Is Vlom safe?

Pros

Cons

Is Vlom Safe or a Scam?

Introduction

Vlom is a relatively new player in the forex market, having been established in 2019. Positioned as an online trading broker, Vlom claims to offer a wide range of trading instruments, including forex, commodities, and cryptocurrencies. However, the rise of online trading has also seen an increase in fraudulent brokers, making it essential for traders to carefully evaluate the legitimacy and safety of brokers like Vlom before committing their funds. In this article, we will investigate the safety and credibility of Vlom, employing a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. Vlom claims to be licensed and regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, the FSA is not regarded as a top-tier regulatory authority, raising concerns about the level of investor protection it offers.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | N/A | St. Vincent and the Grenadines | Unverified |

The lack of stringent regulatory oversight can expose traders to higher risks, including potential fraud and mismanagement of funds. Furthermore, there are reports that the FSA does not regulate forex brokers effectively, making it crucial for potential clients to exercise caution. The absence of a robust regulatory framework means that traders may have limited recourse in case of disputes or issues with fund withdrawals. Therefore, when assessing whether Vlom is safe, the regulatory aspect is a significant red flag.

Company Background Investigation

Vlom operates under the name Vlom Ltd, and its headquarters is purportedly located in St. Vincent and the Grenadines. While the company presents itself as a legitimate trading entity, there is a lack of transparency regarding its ownership and management structure, which raises further concerns.

The company's website does not provide detailed information about its founders or key personnel, making it difficult to assess the qualifications and experience of the management team. This opacity is concerning, as reputable brokers typically disclose their management backgrounds to build trust with potential clients. Moreover, the lack of information regarding the company's history and compliance with international standards further diminishes its credibility.

In summary, the limited information available about Vlom's ownership and management, coupled with the absence of strong regulatory backing, raises questions about its legitimacy and safety.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure and any potentially unusual policies that may impact traders. Vlom advertises a minimum deposit requirement of $100, which is relatively standard in the industry. However, the next tier for account types jumps significantly to $20,000, which is an unusual leap and raises suspicions about the broker's intentions.

| Fee Type | Vlom | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs is reported to be as high as 3 pips, which is above the industry average and could indicate a less favorable trading environment for clients. Additionally, the lack of clarity regarding commissions and overnight interest further complicates the fee structure. Traders should be wary of brokers that do not provide transparent information about their costs, as this can lead to unexpected charges and reduced profitability.

Client Fund Security

The safety of client funds is paramount when assessing whether Vlom is safe. Vlom claims to implement various security measures, including the segregation of client funds from operational funds. However, there is little information available regarding the specifics of these measures.

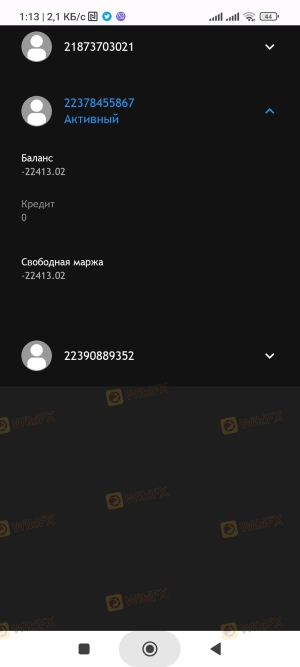

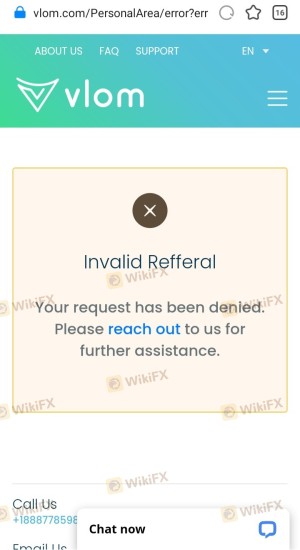

The absence of a clear investor protection scheme or negative balance protection policy is concerning, as it could leave traders vulnerable to significant losses. Furthermore, historical complaints regarding withdrawal issues from clients raise serious red flags about the broker's reliability. If a broker has a track record of making it difficult for clients to access their funds, it suggests a lack of transparency and trustworthiness.

Customer Experience and Complaints

Analyzing customer feedback is crucial to understanding the overall experience traders have with Vlom. Many reviews highlight concerns over withdrawal issues, with several users reporting difficulties in accessing their funds.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

Instances of clients being unable to withdraw funds or experiencing significant delays have been noted, which is a major concern for potential investors. Additionally, the company's responsiveness to complaints has been criticized as inadequate, further eroding trust in Vlom.

For example, one user reported a prolonged withdrawal process, leading to frustration and financial strain. Another individual mentioned that after making a deposit, they faced challenges in accessing their account, which raised suspicions about the broker's legitimacy. Such experiences indicate that Vlom may not prioritize customer satisfaction or transparency.

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a positive trading experience. Vlom claims to offer the Vlom Trader platform, which is accessible on various devices. However, the lack of user reviews regarding the platform's performance raises concerns about its stability and execution quality.

Issues such as slippage and order rejections can significantly impact trading outcomes. If traders experience frequent slippage or rejections, it can lead to frustration and financial losses. The absence of clear evidence supporting the platform's reliability and execution efficiency adds to the uncertainty surrounding Vlom's operations.

Risk Assessment

When considering whether Vlom is safe, it is essential to evaluate the overall risk associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of strong regulatory oversight. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals. |

| Transparency Risk | Medium | Limited information about company operations. |

The high regulatory and withdrawal risks associated with Vlom suggest that potential traders should proceed with caution. To mitigate these risks, it is advisable to conduct thorough research and consider using reputable brokers with strong regulatory backing and positive customer reviews.

Conclusion and Recommendations

In conclusion, the investigation into Vlom raises several concerns regarding its safety and legitimacy. The lack of robust regulatory oversight, transparency about the company's operations, and numerous complaints about withdrawal issues suggest that Vlom may not be a reliable broker. While it may offer attractive trading conditions, the risks associated with trading through Vlom outweigh the potential benefits.

For traders seeking a safer alternative, it is recommended to consider brokers that are regulated by reputable authorities, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). These brokers typically offer better protection for client funds and a more transparent trading environment. Ultimately, the question "Is Vlom safe?" leans toward caution, and potential investors should carefully weigh their options before proceeding.

Is Vlom a scam, or is it legit?

The latest exposure and evaluation content of Vlom brokers.

Vlom Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vlom latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.