Spring 2025 Review: Everything You Need to Know

Executive Summary

Spring is a new player in the trading world. However, it's hard to give a complete review because there isn't much public information about its main trading services. This spring review shows a platform that seems to be still growing, with not enough details about rules, trading conditions, and how it works. The platform might offer new trading tools and different options for users who want to try alternative trading places, but the lack of clear regulatory information and detailed trading specs worries careful traders. Our review stays neutral because we don't have complete information. Spring seems ready to help traders who want to try newer platforms, though potential users should be extra careful before putting money in. Whether the platform works well for new and experienced traders stays unclear until more detailed information becomes available.

Important Notice

This review has big limits because there isn't much information about Spring's trading services. Different regional companies may work under different regulatory rules, which could affect user experience and legal protections in different areas. Our review method uses mainly public information, which is limited for Spring's trading operations. The lack of clear regulatory disclosures means potential users in different regions may find different levels of consumer protection and ways to resolve disputes. This review should not replace independent research and professional financial advice before making trading decisions.

Rating Framework

Broker Overview

Spring appears in the competitive trading world without clearly established credentials about when it started, company background, or operational history. The platform's business model stays undefined in available materials, making it hard to place within the broader context of retail trading services. Without clear disclosure of company ownership, operational headquarters, or management structure, potential users face uncertainty about the platform's stability and long-term viability.

The platform's trading infrastructure and asset offerings lack detailed specification in publicly available information. While Spring may operate trading platforms supporting various financial instruments, specific details about supported asset classes, trading technology, and market access remain undisclosed. The absence of clear regulatory oversight information particularly concerns this spring review, as regulatory compliance forms the foundation of trustworthy trading services.

Regulatory Oversight: Available information fails to specify regulatory authorities overseeing Spring's operations or provide regulatory reference numbers for verification.

