Is SCEID safe?

Pros

Cons

Is SCEID Safe or Scam?

Introduction

SCEID, a forex broker established in 2019 and based in the United Kingdom, has emerged as a player in the competitive foreign exchange market. With the growing number of forex brokers, traders must exercise caution and thoroughly evaluate the legitimacy and safety of their chosen platforms. The forex market is rife with potential risks, and understanding the regulatory landscape, trading conditions, and customer experiences is crucial for safeguarding investments. This article investigates whether SCEID is a safe option for traders or if it raises red flags indicating potential scams. We will employ a structured assessment framework that includes regulatory compliance, company background, trading conditions, customer experiences, and risk evaluation.

Regulatory and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. SCEID claims to operate under the oversight of the National Futures Association (NFA); however, it has been flagged as unauthorized by various sources. The table below summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0526289 | United States | Unauthorized |

The importance of regulation cannot be overstated. Regulatory bodies like the NFA enforce strict compliance measures to protect traders from fraud and malpractice. A broker that operates without proper regulation poses significant risks to investors. In SCEID's case, the lack of proper regulatory oversight raises concerns regarding its operational integrity. Furthermore, historical compliance issues have been noted, with reports indicating that SCEID has received numerous complaints from users regarding withdrawal difficulties and unresponsive customer service. These factors contribute to the growing skepticism surrounding whether SCEID is safe for trading.

Company Background Investigation

SCEID was founded in 2019, making it a relatively new entrant in the forex market. Its ownership structure and management team are vital for assessing its credibility. Unfortunately, information regarding the management team and their qualifications is sparse, which is a potential red flag for transparency. A company that lacks clear information about its leadership may not be fully committed to ethical business practices.

Moreover, SCEID's transparency regarding its operations and financial disclosures is questionable. A reliable broker typically provides detailed information about its business practices, ownership, and regulatory compliance. In contrast, SCEID's limited information makes it difficult for potential clients to evaluate its credibility effectively. This lack of transparency is concerning and contributes to the overall uncertainty regarding whether SCEID is safe for traders.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. SCEID's fee structure includes spreads, commissions, and overnight interest rates. However, the specifics of these fees are not readily available, making it challenging to assess their competitiveness compared to industry averages. The following table provides a comparative analysis of core trading costs:

| Fee Type | SCEID | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unavailable | 1-2 pips |

| Commission Model | Unavailable | Varies |

| Overnight Interest Range | Unavailable | Varies |

The lack of clear information on trading costs raises concerns about potential hidden fees, which could impact traders' profitability. Furthermore, if a broker's fees are significantly higher than the industry average, it may indicate an attempt to exploit traders. Therefore, the ambiguity surrounding SCEID's trading conditions adds to the skepticism regarding its safety.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. SCEID claims to implement measures to safeguard client funds, such as segregating client accounts from company funds. However, the effectiveness of these measures remains unclear due to the lack of detailed information available to the public. Additionally, there are no indications of investor protection schemes or negative balance protection policies in place at SCEID.

Historically, there have been complaints related to SCEID's handling of customer funds. Reports suggest that multiple users have experienced difficulties with fund withdrawals, raising questions about the broker's commitment to safeguarding client investments. These issues contribute to the overall perception that SCEID may not be safe for trading, as the lack of effective fund protection measures can lead to significant financial losses for traders.

Customer Experience and Complaints

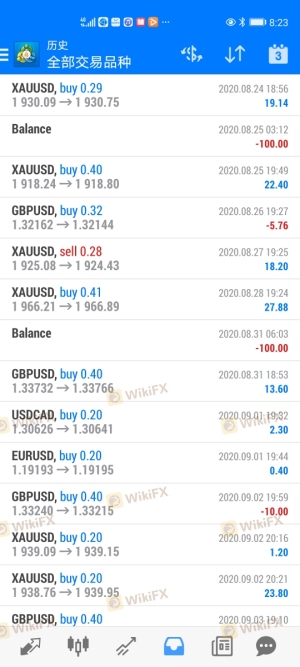

Customer feedback is a valuable resource for assessing a broker's reliability. SCEID has received numerous complaints, with 43 reported issues in the past three months alone. The most common complaints include withdrawal difficulties and unresponsive customer service. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | Poor |

The severity of these complaints indicates a troubling trend for SCEID. Many users have expressed frustration over their inability to withdraw funds, which is a significant red flag for any broker. Additionally, the company's poor response to customer inquiries exacerbates the situation, leading to a lack of trust among traders. These patterns raise substantial concerns about whether SCEID is safe for trading, as a broker that fails to address customer issues effectively may not prioritize the interests of its clients.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for traders. SCEID utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its customizable features and user-friendly interface. However, there are reports of execution issues, including slippage and order rejections, which can negatively impact trading outcomes. A broker that frequently experiences execution problems may indicate a lack of professionalism or even manipulation.

Furthermore, any signs of platform manipulation, such as artificially inflating spreads during volatile market conditions, raise significant concerns about the broker's integrity. Traders need to be vigilant and monitor their trading experiences closely to ensure they are not subjected to unfair practices. Given these factors, it is essential to question whether SCEID is safe for trading, especially for those who rely heavily on platform performance for their trading strategies.

Risk Assessment

Using SCEID for trading involves several risks that traders must consider. The following table summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation raises concerns. |

| Customer Service Risk | High | Numerous complaints about unresponsive service. |

| Fund Security Risk | High | Issues with fund withdrawals and lack of protection measures. |

Traders should take these risks seriously and consider implementing risk mitigation strategies. For instance, starting with a small deposit can help minimize potential losses while assessing the broker's reliability. Additionally, diversifying investments across multiple brokers may reduce exposure to any single broker's risks. Given the high-risk levels associated with SCEID, traders should proceed with caution.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about whether SCEID is safe for trading. The lack of proper regulation, numerous complaints from customers, and issues with fund security all point toward potential red flags. While SCEID may offer certain trading advantages, the overall perception is that it poses considerable risks to traders.

For those considering trading with SCEID, it is advisable to proceed with extreme caution. New traders or those with limited experience should consider seeking alternative, more reputable brokers with solid regulatory oversight and positive customer feedback. Recommendations for reliable alternatives include brokers with established track records and transparent operations, ensuring a safer trading environment. Ultimately, the safety of your investments should always be the top priority, and thorough research is essential in making informed trading decisions.

Is SCEID a scam, or is it legit?

The latest exposure and evaluation content of SCEID brokers.

SCEID Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCEID latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.