Is RBCC safe?

Pros

Cons

Is Rbcc Safe or a Scam?

Introduction

In the ever-evolving world of forex trading, the choice of a broker can significantly impact a trader's success and safety. Rbcc, a broker that has gained attention in the forex market, claims to offer a range of trading services. However, as with any financial service provider, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy and safety of the broker before committing their funds. This article aims to provide an objective analysis of Rbcc, exploring its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a comprehensive review of multiple sources, including regulatory databases, customer feedback, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety and reliability. Rbcc's regulatory standing has raised questions among traders. Regulation serves as a safeguard, ensuring that brokers adhere to strict standards and practices that protect investor interests. Brokers regulated by top-tier authorities are less likely to engage in fraudulent activities and are held accountable for their actions.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

The table above illustrates that Rbcc is purportedly linked to the Australian Securities and Investments Commission (ASIC). However, it has been flagged as a "suspicious clone," indicating potential issues with its legitimacy. This lack of proper regulation raises concerns about the broker's compliance with industry standards and its ability to protect client funds. Furthermore, the absence of a valid license number suggests that Rbcc may not operate under the stringent oversight expected of a reputable broker.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. Rbcc's company history is relatively obscure, and there is limited information available regarding its establishment and operational background. Transparency in ownership and management is essential, as it often reflects a broker's commitment to ethical practices and accountability.

The management team's background is another critical consideration. A team with extensive experience in finance and trading can instill confidence in clients. However, Rbcc's management details are not readily accessible, which may indicate a lack of transparency. The absence of clear information about the company's founding and ownership can be a red flag for potential investors.

Trading Conditions Analysis

Evaluating the trading conditions offered by Rbcc is essential for understanding its overall value proposition. Traders often look for competitive spreads, reasonable commission structures, and favorable overnight rates. Rbcc's fee structure has been a point of contention among users.

| Fee Type | Rbcc | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of specific data on Rbcc's trading costs is concerning. Many users have reported encountering unexpected fees or unclear commission structures, which can significantly impact trading profitability. Without transparent pricing, traders may find themselves at a disadvantage, raising further questions about whether Rbcc is safe to trade with.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's trustworthiness. Rbcc claims to implement various measures to secure client funds, including segregated accounts and investor protection mechanisms. However, the effectiveness of these measures is questionable due to the broker's regulatory status.

The absence of a robust investor protection scheme can leave traders vulnerable in case of insolvency or financial mismanagement. Additionally, historical disputes or incidents related to fund safety can tarnish a broker's reputation. Unfortunately, Rbcc's track record in this area remains unclear, which may pose risks to potential clients.

Customer Experience and Complaints

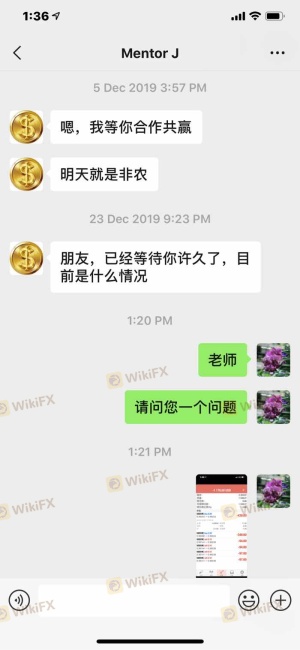

Customer feedback plays a crucial role in assessing a broker's reliability. Analyzing user experiences can reveal patterns of complaints and the broker's responsiveness to issues. Rbcc has faced numerous complaints, primarily related to withdrawal difficulties and customer service inadequacies.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

Many traders have reported frustration with Rbcc's withdrawal process, citing delays and lack of communication as significant concerns. These issues can indicate a lack of commitment to customer satisfaction and raise questions about the broker's operational integrity. Real-life cases of traders struggling to access their funds further emphasize the need for caution when considering whether Rbcc is safe.

Platform and Execution

The performance of a trading platform is critical for a trader's success. Rbcc offers a trading platform that claims to provide stability and efficiency. However, user reviews suggest that the platform may not meet the expectations of many traders.

Factors such as order execution quality, slippage, and rejections can significantly impact trading outcomes. Reports of manipulated trades and poor execution raise alarms about the broker's practices. Traders should be wary of any signs of platform manipulation, as this can lead to significant financial losses.

Risk Assessment

Assessing the risks associated with trading through Rbcc is essential for making informed decisions. The overall risk profile of the broker appears concerning, particularly due to its regulatory status and customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of legitimate regulation |

| Fund Safety Risk | Medium | Uncertain fund protection measures |

| Customer Service Risk | High | Frequent complaints about support |

To mitigate these risks, traders should consider conducting thorough research, maintaining a cautious approach, and potentially seeking alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence surrounding Rbcc raises significant concerns regarding its safety and legitimacy. The lack of proper regulation, transparency in company background, and numerous complaints from customers suggest that traders should approach this broker with caution. While some may still consider trading with Rbcc, it is crucial to weigh the risks carefully.

For traders seeking a safe and reliable trading environment, it is advisable to consider alternative brokers that are regulated by top-tier authorities and have a proven track record of positive customer experiences. Ultimately, the question of whether Rbcc is safe remains unanswered, and potential clients should prioritize their capital's safety by choosing well-regulated and reputable trading firms.

Is RBCC a scam, or is it legit?

The latest exposure and evaluation content of RBCC brokers.

RBCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RBCC latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.