Is poopac safe?

Business

License

Is Poopac Safe or Scam?

Introduction

Poopac is a forex, cryptocurrency, and CFD broker that positions itself as a global trading platform catering to various financial markets. In an industry rife with both reputable and dubious players, it is crucial for traders to meticulously evaluate any broker before committing their funds. The potential for loss is significant, especially with unregulated entities that may not prioritize client protection. This article aims to provide a comprehensive assessment of Poopac, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The analysis is based on a review of multiple sources and customer feedback to offer an objective perspective on whether Poopac is safe or a potential scam.

Regulation and Legitimacy

The regulatory framework within which a broker operates is fundamental to its legitimacy and the safety of client funds. Regulated brokers are required to adhere to strict guidelines that safeguard investor interests, whereas unregulated brokers operate with little oversight, increasing the risk for traders.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

Poopac claims to be registered in the United Kingdom under the name Poopac Wealth Ltd. However, it has no valid licenses from reputable regulatory bodies such as the UK's Financial Conduct Authority (FCA) or the US National Futures Association (NFA). The absence of regulation raises significant concerns regarding the broker's legitimacy. Furthermore, the company's inability to provide verifiable regulatory information suggests a lack of transparency and accountability. In summary, the lack of regulation is a substantial red flag, indicating that Poopac may not be safe for traders.

Company Background Investigation

Understanding the history and ownership structure of a broker is essential for assessing its reliability. Poopac Wealth Ltd. was allegedly established in 2021. However, there is limited information available about its founders or management team, which raises questions about the broker's operational integrity.

The lack of transparency regarding the company's ownership and management is concerning. A reputable broker typically discloses information about its leadership team, including their professional backgrounds and experiences in the financial industry. In the case of Poopac, such details are conspicuously absent, leading to doubts about the broker's credibility. This lack of information further complicates the assessment of whether Poopac is safe for potential investors.

Trading Conditions Analysis

An in-depth analysis of trading conditions is crucial for evaluating a broker's competitiveness and transparency. Poopac offers various trading instruments, including forex pairs, cryptocurrencies, and CFDs. However, the absence of clear information regarding trading fees, spreads, and commissions is alarming.

| Fee Type | Poopac | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The lack of disclosed trading fees and conditions creates uncertainty for potential clients. Furthermore, any unusual fee structures could be indicative of hidden costs that may not be immediately apparent. This opacity raises significant concerns about whether Poopac is safe for trading, as traders may find themselves facing unexpected charges.

Client Funds Safety

The safety of client funds is paramount when evaluating a broker. Poopac's website does not provide adequate information regarding its measures for safeguarding client deposits. A reputable broker typically segregates client funds from its operational capital and participates in compensation schemes to protect investors in the event of insolvency.

Moreover, the absence of information on negative balance protection policies raises further concerns. Negative balance protection ensures that clients cannot lose more than their initial investment, a critical feature for risk management. The lack of transparency regarding these safety measures suggests that Poopac may not be safe for traders, as it does not prioritize the security of client funds.

Customer Experience and Complaints

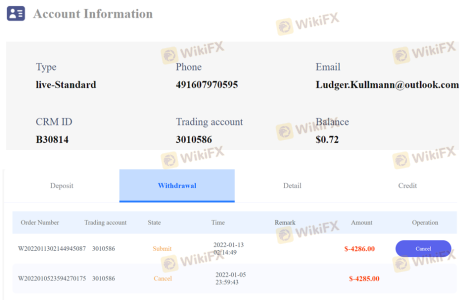

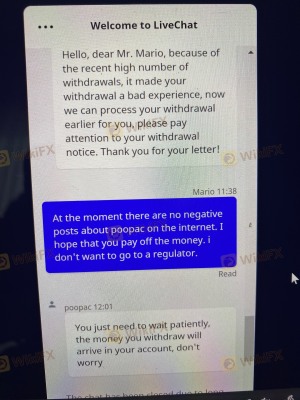

Customer feedback plays a vital role in understanding a broker's reliability. Reviews and complaints about Poopac indicate a consistent pattern of issues, particularly concerning withdrawal requests and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

| Misleading Promotions | High | Ignored |

Many users have reported difficulties in accessing their funds, with complaints about delayed or denied withdrawals. Such issues are indicative of a potentially fraudulent operation. Furthermore, the company's inadequate response to customer inquiries exacerbates the situation, leading to dissatisfaction and distrust among users. This pattern of complaints raises significant concerns about whether Poopac is safe for traders.

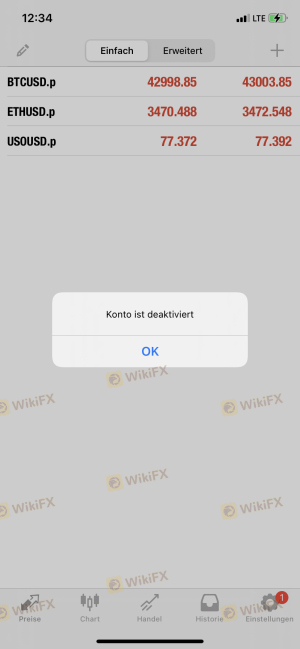

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. Poopac claims to offer a proprietary trading platform, but its performance, stability, and user experience are not well-documented.

Traders have reported issues with order execution, including slippage and high rejection rates. These problems can significantly impact trading outcomes and raise suspicions of potential platform manipulation. Without a reliable platform, the risks associated with trading through Poopac are exacerbated, further questioning the broker's safety.

Risk Assessment

Using Poopac poses several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk. |

| Financial Risk | High | Lack of transparency in fees. |

| Operational Risk | Medium | Issues with platform stability. |

| Customer Service Risk | High | Poor response to complaints. |

Given the high-risk levels across multiple categories, it is essential for traders to approach Poopac with caution. To mitigate these risks, it is advisable to consider alternative brokers with established regulatory oversight and positive user feedback.

Conclusion and Recommendations

In light of the evidence presented, it is evident that Poopac is not safe for traders. The broker's lack of regulation, transparency, and poor customer feedback raises serious red flags. Potential investors are strongly advised to exercise caution and consider reputable alternatives that prioritize client protection and regulatory compliance. Brokers with robust regulatory frameworks, transparent fee structures, and positive customer experiences should be prioritized to ensure a safer trading environment.

Is poopac a scam, or is it legit?

The latest exposure and evaluation content of poopac brokers.

poopac Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

poopac latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.