Is Rong Wei safe?

Business

License

Is Rong Wei Safe or Scam?

Introduction

In the fast-paced world of forex trading, the choice of a broker can significantly impact a trader's success. One such broker that has emerged in recent years is Rong Wei. Positioned as a player in the forex market, Rong Wei offers various trading services to its clients. However, with the proliferation of fraudulent brokers, traders must exercise caution and conduct thorough evaluations before committing their funds. This article aims to investigate whether Rong Wei is a safe broker or potentially a scam. Our evaluation will be based on a combination of regulatory compliance, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape plays a crucial role in determining the safety and legitimacy of a forex broker. A well-regulated broker is typically subject to stringent oversight, which provides a layer of protection for traders. In the case of Rong Wei, it is essential to examine its regulatory status to understand its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Rong Wei does not appear to be regulated by any recognized financial authority. This lack of regulation raises significant red flags, as unregulated brokers often operate without accountability and can engage in unethical practices. The absence of a regulatory framework means that traders may have limited recourse in the event of disputes or issues related to fund withdrawals.

The quality of regulation is paramount; brokers regulated by tier-1 authorities such as the FCA or ASIC are generally considered safer. Unfortunately, without any regulatory oversight, the question of whether Rong Wei is safe becomes more pressing. Traders are advised to be cautious and consider the implications of trading with an unregulated broker.

Company Background Investigation

Understanding the companys history and ownership structure is vital in assessing its reliability. Rong Wei has been active in the forex market for a relatively short period, which may limit its credibility. The ownership structure and management team are crucial components of a broker's integrity.

Rong Wei does not provide extensive information about its founders or management team, which can be a cause for concern. Transparency in a broker's operations, including detailed disclosures about its leadership, is essential for building trust with clients. A company that is hesitant to share such information may be hiding potential issues or a lack of experience in the industry.

Furthermore, the company's operational history is unclear, with no substantial milestones or achievements reported. This lack of a solid track record can lead to questions about its long-term viability and commitment to customer service. Without clear evidence of a reputable background, traders should be wary and consider the potential risks associated with Rong Wei.

Trading Conditions Analysis

Evaluating the trading conditions offered by a broker is critical in determining its attractiveness to traders. Rong Wei claims to provide competitive trading conditions, but it is essential to scrutinize the fee structure and any unusual charges that may apply.

The overall fee structure of Rong Wei appears to be opaque, with limited information available on spreads, commissions, or overnight interest rates. This lack of clarity can be problematic, as traders may encounter unexpected costs that could erode their profits.

| Fee Type | Rong Wei | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 3.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | 0.5% - 2.5% |

The absence of specific data in these categories makes it challenging for potential clients to assess whether Rong Wei is safe in terms of trading costs. Traders should be particularly cautious of brokers that do not provide transparent information about their fee structures, as this can lead to disputes and dissatisfaction down the line.

Client Funds Security

The safety of client funds is a paramount concern for traders. A reputable broker should have robust measures in place to protect clients' money. In the case of Rong Wei, it is essential to analyze its security protocols regarding fund management.

Rong Wei has not provided detailed information regarding its fund safety measures, such as whether it offers segregated accounts or investor protection schemes. Segregated accounts are crucial as they ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

Additionally, the lack of a clear policy on negative balance protection raises concerns. Negative balance protection ensures that clients cannot lose more than their initial investment, providing an additional safety net. The absence of such policies may indicate that Rong Wei does not prioritize client security, which is a significant red flag for potential traders.

