Is ShengTong safe?

Business

License

Is Shengtong Safe or Scam?

Introduction

Shengtong, a forex brokerage that has emerged in recent years, positions itself as a platform for trading various financial instruments, including forex and CFDs. As the forex market continues to grow, it attracts a wide range of brokers, making it imperative for traders to evaluate the credibility and safety of these platforms before investing their hard-earned money. In a landscape rife with potential scams and unregulated entities, understanding the legitimacy of a broker like Shengtong is crucial for safeguarding investments. This article employs a comprehensive investigative approach, utilizing data from reputable financial sources, user reviews, and regulatory information to assess whether Shengtong is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a brokerage is a primary indicator of its reliability and safety. Unfortunately, Shengtong operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy. The absence of regulation means that the broker is not subject to strict financial standards or accountability, leaving traders vulnerable to malpractice. Below is a summary of Shengtong's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of a regulatory framework is alarming, as it implies that traders have minimal recourse in the event of disputes or financial mishaps. Furthermore, the absence of a history of compliance raises questions about the broker's operational integrity. In the financial industry, regulation plays a vital role in ensuring the protection of client funds and promoting fair trading practices. Without such safeguards in place, traders should be cautious when considering Shengtong as a trading partner.

Company Background Investigation

Shengtong's corporate history is another area of concern. Established in October 2021, the brokerage is relatively new in the market, which may contribute to its unregulated status. There is limited information available regarding its ownership structure and development history, further obscuring its credibility. The company claims to operate from a virtual office in Hong Kong, a location often associated with offshore entities that lack transparency.

The management team behind Shengtong is not well-documented, making it difficult to assess their expertise and experience in the financial sector. A transparent brokerage typically provides detailed biographies of its management team, including their qualifications and industry experience. However, Shengtong's lack of such disclosures raises red flags about its operational transparency. Without a clear understanding of who is running the brokerage, traders may find it challenging to trust the platform.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Shengtong offers various account types with different minimum deposits and leverage options. However, the absence of detailed information about spreads, commissions, and other trading costs raises concerns. Below is a comparative table of Shengtong's core trading costs:

| Cost Type | Shengtong | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Starting from 2 pips | 1-2 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not disclosed | Typically 0.5%-2% |

The lack of clarity regarding the cost structure could lead to unexpected expenses for traders, making it difficult to accurately assess potential profitability. Moreover, the reported issues with withdrawal processes and customer service responses further complicate the trading experience. Traders often rely on transparent fee structures to make informed decisions, and Shengtong's ambiguous policies may deter potential clients.

Customer Funds Security

The safety of customer funds is a critical aspect of any brokerage. Shengtong has not provided sufficient information regarding its security measures for client funds. The absence of segregation of client accounts, investor protection mechanisms, and negative balance protection raises significant concerns. Traders should feel secure knowing that their funds are held in separate accounts and that there are safeguards in place to protect them from potential losses.

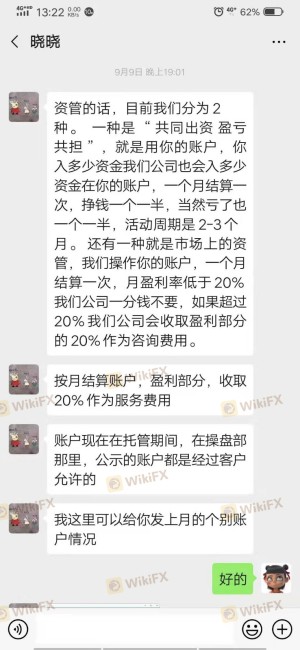

Historically, there have been complaints regarding withdrawal issues associated with Shengtong, indicating that traders have faced challenges accessing their funds. Such incidents can lead to a loss of trust and confidence in the brokerage, suggesting a potential risk for new clients. Without robust security measures and a clear commitment to protecting client funds, it is difficult to establish that Shengtong is a safe trading platform.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a brokerage. Reviews from users of Shengtong indicate a pattern of dissatisfaction, particularly regarding withdrawal processes and customer service responsiveness. Below is a summary of the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inadequate |

| Lack of Transparency | High | Unaddressed |

Many users have reported being unable to withdraw their funds, with some claiming that customer service has been unresponsive or dismissive. These complaints highlight significant operational issues that could pose risks for prospective traders. The failure to address customer concerns effectively further erodes trust in the brokerage, suggesting that Shengtong may not prioritize client satisfaction.

Platform and Trade Execution

The trading platform is a crucial element for any forex broker, impacting the overall trading experience. Shengtong offers the widely-used MetaTrader 4 (MT4) platform, which, while popular, is considered outdated compared to newer trading technologies. The platform's performance, stability, and user experience are vital for successful trading.

Concerns have been raised about order execution quality, including instances of slippage and rejected orders. Such issues can significantly affect trading outcomes, especially for those employing high-frequency trading strategies. Traders must be cautious of any indications of platform manipulation, as this can further compromise their trading experience.

Risk Assessment

Engaging with Shengtong carries inherent risks, primarily due to its lack of regulation and transparency. Below is a summary of the key risk areas associated with this brokerage:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Transparency Risk | Medium | Limited information on management and operations. |

| Platform Risk | Medium | Potential execution issues and platform stability. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts, and only invest amounts they can afford to lose. Engaging with regulated brokers is a recommended strategy for ensuring a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Shengtong is not a safe trading option. The absence of regulatory oversight, coupled with numerous complaints regarding withdrawal issues and poor customer service, raises significant red flags. Traders should exercise extreme caution when considering this brokerage, as the potential for fraud or mismanagement of funds is high.

For those seeking reliable alternatives, it is recommended to consider well-established and regulated brokers that prioritize client security and transparency. By choosing a reputable brokerage, traders can enhance their chances of a positive trading experience and safeguard their investments effectively.

Is ShengTong a scam, or is it legit?

The latest exposure and evaluation content of ShengTong brokers.

ShengTong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ShengTong latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.