RBCC Review 1

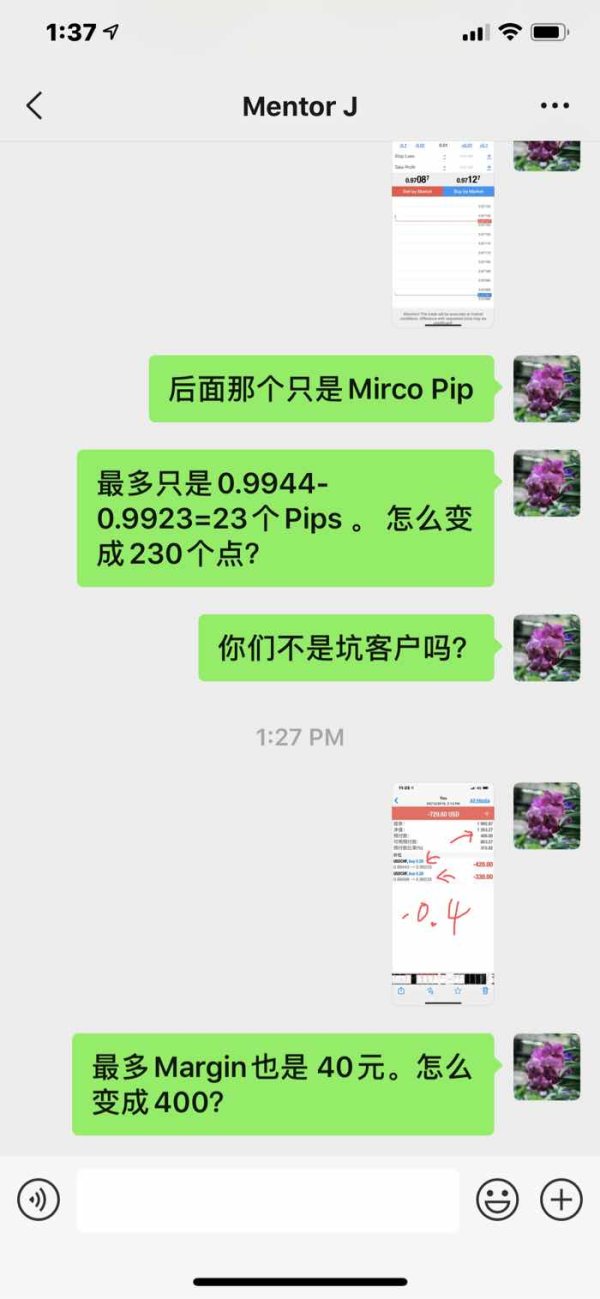

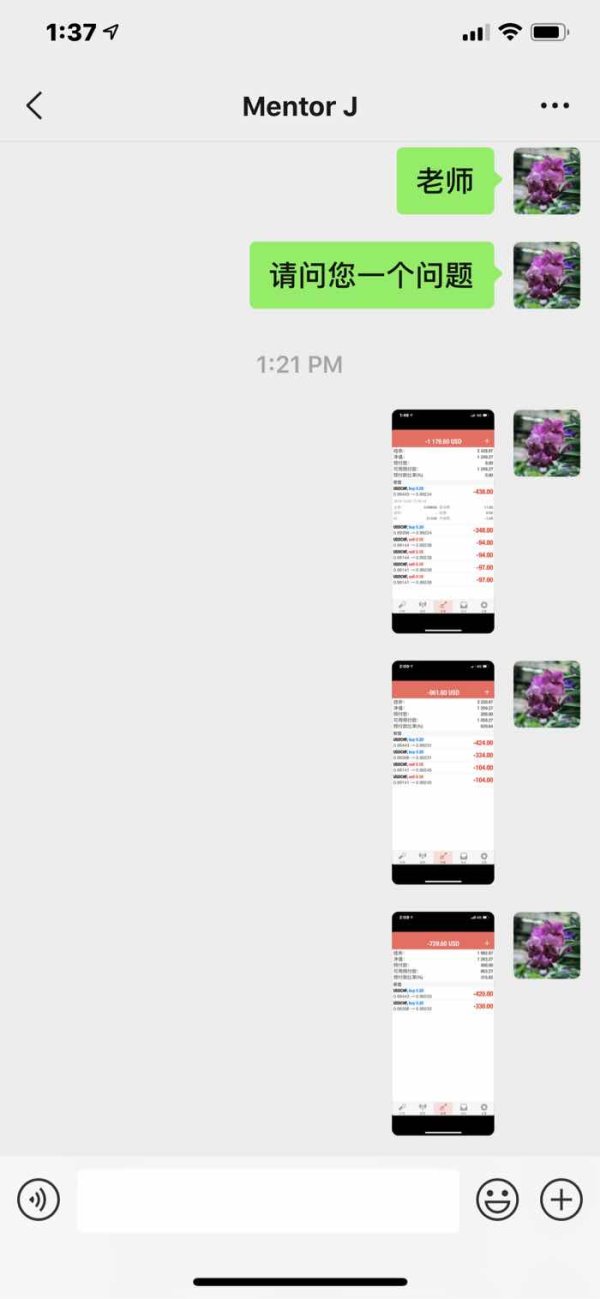

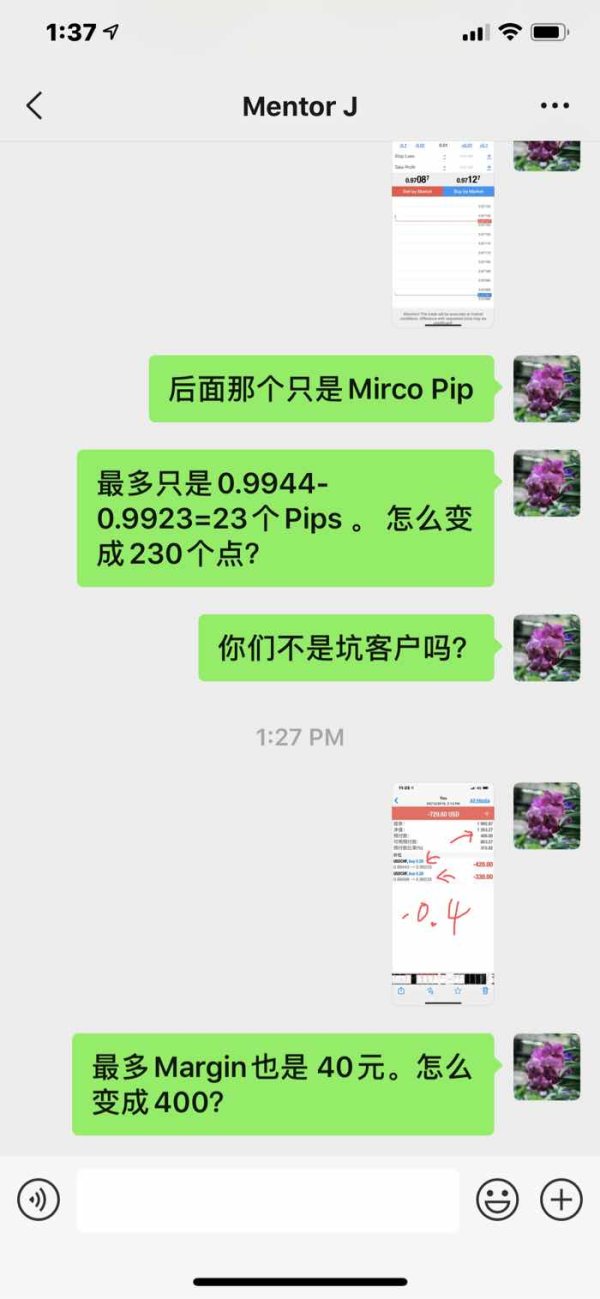

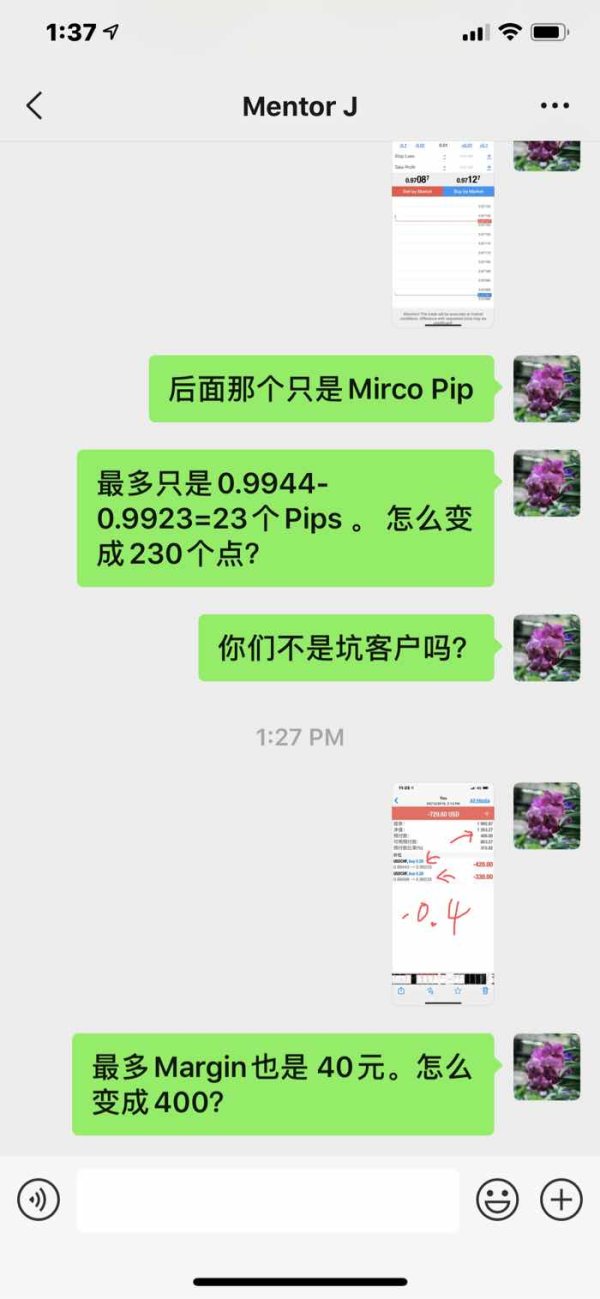

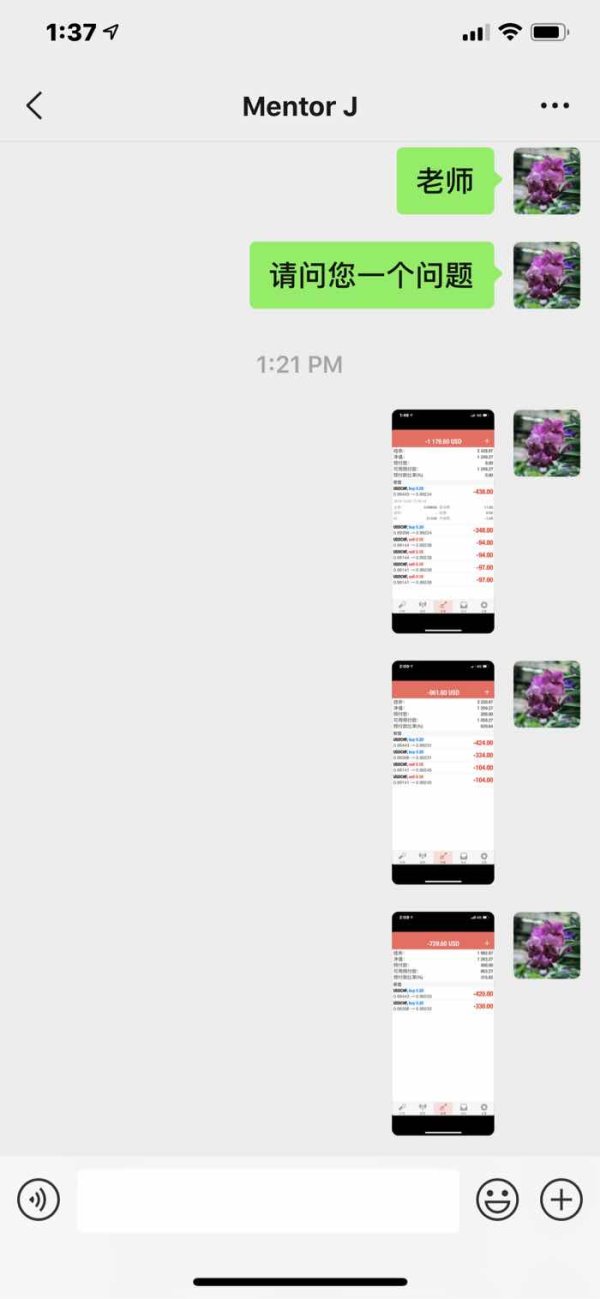

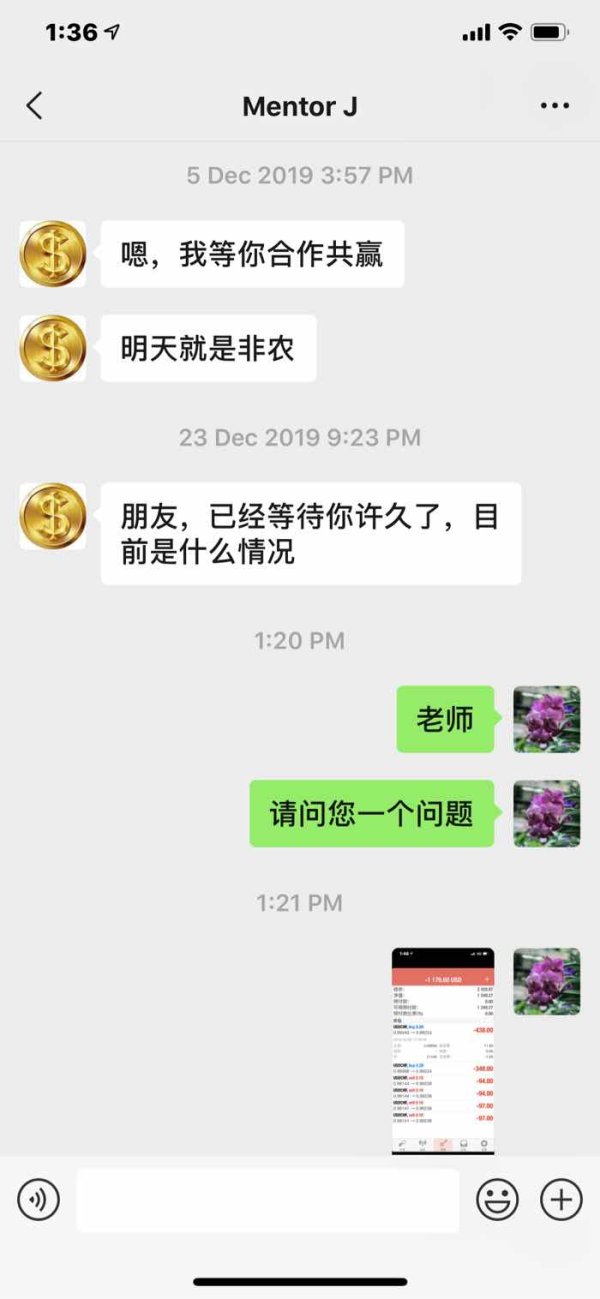

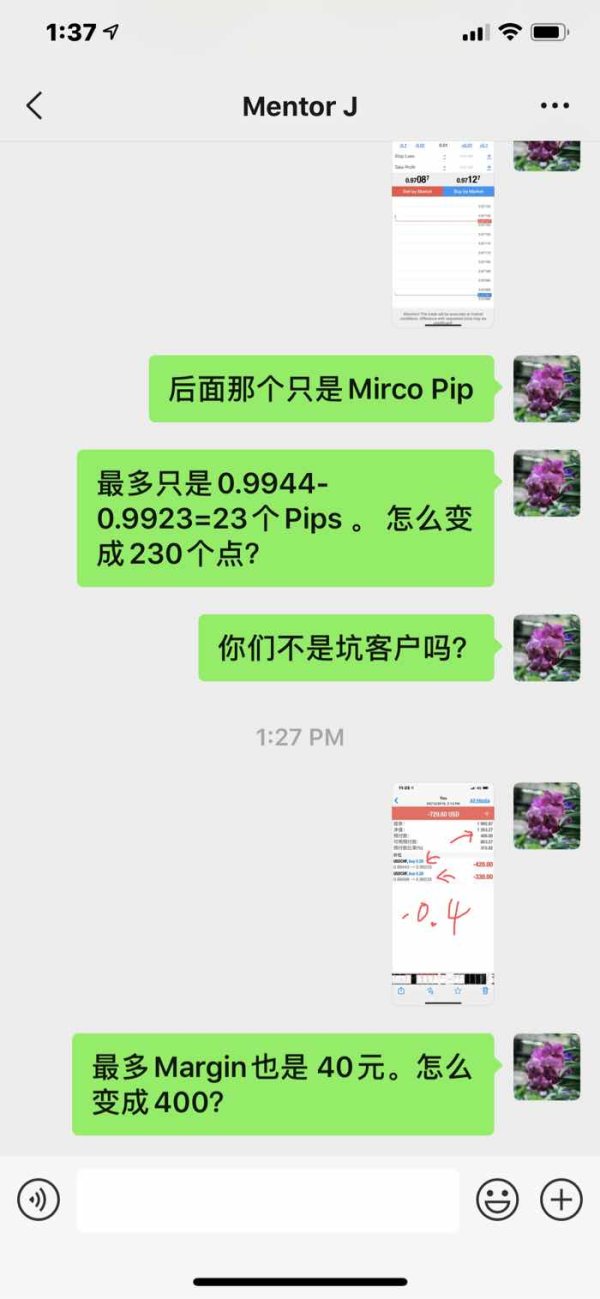

RBCC will tamper your lot, which is a rip-off. If you buy 0.2 lot, it will modify it into 2 lots. Then you will lose $2500 directly. The so-called customer service and teachers are all fraudsters!

RBCC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

RBCC will tamper your lot, which is a rip-off. If you buy 0.2 lot, it will modify it into 2 lots. Then you will lose $2500 directly. The so-called customer service and teachers are all fraudsters!

This comprehensive Rbcc review evaluates a forex broker that presents significant concerns for potential traders. RBCC demonstrates substantial deficiencies in user experience and