Royal Camel 2025 Review: Everything You Need to Know

Executive Summary

Royal Camel presents itself as an online forex broker offering trading services across multiple asset classes. This royal camel review reveals significant concerns about the platform's credibility and safety that traders should know about. The broker claims to provide international experience with friendly customer service. They require a minimum deposit of 200 USD to access their trading platform, which is higher than many competitors offer.

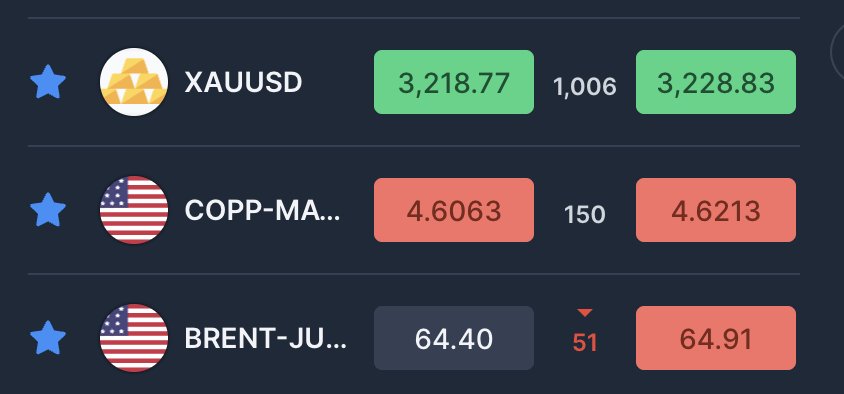

Royal Camel offers a diverse range of markets including stocks, indices, bonds, CFDs, forex, investment funds, commodities, precious metals, and cryptocurrencies. Users should exercise extreme caution when considering this broker. Multiple reports suggest potential fraud risks associated with this broker, raising serious questions about its legitimacy and operational transparency that cannot be ignored.

The lack of clear regulatory information compounds these concerns. This makes it difficult to verify the broker's compliance with financial regulations, which is a major red flag for potential users. Although Royal Camel targets traders seeking diversified investment opportunities, the absence of proper regulatory oversight and negative user feedback regarding potential scam activities significantly undermines its credibility in the competitive forex market.

Important Notice

Due to the absence of verified regulatory information, Royal Camel's operations may vary significantly across different regions. This means they potentially offer varying levels of legal protection and regulatory compliance depending on where you live. Traders should be aware that regulatory frameworks and investor protection measures may differ substantially depending on their geographical location and the specific entity they engage with.

This royal camel review is compiled based on available user feedback and publicly accessible information. The analysis does not constitute investment advice, and potential users are strongly encouraged to conduct independent research and seek professional financial guidance before engaging with this broker. Given the reported concerns about potential fraudulent activities, extreme caution is advised for anyone considering this platform.

Rating Framework

Broker Overview

Royal Camel positions itself as an international online trading platform. Specific details about its establishment date and corporate background remain unclear from available sources, which raises immediate concerns about transparency. The company claims to offer comprehensive trading services with international expertise and customer-friendly support, targeting traders interested in accessing diverse financial markets through a single platform.

The broker's business model centers on providing online trading services across multiple asset categories. These include traditional forex markets alongside modern cryptocurrency trading options that appeal to different types of traders. Royal Camel offers access to stocks, indices, bonds, contracts for difference, foreign exchange markets, investment funds, commodities, precious metals, and digital currencies. This suggests a comprehensive approach to financial market access that could appeal to diversified traders.

However, this royal camel review must highlight the notable absence of transparent information regarding the company's regulatory status, specific trading platforms utilized, and detailed operational procedures. The lack of clear regulatory oversight raises significant questions about the broker's compliance with international financial standards and investor protection protocols that legitimate brokers typically maintain.

Regulatory Jurisdiction: Available information does not specify any regulatory authorities overseeing Royal Camel's operations. This represents a significant concern for potential traders seeking regulated trading environments with proper oversight.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available sources. The platform accepts deposits starting from 200 USD for their standard account offering, but payment methods remain unclear.

Minimum Deposit Requirements: Royal Camel requires a minimum deposit of 200 USD for their Classic account type. This may be considered relatively high for novice traders or those testing the platform compared to industry standards.

Bonus and Promotions: The broker advertises a 200% bonus on first deposits. Specific terms and conditions for this promotional offer are not clearly outlined in available materials, which should concern potential users.

Tradeable Assets: The platform provides access to a comprehensive range of financial instruments including stocks, indices, bonds, CFDs, forex pairs, investment funds, commodities, precious metals, and cryptocurrencies. They claim to offer over 10,000 instruments according to their marketing materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in the reviewed materials. This makes cost comparison difficult for potential users who need to understand the true cost of trading.

