Is ROYAL CAMEL safe?

Pros

Cons

Is Royal Camel Safe or a Scam?

Introduction

Royal Camel is a forex broker that has garnered attention in the trading community, yet it remains shrouded in uncertainty regarding its legitimacy and reliability. As traders navigate the complex and often volatile forex market, it is crucial to assess the credibility of brokers before committing any capital. The potential for scams and fraudulent activities in the forex industry necessitates a thorough evaluation of brokers like Royal Camel. This article aims to provide an objective analysis of Royal Camel's safety, regulatory status, trading conditions, and overall reputation based on comprehensive research and user feedback.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict financial standards and ethical practices. Unfortunately, Royal Camel currently operates without any valid regulatory oversight, raising concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Royal Camel is not subject to the rigorous compliance requirements imposed by reputable financial authorities. This lack of oversight increases the risk of potential fraud and malpractice, making it essential for traders to approach Royal Camel with caution. Without a regulatory framework, there is no assurance that client funds are protected or that trading practices are conducted transparently.

Company Background Investigation

Royal Camel's history and ownership structure are critical components in evaluating its trustworthiness. Unfortunately, information regarding the company's background is sparse, which is often a red flag in the financial services industry. A lack of transparency regarding management and operational practices can lead to concerns about accountability and ethical conduct.

The management teams experience is another essential factor in assessing a broker's credibility. In the case of Royal Camel, there is limited information available about the qualifications and professional backgrounds of its leadership. This opacity can lead to mistrust among potential clients.

Furthermore, the company's failure to provide clear and accessible information about its operations and ownership may indicate a lack of commitment to transparency. Traders should be wary of brokers that do not openly disclose their corporate structure and management team, as this can be a sign of potential misconduct.

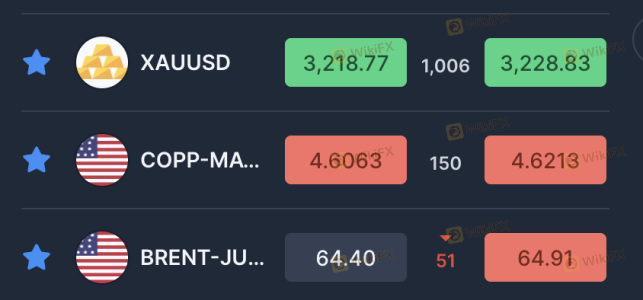

Trading Conditions Analysis

Understanding the trading conditions offered by Royal Camel is vital for potential clients. The broker's fee structure and trading costs can significantly impact a trader's profitability. Royal Camel's overall fees appear to be higher than the industry average, which could deter traders looking for cost-effective trading solutions.

| Fee Type | Royal Camel | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | High | Low |

| Overnight Interest Range | Varies | Standard |

The high costs associated with trading at Royal Camel may not justify the potential benefits, particularly for novice traders. Additionally, any unusual or opaque fee policies could further complicate the trading experience, leading to unexpected expenses. Traders are advised to thoroughly review the fee structure before engaging with Royal Camel to avoid any unpleasant surprises.

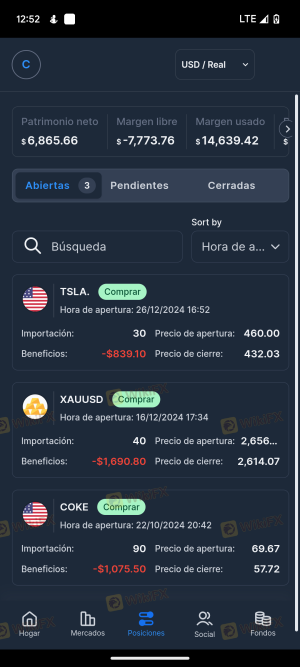

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Royal Camel's lack of regulatory oversight raises concerns about its financial security measures. Without proper regulations in place, there is no assurance that client funds are kept in segregated accounts or that investor protection mechanisms are implemented.

Moreover, Royal Camel does not appear to offer negative balance protection, which is a critical feature that protects traders from incurring losses that exceed their account balance. The absence of such protections can lead to significant financial risks, especially for inexperienced traders who may not fully understand the implications of leverage and market volatility.

Historically, brokers operating without regulatory oversight have faced issues related to client fund mismanagement. Therefore, traders should exercise extreme caution when considering Royal Camel as their forex broker.

Customer Experience and Complaints

Customer feedback and experiences are vital indicators of a broker's reliability. In the case of Royal Camel, numerous complaints have surfaced regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Poor |

Many users have reported difficulties in withdrawing their funds, often citing delays or outright refusals. Such complaints are serious red flags and suggest that Royal Camel may not prioritize client satisfaction. The quality of customer service is crucial for traders, as it can significantly impact the overall trading experience.

A few notable cases include clients who have struggled for weeks to process withdrawals, only to receive vague responses from customer support. These experiences indicate a lack of professionalism and accountability within the organization, further questioning whether Royal Camel is safe for traders.

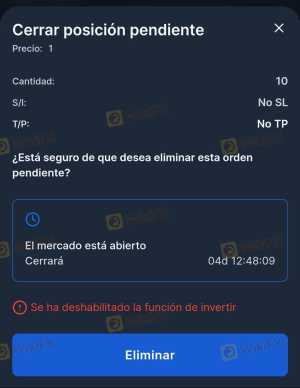

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a successful trading experience. Traders expect a stable and efficient platform that facilitates smooth trade execution. However, reports indicate that Royal Camel's trading platform may not meet these expectations. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes.

Moreover, any signs of potential platform manipulation should raise alarms for traders. If a broker's platform regularly experiences technical glitches or exhibits unusual behavior, it may suggest underlying issues that could jeopardize client funds.

Risk Assessment

Engaging with Royal Camel presents several risks that potential clients should consider. The lack of regulation, high trading costs, and poor customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation in place. |

| Financial Risk | High | High trading costs and no negative balance protection. |

| Operational Risk | Medium | Complaints about withdrawal issues and customer service. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that offer better regulatory oversight, lower trading costs, and a more transparent operational framework.

Conclusion and Recommendations

In conclusion, the evidence suggests that Royal Camel is not a safe option for traders. The lack of regulatory oversight, high trading costs, and numerous client complaints indicate that potential clients should exercise extreme caution. The absence of investor protections and transparent operational practices raises significant red flags.

For traders looking for reliable alternatives, it is advisable to consider brokers that are regulated by reputable financial authorities and offer a robust framework for client protection. Brokers with a proven track record of customer satisfaction and transparent fee structures are more likely to provide a secure trading environment.

In summary, is Royal Camel safe? The overwhelming evidence points to the conclusion that it is not. Traders should prioritize their financial safety by selecting brokers that adhere to high regulatory standards and demonstrate a commitment to client welfare.

Is ROYAL CAMEL a scam, or is it legit?

The latest exposure and evaluation content of ROYAL CAMEL brokers.

ROYAL CAMEL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROYAL CAMEL latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.