traders could end up owing more money than they initially deposited, exposing them to unforeseen financial liabilities. Historical complaints about delayed withdrawals and unresponsive customer service further underscore the risks associated with trading with Elite Strategies.

Customer Experience and Complaints

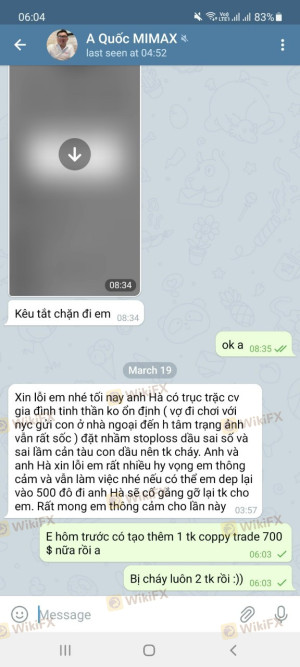

Evaluating the customer experience is vital in determining whether Elite Strategies is safe. Numerous reviews and user feedback reveal a pattern of complaints regarding withdrawal issues, poor customer support, and difficulties in accessing funds. Many users report that their withdrawal requests are either delayed or outright denied, which is a common tactic employed by fraudulent brokers to retain client funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Poor |

| Account Closure Issues | High | Poor |

For instance, one user reported being unable to withdraw their funds after multiple requests, only to receive vague explanations from customer support. Such experiences raise serious concerns about the broker's commitment to client satisfaction and financial integrity. The recurring nature of these complaints suggests that Elite Strategies may not prioritize the needs of its clients, further indicating that it may not be a safe trading option.

Platform and Trade Execution

The trading platform offered by Elite Strategies is another critical factor in evaluating its reliability. The broker claims to provide access to the popular MetaTrader 4 platform, known for its user-friendly interface and robust trading tools. However, user reviews indicate that the platform may suffer from stability issues, including frequent downtime and slow order execution speeds.

Concerns about slippage and order rejections have also been raised by users, with some reporting that their trades were not executed as intended. Such issues can significantly affect trading performance and profitability, leading to frustration among traders. The potential for platform manipulation is another alarming aspect, as unregulated brokers may engage in practices that disadvantage their clients.

Risk Assessment

When considering whether Elite Strategies is safe, it is essential to conduct a comprehensive risk assessment. The following risk categories highlight the key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Safety Risk | High | Lack of fund segregation and investor protection. |

| Customer Support Risk | Medium | Poor response to complaints and withdrawal issues. |

| Platform Stability Risk | High | Frequent downtime and execution issues. |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with Elite Strategies. It is essential to utilize only regulated brokers that adhere to strict compliance standards and prioritize client protection.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that Elite Strategies is not a safe broker. The lack of regulatory oversight, coupled with a history of client complaints and questionable business practices, raises significant red flags for potential investors. Traders should be particularly cautious of the broker's enticing offers, as they may serve as traps designed to lure unsuspecting clients into a precarious financial situation.

For traders seeking reliable and secure trading options, it is advisable to consider reputable brokers regulated by recognized authorities such as the FCA or ASIC. These brokers typically offer better protection for client funds, transparent trading conditions, and responsive customer support. In light of the findings, it is highly recommended to avoid trading with Elite Strategies and seek alternatives that prioritize safety and transparency.

Is Elite Strategies a scam, or is it legit?

The latest exposure and evaluation content of Elite Strategies brokers.

Elite Strategies Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Elite Strategies latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.