Poopac 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive poopac review reveals significant concerns about this forex broker that potential traders must carefully consider. Poopac presents itself as an online forex broker offering over 200 financial instruments across multiple asset classes including currencies, commodities, indices, precious metals, stocks, and cryptocurrencies. Our analysis uncovers critical red flags that substantially impact its overall rating.

The most concerning aspect of Poopac is its complete lack of regulatory oversight from any government authority. This absence of regulation creates substantial risks for traders, as there are no official protections for client funds or standardized operational requirements. According to available information, the company operates from the United Kingdom but has not obtained authorization from the Financial Conduct Authority or any other recognized regulatory body.

User feedback and third-party assessments paint a troubling picture of Poopac's reliability. Scam Detector website has assigned the broker a concerning score of 20, indicating significant trust issues. Multiple sources suggest potential bankruptcy risks, while user reviews consistently highlight poor service quality and overall dissatisfaction with the platform's performance.

The broker appears to target traders with higher risk tolerance who prioritize access to diverse trading instruments over regulatory protection and platform reliability. Given the substantial concerns regarding financial stability and regulatory compliance, even risk-tolerant traders should exercise extreme caution when considering this platform.

Important Notice

This evaluation is based on a comprehensive assessment of publicly available information and user feedback as of 2025. The analysis incorporates data from multiple sources including regulatory databases, user review platforms, and third-party assessment websites. Given the limited transparency of Poopac's operations, some information gaps exist, which are clearly noted throughout this review.

Readers should be aware that the lack of detailed operational information from the broker itself limits the completeness of this assessment. The evaluation methodology emphasizes available data points while acknowledging information limitations that prevent more detailed analysis in certain areas.

Rating Framework

Broker Overview

Poopac operates as an online forex broker with registration in the United Kingdom. Specific establishment dates and detailed company background information remain undisclosed in available sources. The company positions itself in the competitive forex market by offering access to multiple asset classes, attempting to attract traders seeking diversified trading opportunities within a single platform.

The broker's business model centers on providing online trading services across various financial markets. The lack of detailed information about the company's history, leadership, and operational structure raises transparency concerns that potential clients should carefully consider.

Regarding trading infrastructure, Poopac claims to offer access to over 200 financial instruments spanning major asset categories. These include foreign exchange pairs, commodities, stock indices, precious metals, individual stocks, and cryptocurrency trading options. This diverse offering represents one of the few positive aspects identified in this poopac review. The absence of regulatory oversight means there are no official standards governing how these instruments are offered or the quality of execution provided to traders.

The broker's unregulated status represents its most significant limitation. It operates without oversight from the Financial Conduct Authority or any other recognized financial regulatory body, despite its UK registration.

Regulatory Status: Available information confirms that Poopac does not hold authorization from any government regulatory authority. This creates substantial risks for potential clients.

