ONS Review 1

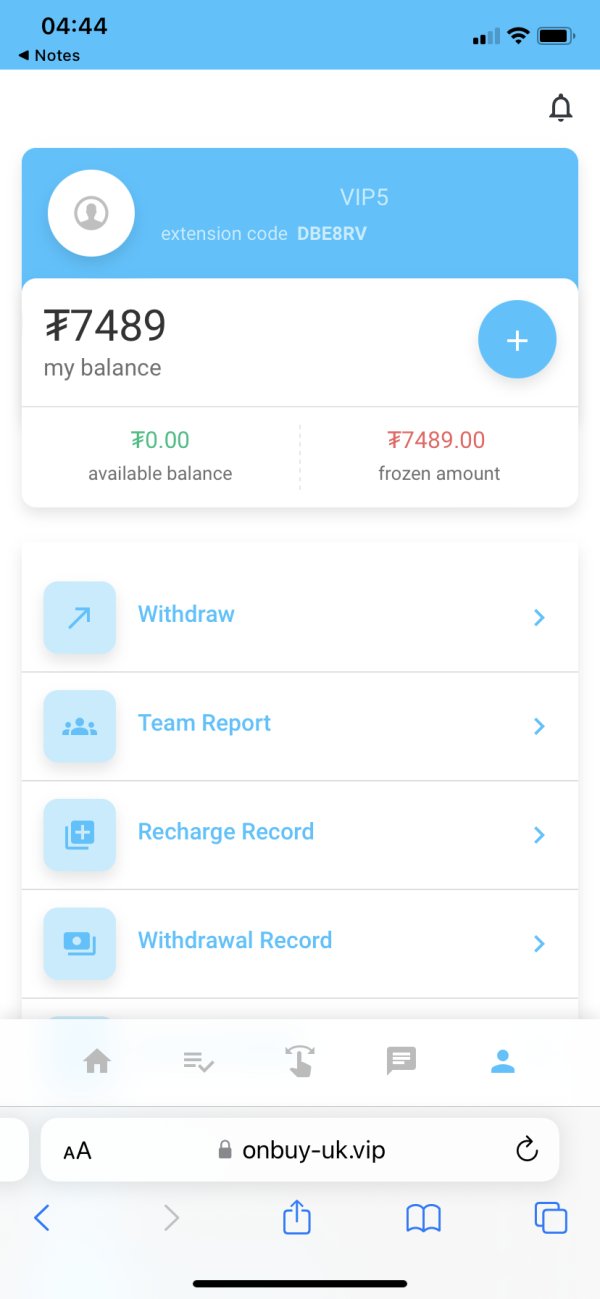

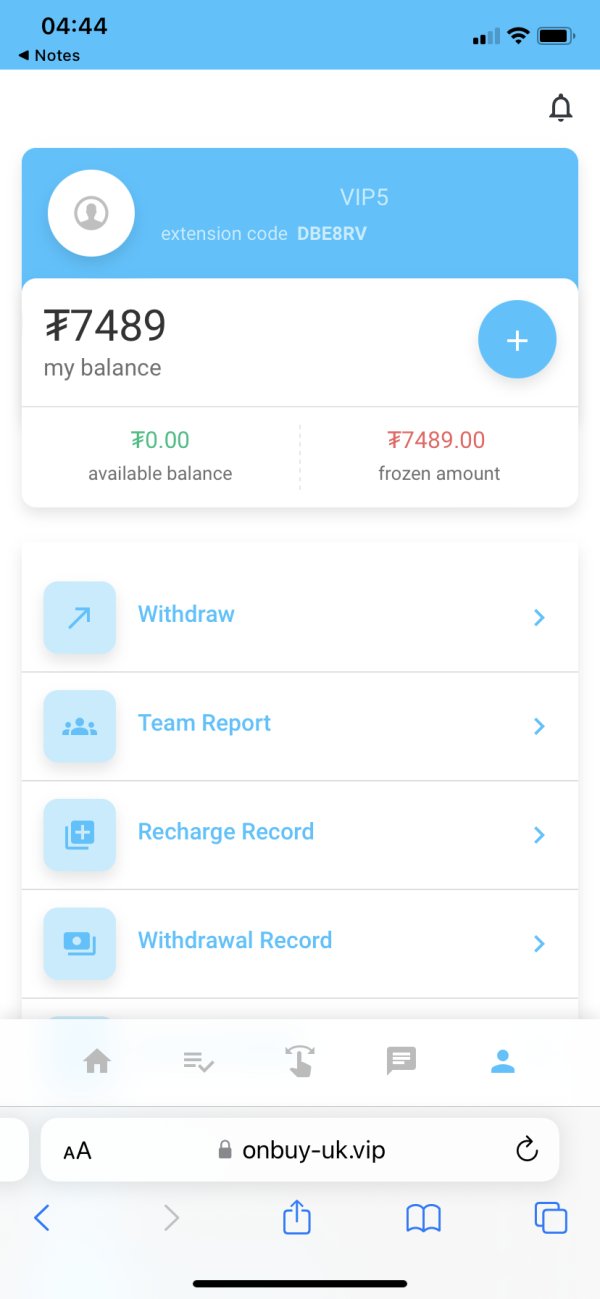

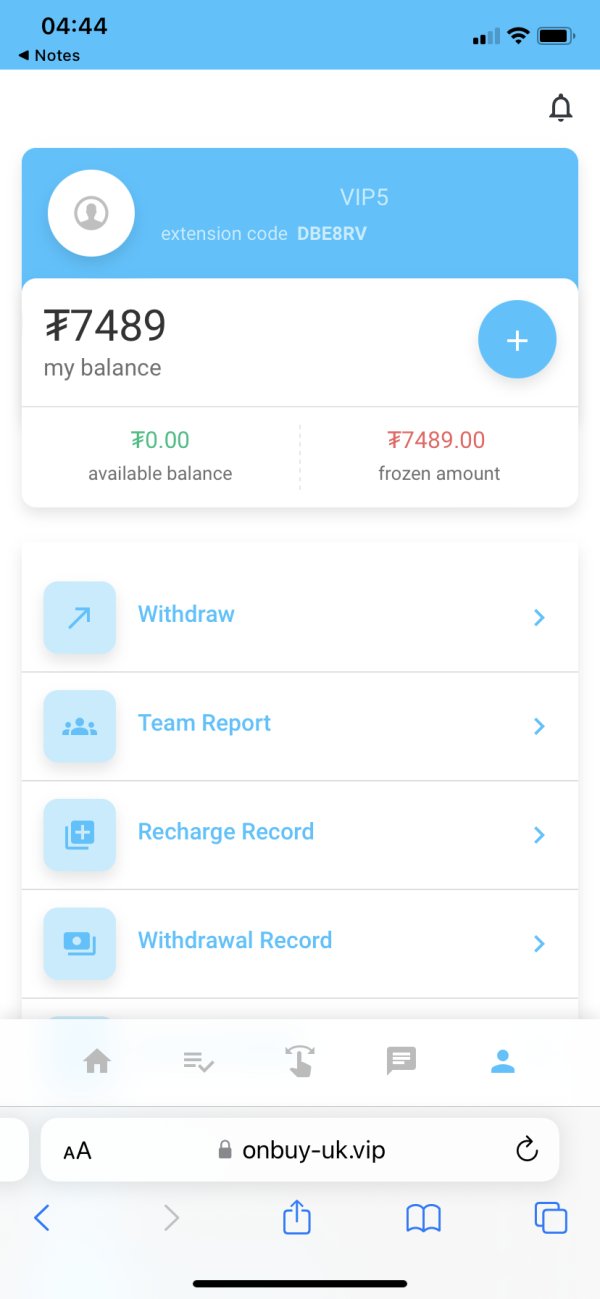

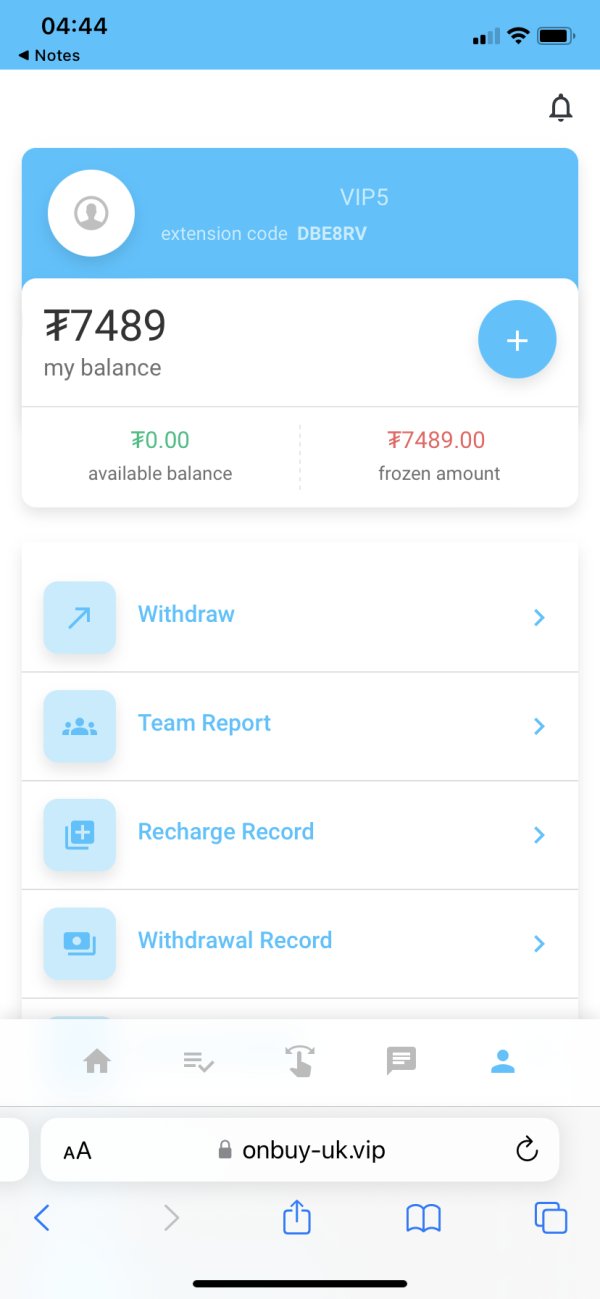

Onbuy-uk.vip I am unable to withdraw my funds from this fraud platform The broker name not listed Onbuy-uk.vip

ONS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Onbuy-uk.vip I am unable to withdraw my funds from this fraud platform The broker name not listed Onbuy-uk.vip

This ons review looks at a new player in the energy brokerage sector. The company has expanded into financial services recently. ONS presents as an energy-focused company that has moved into trading services, though we have limited details about their financial trading operations available to us. The company targets small to medium-sized businesses seeking cost-effective energy solutions. They have also expanded into financial markets.

ONS Energy calls itself a leading energy broker. The company provides business cost-effective energy solutions with a focus on sustainability and helping businesses transition to greener energy sources. However, the transition from energy brokerage to financial trading services lacks detailed documentation in publicly available sources. The company's vision emphasizes environmental impact reduction while maintaining cost efficiency. This approach may appeal to environmentally conscious traders and investors.

We have limited specific information about their trading services, regulatory status, and trading conditions. This review provides a cautious assessment based on the available data from various sources including business profiles and company descriptions.

This ons review uses publicly available information. The information appears limited regarding specific trading conditions, regulatory oversight, and detailed service offerings. The company's primary focus appears to be energy brokerage. Financial trading services seem to be a secondary or emerging offering. Readers should note that the lack of comprehensive regulatory information and detailed trading specifications may indicate either a newer service launch or limited transparency in their financial services division.

