Is exfor safe?

Pros

Cons

Is Exfor A Scam?

Introduction

Exfor is a forex broker that positions itself as a player in the competitive online trading market. Operating under the domain exfor.com, it claims to offer a variety of financial instruments including forex, commodities, and indices. However, the legitimacy of Exfor has become a topic of concern among traders, especially given the increasing prevalence of scams in the forex industry. As traders seek to maximize their investments, it is crucial to thoroughly evaluate the credibility of any broker before committing funds. This article aims to provide an objective analysis of Exfor, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The evaluation is based on a comprehensive review of available online resources, including user feedback and expert opinions.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors that determine its legitimacy. Exfor claims to be regulated by the Labuan Financial Services Authority (LFSA) in Malaysia. However, scrutiny reveals that the broker is not listed in the LFSA's official database, raising doubts about its regulatory claims. The lack of a legitimate forex license from a recognized authority such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) is a significant red flag.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan FSA | Not Listed | Malaysia | Unverified |

The quality of regulation is paramount; it ensures that brokers adhere to strict operational standards and provides a safety net for clients in case of bankruptcy or malpractice. Brokers operating in offshore jurisdictions like Labuan often face minimal regulatory scrutiny, which can lead to potential risks for traders. Without a credible regulatory framework, traders funds may be at risk, and there is little recourse in the event of a dispute or financial loss. Therefore, it is advisable for traders to engage with brokers that are regulated by reputable authorities to ensure the safety and security of their investments.

Company Background Investigation

Exfor Limited, the entity behind Exfor, is reportedly based in Labuan, Malaysia. However, details regarding its establishment, ownership structure, and operational history are vague. The lack of transparency regarding the company's origins and management team raises concerns about its credibility. Reliable brokers typically provide comprehensive information about their founders and management teams, including their professional backgrounds and expertise in the financial industry.

The absence of such information can be indicative of a lack of accountability and can deter potential clients from trusting the broker. Furthermore, a well-structured organization with a transparent operational model is more likely to adhere to ethical practices, which is crucial in the financial services sector. The opacity surrounding Exfor's corporate governance and management structure further complicates its legitimacy, suggesting that potential clients should exercise caution before engaging with this broker.

Trading Conditions Analysis

Exfor offers a minimum deposit requirement of $100, with leverage up to 1:100 and spreads advertised as low as 0.2 pips. While these conditions may appear attractive, the overall cost structure and fee policies warrant a closer examination. A detailed analysis reveals that Exfor charges a flat monthly fee of $25, which is unusual for forex brokers. This fee structure may not be favorable for traders who conduct infrequent trades or those who prefer a commission-based model.

| Fee Type | Exfor | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.6 pips |

| Commission Model | Monthly Fee | Per Lot |

| Overnight Interest Range | Not Specified | Varies |

The imposition of a monthly fee, coupled with potentially hidden charges, can significantly impact a trader's profitability. Traders should be wary of brokers that deviate from standard fee structures, as this can often lead to unexpected costs. Additionally, the lack of transparency regarding overnight interest rates and potential withdrawal fees raises further concerns about the broker's overall cost-effectiveness. It is essential for traders to fully understand the fee structure before committing to a broker, as this can directly affect their trading outcomes.

Client Fund Security

The security of client funds is a paramount concern for traders when choosing a broker. Exfor claims to hold client funds in segregated accounts; however, the lack of regulatory oversight raises questions about the actual implementation of these measures. Without a credible regulatory framework, there is no guarantee that client funds are protected in the event of the broker's insolvency or mismanagement.

Additionally, Exfor does not offer negative balance protection, which further exposes traders to potential financial risks. In regulated environments, brokers are typically required to maintain client funds in separate accounts and provide compensation schemes to safeguard traders in case of financial difficulties. The absence of such protections with Exfor indicates a significant risk to client funds, making it imperative for traders to consider these factors before investing.