trustworthiness with an overall user rating of 1.00 out of 10 that warrant careful consideration. The broker's most notable features include a relatively accessible minimum deposit requirement of $100. They also make ambitious claims of monthly returns reaching up to 100%.

While the low entry barrier may initially attract new traders, the overwhelmingly negative user feedback suggests serious underlying issues with the platform's operations and service delivery. RBCC positions itself primarily toward traders seeking high-risk, high-reward investment opportunities. These traders are particularly willing to engage with forex markets, stocks, smart contracts, and staking products.

However, the absence of clear regulatory information combined with the extremely poor user satisfaction ratings raises substantial red flags about the broker's legitimacy and operational standards. The platform's promise of extraordinary returns should be viewed with extreme caution. Such claims often indicate unrealistic expectations or potentially problematic business practices.

Traders should exercise extreme caution when considering RBCC. Regulatory information was not available in the reviewed materials. This lack of regulatory transparency creates significant uncertainty regarding investor protections and legal recourse across different jurisdictions.

The evaluation presented here is based on limited publicly available information and user feedback. This may not provide a complete picture of the broker's operations. Given the absence of regulatory oversight details, potential clients must independently verify the broker's compliance status in their respective regions before engaging with any services or depositing funds.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 3/10 | Low minimum deposit offset by poor user satisfaction |