Our evaluation uses available business profiles and company descriptions. We could not access specific user testimonials and detailed trading performance data through standard industry review channels. Potential clients should conduct independent verification of all trading conditions and regulatory status before engaging with any financial services.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | 3/10 | Specific account types, minimum deposits, and trading conditions not detailed in available sources |

| Tools and Resources | 3/10 | Limited information about trading platforms, analytical tools, or educational resources |

| Customer Service | 4/10 | Basic contact information available but service quality metrics not documented |

| Trading Experience | 3/10 | Insufficient data on platform performance, execution quality, or user interface |

| Trust and Regulation | 2/10 | No clear regulatory oversight information available for financial services division |

| User Experience | 4/10 | Limited user feedback available, primarily focused on energy services rather than trading |

Company Background and Establishment

ONS Energy operates as a leading energy broker. The company has expanded its service portfolio to include financial trading solutions. The company's primary mission centers on providing businesses with cost-effective energy solutions while emphasizing sustainability initiatives. According to available company information, ONS Energy helps businesses transition to greener energy sources while simultaneously reducing costs and environmental impact.

The company's vision statement emphasizes sustainability as a core value. They position themselves as an environmentally conscious service provider in both energy and financial markets. This dual focus on cost efficiency and environmental responsibility may attract clients who prioritize sustainable business practices alongside their trading activities.

Business Model and Service Scope

The business model appears to leverage expertise in energy market analysis. This expertise informs broader financial market services. However, specific details about how this expertise translates into trading advantages, platform capabilities, or market analysis remain unclear in publicly available documentation. The company's expansion from energy brokerage into financial services suggests an attempt to diversify revenue streams and leverage existing market analysis capabilities.

Available information indicates that ONS maintains a focus on business clients rather than individual retail traders. Specific client eligibility criteria and account requirements are not detailed in accessible sources. This business-to-business orientation may influence their service structure and support offerings.

Regulatory Environment

Available sources do not provide specific information about financial services regulation. We found no information about oversight bodies governing ONS's trading operations. This lack of regulatory transparency represents a significant concern for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods

We found no specific information about accepted payment methods. Processing times and associated fees for deposits and withdrawals are not detailed in available company documentation.

Minimum Investment Requirements

Minimum deposit amounts are not specified in accessible sources. Initial investment requirements are also not documented. This makes it difficult for potential clients to assess entry barriers.

Promotional Offerings

Current bonus structures are not documented in available company materials. We found no information about promotional campaigns or incentive programs.

Available Trading Assets

The company's energy market expertise suggests potential access to energy-related financial instruments. However, specific asset classes, currency pairs, or commodity offerings are not detailed in public information.

Fee Structure and Costs

We found no comprehensive information about spreads, commissions, overnight fees, and other trading costs. This lack of information limits cost comparison capabilities.

Leverage Options

Maximum leverage ratios are not specified in accessible company information. Margin requirements are also not documented.

Platform Selection

We found no details about trading platform options. Mobile applications and third-party platform integrations are not mentioned in available sources.

Geographic Restrictions

Specific information about service availability by region is not detailed. Country-specific restrictions are not mentioned in current documentation.

Customer Support Languages

Available customer service languages are not specified. Support channel options are not detailed in accessible materials.

The account conditions evaluation for this ons review reveals significant information gaps. We found limited details about specific account types, features, and requirements. Available sources do not provide details about different account tiers, minimum balance requirements, or account-specific benefits that might differentiate service levels.

Potential clients cannot adequately assess whether the service aligns with their trading needs without clear documentation. The absence of information about account opening procedures, verification requirements, or eligibility criteria creates uncertainty. We also found no information about account currencies, funding options, or account management tools. This further limits the ability to evaluate account condition competitiveness.

The company's focus on business clients suggests that account structures may be customized for commercial needs. However, we found no specific details about business account features, corporate verification processes, or institutional service levels in current documentation.

Professional traders and institutional clients typically require detailed information about account segregation. They also need information about client fund protection and account security measures. None of these topics are adequately addressed in available company materials.

Our evaluation of trading tools and analytical resources reveals limited publicly available information. We found little documentation about platform capabilities, market analysis tools, or educational resources. Given the company's background in energy market analysis, there may be specialized tools for energy-related trading. However, specific details are not documented in accessible sources.

Research capabilities are standard expectations for modern trading platforms. Market commentary, economic calendars, and technical analysis tools are also expected features. Yet none of these features are detailed in current company documentation. The absence of information about automated trading support, API access, or third-party tool integrations limits assessment of platform sophistication.

Educational resources such as webinars, tutorials, market analysis reports, or trading guides are not mentioned in available materials. This may indicate limited support for trader development and market education. This gap could be particularly significant for clients transitioning from energy market participation to broader financial market trading.

