Is Ascuex safe?

Pros

Cons

Is Ascuex A Scam?

Introduction

Ascuex is a relatively new player in the forex market, positioned as an online trading platform that offers a variety of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. Given the rapid growth of online trading, it is crucial for traders to exercise caution and conduct thorough evaluations of forex brokers. This is especially important in light of the numerous scams that have plagued the industry, leading to significant financial losses for unsuspecting investors.

In this article, we will investigate the legitimacy of Ascuex by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive review of available online resources, customer feedback, and regulatory information, ensuring a balanced perspective on whether Ascuex is a trustworthy trading platform or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and reliability. Regulations are designed to protect investors and ensure fair trading practices. Unfortunately, Ascuex operates without any regulatory oversight, which raises significant concerns for potential traders.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Ascuex claims to be registered with the Financial Services Regulatory Authority (FSRA) in Saint Lucia; however, investigations reveal no corresponding records in the FSRA's database. This lack of regulatory oversight means that Ascuex is not held accountable by any financial authority, exposing investors to potential risks such as fraud and mismanagement of funds. Moreover, the absence of regulatory protection means that clients have no recourse in the event of disputes or financial losses.

The implications of trading with an unregulated broker are profound. Without regulatory oversight, there are no mechanisms to ensure fair trading practices or to protect clients' funds. This lack of oversight can lead to various issues, including difficulty in withdrawing funds, hidden fees, and potential market manipulation. As such, potential investors should approach Ascuex with extreme caution.

Company Background Investigation

Ascuex was established in January 2023 and is registered in Saint Lucia. The company operates from an office located at Fortgate Offshore Investment and Legal Services Ltd., which raises questions about its transparency and operational integrity.

The ownership structure of Ascuex is not clearly disclosed, and the lack of information regarding its management team further compounds concerns about its legitimacy. A transparent company typically provides detailed information about its leadership and their professional backgrounds, which helps build trust among potential investors. However, Ascuex's failure to disclose such information raises red flags.

Moreover, the company's short operational history—less than a year—coupled with the absence of a solid reputation in the industry, makes it difficult to assess its reliability. Traders should be wary of engaging with a broker that lacks a proven track record and transparency regarding its management.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. Ascuex offers multiple account types, including zero accounts, standard accounts, premium accounts, fixed accounts, and crypto accounts, with minimum deposits ranging from $0 to $5,000. However, the absence of regulatory oversight raises concerns about the fairness and transparency of these offerings.

Trading Costs Comparison Table

| Cost Type | Ascuex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.2 pips | 1.0 - 2.0 pips |

| Commission Structure | $10 per lot (Zero Account) | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While Ascuex advertises competitive spreads and a high leverage ratio of up to 1:1000, such offerings are often associated with higher risk. Traders should be cautious, as high leverage can amplify both profits and losses. Furthermore, the potential for hidden fees or unfavorable trading conditions is heightened in an unregulated environment.

The lack of clarity regarding the fee structure and potential hidden costs may lead to unexpected financial burdens for traders. As such, it is imperative for potential clients to thoroughly read the fine print and understand all costs associated with trading on the Ascuex platform.

Customer Fund Security

The safety of customer funds is paramount when selecting a trading platform. Ascuex's unregulated status raises significant concerns regarding the security of client funds.

Ascuex does not provide clear information regarding its fund segregation practices, investor protection measures, or negative balance protection policies. The absence of these critical safeguards means that clients' funds may not be adequately protected in the event of financial difficulties faced by the broker.

Additionally, there have been reports of clients experiencing difficulties when attempting to withdraw their funds, which is a common issue with unregulated brokers. Historical complaints suggest that clients have encountered barriers when trying to access their money, further underscoring the risks associated with trading with Ascuex.

Customer Experience and Complaints

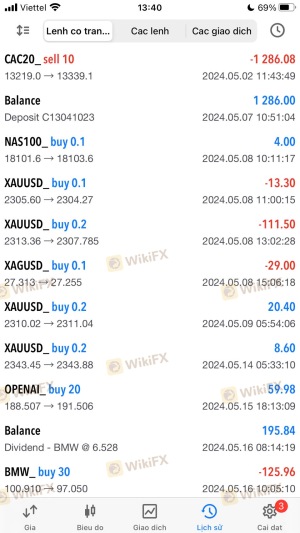

Analyzing customer feedback is essential for understanding the real-world experiences of traders using a particular platform. Unfortunately, feedback regarding Ascuex has been predominantly negative, with numerous complaints related to withdrawal issues and poor customer service.

Complaints Overview Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Evasive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Promotions | High | No Resolution |

Common complaints include difficulties in withdrawing funds, with several users reporting that their withdrawal requests were either delayed or denied without clear explanations. Additionally, the company's customer support has been criticized for being unresponsive and evasive, further exacerbating users' frustrations.

For example, one user reported that after successfully making a profit, their withdrawal request was met with excuses and delays, ultimately leading to a complete inability to access their funds. Such experiences highlight the potential risks of engaging with an unregulated broker like Ascuex.

Platform and Trade Execution

The performance of a trading platform is critical for traders seeking to execute their strategies effectively. Ascuex claims to offer the MetaTrader 5 (MT5) platform; however, users have reported issues with platform stability and execution quality.

Traders have expressed concerns regarding order execution speed, slippage, and instances of rejected orders, which can significantly impact trading outcomes. The lack of transparency regarding the platform's operational integrity raises questions about the overall user experience.

Moreover, the absence of regulatory oversight means that there is little recourse for traders who encounter issues with the platform. This lack of accountability can lead to a loss of trust among users, further complicating the decision to engage with Ascuex.

Risk Assessment

Engaging with an unregulated broker like Ascuex carries inherent risks that traders must consider carefully.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, exposing clients to potential fraud. |

| Fund Security Risk | High | Lack of fund protection measures and history of withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and rejected orders can impact trading outcomes. |

To mitigate these risks, potential traders should consider the following recommendations:

- Conduct Thorough Research: Always verify the regulatory status of a broker before opening an account.

- Start Small: If you decide to engage with an unregulated broker, consider starting with a small investment to minimize potential losses.

- Monitor Your Trades: Keep a close eye on your trades and be prepared to withdraw profits promptly to avoid complications.

Conclusion and Recommendations

In conclusion, the investigation into Ascuex reveals significant concerns regarding its legitimacy as a forex broker. The absence of regulatory oversight, coupled with numerous complaints related to fund security and withdrawal issues, suggests that Ascuex operates in a high-risk environment.

While the platform offers competitive trading conditions, the potential for financial loss and lack of accountability raises red flags for prospective traders. Therefore, it is advisable for traders to exercise extreme caution when considering Ascuex as a trading option.

For those seeking a more secure trading environment, it may be prudent to explore alternative brokers that are well-regulated and have established a positive reputation in the industry. Always prioritize safety and transparency when selecting a trading partner to protect your investments.

Is Ascuex a scam, or is it legit?

The latest exposure and evaluation content of Ascuex brokers.

Ascuex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ascuex latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.