Leverage Ratios: Specific leverage offerings are not mentioned in available sources. This information would be crucial for traders planning their risk management strategies and position sizing.

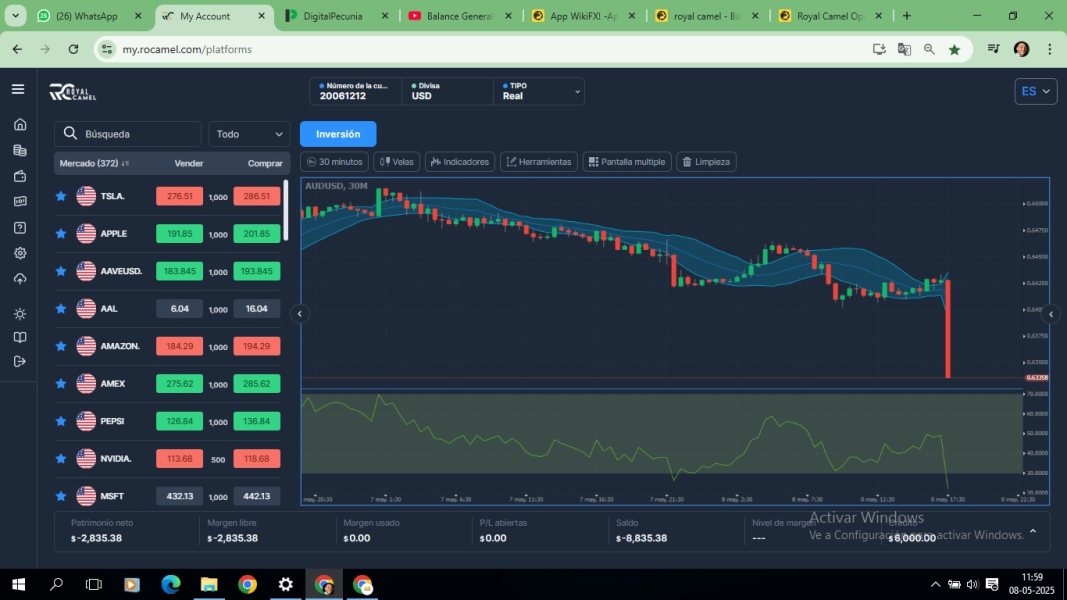

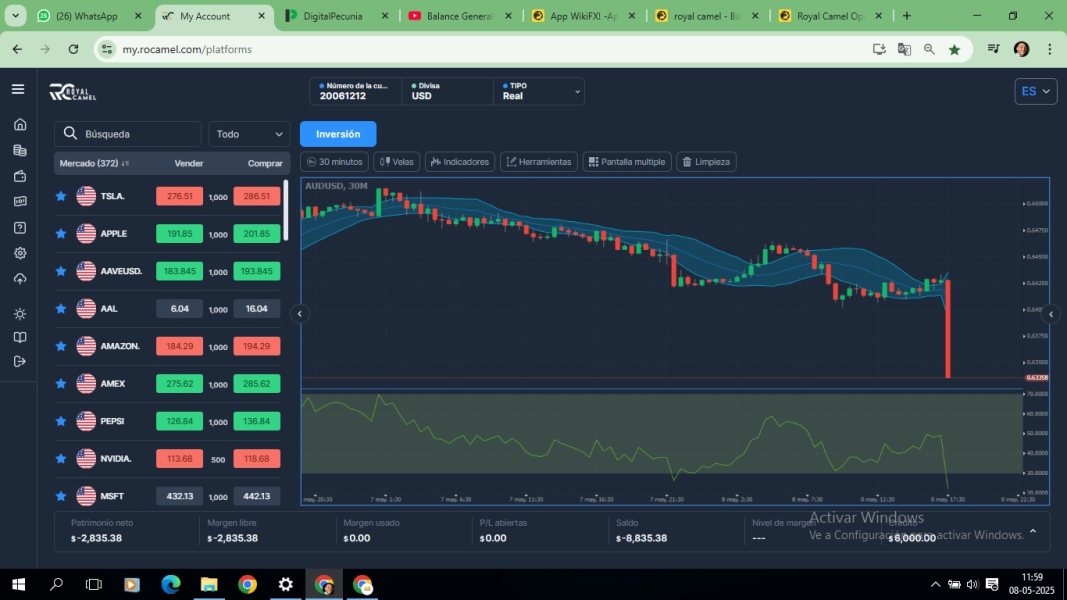

Platform Options: The specific trading platforms offered by Royal Camel are not detailed in available information. This leaves questions about technological capabilities and trading tools that traders can access.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in available materials. This could affect whether traders in certain countries can legally access the platform.