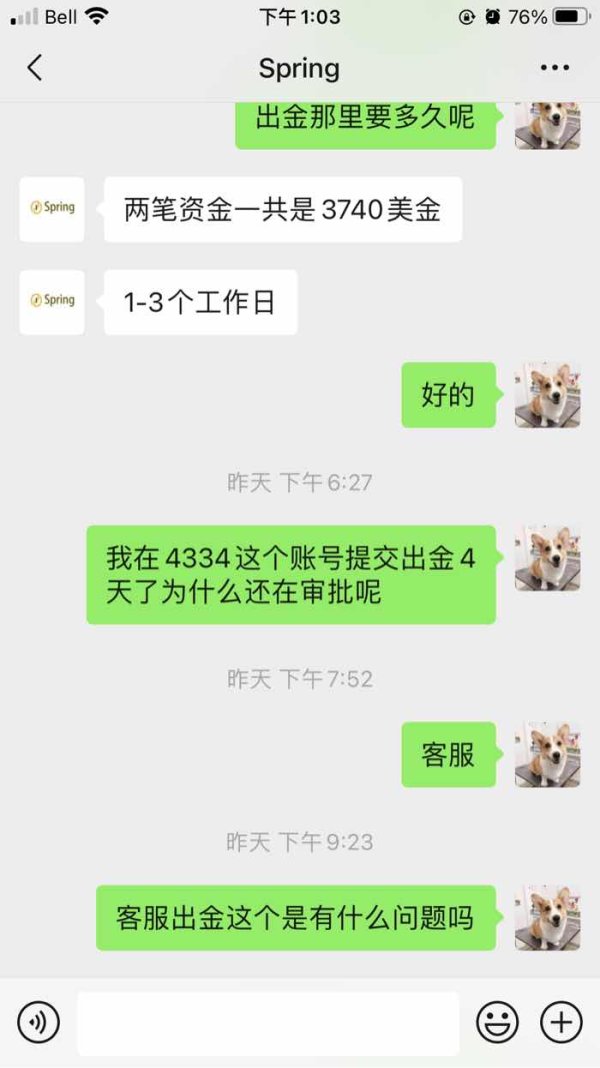

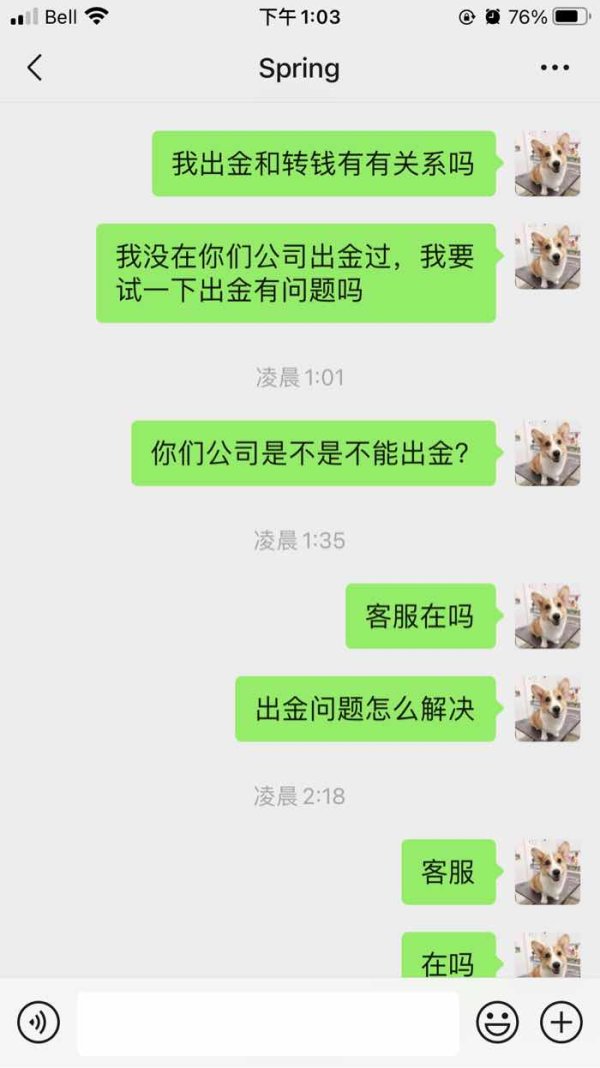

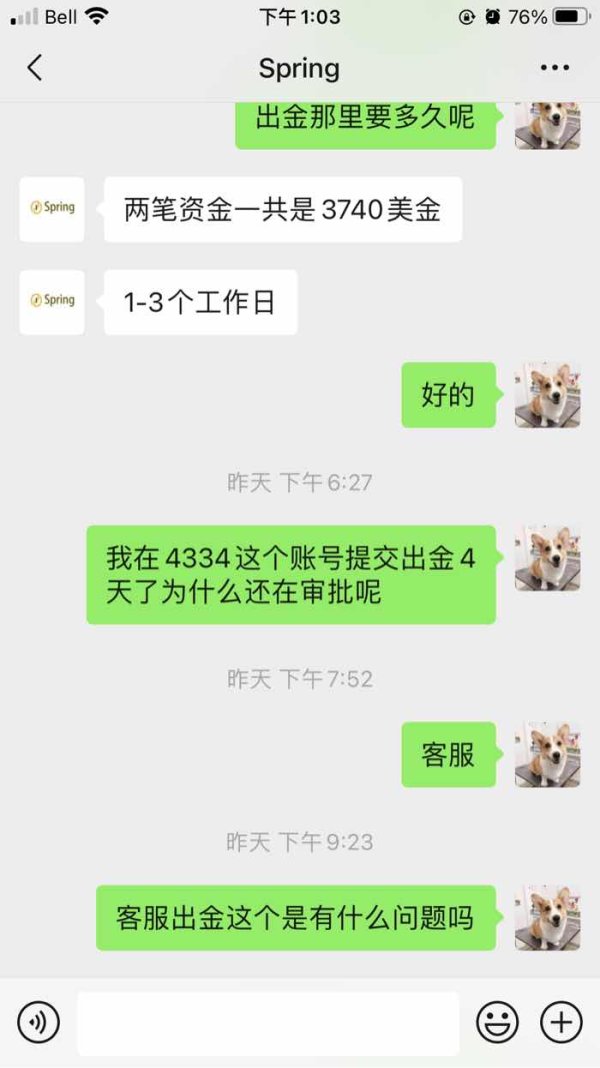

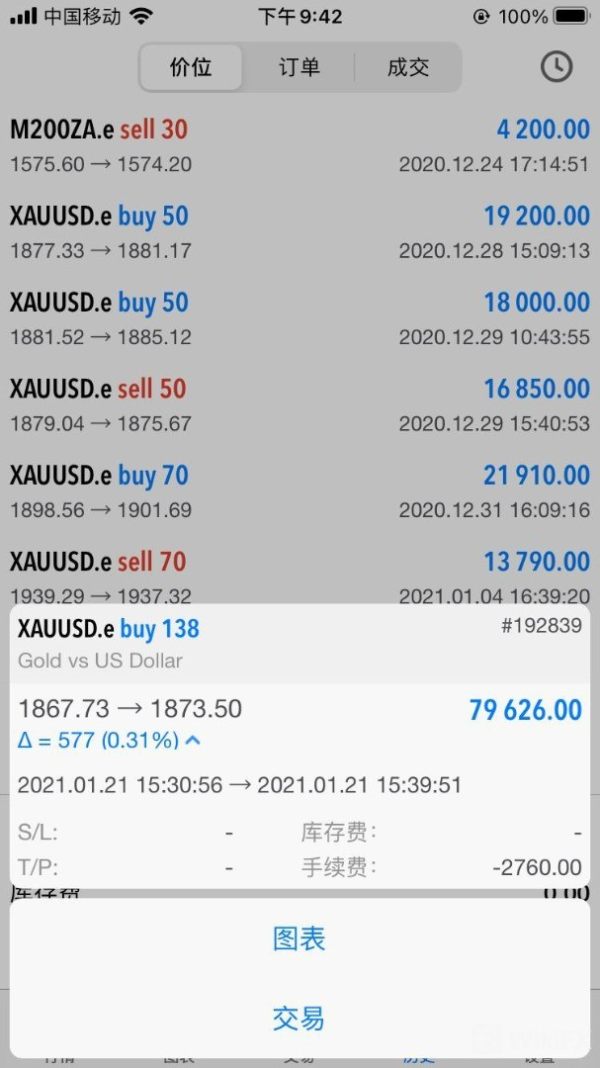

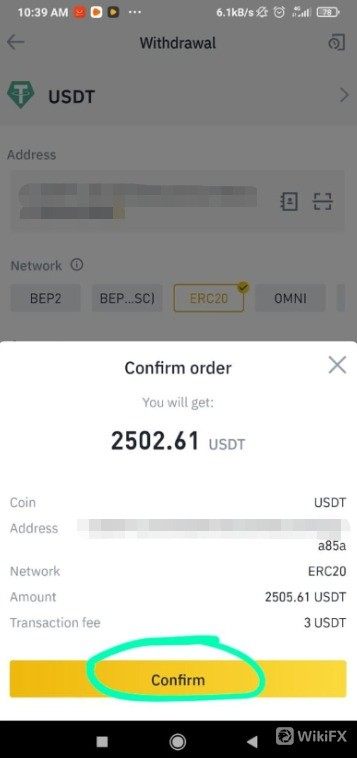

Funding Methods: Deposit and withdrawal options remain unspecified in accessible materials, leaving potential users without clarity on payment processing capabilities.

Minimum Deposit: Entry-level funding requirements are not disclosed in available documentation.

Promotional Offers: Bonus structures, welcome offers, and promotional campaigns lack detailed specification.

