Is Solid Stocks safe?

Pros

Cons

Is Solid Stocks A Scam?

Introduction

Solid Stocks is an online brokerage that claims to provide a platform for trading various financial instruments, including forex, CFDs, and cryptocurrencies. Positioned within the competitive forex market, Solid Stocks has attracted attention from both potential traders and regulatory bodies alike. However, the importance of conducting thorough due diligence on any forex broker cannot be overstated. Traders need to assess the legitimacy, regulatory compliance, and overall safety of their investments, as the forex market can be rife with unregulated entities and potential scams. This article aims to provide an objective analysis of Solid Stocks, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the safety and reliability of a forex broker. Solid Stocks operates without any regulatory oversight from recognized financial authorities, which raises significant concerns about its legitimacy. The absence of regulation means that traders have little recourse in the event of disputes or fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation is alarming, especially considering that reputable brokers are typically registered with top-tier regulatory bodies such as the FCA (UK), ASIC (Australia), or the SEC (USA). Solid Stocks has been blacklisted by several regulatory agencies, including Italy's CONSOB, which has labeled it as a scam. This lack of oversight not only questions the broker's credibility but also puts traders' funds at risk. The historical compliance of Solid Stocks is nonexistent, and the absence of any regulatory license makes it imperative for potential clients to exercise extreme caution.

Company Background Investigation

Solid Stocks is operated by Scintilla Enterprise Ltd., a company allegedly registered in the Commonwealth of Dominica. However, the specifics regarding its history, ownership structure, and management team remain murky. The lack of transparency surrounding the company's operations raises red flags about its legitimacy.

The management team behind Solid Stocks has not been publicly disclosed, making it difficult to assess their professional backgrounds and qualifications. This opacity in company information is a significant concern for potential investors, as it indicates a lack of accountability and oversight. Additionally, the company's registration in a jurisdiction known for lax regulatory standards further complicates the safety of funds deposited with Solid Stocks. The absence of clear ownership and operational details suggests that traders may be dealing with a high-risk entity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Solid Stocks offers various account types, including basic, premium, and luxury accounts, each with different minimum deposit requirements and trading fees. However, the overall fee structure appears to be higher than industry averages, which can significantly impact traders' profitability.

| Fee Type | Solid Stocks | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.1-0.3% |

The spreads offered by Solid Stocks are considerably wider than those of regulated brokers, which often provide more competitive rates. Additionally, the absence of a clear commission structure raises concerns regarding hidden fees that could affect traders' bottom lines. The broker's policies on overnight interest rates also appear to be less favorable compared to industry standards, which may deter traders looking for cost-effective trading conditions.

Customer Fund Safety

Customer fund safety is paramount when selecting a forex broker. Solid Stocks does not provide sufficient information about its fund security measures. It is unclear whether client funds are held in segregated accounts, which is a standard practice among reputable brokers to protect traders' assets in case of insolvency.

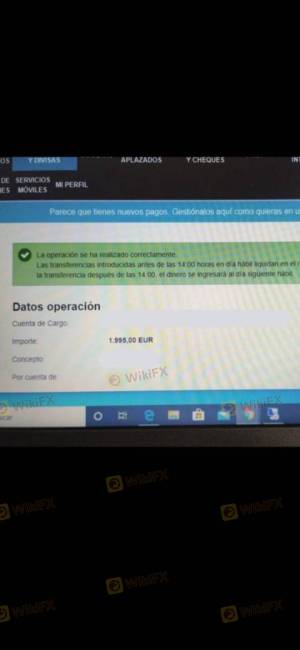

Moreover, there is no indication of investor protection schemes or negative balance protection policies, which are essential safeguards for traders. The lack of these protective measures raises significant concerns about the safety of funds deposited with Solid Stocks. Historical issues related to fund security have also been reported, with numerous complaints from users who experienced difficulties withdrawing their funds, further emphasizing the risks associated with this broker.

Customer Experience and Complaints

Customer feedback serves as a critical indicator of a broker's reliability. Reviews for Solid Stocks are predominantly negative, with many users citing issues related to fund withdrawals and poor customer service. Common complaints include delays in processing withdrawals, lack of communication from the broker, and difficulty in accessing customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Transparency Issues | High | Nonexistent |

One notable case involved a user who reported being unable to withdraw their funds after multiple requests. The broker allegedly ceased communication, leaving the trader with no recourse. Such complaints highlight a pattern of behavior that suggests a lack of accountability and responsiveness from Solid Stocks, reinforcing the notion that traders should be cautious when considering this broker.

Platform and Trade Execution

The trading platform offered by Solid Stocks is a proprietary web-based solution. However, user reviews indicate that the platform is lacking in features and may suffer from performance issues. Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes.

The absence of established trading platforms like MetaTrader 4 or 5 means that traders may miss out on advanced trading features and tools that are critical for successful trading. The overall user experience on the platform has been described as subpar, further contributing to the concerns surrounding the broker's legitimacy.

Risk Assessment

Using Solid Stocks presents several risks that potential traders should be aware of. The lack of regulation, combined with negative user experiences and complaints, creates an environment where traders' funds may be at significant risk.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns. |

| Fund Security | High | Lack of segregated accounts and investor protection. |

| Trading Environment | Medium | Limited platform features and high fees. |

To mitigate these risks, potential traders are advised to conduct thorough research, seek out regulated brokers, and avoid investing large sums of money with unverified entities like Solid Stocks.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Solid Stocks operates as a high-risk broker with significant red flags indicating potential fraudulent behavior. The lack of regulation, poor customer feedback, and questionable trading conditions raise serious concerns about the safety and legitimacy of this broker.

Traders should exercise extreme caution and consider alternative, reputable brokers that offer regulatory oversight and better customer protections. If you are an inexperienced trader or someone looking to invest significant capital, it is advisable to steer clear of Solid Stocks and opt for brokers that are well-regulated and have a proven track record of reliability.

For those still considering trading, reputable alternatives include brokers regulated by the FCA, ASIC, or other recognized financial authorities, which can provide a safer trading environment and better customer support.

Is Solid Stocks a scam, or is it legit?

The latest exposure and evaluation content of Solid Stocks brokers.

Solid Stocks Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Solid Stocks latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.