Probis 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Probis review reveals a concerning picture of a forex broker that has faced significant regulatory and operational challenges. Probis was established in 2009 as a financial services and asset management company based in Sydney, Australia. The company specialized in forex and CFD trading through its multi-asset trading platform. However, the broker's journey took a dramatic turn when it entered voluntary administration in mid-July 2023. This prompted the Australian Securities and Investments Commission to suspend its Australian Financial Services license.

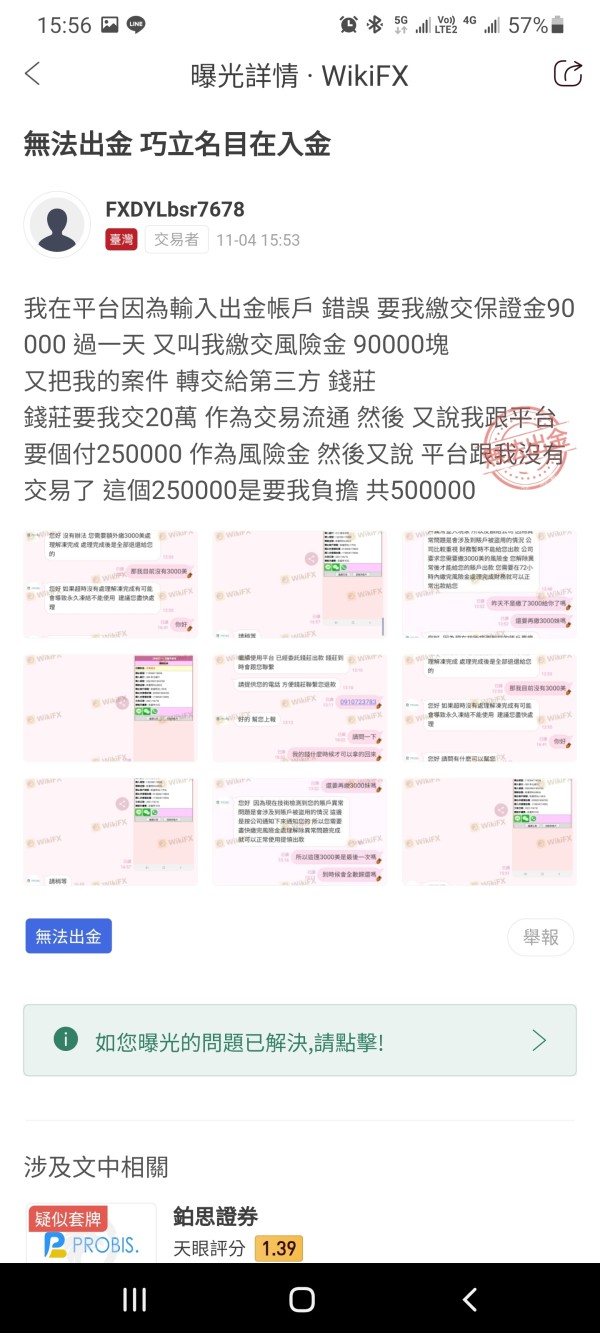

The broker previously offered trading in various financial instruments. These included OTC derivatives such as margin forex products. Despite providing access to multiple asset classes, Probis has garnered overwhelmingly negative user feedback, reflected in its 0 TrustScore rating. Users have consistently reported poor customer service experiences, unsatisfactory trading conditions, and concerns about the platform's reliability. The combination of regulatory license suspension and widespread user dissatisfaction makes Probis a broker that requires extreme caution from potential traders. These traders seek reliable forex and CFD trading services.

Important Notice

Regional Regulatory Differences: Probis's regulatory oversight was limited to Australia under ASIC supervision. Its license is currently suspended due to bankruptcy proceedings. Traders from different jurisdictions should be aware that forex trading regulations vary significantly across countries. The suspension of Probis's Australian license affects its ability to provide services globally.

