Is KINROSS safe?

Pros

Cons

Is Kinross Safe or Scam?

Introduction

Kinross is a forex broker that has garnered attention in the trading community, primarily due to its unique positioning within the foreign exchange market. As traders increasingly seek opportunities in the forex landscape, the importance of evaluating the credibility of brokers like Kinross cannot be overstated. The forex market is rife with potential pitfalls, including unregulated brokers, hidden fees, and insufficient customer support. Therefore, traders must conduct thorough due diligence to ensure their investments are secure.

In this article, we will delve into a comprehensive analysis of Kinross, assessing its legitimacy and safety as a trading platform. Our investigation will incorporate various sources, including regulatory information, company background, trading conditions, and customer feedback. By employing a structured evaluation framework, we aim to provide traders with the insights they need to determine if "Is Kinross safe?" and if they should consider it as a viable trading option.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy and safety. Regulated brokers are required to adhere to stringent guidelines that protect investors, whereas unregulated entities may operate without oversight, increasing the risk of fraud. In the case of Kinross, it is essential to examine its regulatory standing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

As indicated in the table above, Kinross operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. The absence of regulation means that Kinross is not held accountable to any financial authority, leaving traders vulnerable to potential losses. Moreover, the lack of transparency regarding its operational practices further complicates the assessment of its safety.

Historically, brokers without regulation have faced issues related to compliance and investor protection. In the case of Kinross, the absence of a regulatory framework suggests a higher potential risk for traders. Therefore, it is crucial to exercise caution when considering whether "Is Kinross safe?" as a trading platform.

Company Background Investigation

Understanding the background of a broker can provide valuable insights into its operations and trustworthiness. Kinross was established with the goal of providing forex trading services, but its history and ownership structure remain somewhat opaque. There is limited information available regarding the company's founding, evolution, and ownership, which raises questions about its transparency.

The management team behind Kinross is another critical aspect to consider. A strong and experienced management team can significantly enhance a broker's credibility. However, in the case of Kinross, there is a lack of detailed information regarding the qualifications and backgrounds of its executives. This lack of transparency can be a red flag for potential investors, as it indicates that the company may not prioritize open communication with its clients.

In terms of information disclosure, Kinross appears to fall short. A reputable broker should provide clear and accessible information about its services, fees, and operational practices. The absence of such information may lead traders to question the broker's integrity. Therefore, when evaluating the question "Is Kinross safe?", the company's lack of transparency is a significant concern.

Trading Conditions Analysis

The trading conditions offered by a broker play a crucial role in determining its attractiveness to traders. Kinross claims to provide competitive trading conditions, but it is essential to analyze its fee structure and any potential hidden costs.

| Fee Type | Kinross | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | $0 - $10 per trade |

| Overnight Interest Range | High | Low |

As depicted in the table, Kinross's spread for major currency pairs is variable, which can lead to higher trading costs compared to industry standards. The absence of a clear commission structure raises concerns about potential hidden fees that could impact traders' profitability. Additionally, the high overnight interest rates may deter traders who engage in longer-term positions.

Overall, the trading conditions provided by Kinross may not be as competitive as those offered by regulated brokers. This raises further questions about the safety and reliability of trading with Kinross. Traders should carefully consider whether "Is Kinross safe?" when evaluating its trading conditions.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's credibility. Traders need to know that their investments are secure and that the broker has measures in place to protect their capital. In the case of Kinross, it is essential to analyze the company's approach to fund security.

Kinross does not provide clear information regarding fund segregation or investor protection measures. Reputable brokers typically maintain client funds in segregated accounts, ensuring that traders' capital is protected in the event of insolvency. Additionally, many regulated brokers offer negative balance protection, which prevents traders from losing more than their initial investment.

The lack of transparency regarding these critical security measures raises significant concerns about the safety of funds with Kinross. Without clear policies in place, traders may be at risk of losing their investments. Therefore, when considering the question "Is Kinross safe?", the absence of robust fund security measures is a significant red flag.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. In the case of Kinross, there are mixed reviews and reports of customer experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Average |

| High Fees | Medium | Unresponsive |

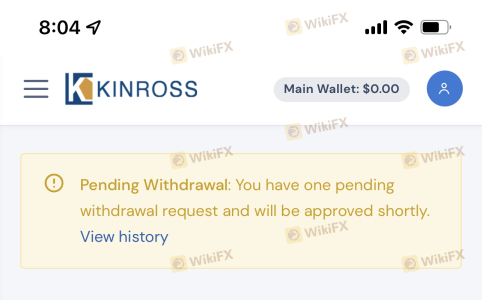

Common complaints about Kinross include difficulties with fund withdrawals and inadequate customer support. Many users have reported challenges when attempting to withdraw their funds, leading to frustration and distrust. Additionally, the responsiveness of the company's support team has been criticized, with many customers feeling neglected when seeking assistance.

Two typical cases highlight these concerns. In one instance, a trader reported being unable to withdraw funds for over a month, despite having a verified account. In another case, a customer expressed dissatisfaction with the lack of support when facing issues with trading conditions. These complaints contribute to the overall perception of Kinross as a potentially unreliable broker.

Platform and Execution

The performance of a trading platform is crucial for a positive trading experience. Traders need a stable and efficient platform to execute their trades effectively. In the case of Kinross, the platform's performance and user experience require careful evaluation.

Reports indicate that Kinross's trading platform experiences occasional stability issues, leading to execution delays and increased slippage. Such issues can significantly impact traders' ability to enter and exit positions at desired prices. Moreover, any signs of platform manipulation or unfair practices can raise serious concerns about the broker's integrity.

Given the importance of execution quality, traders should consider whether "Is Kinross safe?" in light of the platform's performance and reliability.

Risk Assessment

When evaluating a broker, it is essential to assess the overall risk associated with trading with them. In the case of Kinross, several risk factors warrant consideration.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation increases vulnerability. |

| Financial Risk | Medium | Lack of transparency may hide fees. |

| Operational Risk | High | Platform stability issues reported. |

The absence of regulatory oversight poses a significant risk, as traders have no recourse if issues arise. Additionally, the lack of transparency regarding fees and trading conditions further compounds financial risks. Finally, operational risks related to platform performance can lead to potential losses for traders.

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with robust regulatory frameworks and transparent practices. This approach will help ensure a safer trading environment.

Conclusion and Recommendations

In conclusion, the analysis of Kinross raises several concerns regarding its safety and legitimacy as a forex broker. The absence of regulatory oversight, coupled with a lack of transparency and mixed customer experiences, suggests that traders should exercise caution when considering whether "Is Kinross safe?"

For traders seeking reliable and secure trading options, it may be advisable to explore alternative brokers that offer robust regulatory protection, transparent fee structures, and responsive customer support. Brokers such as [Alternative Broker 1], [Alternative Broker 2], and [Alternative Broker 3] have established reputations for safety and reliability in the forex market.

Ultimately, traders should prioritize their safety and security when choosing a broker and remain vigilant against potential scams and unregulated entities in the forex landscape.

Is KINROSS a scam, or is it legit?

The latest exposure and evaluation content of KINROSS brokers.

KINROSS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KINROSS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.