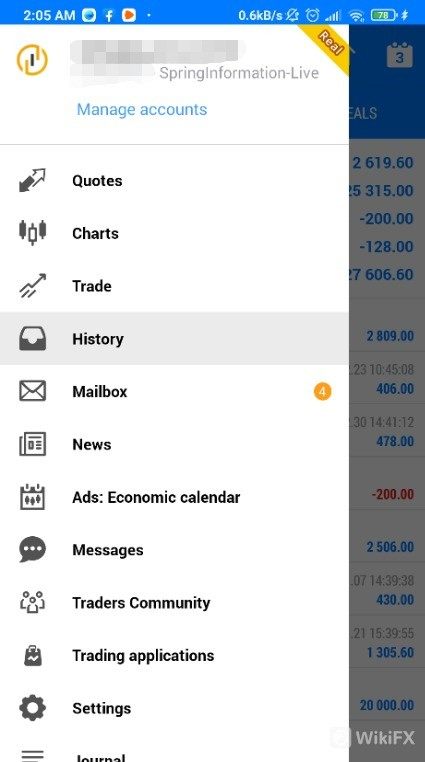

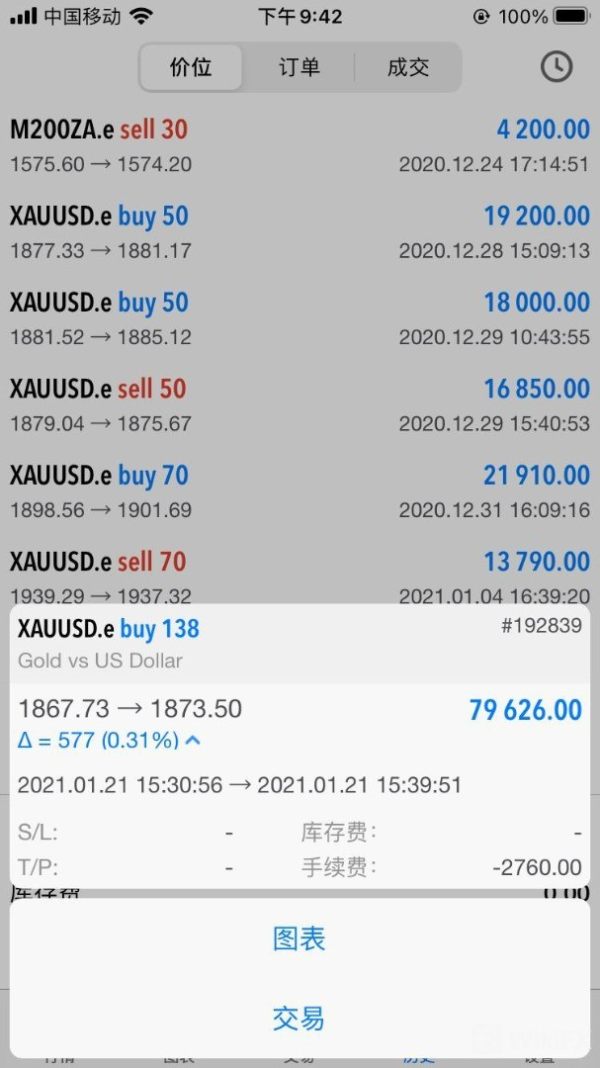

Tradeable Assets: The range of available financial instruments, including forex pairs, commodities, indices, and other assets, remains undefined.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs are not transparently disclosed, significantly impacting trader decision-making capabilities.

Leverage Options: Maximum leverage ratios and margin requirements lack specification.