| Tools and Resources | 2/10 | Insufficient information about trading platforms and tools |

| Customer Service | 1/10 | Extremely poor user rating indicates service failures |

| Trading Experience | 2/10 | Limited platform information and negative user feedback |

| Trustworthiness | 1/10 | Absence of regulatory information and poor user ratings |

| User Experience | 1/10 | Overall rating of 1.00 reflects significant user dissatisfaction |

RBCC operates as a forex broker offering access to multiple financial markets. Detailed company background information remains limited in available sources. The broker positions itself as providing investment opportunities across forex and stock markets, along with emerging financial products including smart contracts and staking mechanisms.

However, the lack of fundamental company information such as establishment date and corporate structure raises immediate concerns about transparency. The business model appears to focus on high-yield investment programs. They claim monthly returns reaching 100%, which is a figure that significantly exceeds industry standards and market realities.

This aggressive marketing approach, combined with the minimal entry requirements, suggests targeting of retail traders who may lack extensive market experience. Without clear information about trading platforms, company leadership, or operational history, potential clients face substantial uncertainty about the broker's capabilities and long-term viability. The absence of regulatory oversight details further compounds these transparency issues.

Regulatory Status: Available materials do not specify regulatory jurisdictions or oversight bodies. This creates significant uncertainty about legal protections and compliance standards.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes is not detailed in available sources. The minimum deposit requirement is set at $100.