Customer Service Languages: Available customer service languages are not specified in the reviewed sources. This could impact international traders who need support in their native languages.

This royal camel review emphasizes the concerning lack of detailed operational information. Potential users should consider carefully before making any financial commitments to this platform.

Detailed Rating Analysis

Account Conditions Analysis

Royal Camel's account conditions present several limitations that impact its overall attractiveness to potential traders. The broker offers a Classic account as their standard option, requiring a minimum deposit of 200 USD, which is relatively high compared to industry standards where many reputable brokers offer accounts with lower entry barriers. This higher threshold may exclude beginner traders who prefer to start with smaller amounts while learning the markets.

The available information does not specify additional account types, such as premium accounts, professional trading accounts, or Islamic accounts for Muslim traders. This limits options for different trader categories who may have specific needs or requirements. The absence of detailed information about account features, trading conditions, and specific benefits associated with different account tiers makes it difficult for potential users to make informed decisions about which account type might suit their needs.

Furthermore, the account opening process is not clearly outlined in available materials. This raises questions about verification requirements, documentation needed, and the time frame for account activation that traders should expect. The lack of transparency regarding account management features, such as account protection measures, negative balance protection, or account segregation policies, adds to concerns about the overall account conditions offered by this broker.

This royal camel review notes that the limited information about account conditions, combined with the absence of regulatory oversight, creates uncertainty about the actual terms and protections available to account holders. Traders should be particularly concerned about the lack of clear account protection measures.

The trading tools and resources offered by Royal Camel remain largely unspecified in available information. This makes it challenging to assess the platform's capabilities comprehensively for traders who depend on analytical tools. While the broker claims to provide access to over 10,000 financial instruments across multiple asset classes, the specific trading tools, analytical resources, and educational materials available to users are not detailed in accessible sources.

The absence of information about market analysis tools, charting capabilities, technical indicators, or automated trading support raises questions about the platform's technological sophistication. Modern traders typically expect access to comprehensive analytical tools, real-time market data, economic calendars, and research resources to support their trading decisions, but Royal Camel's offerings in these areas remain unclear. Educational resources, which are crucial for trader development, are not mentioned in available materials.

The lack of information about webinars, tutorials, market analysis, or trading guides suggests limited support for trader education and skill development. Additionally, the availability of mobile trading applications, API access for algorithmic trading, or integration with third-party analytical tools is not specified in any available documentation. The platform's research and analysis capabilities, including market commentary, expert insights, or fundamental analysis resources, are not described in available sources.

This lack of transparency about trading tools and resources makes it difficult for potential users to evaluate whether the platform can meet their analytical and educational needs. Serious traders should consider this a significant limitation when evaluating Royal Camel.

Customer Service and Support Analysis

Royal Camel's customer service and support infrastructure lacks detailed information in available sources. This makes it difficult to assess the quality and accessibility of their support services for traders who may need assistance. While the company claims to offer friendly customer service with international experience, specific details about support channels, response times, and service quality are not provided in accessible materials.

The availability of customer support through multiple channels such as live chat, email, telephone support, or ticket systems is not clearly specified. Additionally, information about customer service operating hours, timezone coverage, or 24/7 availability is absent from reviewed sources, which is particularly important for forex traders operating across different time zones. Multilingual support capabilities, which are essential for international brokers, are not detailed in available information.

The absence of information about supported languages, local customer service representatives, or region-specific support services raises questions about the broker's ability to serve diverse international clientele effectively. User feedback regarding customer service quality, response times, or problem resolution effectiveness is not available in reviewed materials. The lack of testimonials, service level agreements, or documented customer service standards makes it impossible to verify the claimed friendly and professional support services.

This absence of verifiable customer service information, combined with reports of potential fraud risks, significantly impacts confidence in the broker's support capabilities. Traders should be concerned about getting help when they need it most.

Trading Experience Analysis

The trading experience offered by Royal Camel cannot be comprehensively evaluated due to insufficient information about platform stability, execution quality, and technological capabilities. Available sources do not specify which trading platforms are utilized, whether proprietary or third-party solutions like MetaTrader 4 or 5, making it impossible to assess the technological foundation of the trading environment. Platform stability and speed, crucial factors for successful trading execution, are not addressed in available materials.

Information about server uptime, execution speeds, slippage rates, or latency issues is absent. This leaves potential users without insight into the platform's technical performance capabilities that could affect their trading results. Order execution quality, including fill rates, requotes, and execution transparency, is not detailed in accessible sources.