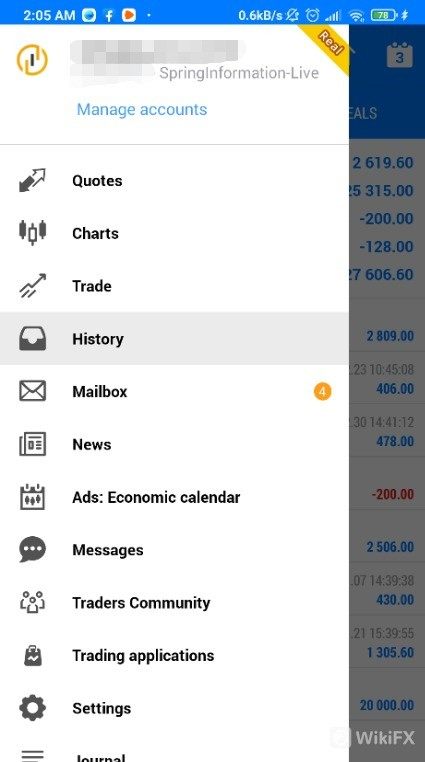

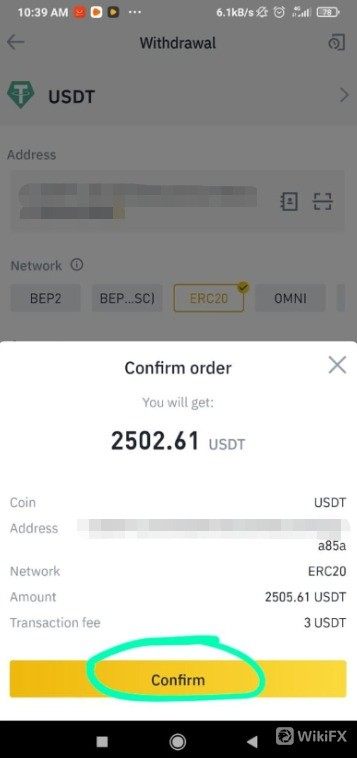

Platform Technology: Trading platform options and technological infrastructure details remain unspecified.

Geographic Restrictions: Regional availability and restricted territories are not clearly outlined.

Support Languages: Customer service language options are not detailed in available materials.

This spring review highlights the significant information gaps that potential users must consider before engaging with the platform.

Account Conditions Analysis

Spring's account structure remains largely hidden, with essential details about account types, features, and requirements missing from publicly available information. Traditional trading platforms typically offer multiple account levels designed for different trader profiles, from basic accounts for beginners to premium accounts for high-volume traders. However, specific information about Spring's account hierarchy, if any exists, is not accessible for evaluation.

The absence of minimum deposit information creates uncertainty for potential users planning their trading capital allocation. Competitive platforms typically provide clear deposit requirements ranging from minimal amounts for basic accounts to substantial requirements for premium services. Without this basic information, traders cannot assess whether Spring's entry requirements align with their financial capabilities or trading objectives.

Account opening procedures and verification requirements remain unspecified, leaving potential users without understanding of the onboarding process complexity or timeline. Modern trading platforms typically implement Know Your Customer procedures, but Spring's specific requirements are not detailed in available materials. This spring review cannot provide guidance on documentation needs or verification timeframes without access to comprehensive account information.

The trading tools ecosystem represents a critical component of modern trading platforms, yet Spring's offerings remain largely unspecified in accessible information. Contemporary trading environments typically provide technical analysis tools, charting packages, market scanners, and automated trading capabilities. However, evaluation of Spring's tool suite proves impossible without detailed platform specifications or user interface demonstrations.

Research and analysis resources form another essential platform component, with established brokers typically offering market commentary, economic calendars, fundamental analysis, and trading signals. Spring's approach to market research and analytical support cannot be assessed from available information, limiting potential users' ability to evaluate the platform's educational and analytical value proposition. Educational resources increasingly differentiate trading platforms, with comprehensive programs supporting trader development through webinars, tutorials, market analysis, and strategy guides.

Spring's commitment to trader education and skill development remains unclear without accessible information about educational initiatives or learning resources. The platform's support for automated trading, including expert advisor compatibility and algorithmic trading tools, also lacks specification in available materials.