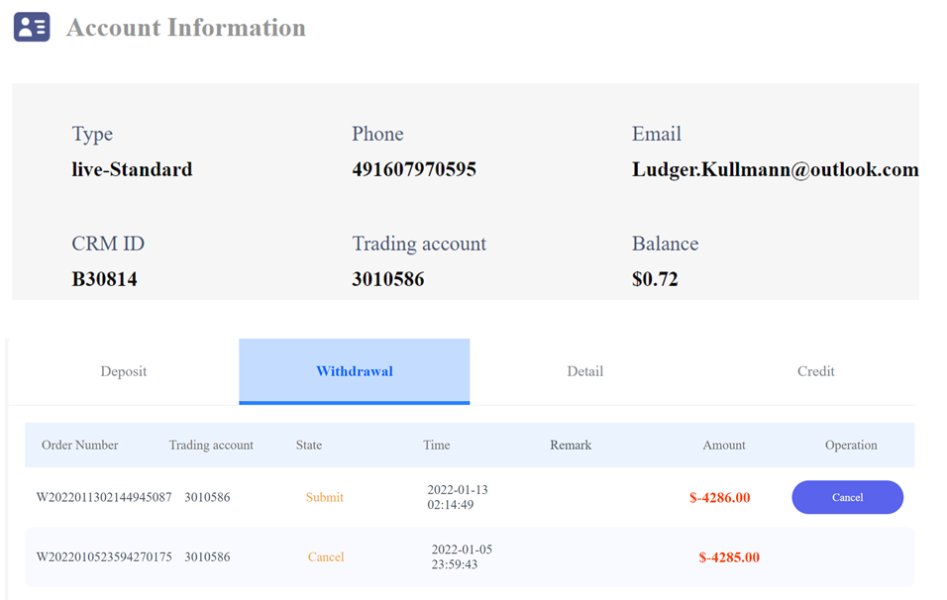

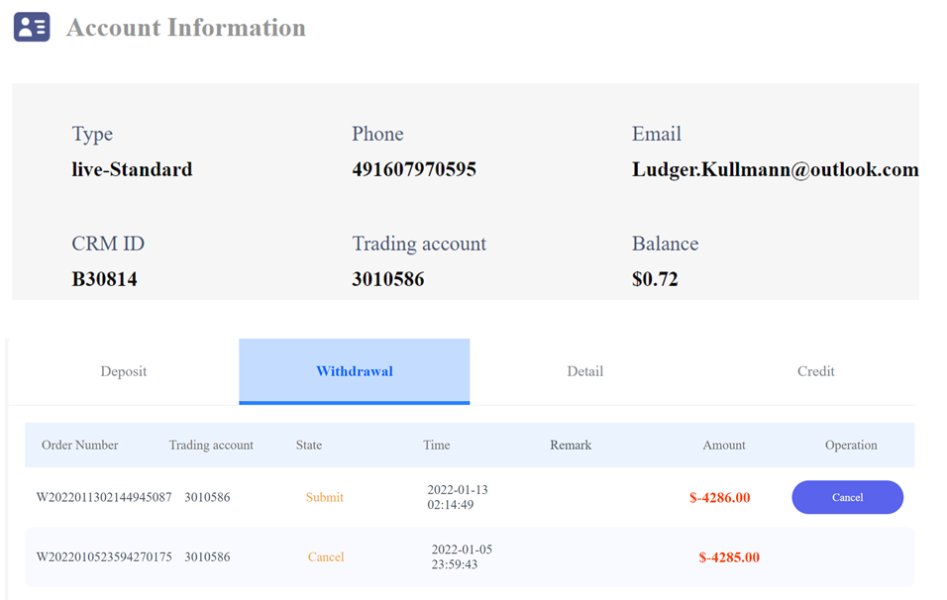

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options has not been detailed in accessible sources, representing a significant transparency gap.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit amounts in available materials. This makes it difficult for potential traders to assess accessibility.

Promotional Offers: No information regarding bonus structures or promotional campaigns is available in current sources.

Tradeable Assets: Poopac offers access to over 200 financial instruments across six major categories: forex pairs, commodities, indices, precious metals, stocks, and cryptocurrencies. This provides relatively diverse trading opportunities.

Cost Structure: Detailed information about spreads, commissions, and other trading costs remains undisclosed in available sources. This prevents accurate cost analysis for this poopac review.

Leverage Options: Specific leverage ratios offered by the platform are not detailed in accessible information.

Platform Options: Trading platform specifications and available software options are not clearly outlined in current sources.

Geographic Restrictions: Information about regional availability and trading restrictions is not specified in available materials.

Customer Support Languages: Available sources indicate English language support. Comprehensive language options remain unclear.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Poopac's account conditions receives the lowest possible rating due to the complete absence of detailed information about account structures, requirements, and features. This lack of transparency represents a significant concern for potential traders who require clear understanding of account terms before committing funds.

No information is available regarding different account types that may be offered. This makes it impossible to assess whether the broker provides options suitable for various trader experience levels or capital requirements. The absence of disclosed minimum deposit amounts prevents potential clients from understanding the financial commitment required to begin trading.

Account opening procedures and verification requirements remain undisclosed, creating uncertainty about the onboarding process and compliance standards. This information gap is particularly concerning given the broker's unregulated status, as there are no standardized requirements governing account opening procedures.

Specialized account features such as Islamic accounts for traders requiring swap-free trading are not mentioned in available sources. The lack of detailed account information significantly impacts the overall assessment in this poopac review, as account conditions form the foundation of the trader-broker relationship.

Without clear account terms, potential clients cannot make informed decisions about whether the platform meets their specific trading needs and risk management requirements.