Customer Experience and Complaints

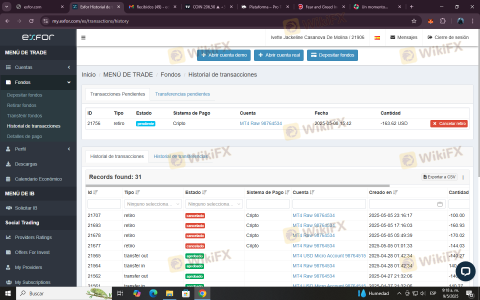

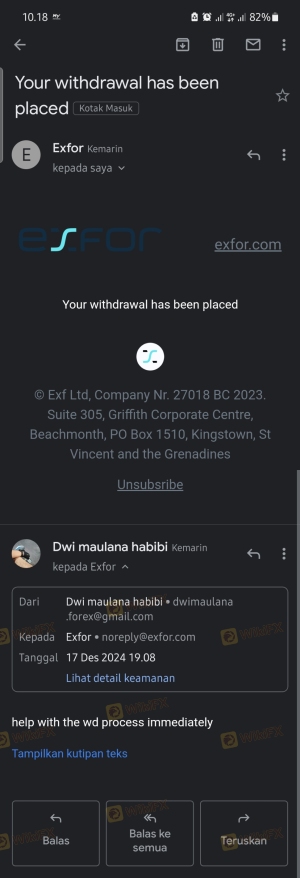

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Exfor suggest a mixed bag of experiences, with numerous complaints highlighting issues such as withdrawal difficulties, lack of customer support, and unexpected fees. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Poor |

| Unexpected Fees | High | Unresponsive |

For instance, several users reported difficulties in withdrawing their funds, with some claiming that the broker imposed excessive fees or failed to process requests altogether. These issues are often indicative of a broker that lacks transparency and accountability, further supporting the notion that Exfor may not be a reliable choice for traders. The quality of customer support is also a critical factor; brokers that are unresponsive to client inquiries can exacerbate frustrations and lead to a negative trading experience.

Platform and Trade Execution

Exfor utilizes popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their robust features and user-friendly interfaces. However, the performance and reliability of the platform are crucial for successful trading. Reports from users indicate that while the platforms are functional, there have been instances of slippage and order rejections, which can adversely affect trading outcomes.

The presence of any signs of platform manipulation, such as frequent rejections of orders or unusual slippage, should raise red flags for traders. A broker should provide a seamless trading experience, and any consistent issues in execution can significantly impact a trader's ability to capitalize on market opportunities. Therefore, it is essential for traders to assess the execution quality and reliability of the trading platform before committing funds.

Risk Assessment

Engaging with Exfor presents a range of risks that traders should carefully consider. The lack of regulation, combined with questionable trading practices and customer service issues, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | No negative balance protection or guaranteed funds. |

| Customer Service Risk | Medium | Poor response to complaints and support issues. |

| Execution Risk | Medium | Reports of slippage and order rejection. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers that offer greater regulatory oversight and robust customer protections. Engaging with well-regulated brokers can provide peace of mind and a more secure trading environment.

Conclusion and Recommendations

In conclusion, while Exfor presents itself as a legitimate forex broker, significant concerns regarding its regulatory status, company transparency, trading conditions, and overall client experience suggest that it may not be a safe option for traders. The absence of credible regulation, combined with reports of withdrawal issues and inadequate customer support, raises red flags that should not be ignored.

Traders are strongly advised to approach Exfor with caution and consider alternative options that offer better regulatory protections and customer service. Brokers such as Fortrade, regulated by the FCA and ASIC, provide a more secure trading environment and are recommended for those seeking reliable trading partners. Ultimately, thorough research and due diligence are essential for safeguarding investments in the forex market.

Is exfor a scam, or is it legit?

The latest exposure and evaluation content of exfor brokers.

exfor Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

exfor latest industry rating score is 2.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.