The company's energy market expertise could potentially translate into valuable market insights and analytical tools. However, without specific documentation of these capabilities, potential clients cannot assess the quality or relevance of available resources.

Customer service evaluation is hampered by limited available information. We found little documentation about support channels, response times, and service quality metrics. While basic contact information may be available through standard business directories, specific details about customer support capabilities are not documented in accessible sources.

The company's business-to-business orientation suggests that customer support may be structured for commercial client needs. This could potentially include dedicated account managers or specialized support teams. However, without documented service level agreements, support hours, or escalation procedures, service quality assessment remains speculative.

Multi-language support capabilities are crucial for international business clients. These capabilities are not specified in available documentation. Similarly, technical support for trading platforms, account management assistance, and dispute resolution procedures are not detailed in current materials.

We found no publicly available customer testimonials or service quality ratings. This makes it difficult to assess actual user experiences with customer support responsiveness and effectiveness.

The trading experience assessment for this ons review is significantly limited. We lack detailed information about platform performance, execution quality, and user interface design. Without access to platform demonstrations, user guides, or technical specifications, evaluation of trading experience quality remains largely theoretical.

Order execution speed, slippage rates, and platform stability metrics are critical factors for trading experience quality. Yet none of these performance indicators are documented in available sources. The absence of information about trading platform features, charting capabilities, and order management tools further limits assessment capabilities.

Mobile trading capabilities are essential for modern trading flexibility. These capabilities are not detailed in current documentation. Similarly, information about platform customization options, workspace organization, and advanced trading features is not available for evaluation.

Market data quality, real-time pricing accuracy, and news feed integration are standard expectations for professional trading platforms. However, specific details about these capabilities are not provided in accessible company materials.

Trust and regulatory compliance represent the most significant concern areas in this evaluation. Available sources do not provide clear information about financial services regulation. We found no information about regulatory oversight bodies or compliance frameworks governing the company's trading operations.

Client fund segregation, deposit insurance, and investor protection measures are fundamental trust factors. These measures are not adequately addressed in available documentation. The absence of regulatory registration numbers, licensing information, or compliance certifications raises questions about operational transparency and client protection.

Industry reputation, third-party audits, and regulatory compliance history are not documented in accessible sources. This makes it difficult to assess the company's standing within the financial services industry. Without clear regulatory oversight, clients may face increased counterparty risk and limited recourse options.

The company's transition from energy brokerage to financial services may involve different regulatory requirements. However, specific information about how this transition addresses compliance obligations is not available in current documentation.

User experience evaluation is constrained by limited available feedback from actual service users. We also found insufficient documentation of service delivery quality. The company's focus on business clients may result in a different user experience profile compared to retail-focused brokers. However, specific details are not available for assessment.

Platform usability, account management efficiency, and service accessibility are important user experience factors. These factors cannot be adequately evaluated based on available information. The absence of user testimonials, case studies, or client success stories limits understanding of actual user satisfaction levels.

Registration and verification processes significantly impact initial user experience. These processes are not detailed in current documentation. Similarly, information about ongoing account management, service communication, and client relationship management is not available for evaluation.

The integration between energy market services and financial trading services could potentially create unique user experience advantages. However, without specific documentation of this integration, assessment remains speculative.

This ons review reveals a company with an established presence in energy brokerage. The company has expanded into financial services, though comprehensive information about their trading operations remains limited. The lack of detailed regulatory information, trading conditions, and user feedback significantly constrains the ability to provide a complete assessment of their financial services offerings.

The company may be suitable for businesses already engaged in energy market activities. These businesses might seek to expand into broader financial market participation, particularly those prioritizing environmental sustainability in their business practices. However, the absence of clear regulatory oversight and detailed service specifications suggests that potential clients should exercise caution and conduct thorough due diligence.

Primary concerns include the lack of transparent regulatory compliance information. We also found insufficient detail about trading conditions and costs, and limited user feedback about service quality. These factors combine to create uncertainty about service reliability and client protection measures that are fundamental to financial services evaluation.

FX Broker Capital Trading Markets Review