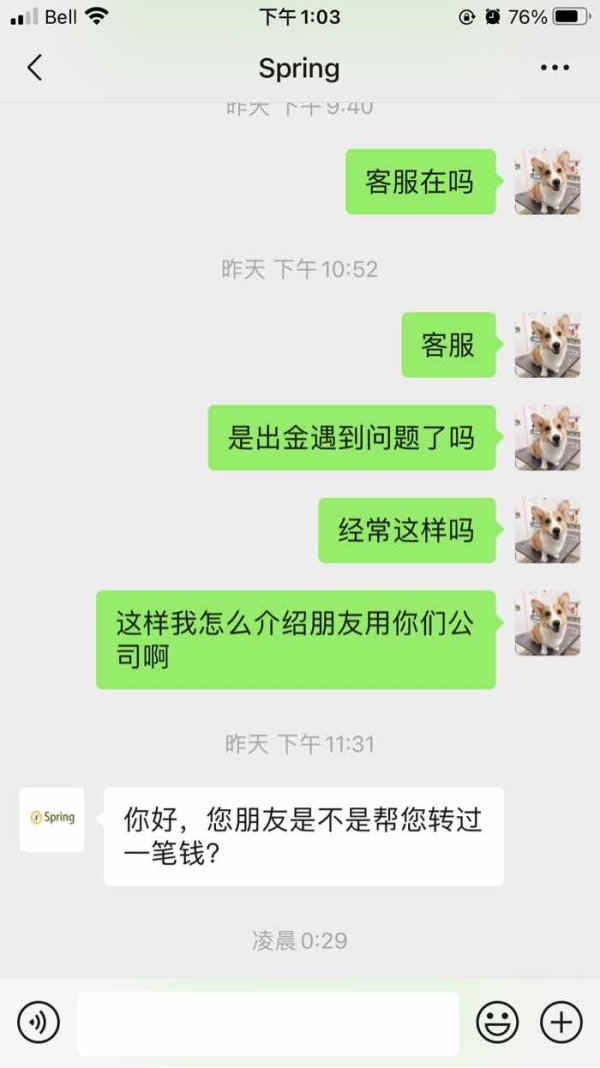

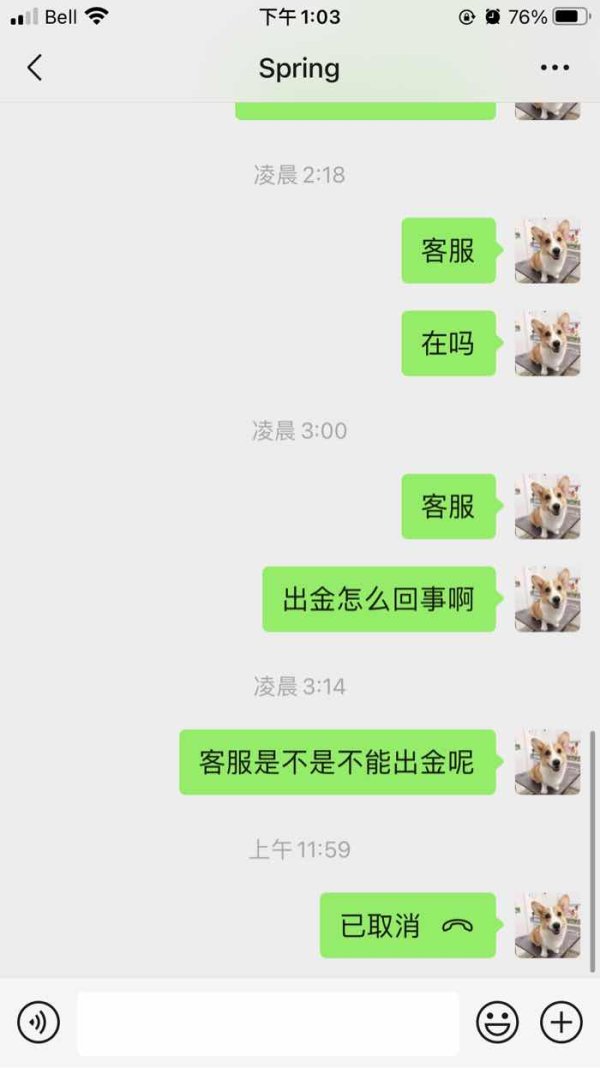

Customer Service and Support Analysis

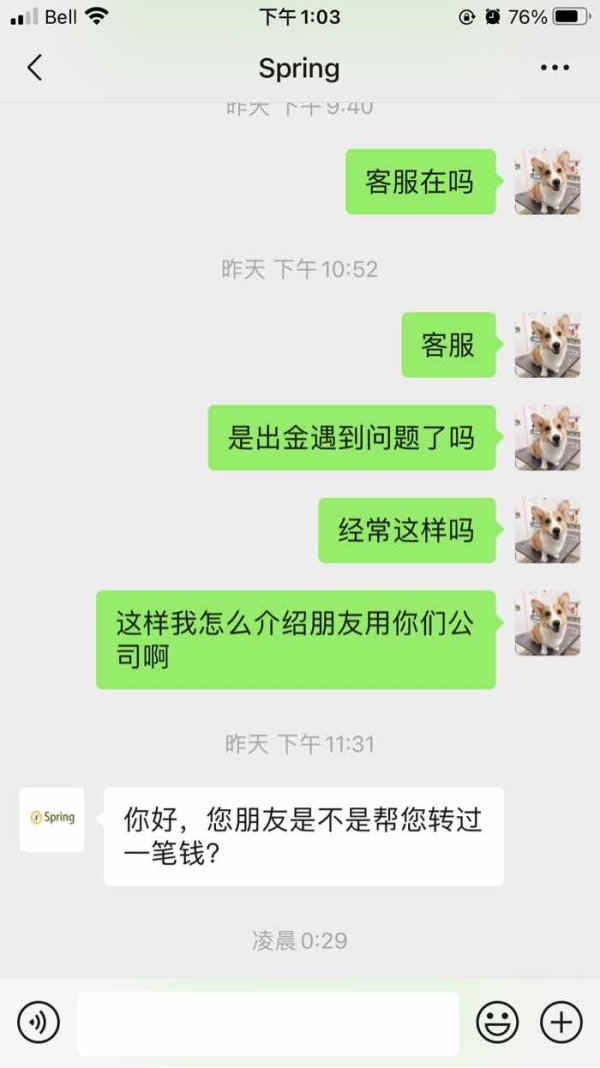

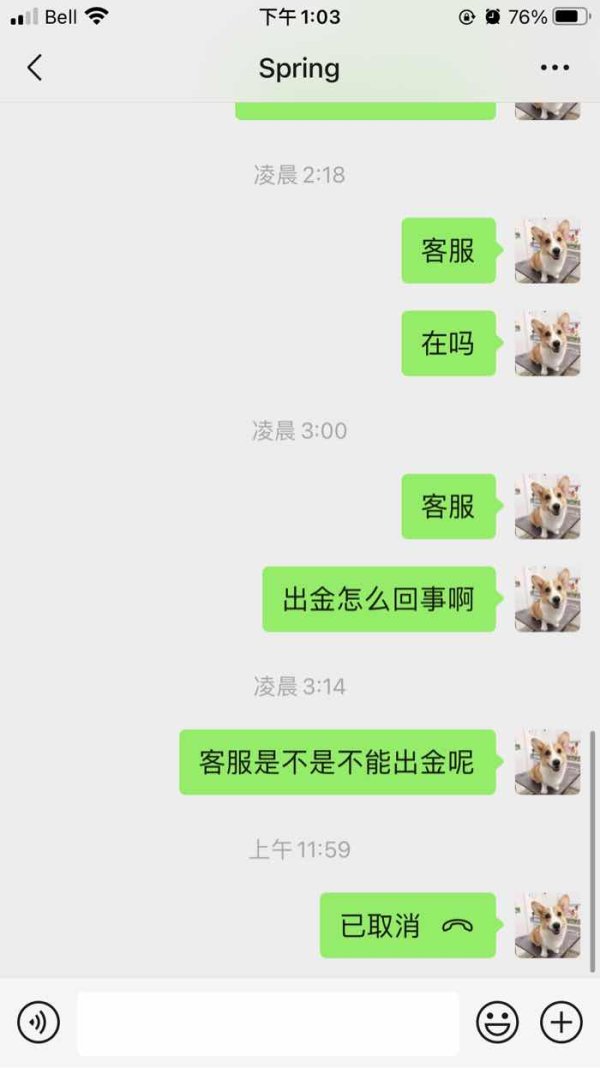

Customer support infrastructure represents a fundamental aspect of trading platform reliability, yet Spring's service framework remains unspecified in accessible information. Effective trading platforms typically maintain multiple communication channels including live chat, email support, telephone assistance, and comprehensive FAQ sections. Without detailed information about Spring's support channels, potential users cannot assess service accessibility or convenience.

Response time expectations and service quality metrics are not disclosed in available materials, preventing evaluation of support efficiency. Competitive platforms often provide service level agreements or typical response timeframes, enabling users to set appropriate expectations for issue resolution. The absence of such information in Spring's case creates uncertainty about support reliability during critical trading situations.