Review Methodology: This evaluation is based on publicly available information, regulatory notices, and user feedback compiled from various sources. The assessment does not constitute personal investment advice. Potential traders should conduct their own due diligence before making any trading decisions.

Rating Framework

Broker Overview

Probis Financial Services Pty Ltd was established in 2009 as an Australian-based financial services provider. The company specialized in forex and CFD trading services. Probis positioned itself as a comprehensive asset management firm, offering retail and institutional clients access to foreign exchange markets and other derivative products. Based in Sydney, Probis operated under the regulatory framework of the Australian Securities and Investments Commission. The company held an Australian Financial Services license that permitted it to provide financial services to Australian residents and international clients.

The broker's business model centered around providing online trading platforms. These platforms enabled clients to trade various financial instruments, with a particular focus on OTC derivatives including margin forex products. According to available information from regulatory sources, Probis aimed to serve both novice and experienced traders by offering access to global financial markets through its proprietary trading infrastructure. However, the company's operational trajectory took a significant downturn in 2023 when it faced financial difficulties. These difficulties ultimately led to voluntary administration proceedings.

The regulatory landscape for Probis changed dramatically when ASIC took decisive action against the broker. Following Probis's entry into voluntary administration in mid-July 2023, ASIC suspended the company's Australian Financial Services license. This action effectively halted its ability to provide financial services. This Probis review must therefore be viewed in the context of these significant regulatory and operational challenges. These challenges have fundamentally altered the broker's status in the financial services industry.

Regulatory Status: Probis was regulated by the Australian Securities and Investments Commission under an Australian Financial Services license. However, this license has been suspended following the company's entry into voluntary administration and subsequent bankruptcy proceedings. This suspension significantly impacts its operational capacity.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available public resources. This information gap itself raises concerns about transparency and operational clarity.

Minimum Deposit Requirements: The exact minimum deposit requirements for opening trading accounts with Probis are not specified in available documentation. This may indicate limited transparency in their account opening procedures.

Bonus and Promotional Offers: No specific information about bonuses or promotional offers is available in current public resources. This suggests either the absence of such programs or limited marketing transparency.

Tradeable Assets: Probis offered trading in OTC derivatives, with particular emphasis on margin forex products. The broker provided access to foreign exchange markets. However, the complete range of available instruments is not comprehensively detailed in available sources.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not readily available in public documentation. This represents a significant transparency concern for potential clients evaluating the broker's competitiveness.

Leverage Ratios: Specific leverage ratios offered by Probis are not mentioned in available public information. This makes it difficult to assess the risk management parameters of the trading environment.

Platform Options: While Probis operated a multi-asset trading platform, specific details about platform types are not clearly specified. Available resources do not indicate whether these were proprietary or third-party solutions like MetaTrader 4 or 5.

Geographic Restrictions: Information about specific geographic restrictions or service limitations is not detailed in current public documentation.

Customer Service Languages: The languages supported by Probis customer service are not specified in available public information.

This Probis review highlights significant information gaps. These gaps, combined with regulatory issues, raise substantial concerns about transparency and operational standards.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Probis present a concerning picture due to limited transparency and poor user feedback. While the broker previously offered trading accounts for forex and CFD trading, specific details about account types, their features, and associated benefits remain unclear in available documentation. This lack of transparency regarding account structures raises immediate red flags for potential traders. These traders require clear information about trading conditions, account minimums, and service levels.

The absence of detailed information about account opening procedures, verification requirements, and account management features suggests either poor communication practices or limited operational transparency. User feedback, where available, indicates dissatisfaction with account-related services. However, specific details about account conditions are not extensively documented in public reviews. The broker's entry into voluntary administration and subsequent license suspension by ASIC further complicates any assessment of current account conditions. The operational status remains uncertain.

