Is ONS safe?

Pros

Cons

Is ONS Safe or Scam?

Introduction

ONS is a relatively new player in the forex market, originating from Turkey and established in 2020. It offers various trading services to clients worldwide, including access to forex, contracts for difference (CFDs), commodities, and indices. As with any financial service, it is crucial for traders to carefully evaluate the credibility of ONS before investing their funds. The forex market has seen its fair share of scams and unreliable brokers, making due diligence imperative for traders seeking to protect their investments. This article aims to provide a comprehensive analysis of ONS, focusing on its regulatory status, company background, trading conditions, client safety measures, and user experiences. The evaluation framework is based on a review of multiple sources, including regulatory databases and user feedback.

Regulation and Legitimacy

One of the most critical factors in assessing whether ONS is safe lies in its regulatory status. Regulation ensures that brokers adhere to strict operational standards, providing a level of security for traders. Unfortunately, ONS operates without proper regulation, which raises significant concerns regarding its legitimacy and the safety of client funds. Below is a summary of the regulatory information available for ONS:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Turkey | Unregulated |

The absence of regulation means that ONS does not have to comply with the stringent requirements imposed by reputable financial authorities, which often include regular audits, capital requirements, and investor protection schemes. This lack of oversight can lead to unfair practices, such as manipulation of spreads or refusal to honor withdrawal requests. Traders should be particularly cautious when dealing with unregulated brokers like ONS, as they may not have the same level of accountability as their regulated counterparts.

Company Background Investigation

The company behind ONS, established only a few years ago, is still relatively unknown in the financial sector. The lack of a long history may raise red flags for potential investors. ONS is based in Istanbul, Turkey, and operates with a focus on providing various trading instruments. However, the ownership structure and management team details are not readily available, which can be a cause for concern regarding transparency.

The management teams professional backgrounds are also unclear, making it difficult for traders to assess their expertise and experience in the financial markets. Transparency in a broker's operations is essential for building trust, and the lack of information about ONS's management may deter potential clients. Furthermore, the company has not provided adequate information about its financial stability, which is crucial for evaluating whether ONS is safe for trading.

Trading Conditions Analysis

When considering whether ONS is safe, it is essential to evaluate its trading conditions, including fees and spreads. ONS offers various financial instruments, but the overall fee structure is not as competitive as some of its regulated counterparts. The following table summarizes the core trading costs associated with ONS:

| Fee Type | ONS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by ONS appear to be higher than the industry average, which could impact the overall profitability of trades. Additionally, the absence of a commission structure may lead to hidden costs that are not immediately apparent to traders. It is crucial for potential clients to thoroughly review the fee structure before deciding to trade with ONS.

Client Fund Safety

The safety of client funds is a top priority for any trader, and ONSs lack of regulatory oversight raises serious concerns in this area. The company does not appear to have implemented adequate measures to protect client funds, such as segregated accounts or insurance for investments. In the absence of these protections, clients may find themselves at risk in the event of financial difficulties faced by ONS.

Furthermore, there have been no reported incidents of fund security breaches or disputes involving ONS, but the absence of regulatory oversight means that there is little recourse for clients should issues arise. Traders should consider these factors carefully when evaluating whether ONS is safe for their trading activities.

Client Experience and Complaints

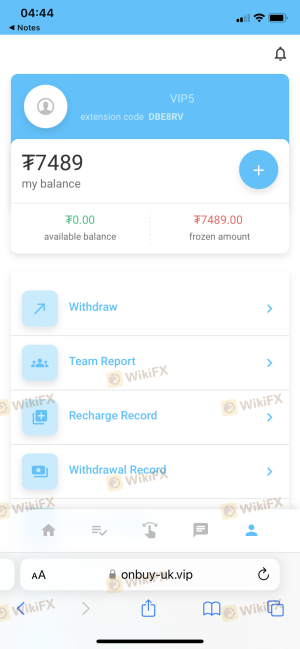

User feedback can provide valuable insights into the reliability of a broker. In the case of ONS, there is a mix of reviews, with some users expressing dissatisfaction with the trading conditions and customer support. Common complaints include difficulties in withdrawing funds and slow response times from customer service. Below is a summary of the main types of complaints received regarding ONS:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Unresolved queries |

| Trading Conditions | Low | General feedback |

One notable case involved a trader who faced significant delays in withdrawing funds, leading to frustration and a lack of trust in the platform. Such experiences can significantly impact a trader's perception of whether ONS is safe and trustworthy.

Platform and Trade Execution

The trading platform offered by ONS is an essential aspect of the overall trading experience. However, user reviews indicate that the platform may not be as stable or user-friendly as competitors. Issues such as slippage and order rejections have been reported, which can hinder trading performance. Traders have also expressed concerns about the execution quality, with some experiencing delays during high volatility periods.

While ONS claims to provide a robust trading environment, the lack of transparency regarding execution practices raises questions about potential manipulation or conflicts of interest. It is crucial for traders to assess these factors when determining whether ONS is safe for their trading needs.

Risk Assessment

In evaluating the overall risk of trading with ONS, it is essential to consider various factors, including regulatory status, client fund safety, and user experiences. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Safety Risk | High | Lack of segregation and insurance |

| Customer Service Risk | Medium | Complaints about slow support response |

| Platform Stability Risk | Medium | Reports of slippage and order issues |

To mitigate these risks, potential clients should proceed with caution. It may be advisable to start with a small deposit or consider alternative brokers with stronger regulatory oversight and proven track records.

Conclusion and Recommendations

In conclusion, the analysis indicates that ONS has several red flags that suggest it may not be a safe option for traders. The lack of regulatory oversight, combined with insufficient transparency and mixed user experiences, raises significant concerns about the reliability of this broker. While there are no outright indications of fraud, the risks associated with trading with ONS are considerable.

For traders looking for safer alternatives, it may be prudent to consider well-regulated brokers with a proven track record, such as OANDA, Forex.com, or IG, which are overseen by reputable financial authorities. These brokers provide a more secure trading environment and are more likely to have the necessary protections in place for client funds.

In summary, while ONS may offer attractive trading conditions, the potential risks make it essential for traders to carefully consider whether ONS is safe before committing their capital.

Is ONS a scam, or is it legit?

The latest exposure and evaluation content of ONS brokers.

ONS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ONS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.