RE1 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive re1 review looks at a forex broker that started in 2018. RE1 creates a complex picture for traders who might want to use their services. RE1 is an Australian forex broker that works under ASIC rules, which gives basic regulatory oversight. The broker's performance numbers show concerning results, with a WikiFX Score of just 1 out of 10. This score shows major user problems and possible operational issues.

The broker's main features include its ASIC regulatory status and customer support in multiple languages. They offer support in English and Simplified Chinese, which shows they want to serve both Western and Asian markets. These good points are overshadowed by consistently poor user feedback and limited transparency about trading conditions and services.

RE1 targets forex traders who care about regulatory compliance. They especially target those seeking ASIC-regulated brokers. Given the extremely low user satisfaction ratings and numerous negative reviews, potential clients should be very careful when considering this broker. The lack of detailed information about trading conditions, platform features, and service offerings makes concerns about the broker's overall reliability and transparency even worse.

Important Disclaimer

This review uses publicly available information and user feedback from various sources. RE1 has limited disclosure of detailed operational information, so some parts of this evaluation may not show a complete picture of the broker's services. Regulatory requirements and service availability may vary significantly across different areas, particularly given RE1's ASIC regulation. This regulation may not give the same protections to traders in all regions.

Readers should do their own research and consider talking with financial advisors before making any trading decisions. The information here reflects the state of available data as of 2025 and may not capture recent changes in the broker's operations or regulatory status.

Rating Framework

Broker Overview

RE1 appeared in the forex brokerage world in 2018. The company positioned itself as an Australian-based trading service provider. The company has tried to establish itself in the competitive forex market by getting ASIC regulation, which represents one of the stricter regulatory frameworks in the global forex industry. Despite this regulatory foundation, RE1 has struggled to build a positive reputation among traders. This is shown by consistently poor user ratings and feedback.

The broker's business model focuses mainly on forex trading services. Specific details about their service offerings remain notably limited in publicly available information. This lack of transparency has become a recurring theme in user complaints and adds to the overall doubt surrounding the broker's operations. The company's Australian headquarters theoretically provides access to strong regulatory protections, but practical user experiences suggest these theoretical benefits may not translate into superior service delivery.

From a regulatory perspective, RE1 operates under the supervision of the Australian Securities and Investments Commission. ASIC requires adherence to strict capital adequacy requirements, client fund segregation, and operational transparency standards. The stark contrast between these regulatory expectations and the broker's actual user ratings raises questions about compliance monitoring and enforcement. This re1 review reveals a significant disconnect between regulatory status and practical service delivery that potential clients must carefully consider.

Regulatory Jurisdiction

RE1 operates under ASIC regulation. This provides a framework of investor protections typically associated with Australian financial services. Traders should verify that these protections extend to their specific area and trading circumstances.