Given the regulatory challenges and lack of clear information about account structures, potential traders should exercise extreme caution. The combination of limited transparency and regulatory issues suggests that account conditions may not meet the standards expected from reputable forex brokers. This Probis review must emphasize that the current uncertainty surrounding the broker's operational status makes any account opening inadvisable. Regulatory matters must be resolved first.

Probis marketed itself as providing a multi-asset trading platform with access to various financial instruments. The company particularly focused on OTC derivatives and margin forex products. However, the specific tools and resources available to traders remain poorly documented in available public information. While the broker claimed to offer comprehensive trading solutions, detailed information about analytical tools, research resources, and educational materials is notably absent from accessible sources.

The platform's technical capabilities, including charting tools, market analysis features, and automated trading support, are not clearly specified in available documentation. This lack of detailed information about trading tools represents a significant transparency issue. This is particularly concerning for traders who rely on sophisticated analytical resources to make informed trading decisions. User feedback suggests that whatever tools were available may not have met trader expectations. This contributed to the overall negative sentiment surrounding the broker.

The educational resources and market research capabilities that modern traders expect from professional brokers appear to be either limited or poorly communicated by Probis. Without access to comprehensive market analysis, educational content, and advanced trading tools, traders would likely find themselves at a disadvantage. This disadvantage becomes apparent when compared to what's available from more established and transparent brokers in the market.

Customer Service and Support Analysis

Customer service represents one of the most problematic aspects of the Probis trading experience. This assessment is based on available user feedback and the overall negative sentiment reflected in the broker's 0 TrustScore rating. Users have consistently reported poor experiences with customer support. These reports indicate significant deficiencies in service quality, responsiveness, and problem resolution capabilities.

The specific customer service channels, availability hours, and response times are not clearly documented in available public information. This itself suggests poor communication practices. Professional forex brokers typically provide multiple contact methods, extended support hours, and multilingual assistance. However, Probis appears to have fallen short in these areas based on user experiences.