Poopac's tools and resources evaluation achieves a moderate rating primarily based on the claimed availability of over 200 financial instruments across multiple asset classes. This diversity represents the platform's strongest feature, potentially offering traders access to various markets within a single account.

The range of available instruments spans traditional forex pairs, commodities including precious metals, major stock indices, individual equities, and cryptocurrency options. This breadth could appeal to traders seeking portfolio diversification or those wanting to capitalize on opportunities across different market sectors.

The assessment is limited by the absence of detailed information about research and analysis resources that support trading decisions. No mention is found of market analysis tools, economic calendars, technical analysis features, or fundamental research materials that professional traders typically require.

Educational resources and training materials are not detailed in available sources, suggesting limited support for trader development and skill enhancement. The lack of information about automated trading capabilities, expert advisors, or algorithmic trading support further limits the platform's appeal to advanced traders.

While the instrument diversity provides some value, the overall tools and resources offering appears limited compared to established brokers who provide comprehensive trading support ecosystems.

Customer Service and Support Analysis

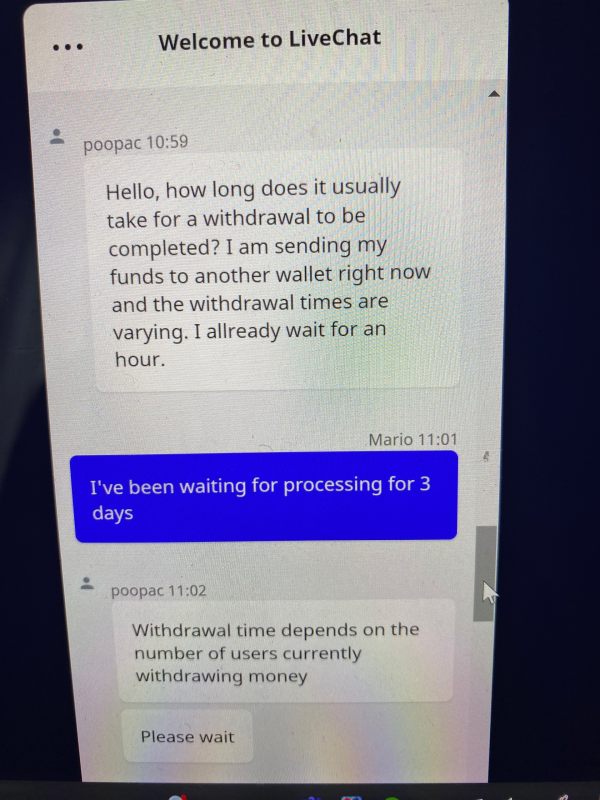

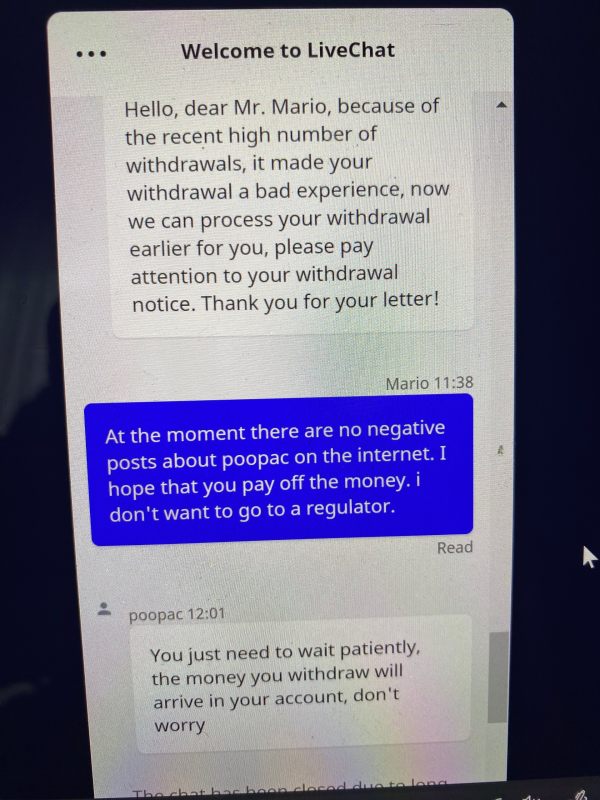

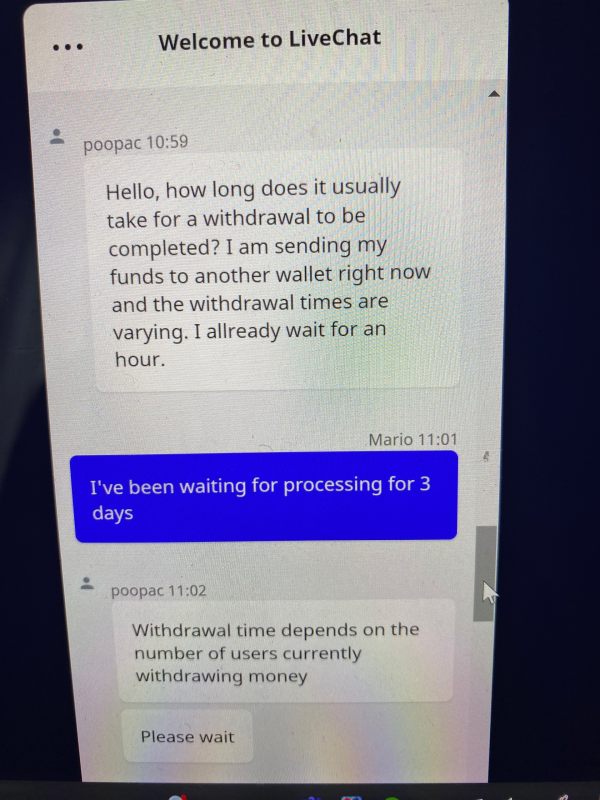

Customer service evaluation reveals significant concerns based on available user feedback and the lack of detailed support information. User reports consistently highlight poor service quality, contributing to the low rating in this category.

Available sources do not provide specific details about customer support channels, availability hours, or response time standards. This information gap makes it difficult for potential clients to understand how they can access help when needed, particularly during critical trading situations.

The absence of detailed multi-language support information limits accessibility for international traders, though English support appears to be available. Without clear communication channels and support procedures, traders may face difficulties resolving account issues or technical problems.

User feedback suggests dissatisfaction with service quality, though specific examples of support interactions are not detailed in available sources. The combination of poor user reports and limited transparency about support procedures creates concerns about the reliability of customer assistance.

Professional traders require responsive, knowledgeable support to address technical issues, account questions, and trading problems promptly. The apparent limitations in Poopac's customer service capabilities represent a significant drawback for serious trading activities.