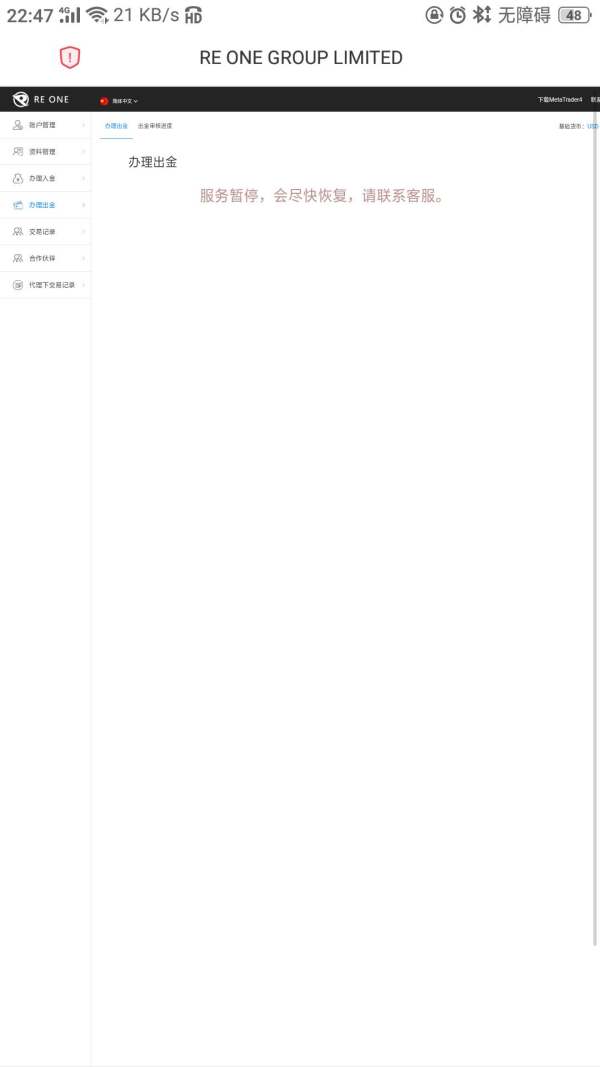

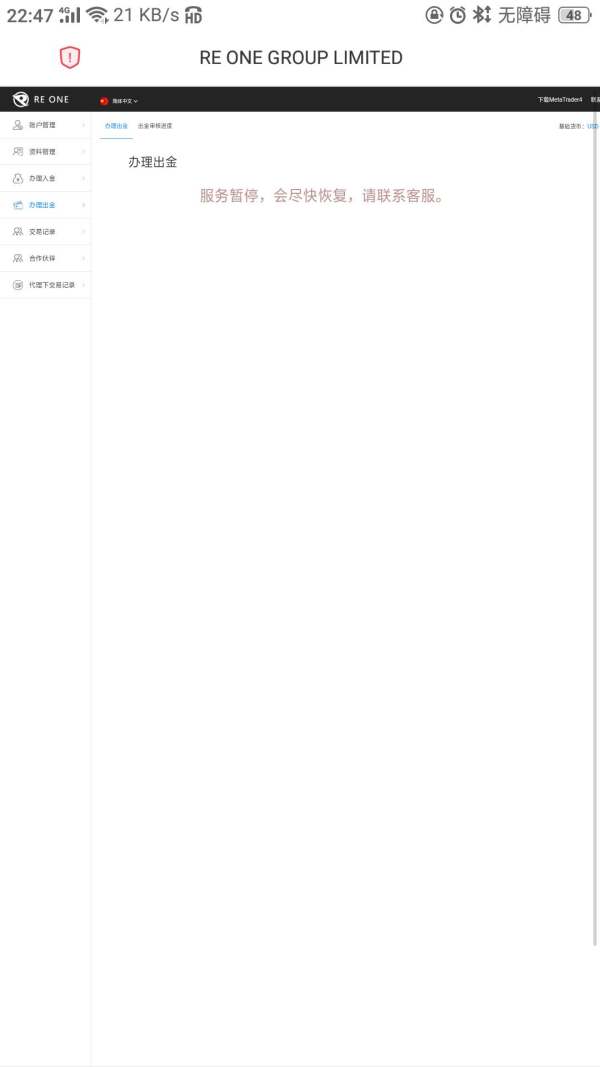

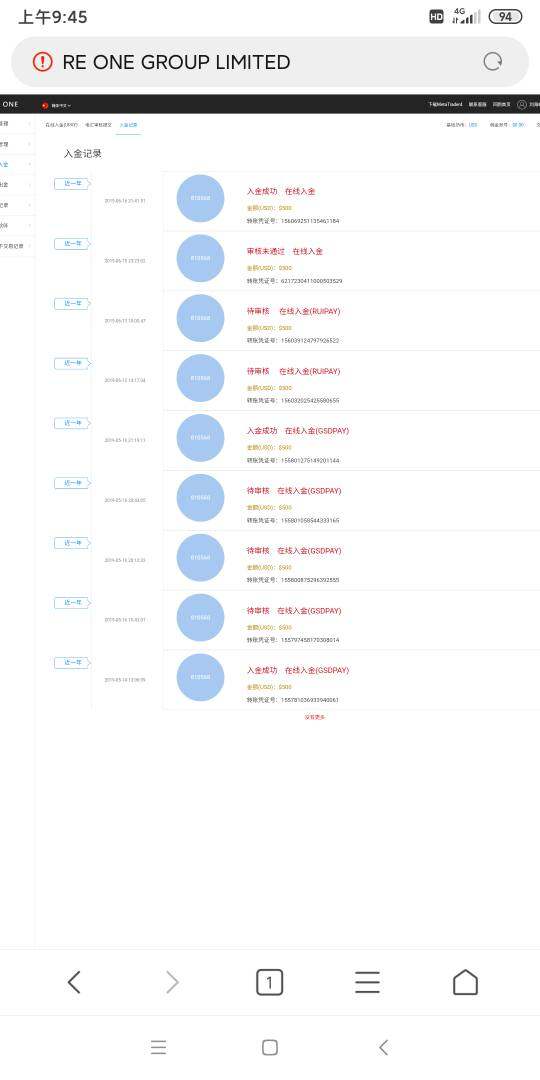

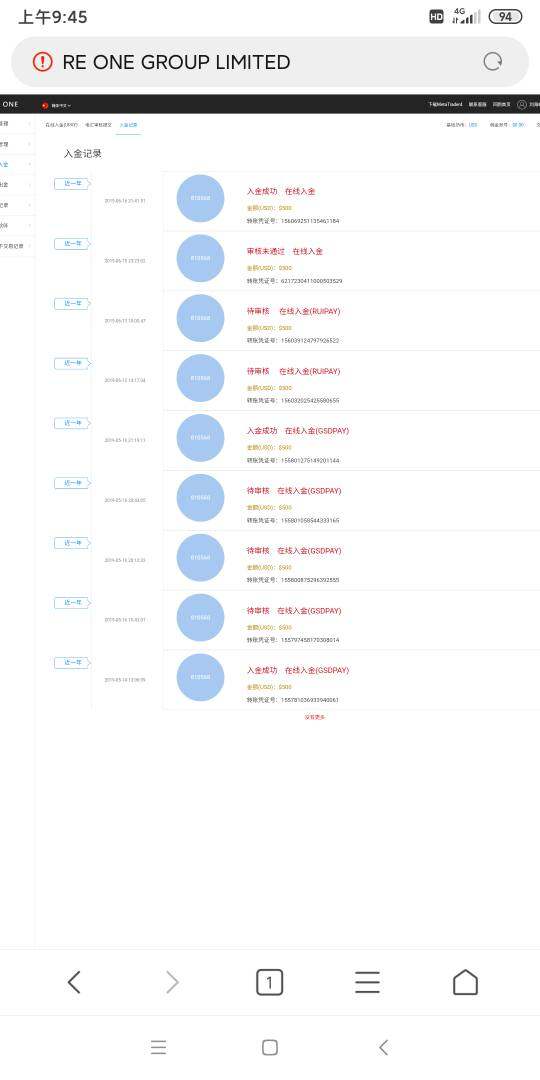

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not detailed in available resources. This represents a significant transparency gap that potential clients should address directly with the broker before opening accounts.

Minimum Deposit Requirements

The broker has not clearly disclosed minimum deposit requirements in publicly available materials. This makes it difficult for potential traders to assess accessibility and entry barriers.

No specific information about promotional offers or bonus programs is available in current resources. This suggests either the absence of such programs or limited marketing transparency.

Tradeable Assets

RE1 identifies as a forex broker, but specific details about available currency pairs, exotic currencies, or additional asset classes remain undisclosed. Available documentation does not provide this information.

Cost Structure

Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available resources. This makes cost comparison with other brokers impossible based on public information.

Leverage Ratios

Leverage offerings and maximum leverage ratios are not specified in available materials. ASIC regulation typically imposes specific leverage limits for retail traders.

The trading platforms offered by RE1 are not clearly identified in available resources. This leaves potential clients without crucial information about trading infrastructure and capabilities.

Geographic Restrictions

Specific information about geographic restrictions or service availability limitations is not detailed in current resources. Direct verification with the broker is required.

Customer Support Languages

RE1 provides customer support in English and Simplified Chinese. This indicates an attempt to serve both Western and Asian market segments.

This re1 review highlights the concerning lack of detailed operational information. This compounds the negative user feedback and raises questions about the broker's commitment to transparency and client service.

Detailed Rating Analysis

Account Conditions Analysis

RE1's account conditions receive a low rating mainly due to the lack of transparent information about account types, features, and requirements. Available resources do not provide clear details about different account tiers, minimum balance requirements, or special account features that might benefit different trader profiles. This information gap represents a significant concern for potential clients who need to understand account structures before committing funds.