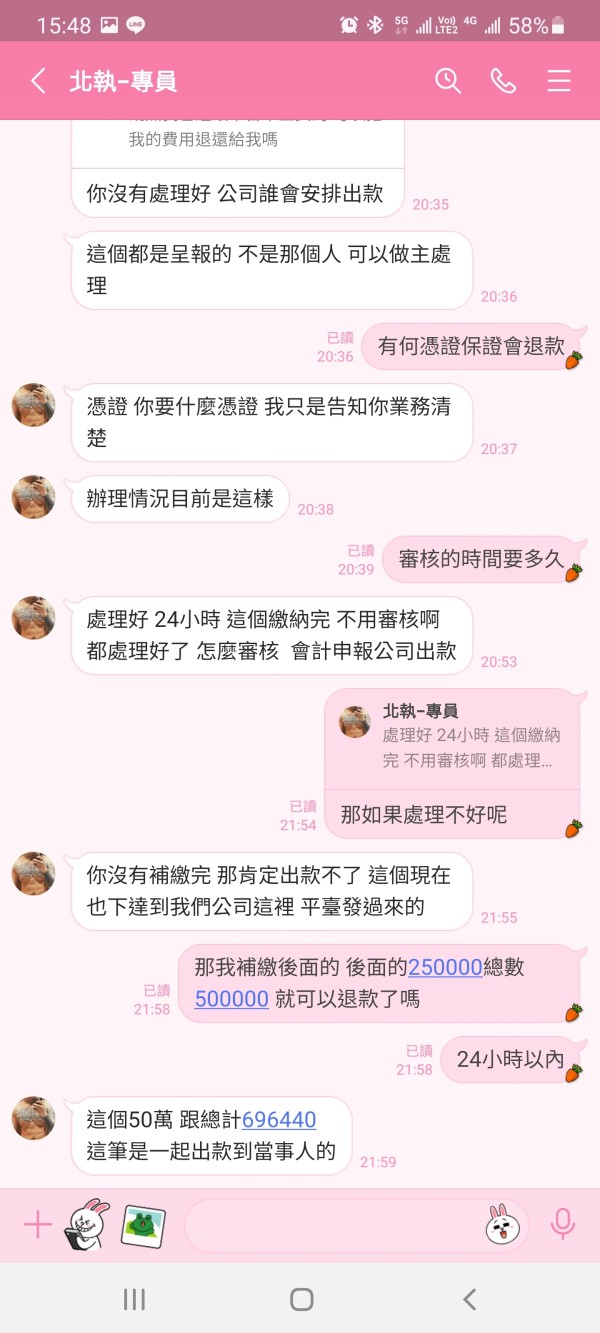

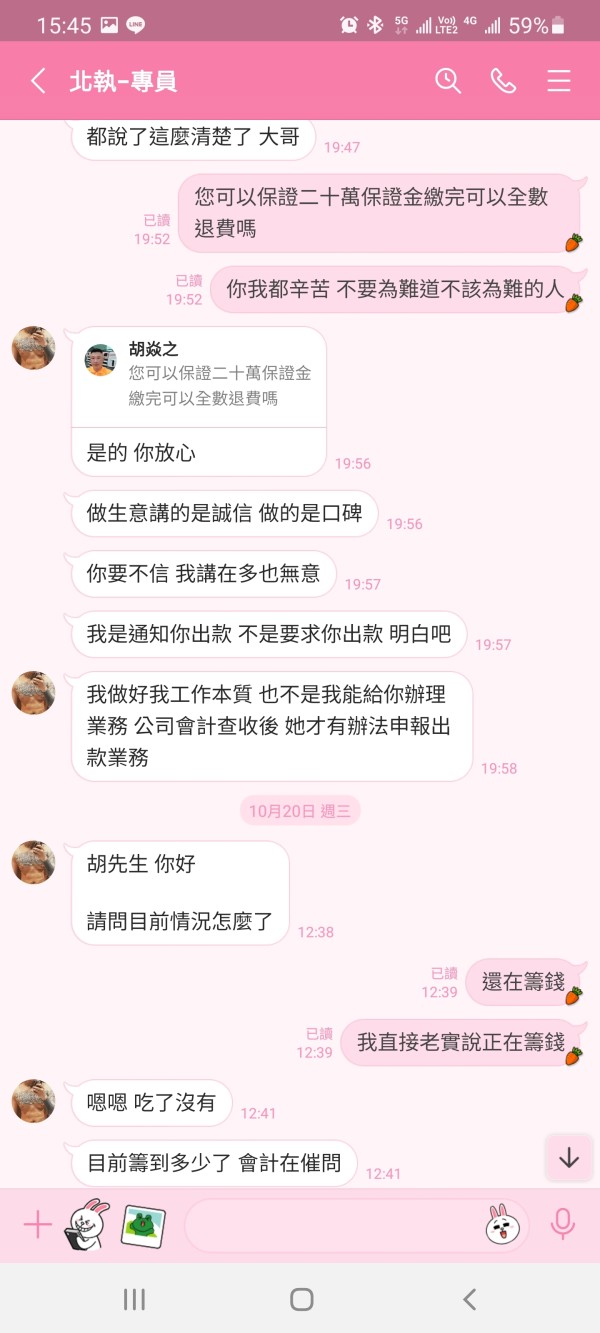

The lack of effective customer support becomes particularly concerning when combined with the broker's regulatory issues and operational challenges. Traders experiencing problems with their accounts, transactions, or platform access would naturally expect prompt and professional assistance. However, the available feedback suggests that Probis failed to meet these basic service expectations. The combination of poor customer service and regulatory uncertainty creates an environment where trader concerns may not be adequately addressed or resolved.

Trading Experience Analysis

The trading experience provided by Probis has been a source of significant user dissatisfaction. This is evidenced by consistently negative feedback and poor ratings. Users have reported various issues related to platform performance, order execution quality, and overall trading conditions. These conditions fall short of industry standards expected from professional forex brokers.