Trading Experience Analysis

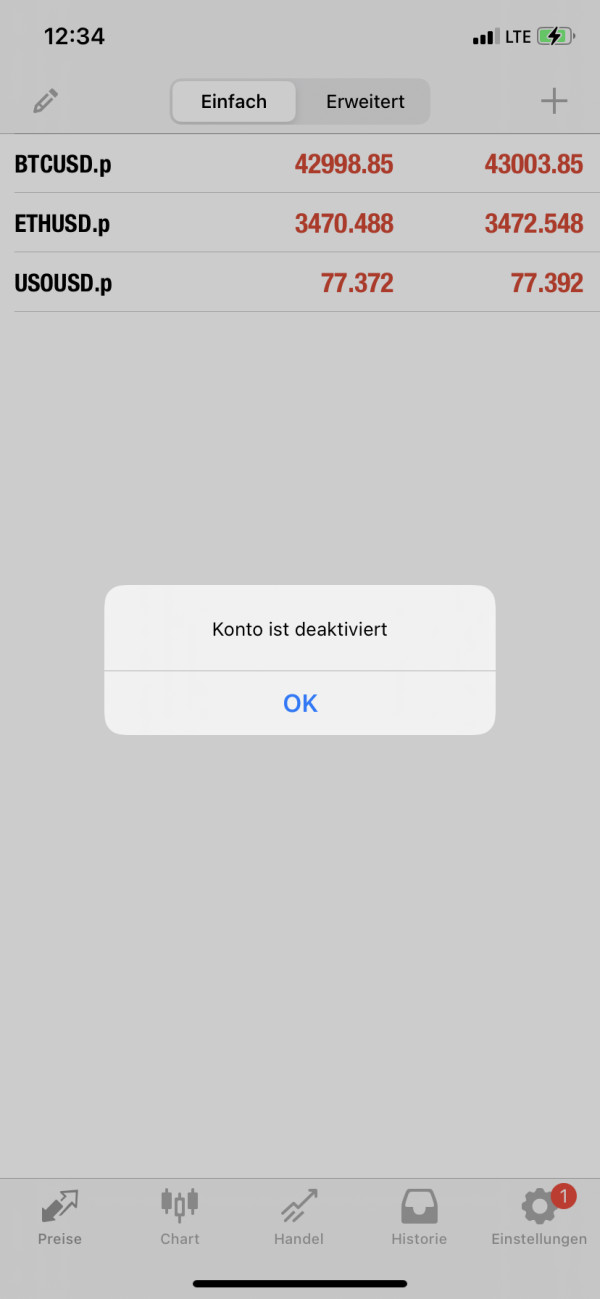

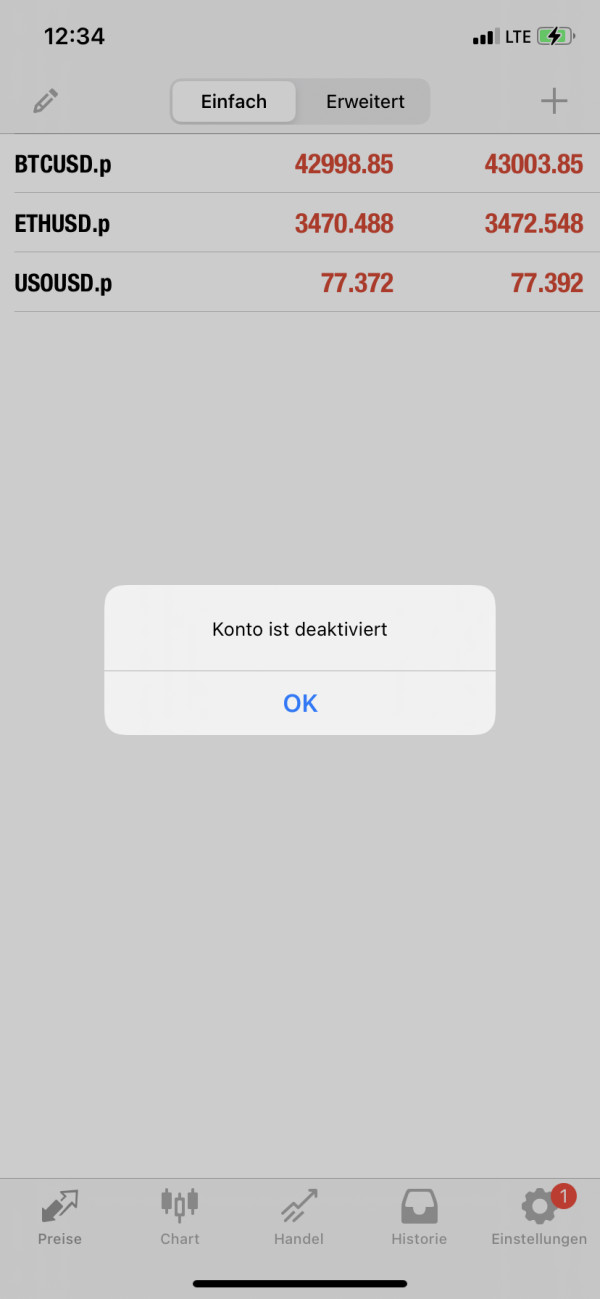

The trading experience assessment reflects concerns about platform performance and user satisfaction based on limited available feedback. While specific technical performance data is not available, the overall user sentiment suggests suboptimal trading conditions.

Platform stability and execution speed information is not detailed in accessible sources, preventing assessment of critical technical performance factors that directly impact trading results. Without reliable execution and stable platform performance, traders may face difficulties implementing their strategies effectively.

Order execution quality data is not available, making it impossible to evaluate how efficiently the platform processes trades or whether slippage and requotes present significant issues. These factors are crucial for active traders who require consistent execution standards.

Mobile trading capabilities and platform functionality details remain undisclosed, limiting understanding of the complete trading environment offered to clients. Modern traders expect seamless cross-platform experiences that support various trading styles and timeframes.