Multilingual support capabilities remain unspecified, potentially limiting platform accessibility for international users. Global trading platforms typically provide support in multiple languages to serve diverse user bases effectively. Spring's language support scope and quality cannot be evaluated without comprehensive service information. Operating hours for customer support also lack specification, leaving users uncertain about assistance availability across different time zones and trading sessions.

Trading Experience Analysis

Platform stability and execution quality form the cornerstone of satisfactory trading experiences, yet Spring's performance metrics remain undisclosed in available information. Modern trading platforms typically provide execution statistics, uptime records, and performance benchmarks enabling users to evaluate platform reliability. Without access to such data, this spring review cannot assess Spring's technical capabilities or execution standards.

Order execution quality, including fill rates, slippage statistics, and rejection rates, represents critical information for active traders. Competitive platforms often publish execution quality reports or provide transparency about order processing capabilities. Spring's execution framework and quality metrics are not available for evaluation, creating uncertainty about trade execution reliability and pricing accuracy.

Mobile trading capabilities increasingly influence platform selection, with traders expecting comprehensive mobile applications supporting full trading functionality. Spring's mobile platform features, compatibility, and performance characteristics remain unspecified in accessible materials. The overall trading environment, including platform customization options, advanced order types, and professional trading tools, cannot be evaluated without detailed platform specifications.

Trust and Security Analysis

Regulatory compliance represents the foundation of trustworthy trading services, yet Spring's regulatory status remains unclear in available information. Established trading platforms typically operate under oversight from recognized financial authorities such as the FCA, ASIC, CySEC, or other reputable regulators. The absence of clear regulatory disclosure significantly impacts confidence in Spring's operational legitimacy and consumer protection standards.

Client fund protection measures, including segregated account structures, deposit insurance, and negative balance protection, are not specified in accessible materials. These safeguards represent essential protections for retail traders, and their absence or unclear implementation raises concerns about capital security. Transparency about fund handling and protection mechanisms remains insufficient for comprehensive trust assessment.

Corporate transparency, including company ownership, financial reporting, and operational disclosure, lacks sufficient detail in available information. Established platforms typically provide comprehensive corporate information enabling users to verify operational legitimacy and financial stability. Spring's corporate structure and transparency standards cannot be adequately evaluated without access to detailed company information and regulatory documentation.

User Experience Analysis

Overall user satisfaction metrics and feedback compilation are not available for Spring evaluation, limiting assessment of real-world user experiences. Established platforms typically accumulate substantial user reviews and satisfaction ratings across multiple review platforms and industry surveys. The absence of comprehensive user feedback prevents evaluation of Spring's service quality from actual user perspectives.

Interface design and platform usability represent crucial factors in trading platform selection, yet Spring's user interface characteristics remain unspecified. Modern trading platforms emphasize intuitive design, customizable layouts, and efficient navigation to support effective trading activities. Without access to platform demonstrations or user interface information, design quality and usability cannot be assessed.

Registration and account verification processes significantly impact initial user experience, yet Spring's onboarding procedures lack detailed specification. Streamlined registration combined with efficient verification processes typically enhance user satisfaction, while complex or lengthy procedures may deter potential users. Funding and withdrawal experiences also influence overall platform satisfaction, but specific information about Spring's payment processing efficiency and user experience is not available for evaluation.

Conclusion

This comprehensive evaluation of Spring reveals significant information limitations that prevent definitive assessment of the platform's suitability for retail trading. The absence of clear regulatory disclosure, detailed trading conditions, and transparent operational information creates substantial uncertainty for potential users. While Spring may offer innovative features or competitive advantages, these cannot be verified without comprehensive platform information.

Risk-averse traders should exercise extreme caution when considering Spring, given the insufficient transparency about regulatory oversight and operational safeguards. The platform may appeal to traders specifically seeking alternative trading environments or willing to accept higher uncertainty levels in exchange for potential innovative features. However, the lack of detailed information makes Spring unsuitable for traders prioritizing transparency, regulatory protection, and established operational track records.