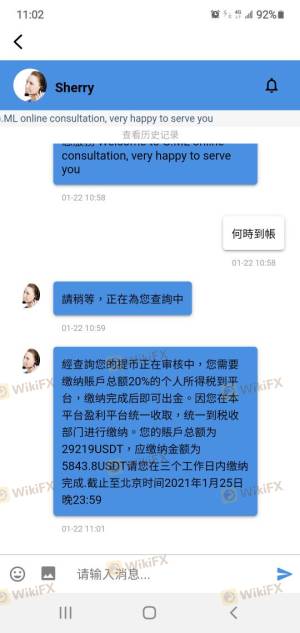

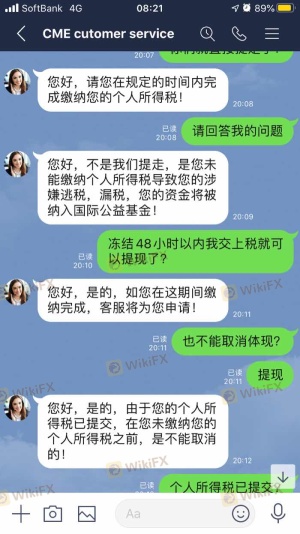

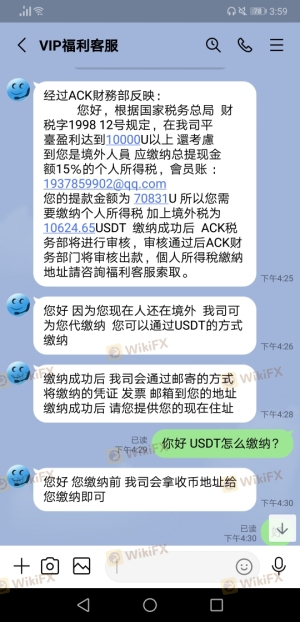

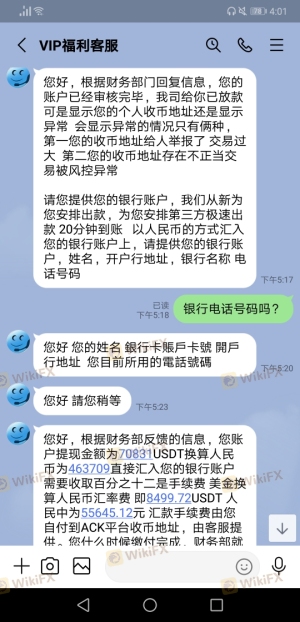

Customer Experience and Complaints

Customer feedback is an invaluable source of information when evaluating a broker. Analyzing user experiences can provide insights into how well a broker operates and addresses client concerns. In the case of Rong Wei, reviews and feedback from clients are mixed, with several users reporting issues related to withdrawal processes and customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Inconsistent |

| Transparency Concerns | High | Lack of Clarity |

Many customers have expressed frustration over delays in withdrawing funds, which is a common complaint among traders dealing with potentially unreliable brokers. Additionally, the quality of customer support has been criticized, with reports of slow response times and vague answers to inquiries. Such issues can significantly impact a trader's experience and raise concerns about whether Rong Wei is safe to work with.

Platform and Trade Execution

The trading platform's performance is critical for a seamless trading experience. Rong Wei provides a trading platform that claims to be user-friendly; however, the execution quality and reliability remain to be scrutinized.

Users have reported varying experiences regarding order execution, with some noting instances of slippage and order rejections. High slippage rates can negatively affect trading outcomes, particularly for those employing scalping strategies. Furthermore, any signs of platform manipulation or inconsistencies in order execution can lead to significant losses for traders.

Risk Assessment

Engaging with any broker involves inherent risks, and Rong Wei is no exception. A comprehensive risk assessment can help traders understand the potential pitfalls of working with this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | Medium | Lack of transparency in fees. |

| Operational Risk | High | Complaints about withdrawal issues. |

The risks associated with trading with Rong Wei are considerable, primarily due to its lack of regulation and transparency. Traders should be aware of these risks and consider implementing risk management strategies to mitigate potential losses.

Conclusion and Recommendations

In conclusion, the investigation into Rong Wei raises several concerns regarding its safety and reliability as a forex broker. The absence of regulatory oversight, coupled with a lack of transparency in trading conditions and customer complaints, suggests that traders should approach this broker with caution.

If you are considering trading with Rong Wei, it is advisable to conduct further research and consider alternative brokers that are well-regulated and have proven track records of customer satisfaction. Brokers regulated by reputable authorities such as the FCA or ASIC may provide a safer trading environment and better protection for your investments. Ultimately, ensuring the safety of your trading experience should be the top priority.

Is Rong Wei a scam, or is it legit?

The latest exposure and evaluation content of Rong Wei brokers.

Rong Wei Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rong Wei latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.