Minimum Deposit Requirements: The broker requires a minimum initial deposit of $100. This is relatively accessible compared to many established brokers but may indicate targeting of less experienced traders.

Promotional Offers: No specific bonus or promotional programs are mentioned in the available information. The high return claims may serve as the primary marketing incentive.

Tradeable Assets: RBCC offers access to forex markets, stock trading, smart contracts, and staking opportunities. This provides diversification across traditional and emerging financial instruments.

Cost Structure: Detailed information about spreads, commissions, and fees is not available in the reviewed materials. This makes cost comparison with other brokers impossible.

Leverage Options: Leverage ratios and margin requirements are not specified in available sources. This leaves traders without crucial risk management information.

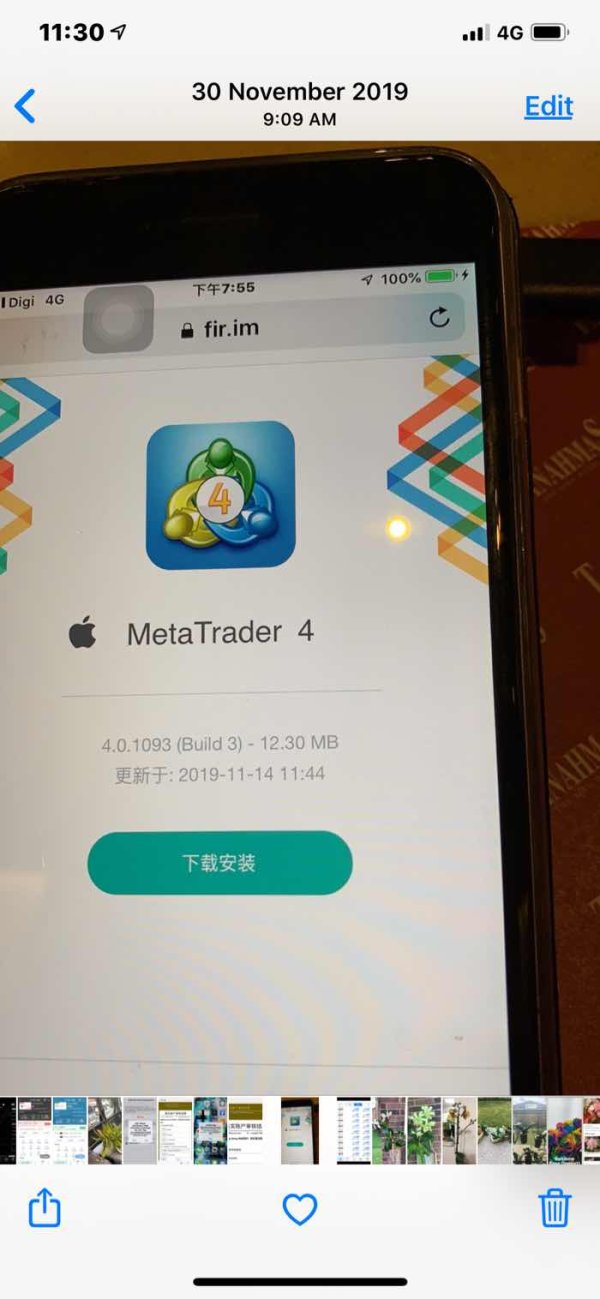

Platform Selection: Specific trading platform information is not provided. This creates uncertainty about execution capabilities and user interface quality.

Geographic Restrictions: Regional availability and restrictions are not detailed in the available materials.

Customer Support Languages: Available customer service languages are not specified in the reviewed information.

This Rbcc review highlights the concerning lack of detailed operational information that professional traders typically require for informed decision-making.

The account structure at RBCC presents a mixed picture that leans heavily toward concerning aspects. While the $100 minimum deposit requirement appears accessible for new traders, this low barrier combined with the extremely poor user rating of 1.00 suggests that account conditions may be designed more for client acquisition than client satisfaction. The absence of detailed information about account types, features, or tier structures indicates a lack of transparency that professional traders typically expect from legitimate brokers.

Most established brokers provide clear documentation about different account categories, their respective benefits, and upgrade pathways. The lack of such information raises questions about whether RBCC offers genuine account differentiation or simply operates with basic, undifferentiated service levels. Account opening procedures and verification requirements are not detailed in available materials.