The absence of information about order types supported, such as market orders, limit orders, stop orders, or more advanced order types, limits understanding of the platform's trading functionality. Mobile trading capabilities and user interface design are not described in available information, despite mobile trading being increasingly important for modern traders. The lack of details about platform customization options, charting capabilities, or analytical tools integrated into the trading interface further limits the assessment of the overall trading experience.

This royal camel review emphasizes that the absence of detailed platform information makes it impossible to verify whether the trading experience meets modern standards expected by active traders. Serious traders should consider this lack of transparency a major concern.

Trust and Reliability Analysis

Trust and reliability represent the most concerning aspects of Royal Camel's operations. Several red flags exist that potential users should carefully consider before risking their money. The most significant issue is the absence of verified regulatory information, as available sources do not specify any financial regulatory authorities overseeing the broker's operations, which is fundamental for trader protection and operational legitimacy.

Reports suggesting potential fraud risks associated with Royal Camel significantly undermine its credibility and trustworthiness. These concerns, combined with the lack of regulatory oversight, create a high-risk environment for potential traders considering the platform. The absence of investor protection schemes, deposit insurance, or regulatory safeguards typically associated with licensed brokers compounds these trust issues significantly.

Company transparency is severely lacking, with limited information available about corporate structure, ownership, physical locations, or operational history. The absence of verifiable company registration details, financial statements, or third-party audits makes it difficult to assess the broker's financial stability and operational legitimacy. Industry reputation and recognition from established financial organizations or regulatory bodies are not evident in available sources.

The lack of awards, certifications, or positive recognition from reputable industry organizations further diminishes confidence in the broker's standing within the financial services sector. The combination of regulatory absence and reported fraud concerns creates significant trust deficits that potential users should carefully consider before risking their capital.

User Experience Analysis

User experience assessment for Royal Camel is hampered by the limited availability of detailed user feedback and specific information about platform usability. Available sources do not provide comprehensive user satisfaction ratings or detailed testimonials that would allow for thorough evaluation of the overall user experience. Interface design and platform usability information is not available in accessible sources, making it impossible to assess whether the platform provides intuitive navigation, clear functionality, or user-friendly design elements.

The absence of information about platform customization options, display preferences, or accessibility features limits understanding of how well the platform accommodates different user preferences and needs. Registration and account verification processes are not detailed in available materials, leaving questions about the complexity, time requirements, and documentation needed for account setup. The efficiency of these processes significantly impacts initial user experience, but specific information is not available for evaluation.

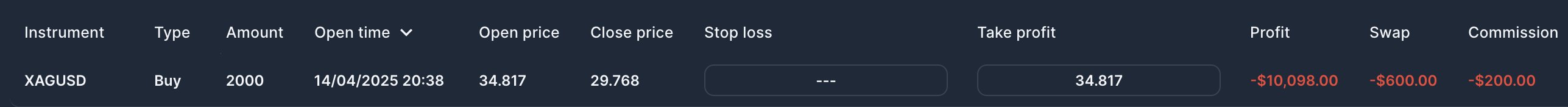

Fund management experience, including deposit and withdrawal procedures, processing times, and fee structures, is not comprehensively detailed in accessible sources. Users typically prioritize smooth and transparent financial operations, but the lack of specific information about these processes creates uncertainty about this aspect of user experience. The most significant concern affecting user experience is the reported potential for fraudulent activities, which would severely impact user satisfaction and safety.

These reports, combined with the absence of regulatory protection, suggest that users may face significant risks that would negatively impact their overall experience with the platform. Traders should consider these factors carefully when evaluating whether to use Royal Camel.

Conclusion

This royal camel review reveals a broker with significant concerns that potential traders should carefully consider before making any financial commitments. While Royal Camel offers access to diverse asset classes including forex, stocks, commodities, and cryptocurrencies, the absence of regulatory oversight and reports of potential fraud risks create substantial red flags for prospective users. The broker may appeal to traders seeking diversified investment opportunities across multiple markets, but the lack of transparency regarding regulatory status, operational procedures, and platform capabilities significantly undermines its credibility.

The relatively high minimum deposit requirement of 200 USD, combined with limited information about account conditions and trading tools, further restricts its appeal to cautious traders. The primary advantages include access to multiple asset classes and claimed international experience, while the major disadvantages encompass the absence of regulatory protection, reported fraud concerns, and lack of operational transparency. Potential users are strongly advised to exercise extreme caution and consider regulated alternatives that provide better investor protection and verified operational credentials before engaging with this platform.