The limited positive user feedback available suggests that the trading experience may not meet professional standards expected by serious traders. This poopac review finds insufficient evidence of robust trading infrastructure that supports consistent, reliable trade execution across different market conditions.

Trust and Reliability Analysis

Trust and reliability represent Poopac's most significant weakness, earning the lowest possible rating due to fundamental concerns about regulatory compliance and financial stability. The broker's unregulated status creates substantial risks that cannot be overlooked in any comprehensive evaluation.

Operating without authorization from any recognized financial regulatory authority means client funds lack official protection mechanisms typically required by licensed brokers. This absence of regulatory oversight eliminates important safeguards including segregated client accounts, compensation schemes, and standardized operational requirements.

Financial stability concerns are highlighted by reports suggesting potential bankruptcy risks. According to available information, third-party assessment platforms have raised questions about the broker's long-term viability, creating additional uncertainty for potential clients considering fund deposits.

Company transparency issues compound these concerns, as detailed information about corporate structure, management, and financial backing remains undisclosed. Professional traders require confidence in their broker's stability and regulatory compliance to commit significant capital to trading activities.

The Scam Detector website's rating of 20 for Poopac indicates substantial trust issues that align with the regulatory and transparency concerns identified in this analysis. These combined factors create a risk profile that makes the platform unsuitable for traders prioritizing capital protection and regulatory compliance.

User Experience Analysis

User experience evaluation reveals consistently poor satisfaction levels based on available feedback and assessment platforms. The overall user sentiment suggests significant dissatisfaction with various aspects of the platform's service delivery and performance.

User satisfaction ratings from available sources indicate widespread concerns about the platform's reliability and service quality. While specific user interface and design details are not available, the negative feedback suggests fundamental issues with the overall user experience.

Registration and account verification processes are not detailed in available sources, preventing assessment of the onboarding experience that forms users' first impressions of the platform. Smooth, efficient account opening procedures are essential for positive initial user experiences.