This makes it impossible to assess the legitimacy of onboarding processes or compliance with international anti-money laundering standards. The absence of information about specialized accounts, such as Islamic or professional trader accounts, further suggests limited service sophistication. The overwhelmingly negative user feedback reflected in the 1.00 rating indicates that whatever account conditions exist, they fail to meet basic trader expectations.

This could relate to hidden fees, difficult withdrawal processes, or inadequate account management support. Without specific user testimonials or detailed complaint information, the exact nature of these account-related issues remains unclear, but the severity of the rating suggests fundamental problems. This Rbcc review emphasizes that the superficially attractive low deposit requirement cannot offset the apparent systemic issues reflected in user satisfaction metrics.

The evaluation of RBCC's trading tools and resources reveals significant gaps in available information that raise serious concerns about platform capabilities. No specific details about trading platforms, analytical tools, or educational resources are provided in the reviewed materials. This represents a major red flag for potential clients seeking comprehensive trading support.

Professional forex trading requires access to advanced charting tools, technical indicators, economic calendars, and market analysis resources. The absence of any information about these fundamental trading necessities suggests either inadequate platform development or concerning transparency issues. Established brokers typically highlight their platform features, third-party integrations, and proprietary tools as key differentiators.

Educational resources play a crucial role in trader development, particularly for the retail market segment that RBCC appears to target with its low minimum deposit. The lack of information about webinars, trading guides, market analysis, or educational partnerships indicates potential deficiencies in client support infrastructure. Automated trading capabilities, including Expert Advisor support, copy trading, or social trading features, are not mentioned in available materials.

These tools have become standard expectations in modern forex trading environments, and their absence could significantly limit trading flexibility and strategy implementation. The poor overall user rating of 1.00 may partially reflect inadequate tools and resources. Traders typically express dissatisfaction when platforms lack essential functionality.

Without access to proper trading tools, even motivated traders struggle to achieve consistent results, leading to frustration and negative reviews. Research and analysis capabilities appear to be entirely absent from available information. This suggests that traders would need to rely on external sources for market insights and decision support.

Customer service quality at RBCC appears to be severely compromised, as evidenced by the extremely poor user rating of 1.00. This rating suggests fundamental failures in support delivery that extend beyond minor inconveniences to potentially serious service breakdowns that affect trader operations and satisfaction. The absence of detailed information about customer support channels, availability hours, or response time commitments indicates a lack of structured support infrastructure.

Professional brokers typically provide multiple contact methods including live chat, phone support, email tickets, and comprehensive FAQ sections. The lack of such information suggests either inadequate support systems or concerning transparency issues. Multi-language support capabilities are not specified, which could create significant barriers for international clients.

Given that forex trading operates in a global marketplace, the absence of language support information may indicate limited international service capabilities or inadequate localization efforts. Response time expectations and service level agreements are not documented in available materials. This leaves clients without clear understanding of support availability during critical trading situations.

This uncertainty becomes particularly problematic during volatile market conditions when timely support can significantly impact trading outcomes. The severity of the 1.00 user rating suggests that existing clients have experienced significant support failures. These may include unresponsive communication, inadequate problem resolution, or potentially more serious issues such as difficulty accessing accounts or processing withdrawals.

Without specific user testimonials or complaint details, the exact nature of these service failures remains unclear, but the rating severity indicates systemic problems rather than isolated incidents. Professional trading environments require reliable, knowledgeable support teams capable of addressing technical issues, account problems, and trading-related queries promptly and effectively.

The trading experience at RBCC presents significant concerns due to the combination of limited platform information and overwhelmingly negative user feedback. The 1.00 user rating strongly suggests that traders encounter substantial difficulties when attempting to execute their trading strategies or navigate the platform's functionality. Platform stability and execution speed are critical factors in forex trading success, yet no specific information about these technical capabilities is available in the reviewed materials.

Professional traders require reliable order execution, minimal slippage, and stable platform performance during high-volatility periods. The absence of technical specifications or performance metrics raises concerns about the platform's ability to handle standard trading requirements. Order execution quality directly impacts trading profitability, particularly for strategies that depend on precise entry and exit timing.