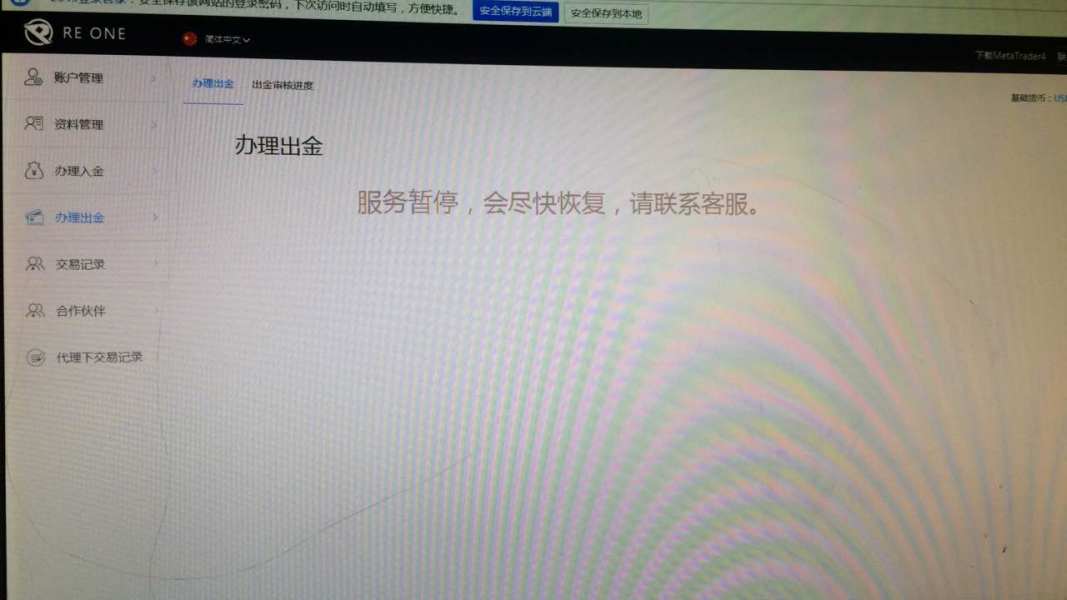

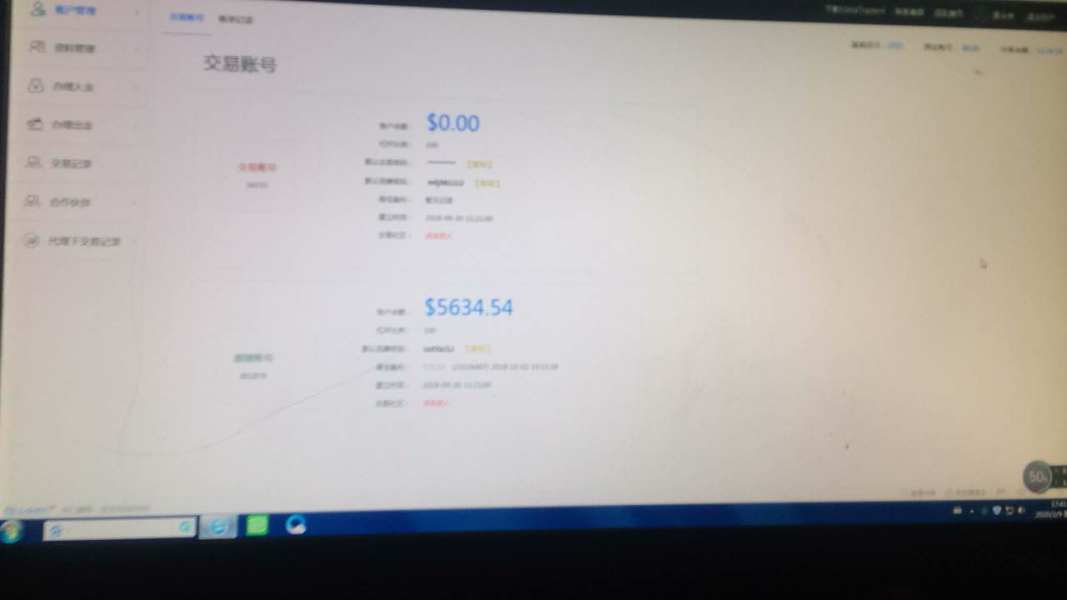

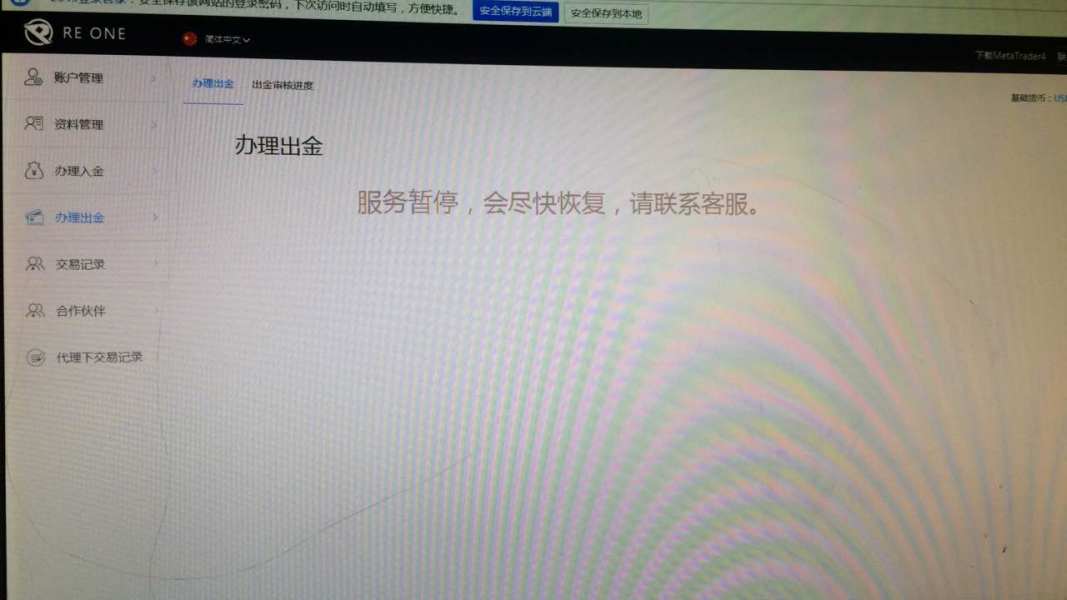

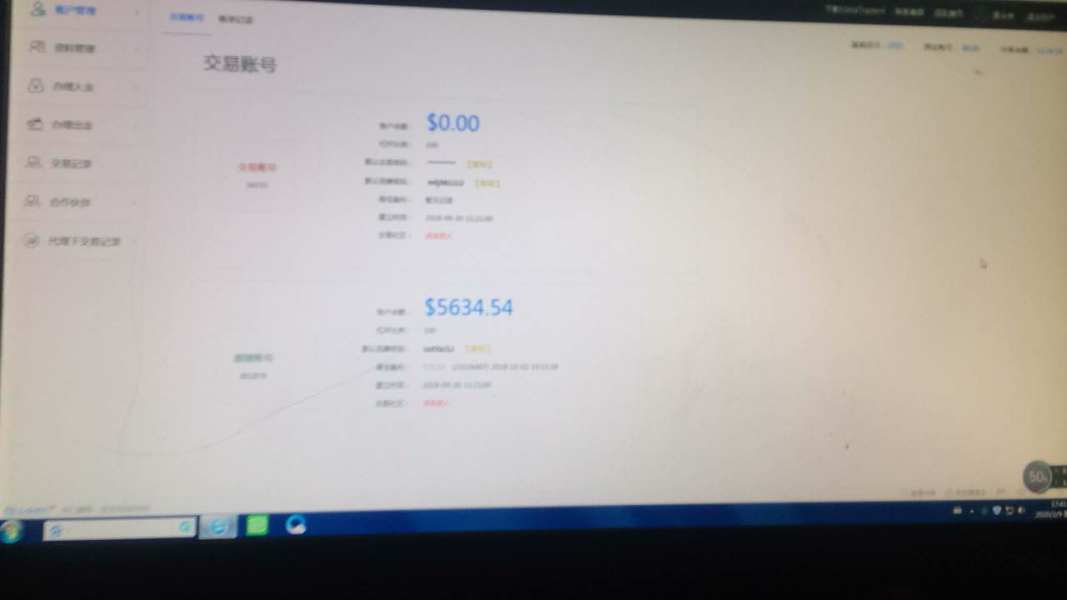

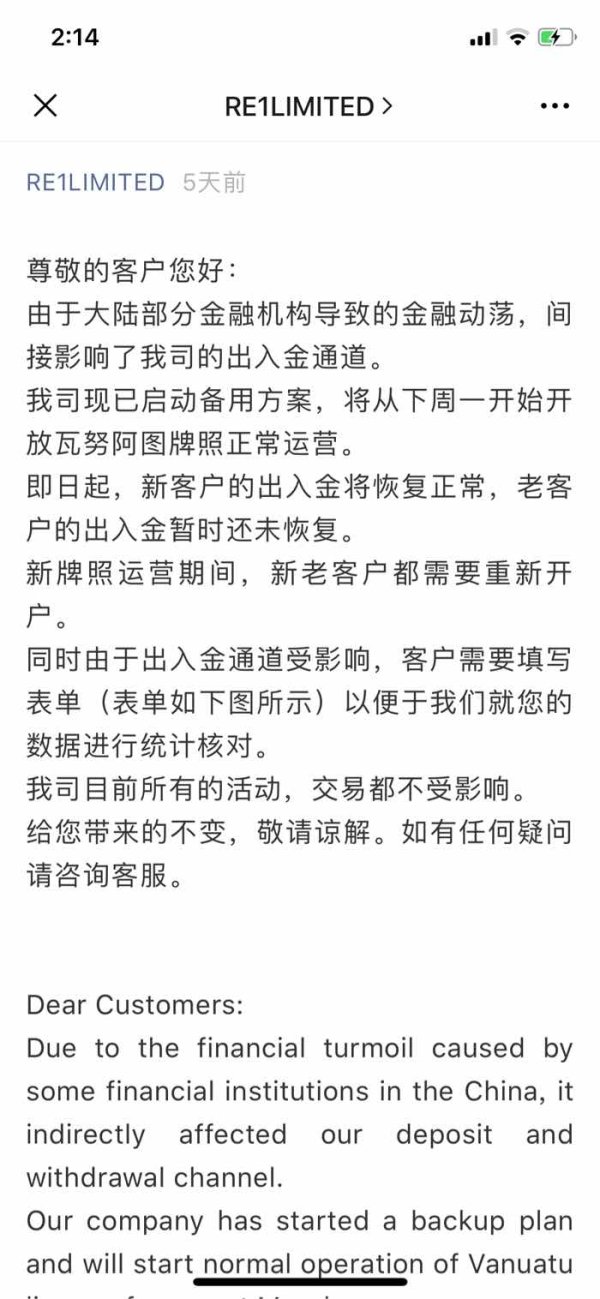

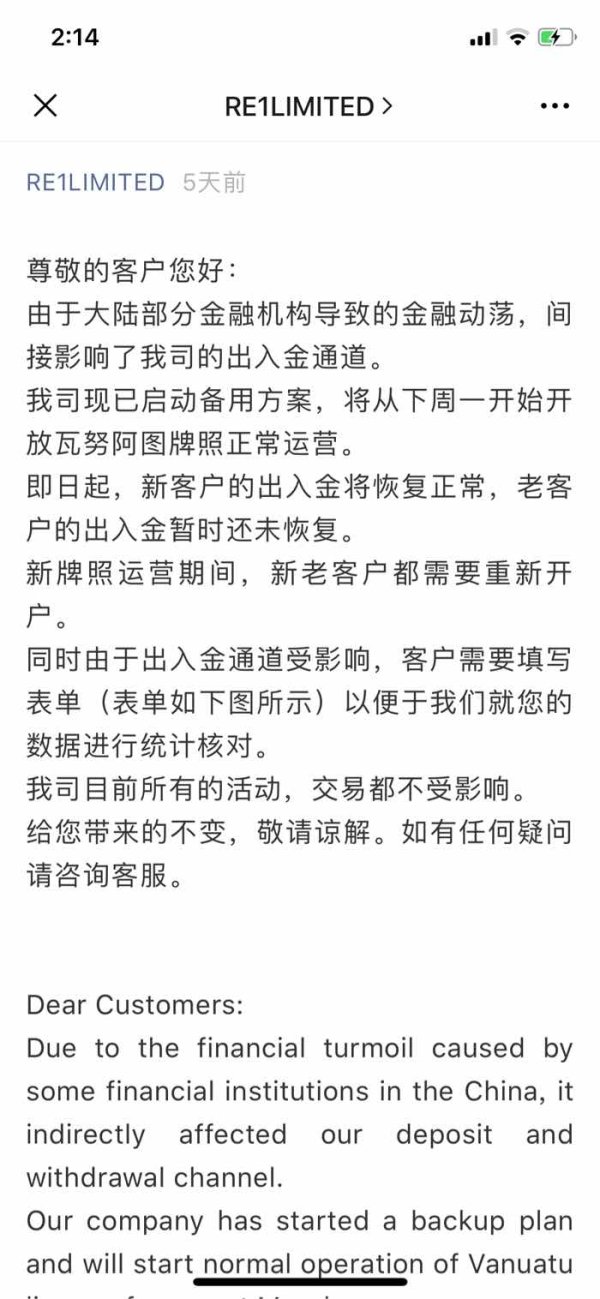

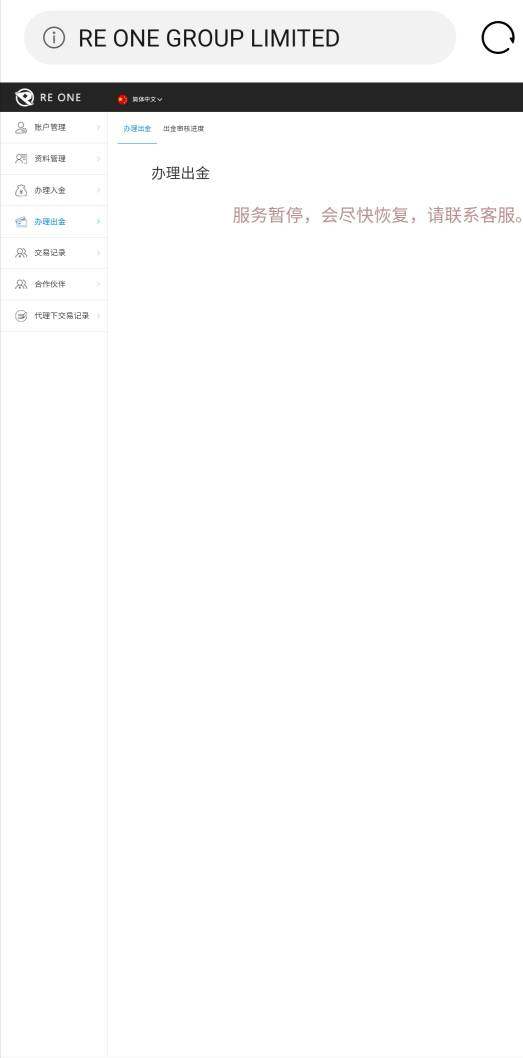

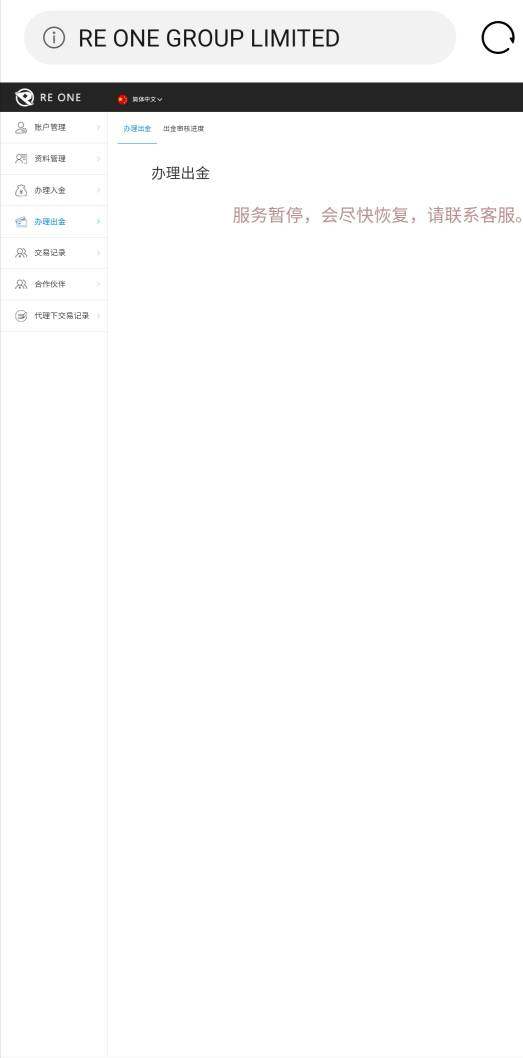

The absence of detailed account condition information is particularly problematic given the broker's poor user ratings. Traders report difficulties accessing their funds, with one notable case mentioning that "12 thousand RMB was unavailable for 6 months." Such reports suggest potential issues with account management, fund accessibility, or withdrawal processes that directly impact account holders' experiences.

No information is available about specialized account types such as Islamic accounts, professional trader accounts, or accounts with enhanced features for high-volume traders. This lack of account diversity and transparency suggests limited accommodation for different trader needs and preferences. The combination of poor user feedback and inadequate information disclosure results in a low confidence rating for account conditions.

