Is FXCN safe?

Pros

Cons

Is Fxcn Safe or Scam?

Introduction

Fxcn is a recently established online forex and CFD broker that claims to offer a wide range of trading instruments, including forex currency pairs, stocks, indices, and commodities. As the forex market continues to grow, traders must remain vigilant and thoroughly assess the legitimacy of brokers like Fxcn before committing their funds. With numerous reports of scams and fraudulent activities in the industry, it is crucial to evaluate brokers based on their regulatory status, company background, trading conditions, and customer experiences. This article aims to provide a comprehensive analysis of Fxcn, focusing on its safety, legitimacy, and overall trustworthiness.

To conduct this investigation, we utilized various online resources, including broker review websites, regulatory databases, and user feedback platforms. Our evaluation framework encompasses key aspects such as regulatory and legal status, company background, trading conditions, customer fund safety, client experiences, platform performance, and risk assessment. By analyzing these factors, we aim to determine whether Fxcn is a safe trading option or if it poses potential risks to its clients.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. A well-regulated broker is more likely to adhere to industry standards and provide a safer trading environment for clients. Unfortunately, information regarding Fxcn's regulatory status is sparse. According to various sources, Fxcn does not appear to be registered with any reputable regulatory authority. This raises significant concerns about its credibility and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight from recognized bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US is alarming. Without such regulation, traders may not have the protection and recourse they need in case of disputes or issues with fund withdrawals. Furthermore, the lack of transparency regarding Fxcn's operational history and compliance record exacerbates concerns about its legitimacy.

Company Background Investigation

Fxcn's company background is another essential aspect of our evaluation. While the broker claims to have been established in 2020, detailed information regarding its ownership structure, management team, and operational history is minimal. This lack of transparency raises red flags about the broker's legitimacy. A reputable broker typically provides comprehensive information about its founders, management team, and corporate structure.

Moreover, the absence of a physical office address and limited contact options, such as an email address, further diminishes the broker's credibility. A trustworthy broker should have a clear and accessible communication channel, allowing clients to reach out for assistance or inquiries. The opaque nature of Fxcn's operations and its failure to provide adequate information about its management team contribute to the perception that it may not be a safe option for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall appeal and safety. Fxcn claims to provide competitive trading conditions, but specific details regarding spreads, commissions, and fees are not readily available. This lack of clarity can be a significant concern for potential clients who wish to understand the costs involved in trading.

| Fee Type | Fxcn | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information about trading costs can lead to unexpected expenses for traders. Additionally, reports from users indicate that Fxcn may impose unusual withdrawal fees and requirements, which could hinder clients' ability to access their funds. Such practices are often indicative of less reputable brokers that seek to exploit traders financially.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Fxcn's website does not provide clear information about its fund protection measures, such as segregated accounts, investor protection schemes, or negative balance protection policies. A reputable broker typically ensures that clients' funds are kept in segregated accounts to protect them from company insolvency.

Without these protective measures, traders may face significant risks, especially in the event of the broker's financial instability or operational issues. Moreover, historical complaints regarding fund withdrawal difficulties and issues with accessing profits further raise concerns about the safety of funds held with Fxcn. Traders should be cautious when dealing with brokers that lack transparency in their fund management practices.

Customer Experience and Complaints

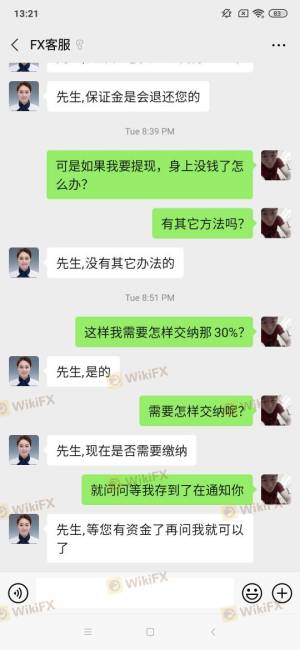

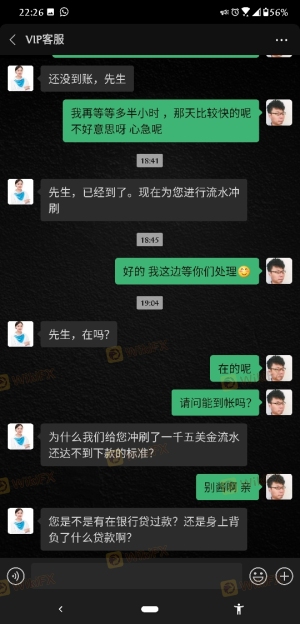

Analyzing customer feedback and experiences is vital for understanding a broker's reputation. Unfortunately, numerous reviews and testimonials regarding Fxcn indicate a pattern of complaints related to withdrawal issues, lack of customer support, and difficulties in accessing funds. Many users have reported being unable to withdraw their profits without facing additional fees or requirements, which raises significant concerns about the broker's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Poor |

| Transparency Concerns | High | Poor |

Typical cases highlight instances where clients were asked to pay additional fees to process withdrawals or faced unexpected tax requirements before accessing their funds. Such practices are often associated with fraudulent brokers and should serve as a warning to potential clients. The overall sentiment among users suggests that Fxcn may not be a safe or reliable option for forex trading.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are crucial for a positive trading experience. However, reviews of Fxcn's platform indicate concerns regarding stability, execution quality, and potential manipulation. Users have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

Additionally, the lack of transparency regarding the platform's technology and execution policies raises questions about the broker's commitment to fair trading practices. A reputable broker should provide clear information about its execution methods and any potential conflicts of interest that may arise.

Risk Assessment

Engaging with Fxcn presents several risks that traders should consider before proceeding. The absence of regulatory oversight, coupled with numerous complaints regarding fund access and withdrawal issues, creates a high-risk environment for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Reports of fund withdrawal issues |

| Operational Risk | Medium | Lack of transparency and accountability |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Fxcn. It is advisable to start with a small deposit, if at all, and to closely monitor the broker's practices before committing larger amounts of capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fxcn raises significant red flags regarding its safety and legitimacy. The lack of regulatory oversight, transparency issues, and numerous complaints about withdrawal difficulties indicate that it may not be a trustworthy broker. Potential clients should exercise extreme caution when considering Fxcn for their trading needs.

For traders seeking reliable alternatives, it is recommended to explore brokers with established regulatory credentials, transparent operations, and positive customer feedback. Reputable options include brokers regulated by top-tier authorities like the FCA or ASIC, which offer a safer trading environment and better protection for client funds. Ultimately, the decision to engage with Fxcn should be approached with caution, given the potential risks involved.

Is FXCN a scam, or is it legit?

The latest exposure and evaluation content of FXCN brokers.

FXCN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCN latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.