Without information about execution methods, order types, or processing speeds, traders cannot adequately assess whether the platform meets their technical requirements. The poor user rating may partially reflect execution-related issues that affect trading outcomes. Mobile trading capabilities are not detailed in available information, despite mobile access being essential for modern forex trading.

Traders increasingly require full platform functionality on mobile devices to monitor positions and respond to market developments regardless of location. The platform's functional completeness remains unclear due to insufficient technical documentation. Essential features such as advanced order types, risk management tools, and analytical capabilities are not specified.

This makes it impossible to evaluate whether the platform supports sophisticated trading strategies. This Rbcc review emphasizes that the lack of detailed platform information, combined with extremely poor user satisfaction, suggests a trading environment that fails to meet professional standards and may significantly hinder trading success.

The trustworthiness assessment of RBCC reveals multiple red flags that should concern potential clients. The absence of regulatory information represents the most significant concern. Legitimate brokers typically maintain oversight from recognized financial authorities and prominently display their regulatory credentials.

Regulatory oversight provides essential investor protections including segregated client funds, dispute resolution mechanisms, and operational standards compliance. Without clear regulatory status, clients lack these fundamental protections and may have limited recourse in case of disputes or operational failures. The failure to provide regulatory information suggests either non-compliance with oversight requirements or concerning transparency issues.

Fund security measures are not detailed in available materials, leaving clients without understanding of how their deposits are protected. Professional brokers typically maintain segregated client accounts, provide deposit insurance, or maintain relationships with reputable banking institutions to ensure fund security. The absence of such information raises serious questions about financial safety.

Corporate transparency appears limited given the lack of detailed company information, leadership profiles, or operational history. Established brokers typically provide comprehensive corporate information to build client confidence and demonstrate legitimacy. The minimal available information suggests potential transparency issues that could indicate operational concerns.

Industry reputation information is not available in reviewed materials, though the extremely poor user rating of 1.00 suggests significant reputation challenges within the trading community. Professional brokers typically maintain positive industry relationships and receive recognition from trading publications or industry organizations. The combination of missing regulatory information, unclear fund protection measures, and overwhelmingly negative user feedback creates a trustworthiness profile that suggests extreme caution is warranted when considering this broker.

User experience at RBCC appears to be severely compromised, as demonstrated by the devastating 1.00 overall rating that reflects widespread client dissatisfaction. This rating suggests systematic failures in user interface design, platform functionality, or service delivery that fundamentally impact the trading experience. The extremely low satisfaction score indicates that users encounter significant obstacles when attempting to utilize the platform's services.

These obstacles may be related to account management, trading execution, or support interactions. Such severe ratings typically result from multiple compounding issues rather than isolated problems, suggesting systemic operational deficiencies. Interface design and usability information is not available in reviewed materials, but the poor user rating may indicate navigation difficulties, confusing layouts, or inadequate functionality that impedes effective platform utilization.

Modern traders expect intuitive interfaces that facilitate rapid decision-making and efficient trade management. Registration and verification processes are not detailed in available sources, though onboarding difficulties could contribute to negative user experiences. Complicated or unclear account setup procedures often create initial frustration that colors subsequent platform interactions.

Fund management experiences, including deposit and withdrawal processes, may contribute to user dissatisfaction based on the severity of the rating. Difficulties accessing funds or unclear financial procedures typically generate strong negative reactions from trading clients. The broker appears to target high-risk, high-reward investors based on the ambitious return claims.

However, the poor user experience suggests that even risk-tolerant traders find the platform inadequate for their needs. This disconnect between marketing promises and actual user satisfaction represents a significant operational failure that potential clients should carefully consider.

This comprehensive Rbcc review reveals a broker with fundamental operational and transparency issues that make it unsuitable for most traders. The overall rating of 1.00 reflects severe deficiencies in user experience, service delivery, and trustworthiness that extend far beyond minor inconveniences to suggest systematic operational failures. The broker is not recommended for general retail traders, and even high-risk investors should exercise extreme caution given the absence of regulatory oversight and overwhelmingly negative user feedback.

While the $100 minimum deposit appears accessible, this advantage is completely overshadowed by the significant risks indicated by poor user satisfaction and lack of transparency. The primary disadvantages include the absence of regulatory information, extremely poor user ratings, and insufficient operational transparency. The only apparent advantage is the low entry requirement that may actually serve as a warning sign rather than a benefit.

FX Broker Capital Trading Markets Review