Is Unit Club safe?

Pros

Cons

Is Unit Club Safe or a Scam?

Introduction

Unit Club is a relatively new player in the forex market, positioning itself as an innovative platform that promises to help traders maximize their financial ambitions. As with any financial service, especially in the volatile world of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The legitimacy and reliability of a trading platform can significantly impact a trader's experience and financial safety. This article aims to provide an objective analysis of Unit Club, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. The assessment is based on a review of various sources, including user feedback, regulatory databases, and expert analyses, to offer a comprehensive view of whether Unit Club is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. A well-regulated broker is typically subject to stringent oversight, which helps protect traders' interests. In the case of Unit Club, it is essential to examine its regulatory framework to assess its safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Unit Club does not appear to be regulated by any recognized financial authority. This lack of regulation is a significant red flag for potential investors. Top-tier regulators, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia, enforce strict compliance standards that protect traders from fraud and malpractice. Without oversight from such authorities, traders may face higher risks, including potential loss of funds and lack of recourse in the event of disputes. Therefore, it is prudent to conclude that Unit Club is not safe due to its unregulated status.

Company Background Investigation

A thorough understanding of a company's history, ownership structure, and management team can provide valuable insights into its reliability. Unit Club claims to offer various trading tools and resources designed to enhance the trading experience. However, details about its founding, ownership, and operational history are sparse.

The company's website presents a simple interface and claims to operate from London, UK. However, the absence of clear information regarding its founders or key management personnel raises concerns about transparency. A reputable broker typically provides comprehensive information about its leadership team, including their professional backgrounds and industry experience. The lack of such disclosure can lead to skepticism regarding the company's intentions and operational integrity.

Furthermore, the opacity surrounding Unit Club's ownership and management may hinder potential traders from making informed decisions. A transparent company is often a sign of trustworthiness, whereas a lack of information can indicate potential risks. Thus, traders should be cautious, as the absence of a clear corporate structure and leadership information suggests that Unit Club may not be a safe option.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value. Unit Club advertises various investment products with attractive returns, which may seem appealing at first glance. However, it is essential to scrutinize the overall fee structure and any potential hidden costs.

| Fee Type | Unit Club | Industry Average |

|---|---|---|

| Spread for Major Pairs | High (not disclosed) | Low (1-2 pips) |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Unclear | 0.5% - 3% |

Unit Club claims to offer competitive trading conditions, but the lack of transparency regarding spreads and commission structures is concerning. High spreads can significantly erode trading profits, and undisclosed fees can lead to unexpected costs. In comparison, established brokers typically provide clear information about their fee structures, allowing traders to make informed choices.

Moreover, the absence of detailed information regarding overnight interest rates and commissions raises further questions about the broker's practices. Traders should be wary of any broker that does not clearly disclose its fee structure, as this can be indicative of potential issues down the line. Therefore, it is reasonable to assert that Unit Club's trading conditions may not be safe for traders seeking transparency and fair pricing.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading space. Reputable brokers implement robust measures to protect traders' funds, including segregated accounts, investor protection schemes, and negative balance protection policies. In the case of Unit Club, the safety measures in place are unclear.

Unit Club does not provide explicit details regarding how it safeguards customer deposits. The absence of information about fund segregation or investor protection mechanisms is alarming. Traders should ensure that their funds are held in segregated accounts, separate from the broker's operational funds, to mitigate risks associated with insolvency or mismanagement.

Additionally, negative balance protection is a crucial feature that prevents traders from losing more than their initial investment. Without such policies, traders could face significant financial risks. Given the lack of transparency regarding these critical safety measures, it is concerning to conclude that Unit Club may not adequately protect customer funds, making it a potentially unsafe choice for traders.

Customer Experience and Complaints

Analyzing customer feedback is an essential aspect of evaluating a broker's reliability. In the case of Unit Club, the feedback from users has been mixed, with several complaints surfacing regarding the company's practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Hidden Fees | Medium | No Clear Explanation |

| Poor Customer Support | High | Often Unavailable |

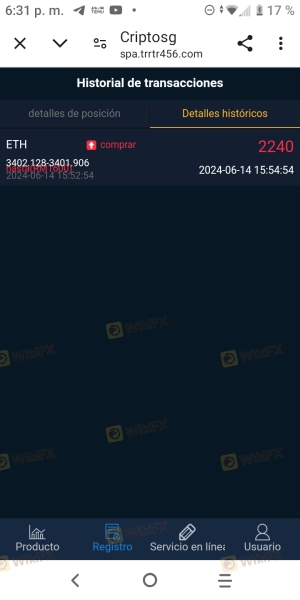

Common complaints include difficulties with withdrawals, unclear fee structures, and inadequate customer support. Many users have reported that their withdrawal requests were met with delays or outright refusals, raising concerns about the broker's trustworthiness. Additionally, the lack of responsive customer support can exacerbate frustrations for traders seeking assistance.

One notable case involved a trader who reported being unable to withdraw funds for several weeks, only to receive vague responses from the company's support team. Such experiences can significantly impact a trader's confidence in a broker's reliability. Therefore, it is prudent to conclude that Unit Club may not provide a satisfactory customer experience, further questioning its safety as a trading platform.

Platform and Execution

The performance and reliability of a trading platform are critical to a trader's success. Unit Club offers a trading platform that claims to be user-friendly and efficient. However, user experiences suggest that the platform may not meet high standards.

Traders have reported issues with order execution, including slippage and rejected orders. Such problems can lead to significant financial losses, especially in a fast-paced trading environment. Furthermore, any signs of platform manipulation, such as unusual delays during high volatility, should be taken seriously.

A reliable trading platform should provide stable performance, quick order execution, and minimal slippage. If traders experience frequent issues with execution quality, it raises concerns about the broker's operational integrity. Therefore, it is reasonable to assert that Unit Club's platform may not be safe, given the reported execution issues.

Risk Assessment

Evaluating the overall risk associated with a broker is essential for making informed trading decisions. In the case of Unit Club, several risk factors have emerged from the analysis.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risk. |

| Financial Transparency | High | Lack of clear fee structures and policies. |

| Customer Support | Medium | Inconsistent support can lead to unresolved issues. |

The unregulated status of Unit Club presents a significant risk, as traders may have little recourse in the event of disputes or financial issues. Additionally, the lack of transparency regarding fees and trading conditions exacerbates the risk profile. Traders are advised to approach Unit Club with caution and consider alternative brokers with a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that Unit Club may not be a safe broker for forex trading. The lack of regulation, transparency issues, and negative customer experiences raise significant concerns about its legitimacy. Traders should exercise caution and conduct thorough research before engaging with any broker, especially one that exhibits red flags.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by top-tier authorities, offering transparent fee structures and robust customer support. Brokers such as [Broker A], [Broker B], and [Broker C] have established reputations for safety and reliability, providing traders with a more secure trading environment. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Unit Club a scam, or is it legit?

The latest exposure and evaluation content of Unit Club brokers.

Unit Club Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Unit Club latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.