The re1 review data indicates that potential clients should exercise extreme caution and demand comprehensive account condition information before proceeding with account opening. This is given the apparent disconnect between regulatory status and actual service delivery.

RE1's tools and resources offering receives one of the lowest ratings due to the complete absence of information about trading tools, analytical resources, or educational materials. Modern forex trading requires sophisticated analytical tools, real-time market data, economic calendars, and educational resources to support trader decision-making. The lack of any mention of such resources in available materials suggests either their absence or poor marketing of existing capabilities.

Professional forex traders typically expect access to technical analysis tools, fundamental analysis resources, market research, and educational content. This content ranges from basic forex concepts to advanced trading strategies. The absence of information about these essential resources raises serious questions about RE1's commitment to supporting trader success and development.

No information is available about automated trading support, API access, or integration with third-party analytical tools that experienced traders often require. The modern forex trading environment demands technological sophistication and comprehensive resource availability, areas where RE1 appears to fall significantly short based on available information.

User feedback does not provide specific insights into tool quality or resource availability. This further emphasizes the information vacuum surrounding this critical aspect of broker services. This lack of transparency and apparent absence of comprehensive trading support tools contributes to the overall poor assessment of RE1's service offering.

Customer Service and Support Analysis

RE1's customer service receives a moderate rating mainly due to its multilingual support capability. They offer assistance in English and Simplified Chinese. This language support suggests an attempt to serve diverse international markets and accommodate traders from different linguistic backgrounds. This positive aspect is significantly undermined by poor overall user ratings and feedback.

The availability of customer service channels, response times, and service quality metrics are not detailed in available resources. This makes it difficult to assess the actual effectiveness of customer support operations. Professional forex brokers typically provide multiple contact channels including phone, email, live chat, and sometimes social media support, with clearly defined response time commitments and service level agreements.

User feedback suggests significant customer service issues, with reports of prolonged fund access problems and general dissatisfaction. The case of funds being "unavailable for 6 months" indicates potential customer service failures in resolving critical client issues. Such reports suggest that while multilingual support may be available, the quality and effectiveness of problem resolution may be severely lacking.

The contrast between theoretical language support capabilities and actual user experiences creates a mixed picture where basic infrastructure exists but practical service delivery appears inadequate. This re1 review suggests that potential clients should thoroughly test customer service responsiveness and effectiveness before committing significant funds.

