Is RTI365 safe?

Business

License

Is RTI365 Safe or Scam?

Introduction

RTI365 is an online forex broker that has recently garnered attention in the trading community. Operating in a highly competitive market, RTI365 claims to offer a range of trading instruments, including forex, commodities, and cryptocurrencies. However, the importance of due diligence in evaluating forex brokers cannot be overstated. With the increasing number of scams and fraudulent activities in the online trading space, traders must carefully assess the legitimacy and safety of the platforms they choose to engage with. This article aims to provide an objective analysis of RTI365, investigating its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risks involved. The evaluation is based on a thorough review of various online sources, including user feedback, expert opinions, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy and safety. RTI365 operates without any regulatory oversight, which raises significant concerns about the protection of client funds and the broker's operational transparency. The absence of regulation means that RTI365 is not held accountable by any financial authority, leaving traders vulnerable to potential fraud.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a license from reputable regulatory bodies such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) is a major red flag. Regulated brokers are required to adhere to strict guidelines that ensure client protection, including segregated accounts for client funds and negative balance protection. In contrast, RTI365s unregulated status means it can operate with little to no accountability, making it a risky choice for traders who prioritize safety.

Company Background Investigation

Understanding the company structure and history behind RTI365 provides further insights into its reliability. Established in 2021, RTI365 claims to be based in the United Kingdom, but there is a lack of transparency regarding its ownership and management team. The absence of verifiable information about the individuals running the brokerage raises questions about its credibility and operational integrity.

While the website lists a contact number and an email address, these details are insufficient to establish trust. Furthermore, the lack of a physical address and the vague information about the company's history contribute to the perception that RTI365 may not be a trustworthy broker. A transparent company is typically characterized by clear information about its leadership, operational history, and regulatory compliance, all of which are noticeably absent in the case of RTI365.

Trading Conditions Analysis

When evaluating whether RTI365 is safe, it's essential to analyze its trading conditions and fee structures. The broker offers a minimum deposit requirement of $1,000, which is significantly higher than many competitors who allow traders to start with as little as $100. This high barrier to entry can deter novice traders who may be looking for more accessible options.

| Fee Type | RTI365 | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 3 pips | 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by RTI365 are considerably higher than the industry average, which could affect overall trading profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden costs that may not be immediately apparent to traders. Such discrepancies in trading conditions can make it challenging for traders to achieve consistent profitability, further questioning the safety and reliability of RTI365.

Client Fund Safety

Client fund safety is paramount when determining if RTI365 is safe. Unfortunately, RTI365 does not provide adequate measures to protect client funds. The broker does not offer segregated accounts, which means that client funds may be mixed with the companys operating funds. This poses a significant risk, as it increases the likelihood of losing access to funds in the event of the broker's insolvency.

Furthermore, RTI365 lacks any investor protection schemes, which are typically provided by regulated brokers to safeguard client funds. The absence of such measures leaves traders without recourse in the event of a dispute or if the broker decides to withhold funds. Historical evidence of fund safety issues or controversies involving RTI365 has not been disclosed, but the lack of regulatory oversight raises serious concerns about the potential for future problems.

Customer Experience and Complaints

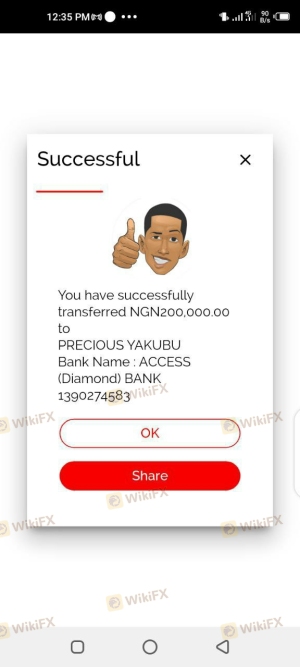

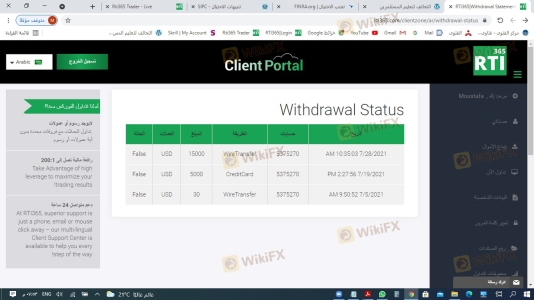

Analyzing customer feedback is crucial in assessing whether RTI365 is safe. Numerous reports from traders indicate dissatisfaction with the broker's services, particularly regarding withdrawal processes. Common complaints include delays in processing withdrawals, lack of communication from customer support, and difficulties in accessing funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Information | High | Poor |

One notable case involves a trader who deposited $15,000 and reported being unable to withdraw their funds despite generating profits. The trader claimed that the broker cited system errors and subsequently ceased communication. Such experiences are alarming and highlight the risks associated with trading with unregulated brokers like RTI365.

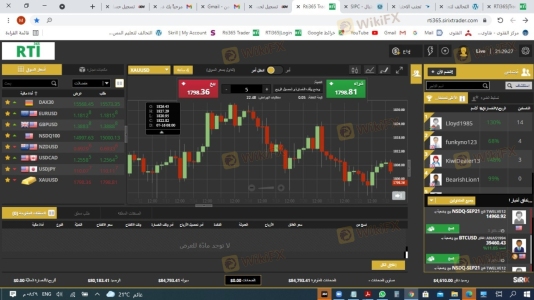

Platform and Trade Execution

The trading platform provided by RTI365 is another critical aspect to consider when evaluating its safety. The broker utilizes the Sirix trading platform, which, while functional, lacks the advanced features and stability offered by industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform performance, including slippage and order rejections, which can significantly impact trading outcomes.

The possibility of platform manipulation is a concern, especially given the broker's unregulated status. Traders must be cautious, as unscrupulous brokers may manipulate trading conditions to their advantage, further eroding trust in the platform.

Risk Assessment

A comprehensive risk assessment is essential in determining whether RTI365 is safe for trading. The following risk categories highlight the significant concerns associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud potential. |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Poor communication and support responsiveness. |

| Platform Stability Risk | High | Reports of slippage and execution issues. |

To mitigate these risks, traders should conduct thorough research, avoid depositing large sums of money, and consider using a regulated broker with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that RTI365 is not a safe trading option. The absence of regulatory oversight, high fees, lack of transparency, and numerous customer complaints indicate a higher risk of fraud and financial loss. Traders seeking a reliable and secure trading environment should be wary of engaging with RTI365.

For those looking to trade forex, it is advisable to choose brokers that are regulated by reputable authorities and provide clear information about their services and fees. Some recommended alternatives include established brokers such as IG, OANDA, or Forex.com, which offer robust regulatory frameworks, competitive trading conditions, and reliable customer support. Ultimately, prioritizing safety and transparency is crucial for successful trading in the forex market.

Is RTI365 a scam, or is it legit?

The latest exposure and evaluation content of RTI365 brokers.

RTI365 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RTI365 latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.