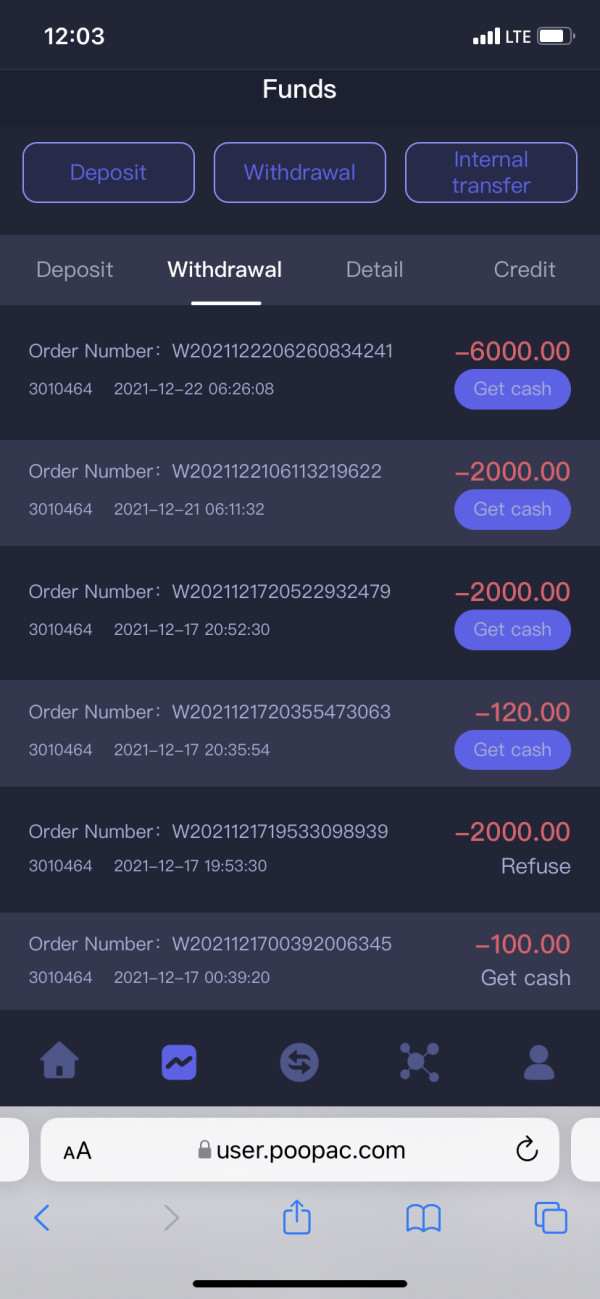

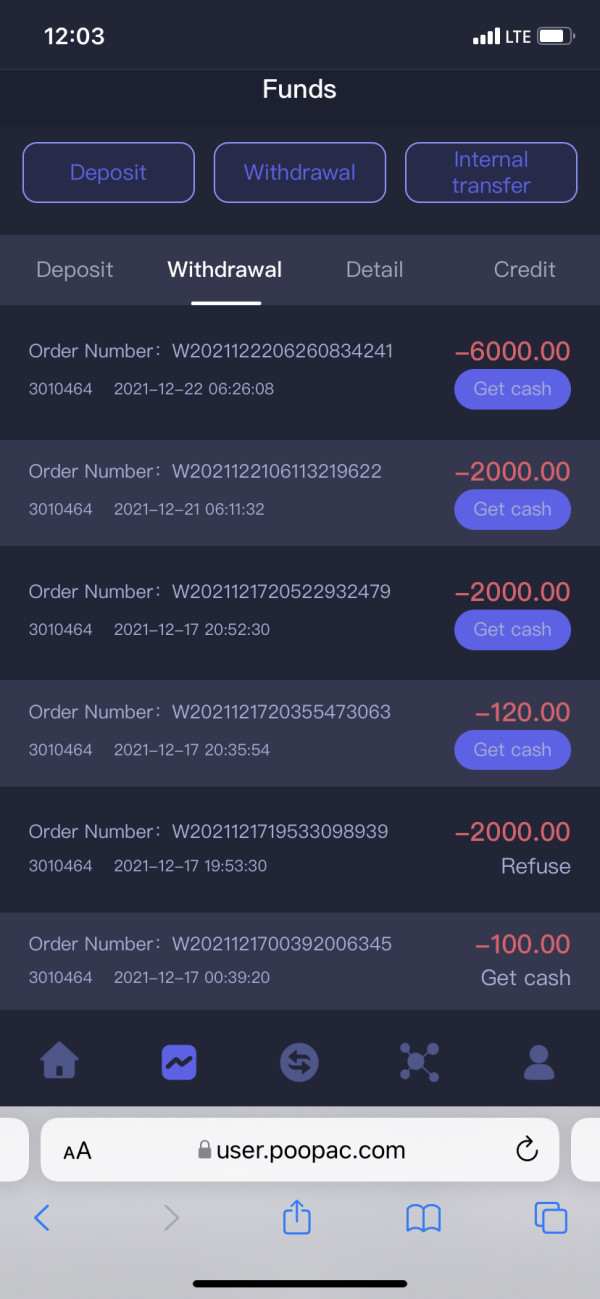

Fund management and withdrawal experiences are not specifically detailed, though the general negative user sentiment suggests potential issues with financial transactions that directly impact user satisfaction and confidence. Common user complaints appear to center on service quality issues, though specific examples are not detailed in available sources.

The pattern of negative feedback across multiple assessment platforms suggests systemic issues rather than isolated incidents that could be easily resolved.

Conclusion

This comprehensive poopac review reveals significant concerns that substantially outweigh any potential benefits offered by the platform. While Poopac provides access to over 200 financial instruments across diverse asset classes, the fundamental issues surrounding regulatory compliance, financial stability, and user satisfaction create substantial risks for potential traders.

The broker's unregulated status represents an unacceptable risk for most traders, as it eliminates essential protections and oversight mechanisms that licensed brokers must provide. Combined with reports of potential bankruptcy risks and consistently poor user feedback, Poopac fails to meet basic standards expected from professional trading platforms.

Based on this analysis, Poopac is not recommended for any trader category, particularly those with lower risk tolerance or limited trading experience. Even traders comfortable with higher risk levels should carefully consider whether the limited benefits justify the substantial concerns identified in this evaluation.

Professional traders seeking reliable, regulated platforms with strong reputations would be better served by exploring established alternatives with proper regulatory oversight and positive user feedback.