Trading Experience Analysis

The trading experience with RE1 receives a very low rating based on extremely poor user satisfaction indicators and the absence of detailed information about platform capabilities, execution quality, and trading environment features. The WikiFX Score of 1 out of 10 strongly suggests that users have encountered significant problems with their trading experiences. These range from platform issues to execution problems.

Modern forex trading requires stable, fast, and reliable trading platforms with sophisticated order management capabilities, real-time price feeds, and comprehensive charting tools. The lack of information about platform specifications, uptime statistics, or execution quality metrics raises concerns about RE1's technological infrastructure and commitment to providing professional trading environments.

User feedback, while limited in specific details, indicates widespread dissatisfaction with the overall trading experience. Reports of fund access issues suggest potential problems with the trading infrastructure or account management systems that directly impact traders' ability to manage their positions and access their capital effectively.

The absence of mobile trading information, platform stability data, or execution speed metrics further compounds concerns about the trading environment quality. Professional traders require detailed information about slippage rates, execution speeds, and platform reliability to make informed broker selection decisions.

This re1 review indicates that the trading experience appears to fall well below industry standards. User feedback suggests significant operational issues that potential clients should carefully consider before opening trading accounts.

Trust and Reliability Analysis

RE1's trust and reliability rating reflects the complex contradiction between regulatory status and user experiences. The broker's ASIC regulation provides a foundation of regulatory oversight and theoretical investor protections. This includes requirements for capital adequacy, client fund segregation, and operational compliance. ASIC regulation is generally considered among the more stringent regulatory frameworks in the global forex industry.

This regulatory foundation is severely undermined by consistently poor user feedback and an extremely low WikiFX Score of 1 out of 10. Such ratings suggest widespread user dissatisfaction and potential trust issues that contradict the theoretical protections provided by ASIC oversight. The disconnect between regulatory status and user experiences raises questions about compliance monitoring and the practical effectiveness of regulatory protections.

Fund safety concerns are highlighted by user reports of prolonged fund access issues. There are specific mentions of funds being unavailable for extended periods. Such reports directly contradict the client fund protection requirements typically associated with ASIC regulation and suggest potential operational or compliance issues.

The lack of transparency regarding company financial information, operational statistics, or third-party audits further compounds trust concerns. Professional forex brokers typically provide detailed information about their financial stability, operational procedures, and risk management practices to build client confidence.

The combination of regulatory status and poor user experiences creates a complex trust profile that requires careful evaluation by potential clients seeking reliable forex trading services.

User Experience Analysis

RE1's user experience receives one of the lowest possible ratings based on the WikiFX Score of 1 out of 10 and consistently negative user feedback. This extremely low satisfaction rating indicates widespread problems with various aspects of the user experience. These range from account opening and platform usage to fund management and customer service interactions.

The user experience encompasses all touchpoints between traders and the broker. This includes website navigation, account registration processes, platform usability, customer service interactions, and fund management procedures. The absence of detailed information about these user journey elements, combined with poor satisfaction ratings, suggests significant deficiencies across multiple user interaction points.

Specific user complaints, while limited in available details, indicate serious operational issues including prolonged fund access problems that directly impact trader satisfaction and confidence. Professional forex trading requires seamless user experiences that support rapid decision-making and efficient fund management, areas where RE1 appears to fall significantly short.

The lack of positive user testimonials, detailed service descriptions, or user interface demonstrations further emphasizes the poor user experience profile. Modern forex brokers typically invest heavily in user experience optimization, providing intuitive interfaces, streamlined processes, and comprehensive user support resources.

Given the extremely poor user satisfaction indicators and the absence of evidence suggesting service improvements, potential clients should approach RE1 with significant caution. They should thoroughly evaluate alternative broker options that demonstrate stronger commitments to user experience excellence.

Conclusion

This comprehensive re1 review reveals a forex broker with fundamental contradictions between its regulatory status and actual service delivery. RE1 operates under ASIC regulation, which theoretically provides robust investor protections. The broker's WikiFX Score of 1 out of 10 and consistently poor user feedback indicate significant operational and service quality issues that potential clients must carefully consider.

RE1 may appeal to traders who prioritize regulatory compliance and require multilingual support in English and Simplified Chinese. The extremely poor user satisfaction ratings, lack of transparency regarding trading conditions and services, and reports of fund access issues suggest that these potential benefits are overshadowed by substantial operational concerns.

The primary advantages of RE1 include its ASIC regulatory status and multilingual customer support capabilities. These are significantly outweighed by major disadvantages including poor user satisfaction ratings, lack of detailed service information, reported fund access issues, and absence of comprehensive trading tools and resources. Potential clients should exercise extreme caution and thoroughly research alternative brokers that demonstrate stronger commitments to service quality, transparency, and user satisfaction before considering RE1 for their forex trading needs.