Platform stability and execution speed appear to be particular areas of concern based on user feedback. Reports suggest that traders experienced difficulties with order processing and platform reliability. These technical issues can significantly impact trading outcomes, particularly for strategies that require precise timing and reliable execution. The absence of detailed technical performance data or platform specifications in available documentation further compounds concerns about the trading environment.

User reports indicate problems with spreads, slippage, and requoting. These are critical factors affecting trading profitability and user satisfaction. Without transparent information about execution policies, spread structures, and order handling procedures, traders cannot adequately assess whether the trading conditions meet their requirements. This Probis review must note that the combination of poor user feedback and limited transparency about trading conditions suggests an unsatisfactory trading environment. This environment would not meet the expectations of serious forex traders.

Trust and Reliability Analysis

Trust and reliability represent the most severely compromised aspects of Probis's operations. This is primarily due to the suspension of its ASIC license following bankruptcy proceedings. The Australian Securities and Investments Commission's decision to suspend Probis's Australian Financial Services license represents a fundamental breach of the regulatory framework. This framework underpins trader protection and market integrity.

The company's entry into voluntary administration in mid-July 2023 indicates serious financial difficulties. These difficulties directly impact its ability to fulfill obligations to clients and maintain operational standards. This situation raises immediate concerns about fund safety, operational continuity, and the broker's capacity to honor its commitments to traders. The regulatory action taken by ASIC demonstrates that the broker's financial condition had deteriorated to a point where continued operation under normal licensing arrangements was no longer viable.

The absence of information about client fund segregation, compensation schemes, or other protective measures further undermines confidence in the broker's reliability. Professional forex brokers typically maintain clear policies about client fund protection and provide transparent information about their financial stability. However, Probis appears to have failed in these fundamental areas. The combination of regulatory license suspension and bankruptcy proceedings makes Probis unsuitable for any trader seeking a reliable and trustworthy trading partner.

User Experience Analysis

User experience with Probis has been overwhelmingly negative. This is reflected in the broker's 0 TrustScore rating and consistent reports of dissatisfaction across multiple aspects of the trading relationship. The overall user satisfaction level suggests fundamental problems with service delivery, platform functionality, and customer relationship management. These problems extend beyond typical operational challenges.

The negative user feedback encompasses various aspects of the trading experience. This includes everything from initial account opening procedures through ongoing platform usage and customer service interactions. Users appear to have encountered difficulties that were not adequately resolved by the broker's support systems. This led to widespread dissatisfaction and poor ratings. The absence of positive user testimonials or success stories in available documentation suggests that few, if any, clients had satisfactory experiences with the broker.

The user experience challenges become particularly significant when viewed alongside the broker's regulatory and financial difficulties. Traders typically seek brokers that provide not only competitive trading conditions but also reliable service delivery and professional customer relationship management. Probis appears to have failed in these fundamental areas. This created an environment where user needs were not met and concerns were not adequately addressed. The combination of poor user experience and regulatory issues makes Probis unsuitable for traders seeking professional and reliable forex trading services.

Conclusion

This comprehensive Probis review reveals a forex broker that faces severe regulatory and operational challenges. These challenges make it unsuitable for traders seeking reliable financial services. The suspension of Probis's ASIC license following bankruptcy proceedings represents a fundamental breach of the regulatory framework that underpins trader protection and market integrity. Combined with consistently negative user feedback reflected in a 0 TrustScore rating, the evidence suggests significant deficiencies across all aspects of the broker's operations.

The broker is not recommended for any trader category, whether novice or experienced. This is due to the combination of regulatory license suspension, financial instability, and poor user satisfaction. Risk-averse investors should particularly avoid this broker given the uncertainty surrounding fund safety and operational continuity. While Probis previously offered access to multiple financial instruments including forex and CFD products, these potential advantages are completely overshadowed by the serious regulatory and operational concerns. These concerns compromise the fundamental requirements for a trustworthy trading relationship.