Is MCFX safe?

Pros

Cons

Is MCFX Safe or a Scam?

Introduction

MCFX, an online forex broker, has positioned itself within the competitive landscape of the foreign exchange market. Established in the United Kingdom and operational for several years, MCFX offers trading services through the widely-used MetaTrader 4 platform. For traders, especially those new to the forex market, evaluating the trustworthiness of a broker is crucial. The potential risks associated with unregulated trading can lead to significant financial losses. Therefore, it is essential to conduct a thorough assessment of MCFX's regulatory status, operational history, and customer experiences. This article employs a comprehensive evaluation framework, combining qualitative assessments and quantitative data to determine whether MCFX is safe or if it poses risks to its clients.

Regulation and Legitimacy

The regulatory environment of a forex broker is a fundamental aspect that influences its credibility. MCFX operates without oversight from recognized financial authorities, which raises significant concerns about its legitimacy. The absence of regulation means that traders may lack the necessary protections in case of disputes or financial irregularities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulatory oversight is alarming, as it indicates that MCFX may not adhere to the stringent standards set by reputable financial institutions. Regulatory bodies enforce rules designed to protect traders, ensuring fair trading practices and safeguarding client funds. Throughout its operational history, MCFX has faced scrutiny for its unregulated status, which has resulted in a low rating of 1.51 on platforms like WikiFX. This rating reflects potential issues with the broker's transparency and client satisfaction. Consequently, the absence of regulation is a critical factor for traders to consider when questioning, "Is MCFX safe?"

Company Background Investigation

MCFX was founded approximately five to ten years ago, and its ownership structure remains somewhat opaque. While the broker claims to operate from the United Kingdom, there is little information available regarding its management team or operational history. Transparency is vital for any brokerage, as it builds trust with clients. However, MCFX's lack of detailed information about its founders and management raises red flags.

The company's website has also faced accessibility issues, which can hinder potential clients from obtaining essential information about its services and terms of operation. Such inaccessibility is often viewed as a warning sign, indicating that the broker may not be fully operational or may be undergoing significant changes. The absence of a clear company history and management background further complicates the question of whether MCFX is safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is paramount. MCFX's fee structure and trading conditions are critical components that potential clients must scrutinize. The broker offers various trading instruments but does not provide clear information about its fee structure, which can lead to confusion and unexpected costs for traders.

| Fee Type | MCFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of transparent information regarding spreads, commissions, and overnight interest rates raises concerns. Traders should be wary of hidden fees that can erode their profits. Additionally, the lack of a clear commission structure may indicate that MCFX could impose unexpected costs, leading to further financial risks. As such, traders must ask themselves, "Is MCFX safe?" when considering the potential financial implications of trading with this broker.

Client Funds Security

The security of client funds is another critical factor in assessing a broker's reliability. MCFX's approach to fund safety remains ambiguous, with limited information available regarding its policies on fund segregation, investor protection, and negative balance protection.

Traders should prioritize brokers that offer robust security measures, including the segregation of client funds into separate accounts, which protects them in the event of the broker's insolvency. Furthermore, negative balance protection is essential for safeguarding clients from losing more than their initial investment.

MCFX's lack of transparency regarding these critical safety measures raises significant concerns about the security of client funds. Historical complaints about fund withdrawals and other financial disputes further exacerbate the question of whether MCFX is safe for trading.

Customer Experience and Complaints

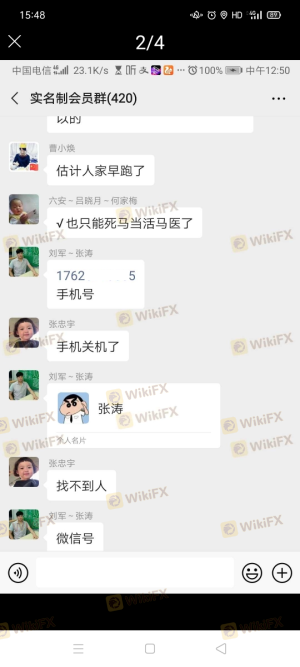

Analyzing customer feedback is crucial in understanding a broker's reliability. MCFX has received numerous complaints from users, indicating potential issues with customer service and trading practices. Common complaints range from difficulty withdrawing funds to poor customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Fair |

| Misleading Promotions | High | Poor |

One notable case involved multiple clients reporting that they were unable to withdraw their funds, raising alarms about the broker's operational integrity. Another frequent complaint pertains to the quality of customer service, with many users expressing frustration over delayed responses and a lack of effective resolutions to their issues. Such patterns of complaints significantly contribute to the question, "Is MCFX safe?" for potential clients.

Platform and Trade Execution

The trading platform is a vital aspect of the overall trading experience. MCFX utilizes the MetaTrader 4 platform, which is well-regarded in the industry for its user-friendly interface and advanced charting capabilities. However, the performance and reliability of the platform are equally important.

Issues such as order execution delays, slippage, and high rejection rates can severely impact a trader's experience. Reports of execution problems on MCFX's platform have surfaced, suggesting that traders may face challenges when attempting to execute trades efficiently. Such issues raise further concerns about the broker's operational integrity and reliability.

Risk Assessment

Using MCFX involves various risks, primarily due to its unregulated status and the associated lack of investor protections.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Numerous complaints regarding service quality. |

Traders should approach MCFX with caution, understanding that the absence of regulation and the potential for hidden fees can lead to significant financial risks. To mitigate these risks, it is advisable for traders to conduct thorough research and consider trading with regulated alternatives that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that MCFX may not be a safe choice for traders. The broker's lack of regulation, coupled with numerous complaints regarding fund safety and customer service, raises significant concerns. Potential clients should carefully consider these factors before deciding to trade with MCFX.

For those seeking reliable forex trading options, it is advisable to explore regulated brokers with transparent fee structures and robust customer support. Some recommended alternatives include well-established brokers with strong regulatory oversight, such as IG Group, OANDA, or Forex.com. These options provide a safer trading environment and greater peace of mind for traders. Ultimately, the question of "Is MCFX safe?" leans toward a negative response, warranting caution for potential clients.

Is MCFX a scam, or is it legit?

The latest exposure and evaluation content of MCFX brokers.

MCFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MCFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.